Signs of Stability

An early-week rally in crude oil helped spark a rebound in global equities. Despite edging lower again on Friday, this was officially the best week on Wall Street in 2016.

Market Commentary

OPECing order

Saudi Arabia, Russia, Qatar and Venezuela said they wouldn’t increase crude-oil output above January’s levels but the agreement came with a significant caveat: Iran and Iraq must also halt production increases.

- While freezing production at current record levels may not be enough, the oil producers working together is a good sign for oil supply stabilization.

Keys to the Kingdom

In somewhat unprecedented territory, the FBI is pursuing actions to force Apple to “unlock” the phones of San Bernardino terrorists using backdoor unencrypting techniques.

- It’s a debate that pins consumer privacy up against national security, and one that could be a defining case going forward for tech. companies. If these “backdoors” are unlocked by the courts, it could compromise the very security put in place to protect individual data.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 2.84 | -6.17 |

| S&P 400 (Mid Cap) | 3.43 | -6.68 |

| Russell 2000 (Small Cap) | 3.89 | -11.1 |

| MSCI EAFE (Developed International) | 5.11 | -8.6 |

| MSCI Emerging Markets | 4.92 | -6.03 |

| S&P GSCI (Commodities) | 1.42 | -4.0 |

| Gold | -0.71 | 15.79 |

| MSCI U.S. REIT Index | 4.26 | -5.72 |

| Barclays Int Govt Credit | 0.11 | 1.51 |

| Barclays US TIPS | -0.21 | 1.55 |

Economic Commentary

Contributed by Max Berkovich , Doug Walters

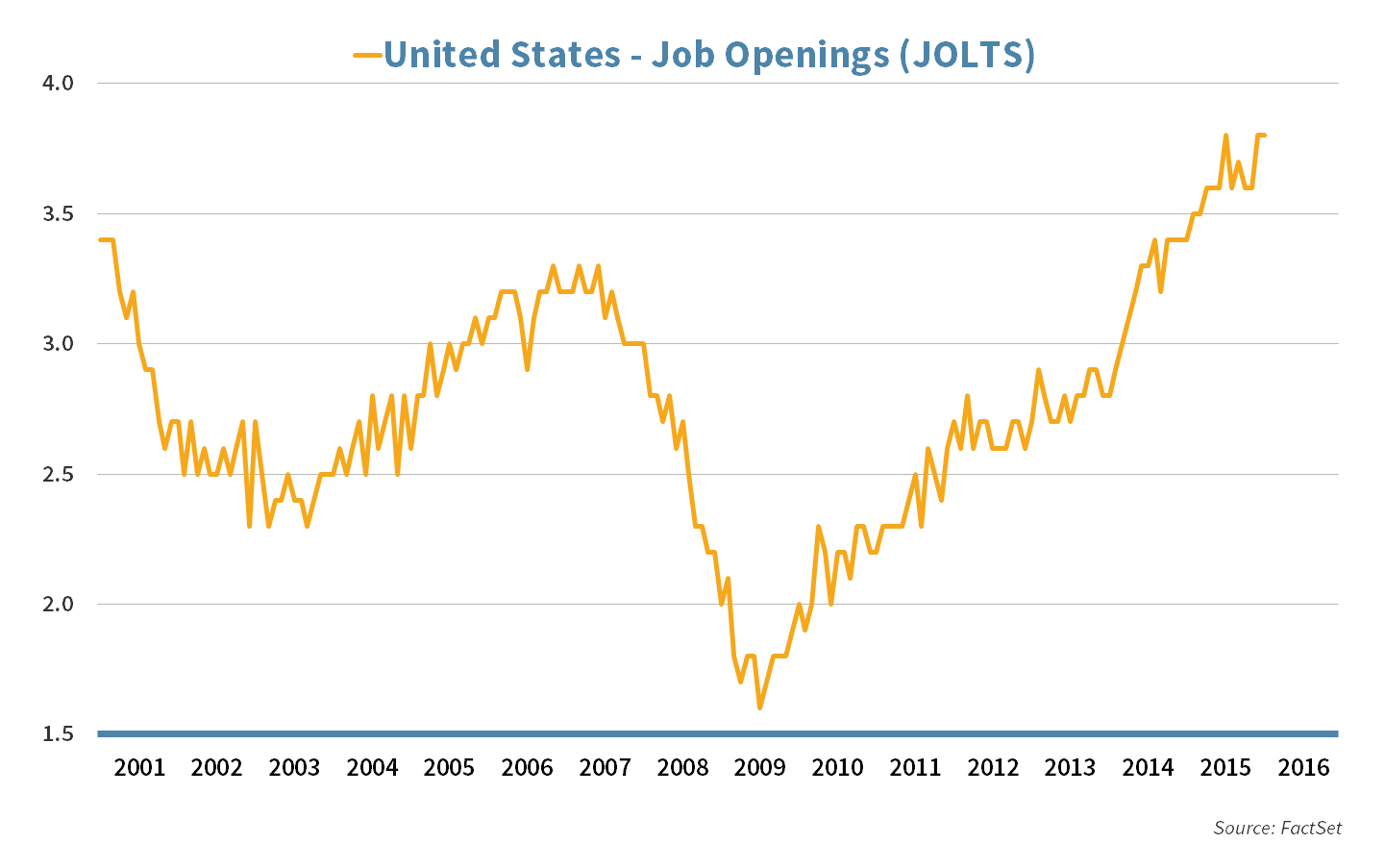

Fear can be contagious, especially when it comes to the stock market. With the recent volatility in equities, and the media frenzy, we take a moment to remind our readers that the stock market is not the same thing as the economy. Last week’s JOLTs report provides the latest evidence that the domestic economy is still hanging in there.

JOLTing jobs report

The Job Openings and Labor Turnover (JOLTs) report, measures the rate of change of job openings in the U.S. It is a way of measuring the health of the labor market by the demand for labor. This month’s 3.8% reading is the highest level we have seen in the past 15 years.

Take this job and …

The report also showed that voluntary quits rose to nearly 3.1 million, the highest mark since December of 2006. This report signals that the American worker is feeling optimistic about his chances to find a better job. The report also showed 5.4 Million new hires, which is a post-recession high and as of December 2015 there were 5.6 million job openings.

A little cold water

January brought some unwelcomed layoff reports from several big companies, most notably Yahoo Inc.’s 14,000 cut. The December Non-Farm Payroll report of 262,000 new jobs was followed by a less-than-expected 151,000 in January. This has caused the markets to fear that December may have been the peak.

Week Ahead

Contributed by Aaron Evans

Down with GDP

The 2nd of three revisions to U.S. fourth quarter GDP growth will be released on Friday.

- The revision is headed lower from January’s estimate of 0.7% year over year growth, which would mark the lowest growth rate since Q1 of 2014.

Woman’s World

The Global Women’s Forum will take place in Dubai, UAE next Tuesday and Wednesday with 2000 attendees and 200 speakers from around the world.

- This year’s theme is “Let’s Innovate” which will continue to build on the forums mission of strengthening the influence of women throughout the world and encouraging women’s contributions to society and business.

Cross Country

Nevada and South Carolina are the next up on the presidential primary trail.

- The fields have slimmed with the Dems down to just Hilary and Bernie, while the GOP has gone from 17 original candidates to 6 which should make for a much less crowded debate setting.

Investment Strategy Update

STRATEGIC ASSET ALLOCATION

Keeping it real

The best performing asset class this week was Real Estate. Looking deeper, health care and hospitality (hotels) related properties had a strong bounce.

Goldman sacks gold

Gold has proved to be a safe haven so far in 2016, up nearly 16% on the year. Investment bank Goldman Sachs & Co. issued a sell rating on the precious metal after its best week since 2008. Gold at around $1,230 an ounce is still a far cry from $1,800 an ounce in 2011.

20% off

After adding to small cap equities a few weeks earlier, another asset class piqued our curiosity after a 20% correction from its recent peak; International Developed. The rebalance of the asset class coincided with a reduction in our core fixed income allocation after significant relative outperformance in the capital preservation part of client portfolios.

STRATEGIC GROWTH

Booking it!

The materials sector was a laggard, while consumer discretionary and technology sectors were in the lead. Earnings reports are in the final innings for the quarter, but continue to drive returns. For example…

- Priceline Group Inc. (PCLN) reported a stellar quarter topping estimates. Bookings rose 12.7% in the quarter. International bookings were up 15.9%, excluding currency impact, an eye-popping 29%. The company expects another 12%-19% bookings growth in Q1 2016. The phenomenal report not only helped the stock, but also dragged along peer and fellow strategy holding Expedia Inc. (EXPE).

STRATEGIC EQUITY INCOME

Roll ‘em back

The Industrial sector was the leading sector and consumer staples sector was the laggard thanks to a report from…

- Wal-Mart Stores Inc. reported a quarter that seemed to look good on the surface, but store closures masked some underlying issues, i.e. a 17% y/y drop in operating income. The company also guided for flat sales for the full year. In a nod to Walmart’s late “Smiley”, investors reacted by “rolling back” the stock price.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Max Berkovich

Max Berkovich