A Scary Good Run

U.S. equities gave investors a trick early in the week, only to provide a sweet treat Friday with a big bounce back. Performance of stocks has been scary good this year.

Market Review

Contributed by Doug Walters

A pullback in U.S. equities early in the week was quickly forgotten as markets leaped forward, fueled by tax relief progress and earnings beats by large-cap Tech stocks. Markets had a lot to digest, with news on the Fed Chair, Q3 GDP and International elections.

Phantom Profits

The passage by the House of Representatives of the Senate’s budget bill (discussed last week in Forward Progress), brings us yet another step closer to tax reform. While there is talk of a vote on reform before the end of November, the hurdles to clear are tall and numerous. The U.S. stock market rewarded the progress with a late-week rally. Leading the charge were Tech stocks (and Amazon) which were busy releasing strong earnings reports.

We have trouble justifying the valuation of many of these stocks and have avoided them in our core portfolios. We are increasingly hearing talk of a new paradigm, where profits are not as important as the value a company provides to customers. Companies like Amazon, who are willing to forego profitability to achieve massive scale are a challenge for investors. They do not make enough profit to justify their share price, yet their willingness to undercut everybody in seemingly any industry make them the likely winners.

Death Grip

Domestically, we had a solid report on Q3 GDP this week, which we discuss in our Economics section. In addition, the rumor mill has narrowed the field for the next Fed Chairman to Powell and Taylor, with the former being the perceived favorite. Both are expected to be less dovish than Chairwoman Yellen, who now appears to be out of the running.

While Yellen’s days look numbered, overseas, we have seen leaders tighten their grip on power. In Japan, Prime Minister Shinzo Abe won reelection in this week’s snap elections. With an overwhelming victory at his back, Abe is expected to push reform of their pacifist constitution (in place since the end of World War II) to allow a standing army. In China, President Xi Jinping was also reelected. In concert with the election, the Chinese constitution was amended to include “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era”. Experts believe that enshrining Xi’s thoughts in the constitution during his rule (a privilege last granted to Mao Zedong), will result in expanded powers and possible term limit extensions.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.2 | 15.3 |

| S&P 400 (Mid Cap) | 0.3 | 10.8 |

| Russell 2000 (Small Cap) | -0.1 | 11.1 |

| MSCI EAFE (Developed International) | -0.4 | 18.2 |

| MSCI Emerging Markets | -0.8 | 28.8 |

| S&P GSCI (Commodities) | 2.4 | 3.5 |

| Gold | -0.6 | 10.3 |

| MSCI U.S. REIT Index | -1.6 | -0.5 |

| Barclays Int Govt Credit | 0.0 | 0.6 |

| Barclays US TIPS | 0.0 | 0.2 |

Economic Commentary

Surprise! GDP is Strong

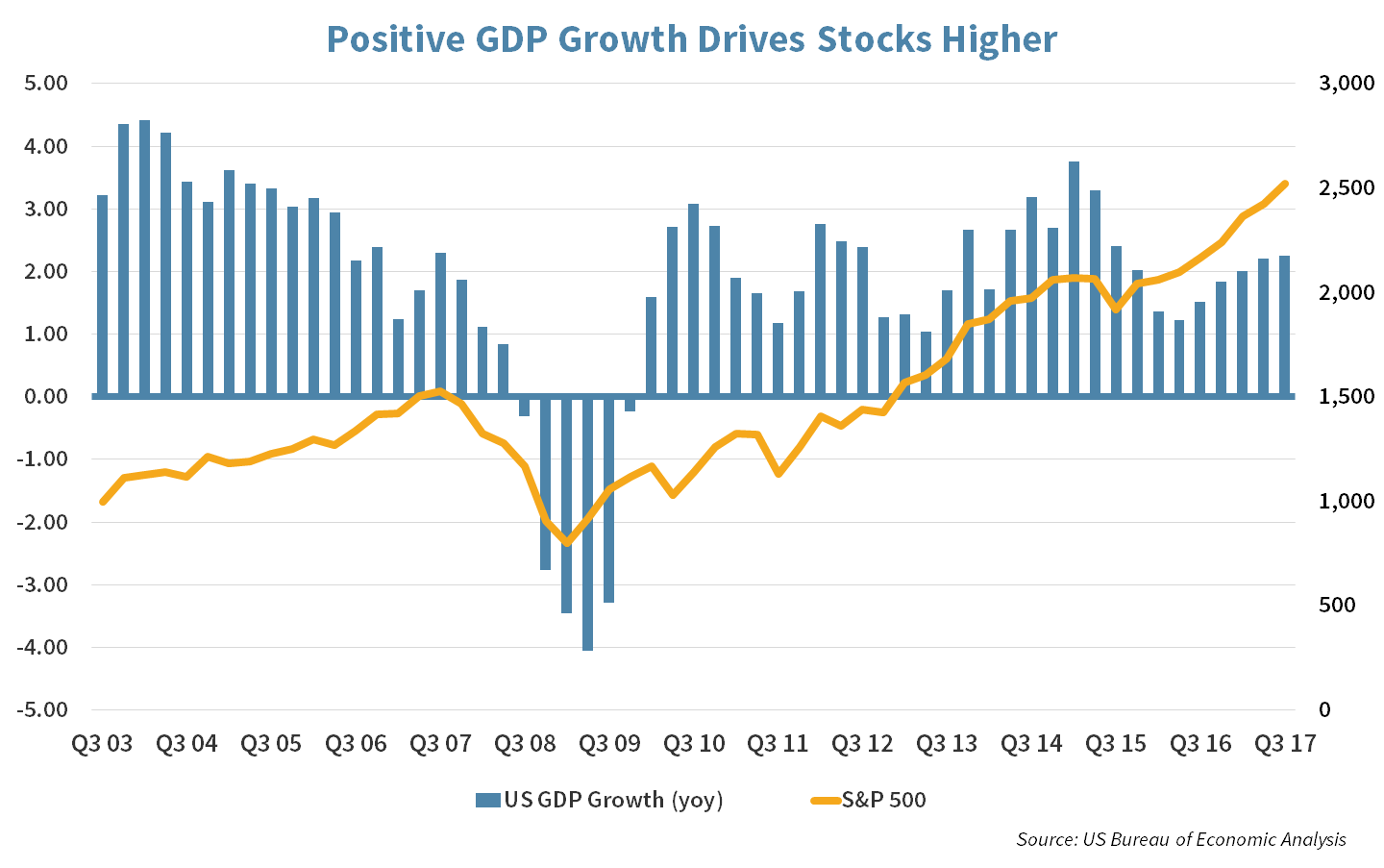

United States Gross Domestic Product (GDP) grew at an annual rate of 3% in the third quarter of this year, according to the Commerce Department. This is above expectations, which had built in a headwind due to the hurricanes. Quarterly-on-quarter growth is notoriously volatile. More relevant is the actual annual year-on-year run rate, which is a more modest 2.3%. Helping to support growth is:

- Strong household spending, as unemployment rates are low, and

- Strong business spending as, firms are investing in long-term projects with Small Business Optimism levels high (see Expectations Inflating)

The question is whether the recent economic strength is sustainable. For this, we need to look no further than the current corporate earnings season. With about half of the companies in the S&P 500 having reported, sales growth for Q3 compared to Q3 last year is expected to be about 5.6%. This continues an upward trend that began in early 2016.

While economic strength is undoubtedly good for stocks, equally as important is expectations. The upside surprise to GDP combined with 66% of companies beating sales forecasts, has raised expectations and added fuel to an already hot stock market.

Week Ahead

A Halloween SCARE

Spending in the U.S. will be closely watched by investors as hurricane Harvey and Irma have increased uncertainty.

- Analysts are estimating nearly 1% growth in spending for September.

Consumer Confidence index is expected to remain high for October.

- The index measures the public’s confidence in the health of the U.S. economy.

Apple Inc. (AAPL) is scheduled to report earnings after market hours on Thursday, November 3rd.

- The focus will be on pre-orders for the iPhone X and continued growth of services.

- iPhone X pre-orders began on October 27th and exceeded supply within minutes.

Rate decision from U.S. Fed Reserve is expected to be a non-event, as a hike has been telegraphed for December, not earlier.

Employment data is expected to be robust in October. Analysts are estimating the Friday report will show that the U.S. economy added around 300,000 jobs in the month.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Is This a Trick?

The U.S. 10-year Treasury has returned to its January yield of 2.42%, after a decline to near 2% this summer (bond prices fall as yields rise). The 2-year Treasury, on the other hand, has made major progress, driven by the federal funds rate (the rate banks charge each other for overnight loans), which increased from 0.5% to 1.25% over the past ten months. After Chairwoman Yellen’s indication in September of a likely 3rd rate hike for the year in December, the 2-year Treasury yield moved higher.

- If the U.S. Federal Reserve increases the federal fund rate in December and follows through with the telegraphed three rate hikes next year, the target rate could reach 2.25% by the end of 2018.

- The 2-year U.S. Treasury yield is around 1.67%. The market has yet to price in the expected increases for 2018 fully.

STRATEGIC GROWTH

Walking a Hotwire

The Energy sector was the laggard on the week with earnings being more a trick than a treat. The Technology sector, paced by Alphabet (GOOG, GOOGL), served up delicious earnings treats. In other earnings news…

- Expedia, Inc. (EXPE) the online travel booking company that owns sites such as hotwire, ORBITZ, Hotels.com and Travelocity, reported a quarter that made investors scream and run for the exits. The company missed expectations, blaming hurricanes and terrorism on slowing travel. More concerning was the guidance slashing. The new CEO, Okerstrom, cut EBITDA guidance to low-mid single digits for the remainder of this year and low double-digit growth next year. The 5-year compound average EBITDA growth has been around 15%. The new CEO may be resetting the bar after a spectacular run from his predecessor.

STRATEGIC EQUITY INCOME

Managing More Care

The Technology sector was the clear winner this week as earnings from Microsoft (MSFT) and Intel (INTC) flamed investor enthusiasm. Staples were a laggard thanks to major news of an acquisition…

- CVS Health Corporation (CVS), the retail pharmacy and pharmacy benefit manager (PBM), made an offer for health insurer Aetna Inc. (AET) of $200 per share. The $66 Billion acquisition would help transform CVS into something similar to Strategic Growth holding UnitedHealth (UNH). CVS was forced into actions as Amazon (AMZN) encroaches on its space with recent attempts at entry into drug distribution. Aetna’s stock price is still below the offer price, which may mean getting the deal done will not be easy.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters