Stress Relief

The S&P 500 rose 0.4% this week through a combination of good corporate earnings and acquisition announcements. While the political tension has many Americans on edge, U.S. equity markets have been fairly sanguine. Investors should take notice.

Market Review

Contributed by Doug Walters

A good deal

U.S. equities were up this week, in what has been a wild few days of corporate earnings, acquisition announcements and political drama. The S&P 500 ended the week up 0.4% thanks in part to strength in growth stocks as well as the announcement of some very large deals.

- While the number of deals is down this year, the size of the recent deals catches the eye. We discuss the deals in more detail in our Economics and Strategy sections.

- The political drama reached a fever pitch on Wednesday with the third and final presidential debate of this election season. While stress levels are high amongst voters, stocks have been relatively unperturbed.

Improving your long game

Last week we discussed how the stress of the upcoming election has had some investors opting to pull out of equity markets. We noted that trying to time market moves around specific events is unlikely to succeed over time. This week we back up that statement with data.

- First, it is important to note that we do believe that the markets are not always efficient and that it is possible to identify attractive long-term investment opportunities. But the important phrase here is “long-term”. The short-term is largely unpredictable in our view.

- A study of American households, found that those families that tended to have high levels of investment trading activity, underperformed the average family by 4% annually. Over the course of 30 years that would lead to a halving of retirement funds.

- Why is this? It turns out, the bulk of your investment returns are earned on just a handful of days. Being out of the market for one of these exceptional days can have a detrimental impact on your returns. For example, missing just the 10 best trading days between 1995 and 2015 would have cut your ending investment value in half.

The message here is simple. If your equity exposure is properly matched to your willingness and ability to take on risk, then you are better off sitting tight and riding out any short-term moves to capture the long-term gains that the market can offer.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.4 | 4.8 |

| S&P 400 (Mid Cap) | 0.5 | 9.2 |

| Russell 2000 (Small Cap) | 0.5 | 7.2 |

| MSCI EAFE (Developed International) | 0.9 | -2.1 |

| MSCI Emerging Markets | 1.8 | 15.0 |

| S&P GSCI (Commodities) | -0.4 | 20.0 |

| Gold | 1.3 | 19.1 |

| MSCI U.S. REIT Index | 0.4 | 4.3 |

| Barclays Int Govt Credit | 0.3 | 2.6 |

| Barclays US TIPS | 0.6 | 5.9 |

Economic Commentary

Economics of Mergers & Acquisitions

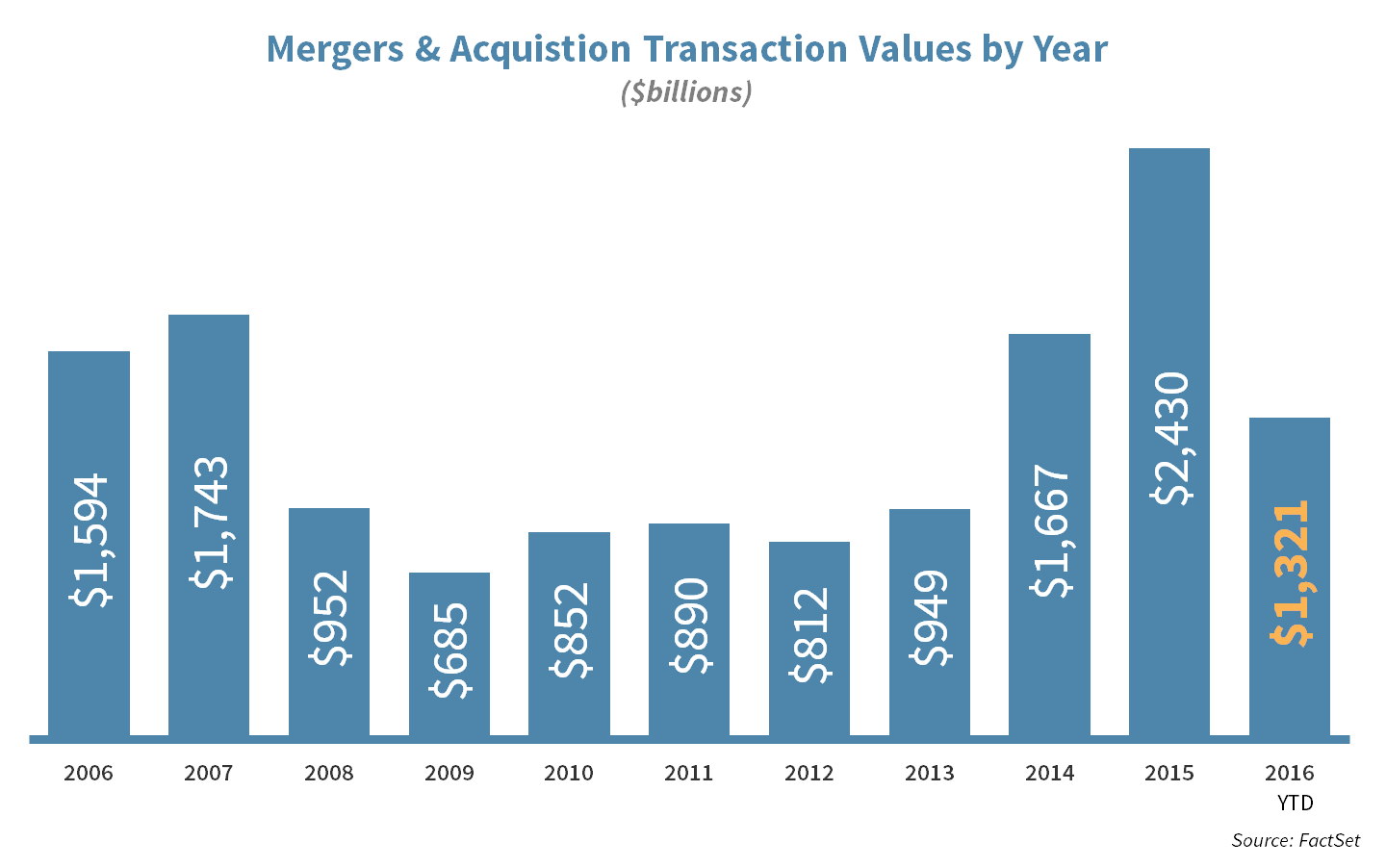

There have been over 3,000 billion-dollar merger and acquisition deals over the past 10 years. This number includes transactions from the Buffalo Bills being privately acquired for $1.4 billion in 2014 to Enbridge agreeing to acquire Spectra Energy last month for $43 billion. This week, rumors came out that AT&T is considering a blockbuster acquisition of Time Warner. Investors in our Equity Income strategy have enjoyed the benefits of both the Time Warner rumors and the Spectra deal, with Time Warner shares rallying over 12% this week.

Companies often justify these deals based on “synergies”. Examples of synergies that could come from a deal include cutting redundant costs and increasing prices as competition has lessened. Government agencies with antitrust authority will block deals if they deem them damaging to consumers, as they did with Halliburton and Baker Hughes this year. Three major oil field service companies, instead of four, was deemed to be too few to foster competition.

One trend we have seen over the past couple of years is that deal sizes have become larger, with big companies targeting other large ones. For example, BASF is one of the largest chemical companies in the world and is trying to acquire Monsanto, an agriculture chemical giant, with a $54 billion enterprise value. Many analysts think this deal will be blocked by regulators given the sheer size of the companies, with Bayer already controlling 19% of market revenue.

Periods of heightened acquisitions tend to come in waves. It is too soon to say if we are in the early stages of the next great wave of M&A, but if so, it could be positive for equities.

Week Ahead

Big Oil

Big Oil is reporting next week with Equity Income holdings Exxon Mobil (XOM) and Chevron (CVX) leading the pack. The company could show positive progress as the outlook for energy companies have improved, with oil prices north of $50 a barrel.

- Fun Fact: If Exxon-Mobil were a nation, it would rank as the 47th largest economy in the world; larger than Vietnam, Czech Republic, Portugal, and Greece. Similarly, Chevron would rank 59th, which would make it larger than Puerto Rico and Kuwait.

Economic Calendar

September durable goods – the data measures industrial activity in the prior month. Growth in new orders will signal positive economic strength. Economists expect growth of 0.2% for the month of September.

- GDP – Q3 results will be announced on Friday, with economists expecting growth of 2.5%.

Tech on Deck

Apple (AAPL) and Alphabet (GOOGL) will lead the pack in the tech sector.

Investors will be watching iPhone sales, particularly to see how much Apple Inc. has gained from rival Samsung’s worst nightmare Galaxy Note 7, which notoriously joined the list of the worst product flops in history.

- Fun Fact: Ford’s Edsel, released in 1957, claims the #1 spot for the worst product flops. The car cost Ford at least $350 million, which in today’s dollars is equal to roughly $2.9 billion.

1959 Ford Edsel – istock Photos by Getty Images

Strategy Update

Contributed by , Max Berkovich

Strategic Asset Allocation

Market Moving

Large cap growth inched higher this week beating out large cap value. Strong earnings as well as mergers and acquisitions were the main drivers for U.S. equities. Dollar strength also played a role. The Financial sector reported better than expected earnings, giving the S&P 500 a bit of a boost.

Dollar Pains for Market Gains

The U.S. Dollar has continued to strengthen against the British Pound and Euro. To put it in perspective, British Pounds have declined against the U.S. Dollar almost 21% year-to-date, while the Japanese Yen strengthened over 13%. While the U.S. brushed off Brexit, Britain and Europe continue to feel its ramifications.

- A stronger dollar weighs on U.S. manufacturing and international growth for U.S. corporations, because goods and services will cost more to non-U.S. consumers.

- Japan’s monetary easing is not working as the demand for its “safe haven” currency remains. A strong Yen makes exports more expensive for buyers, which dampens the demand for Japanese goods. 17.9% of Japan’s Gross Domestic Product was from exports in 2015.

Strategic Growth

Different Sides of a Coin

Single security moves determined sector winners, a natural end product of quarterly earnings. Technically, the leading sector was Health Care and the laggard was Industrials, but this was attributed to earnings of…

- UnitedHealth Group Inc. (UNH) topped expectations handedly. A quarterly revenue increase of 12% was very healthy. A bump in guidance was an added benefit.

- Union Pacific Corporation (UNP) the largest railroad network in America missed expectations. A 6% drop in total freight was driven by a 19% annual drop in coal hauling related revenue. Total revenue for the quarter was over $5 billion dollars.

Strategic Equity Income

AT&E?

Consumer Staples were caught at the back of the line this week. Financials would be the leading sector, but deal news from a Consumer Discretionary company pushed that sector to the top. The deal rumor…

- Time Warner Inc. (TWX), the owner of the Turner television network and HBO, is rumored to be acquired by telecom giant and former strategy holding AT&T Co. (T) for a price north of $90 per share. The deal rumors started Thursday night and by mid-day Friday, looked like it would be announced by Monday if not sooner. The rumored transaction may finally lead to American Telephone & Telegraph to drop the Telegraph from its name, we recommend adding an “E” for entertainment.

- Without the deal news we would most likely focus on earnings, as Microsoft Corp. (MSFT) and Bank of New York Mellon Corp. (BK) both reported newsworthy positive quarters.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters