Sticker Shock

An early-week run saw stocks climb to new highs, only to lose steam as tax reform challenges came to the fore. While the President toured Asia, the Strategic Investment team was adding exposure to a particularly attractive country in the region.

Market Review

Contributed by Doug Walters

Stocks reached new all-time highs mid-week before relenting to tax reform uncertainty. While the House continues to push forward its version of the bill, the Senate is experiencing sticker shock. The President spent the week in Asia with hopes of advancing trade.

Heat of the Moment

Progress on tax reform continues to have an impact on the stock market. This week the market reacted negatively to the commentary coming out of the Senate which faces stricter restrictions than the House when it comes to increasing the deficit. The Senate may push to have the corporate tax rate cut from 35% to 20% not go into effect until 2019. The House bill called for the change in 2018. Republicans are eager to push this bill through before year-end, but this week highlighted some of the difficulties the bill will face when reconciliation heats up.

Asia was in focus this week, with the President traveling through the region. North Korea and the Trade Balance were in the hot seat. We discuss the U.S.-China trade balance in our Economics section. Asia has also been a topic of focus for the Strategic Investment Team. We have recently increased our exposure to India, which we see as a long-term secular growth story.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.2 | 15.3 |

| S&P 400 (Mid Cap) | -0.6 | 9.9 |

| Russell 2000 (Small Cap) | -1.3 | 8.7 |

| MSCI EAFE (Developed International) | -0.3 | 18.9 |

| MSCI Emerging Markets | 0.7 | 31.5 |

| S&P GSCI (Commodities) | 2.0 | 7.8 |

| Gold | 0.4 | 10.5 |

| MSCI U.S. REIT Index | 2.1 | 2.5 |

| Barclays Int Govt Credit | -0.3 | 0.3 |

| Barclays US TIPS | -0.2 | 0.5 |

Economic Commentary

Contributed by Doug Walters

A Balancing Act

President Trump spent the week in Asia speaking with regional leaders, with stops in Japan, South Korea, China, Vietnam and the Philippines. There appeared to be two major objectives: solidify resolve around the denuclearization of North Korea and promoting fair trade. The latter was of particular relevance while in China.

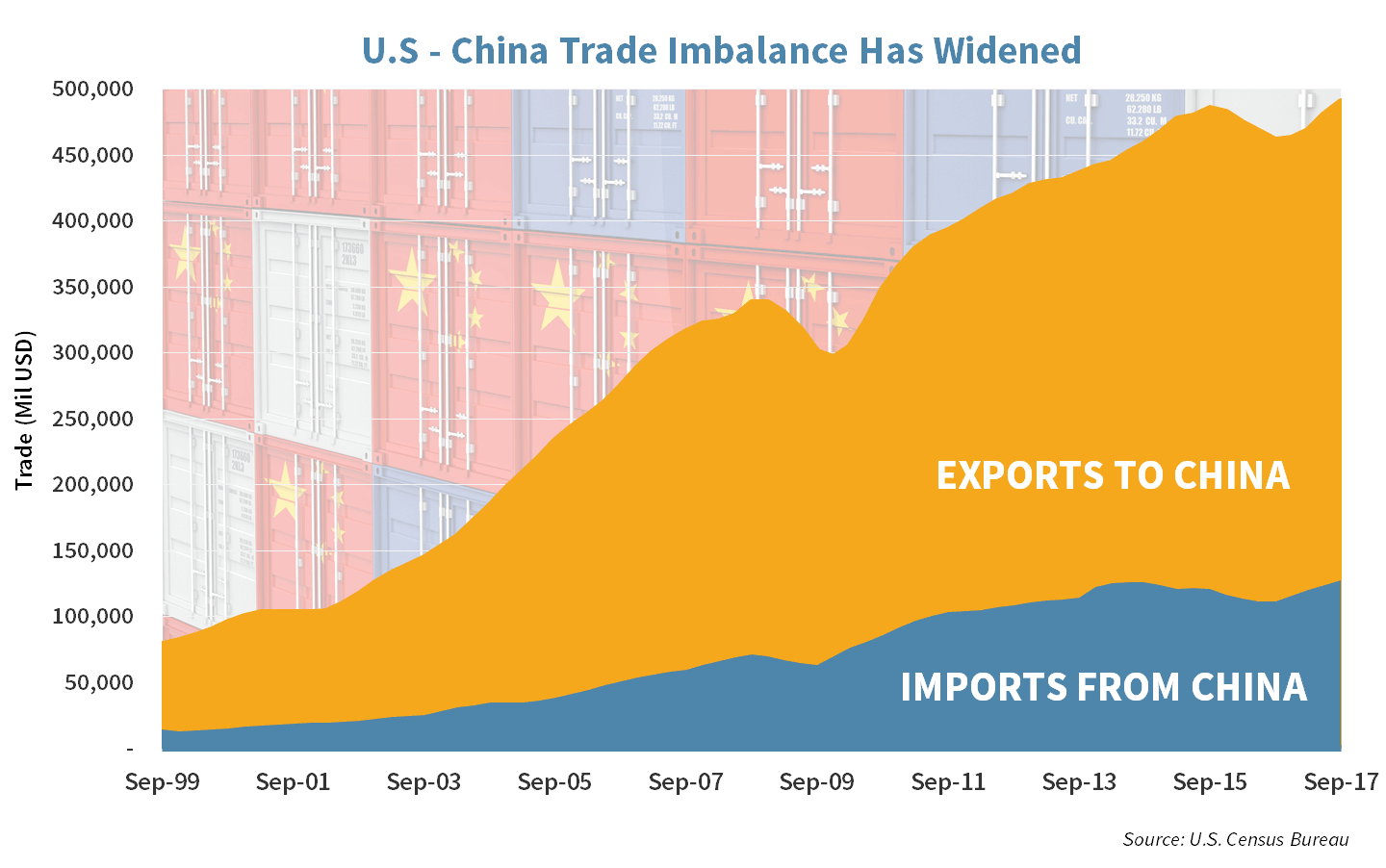

The chart below shows the U.S.-China trade balance over the past 20 years. The deficit (Exports minus Imports) has grown from roughly $50 Billion to $360 Billion. The administration is touting, a largely symbolic, $250 Billion in deals with China which were unveiled during the trip. Time will tell if this push for bilateral trade deals, rather than multi-party trade treaties like the Trans-Pacific Partnership (TPP), will pay off in an improved trade deficit.

In our Asset Allocation section below, we outline the case for de-emphasizing China in our model with an overweight of India within Emerging Markets.

Week Ahead

ITCH to Get Tax Reform Done by Thanksgiving

Inflation numbers estimated to remain tepid in October, with both Consumer Price and Producer Price Indexes out next week.

- Inflation data have been one of the major anomalies for central bankers. Despite a tight labor market and strong GDP, inflation has yet to budge from its current low level.

Tax reform debate continues.

- We should see the House bring their tax bill up for a vote next week.

Cisco Systems (CSCO) and retail companies in our Equity Income strategy are due to report earnings next week.

- TJ Maxx (TJX), Walmart (WMT), and Williams-Sonoma (WSM) should give some insights into consumer spending.

Housing starts and building contracts are expected to show some improvement.

- National housing supply is at a nearly 10-year low.

- The monthly supply of houses for sale in the United States is at around 4.1 months – the time it would take to run out of houses available for sale if no additional inventory was built.

Strategy Updates

Contributed by , Max Berkovich

STRATEGIC ASSET ALLOCATION

Small Moves Make Big News

Large capitalization companies have had a strong year and now face valuation questions. As a result, small capitalization stocks and emerging markets have become somewhat more attractive relative to their U.S large-cap peers.

We moved to take advantage of the relative value opportunity with a modest increase in exposure to emerging markets and U.S small-cap while right-sizing our exposure to large-cap. For emerging markets, we have allocated funds to a broad-based India ETF, WisdomTree India Earnings Fund (EPI). For small-cap exposure, we increased our existing holding of iShares Russell 2000 ETF (IWM).

- India is one of the best growth stories in the emerging markets. In 2015, for the first time, India’s Gross Domestic Product (GDP) outgrew China. See “Proceed With Caution?” in the “A War of Words” edition.

- Unlike China, India is undercapitalized, has a large pool of underemployed labor, and wages of one-tenth of the U.S. level.

- Small capitalization companies should benefit the most from corporate tax cuts, lower levels of regulations and a higher percentage of M&A activity. See “A Small Fire” in the “Expectations Inflating” edition.

STRATEGIC GROWTH

The Mouse Chasing the Fox

Consumer Staples edged out Energy for the leading sector of the week. The Health Care sector was the big laggard, dragged down by Biotechnology. In other strategy news…

- The Walt Disney Co. (DIS) reported a less than stellar quarter, missing consensus estimates on both sales and earnings. But the quarterly report was a small sideshow compared to two other developments. The first was the discussion of future projects by CEO Iger on the call. This includes direct-to-consumer service, 4-5 exclusive films only available on that service, a Star Wars live-action series, a series based on Monsters Inc., and another Star Wars trilogy after 2020. The other news revolved around an acquisition rumor that Twenty-First Century Fox (FOX, FOXA) has been holding talks with Disney to sell much of its operations. This is expected to include everything but Fox Sports and Fox News. Stay tuned for more on this in the weeks to come!

STRATEGIC EQUITY INCOME

At the ‘Gate

The Telecom sector was the biggest laggard, but Financials also had a rough week. Consumer Staples was the clear leader. Most of that can be attributed to another acquisition rumor…

- It is rumored that a buyer is lining up to purchase Colgate-Palmolive Corp. (CL). The Financial Times’ blog, Alphaville, reported the story. In July, the word on the street was that Unilever (UL, UN) was on the hunt and in May it was Kraft-Heinz (KHC). At that time, CEO Ian Cook signaled that the company could be purchased for $100 per share. This was first mentioned in the Glass Half Full issue of Insights.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters