Spotlight

The political theater from presidential hopefuls took center stage, overshadowing another solid performance from the S&P 500 which posted gains for the second week in a row and is now nearly 7% above the market lows of February 11th.

Market Review

Contributed by Doug Walters

And the Oscar goes to…

The political theater from presidential hopefuls took center stage, overshadowing another solid performance from the S&P 500 which posted gains for the second week in a row and is now nearly 7% above the market lows of February 11th. Higher oil prices once again played a supporting role in this move.

Fury Road

There were several Oscar-worthy debate performances from the candidates this week. The road to the White House is heating up ahead of Super Tuesday with the rhetoric getting increasingly hostile.

- Equity markets punish uncertainty. The volatility of this election cycle has undoubtedly been a drag on stock performance. Yet despite this week’s fireworks, equities were undeterred…a positive sign longer-term.

The Revenant

The U.S. Economy has been left for dead by many commentators, but proved its resilience this week with an upward revision to Q4 GDP. With the revision, 2015 U.S. personal consumption expenditures were officially the highest in a decade.

- Elsewhere in the world, growth is proving more elusive and is a topic of discussion at the G-20 summit of finance leaders currently underway in Shanghai. A coordinated policy response is a potential outcome.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.0 | 10.4 |

| S&P 400 (Mid Cap) | -0.7 | 6.1 |

| Russell 2000 (Small Cap) | -0.5 | 5.3 |

| MSCI EAFE (Developed International) | 0.2 | 14.7 |

| MSCI Emerging Markets | 0.3 | 23.3 |

| S&P GSCI (Commodities) | 4.2 | -2.9 |

| Gold | 1.2 | 10.1 |

| MSCI U.S. REIT Index | 0.5 | 1.7 |

| Barclays Int Govt Credit | -0.1 | 1.1 |

| Barclays US TIPS | 0.1 | 0.4 |

Economic Commentary

The Big Short

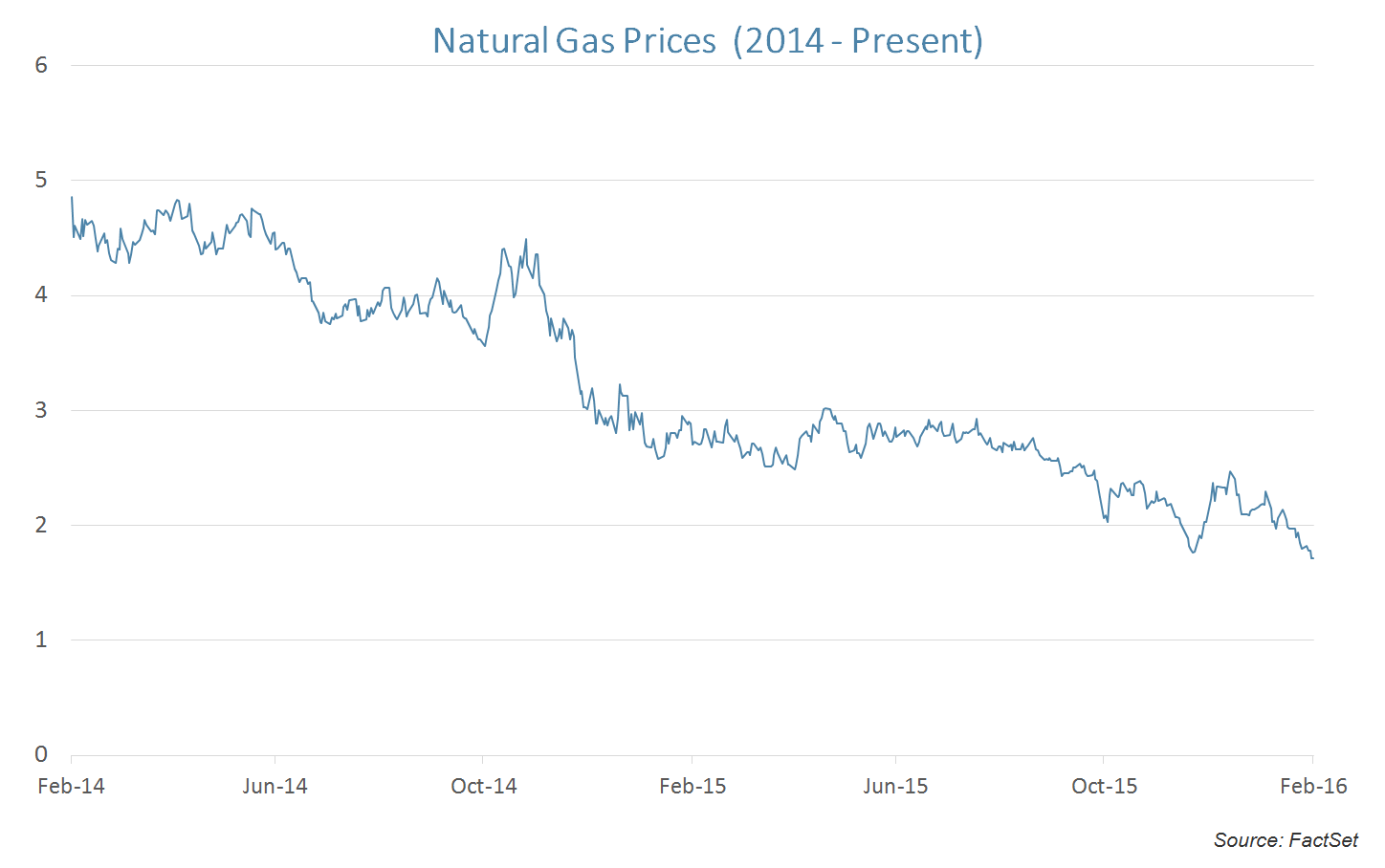

Natural gas has been an excellent short play over the past two years reaching new lows this week at $1.71 per million Btu. Weak demand from a warm winter combined with strong supply from the Utica and Marcellus natural gas basins have caused prices to collapse.

Inside Out

This week marked the first time Liquefied Natural Gas (LNG) has been exported from the United States with Cheniere’s LNG carrier Asia Vision leaving its Louisiana port for Brazil. Although, this will not lead to a tight market anytime soon, it may lead to a long term secular trend of increased natural gas demand. As natural gas is much cheaper in the United States than it is in Brazil, Europe and Asia, exporting the commodity makes economic sense. However, the liquefying and re-gasifying at the receiving end require large capital investments that have finally been made. Future LNG demand combined with electric utility companies switching from “dirty” coal to “clean” natural gas bodes well for the latter fossil fuel over the long run. It may take some time but eventually supply and demand will rebalance.

Week Ahead

Contributed by Aaron Evans

And the Nominees Are…

The presidential candidates. Both parties ready themselves for the biggest day on the primary schedule, Super Tuesday.

- 13 states and U.S. territories will hold votes or caucuses which could make or break several candidates’ chances of receiving a party nomination.

- With several primary states having colleges that compete in the same athletic conference, Super Tuesday has been dubbed “The SEC Primary”.

And the Winner Is…

The U.S. employment picture. Friday brings the latest report on domestic job growth and unemployment from the Department of Labor.

- Expectations are for job growth to accelerate beyond January’s somewhat disappointing 158k number, while unemployment should hold below 5%.

- Over the past year, an average of over 230k jobs have been added per month.

Strategy Update

Contributed by David Lemire , Max Berkovich

STRATEGIC Asset Allocation

The Asset Class Awards

Combining the Oscars and the Razzies, we bring the best and worst performers over the past year.

Performance from a Major Asset Class

The Oscar goes to the bond market. Over the past few years, a near 2% performer would usually not see any reason to work on an acceptance speech. But this past year boring was better with the bond market beating out a significantly weaker field.

- The Razzie goes to Emerging Markets after a disappointing near 25% loss. Sub-plots out of China and currency markets drove the story in this market over the past year.

Performance in a Supporting Role

The statue is gold…for a reason. Gold gave a rousing performance more recently posting a near 16% gain in 2016 enabling a 2.5% gain over the past year. While 2.5% is not a performance for the ages, it has been an important source of support to challenging equity markets.

- The Razzie goes to Commodities. A lack of any positive storylines in the Energy sector helped push this asset class down nearly 30% this past year.

Strategic Growth

Inside Out

Best Picture this week goes to the consumer discretionary sector. While the rotten tomatoes award goes to Energy stocks. Leading role goes to…

- Carters, Inc. (CRI) the children’s clothing retailer reported a strong quarter. Sales grew 5% year over year and the company offered up guidance of 6% to 7% sales growth for the year and roughly 8% to 10% EPS growth. The company also authorized a buyback of roughly 10% of its outstanding shares and dumped its dividend by 50%.

STRATEGIC Equity Income

The Force Awakens

Health Care stocks received critical acclaim while the Energy sector was left stranded like Matt Damon in the Martian. In other strategy news…

- Honeywell International, Inc. (HON) put out a bid to buy a fellow industrial conglomerate United Technologies, Inc. (UTX) a Strategic Growth holding. The rumor was a $108 price tag. UTX rejected the offer, as it is undervaluing the company and potentially destroying shareholder value as regulatory approval will delay the merger.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters