Relief Rally

Investors welcomed a much needed relief rally on Wall Street this week. The S&P 500 was up 1% as oil prices stabilized and global central banks vowed more support.

Market Commentary

Contributed by Alan Leist, III

Investors welcomed a much needed relief rally on Wall Street this week. The S&P 500 was up 1% as oil prices stabilized and global central banks vowed more support.

Recession and a Crash?

While oil, stock prices and monetary policy grab the headlines, the question remains whether the fears that caused the January market swoon remain intact.

- More clarity is needed on China’s growth and the likelihood of a U.S. recession, the big threat to markets.

- Peak auto sales, oil’s contagion effects and a slowdown in manufacturing are economic warning signs worth noting.

- However, the job market and wage picture, along with savings at the pump and a still friendly Fed, continue to provide a decent backdrop for the overall economy.

- A dead cat bounce in oil and talk of easy money is not enough to form the underpinnings of the next big rally, so we can expect more tests in the months ahead.

- As we look out into the 2nd half of 2016, however, we see a resilient U.S. economy, the bottom in oil and the return of corporate profits. The underpinnings of a healthy bull market will be welcomed with open arms.

The underpinnings of a healthy bull market will be welcomed with open arms.

Alan R. LEIST III, CFA

Economic Commentary

Contributed by Doug Walters

The rise in consumer price inflation reported this week, is a healthy sign for the U.S. economy.

Modestly pricey

The U.S. reported that Core CPI (a consumer price inflation index, excluding Food and Energy), rose just 0.1% in December; below the 0.2% forecast by economists.

- However, over the course of 2015, consumer prices increased 2.1%, the fastest pace in over three years.

- Modest inflation (2-3%) is an important component of a healthy economy; too little, risks deflation… too much, risks an inflationary spiral.

Price leaders

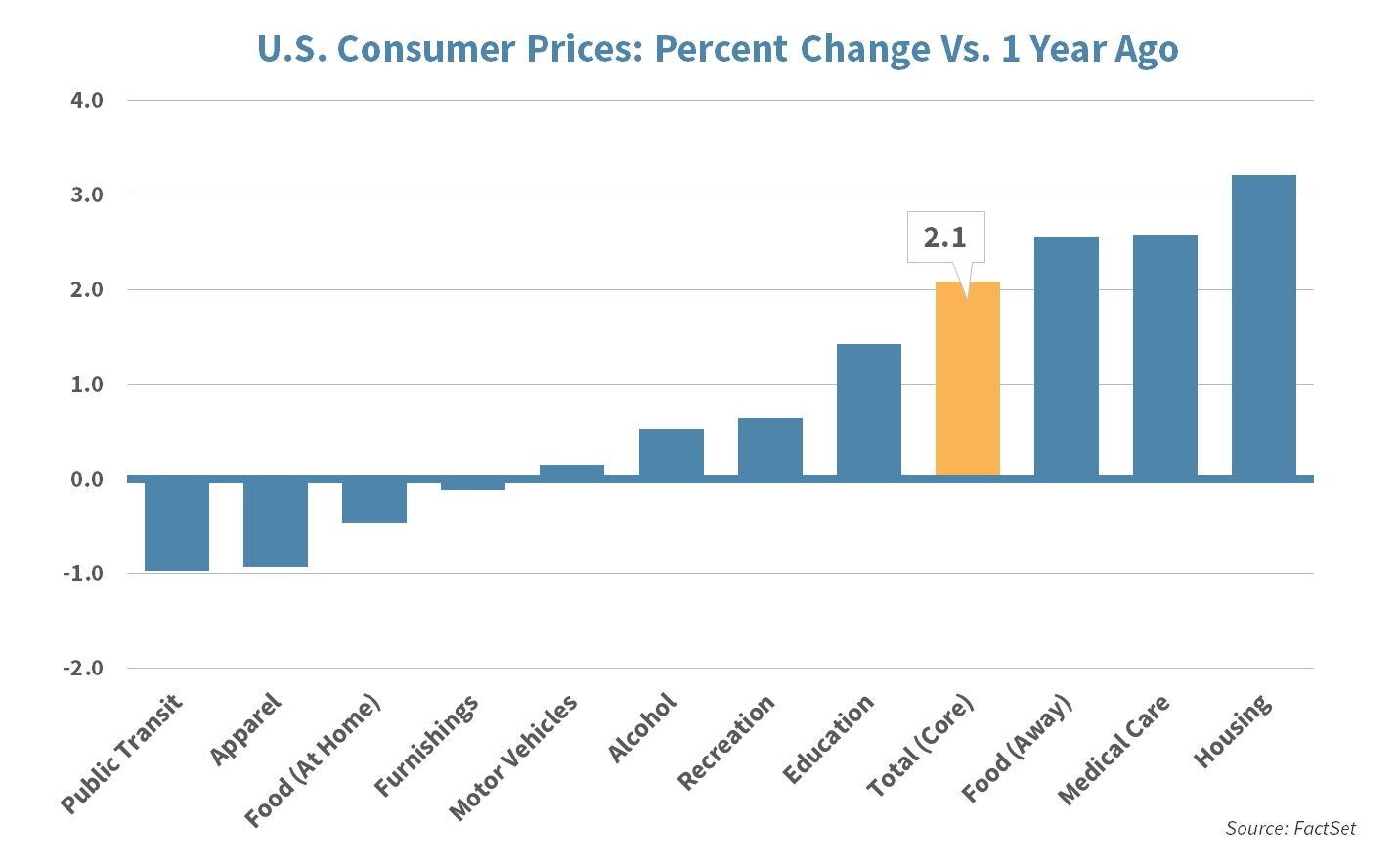

- The chart below highlights some of the consumer categories driving the 2015 growth.

- Housing tops the list, as both house prices and rental rates grew. Medical and Education expenses also rose notably, which is likely a surprise to no one.

- While prices for home-prepared food fell, food away from home, was up. Evidence suggests consumers are spending their gasoline savings on leisure activities.

Takeaway

While it is easy as a consumer to demonize price inflation, it is a good sign of economic resilience.

Looking Ahead to Next Week

Domestic Data

Global economic focus turns back to the home front next week with the Q4 GDP advance report (the first of three estimates) due out on Friday.

- Growth has likely slowed to 0.8% yoy, from 2.0% in the previous quarter attributed to lower consumer spending and a weak global economy weighing on exports.

Steady as She Goes

The Federal Reserve and Chair Janet Yellen will hold their monthly meeting next week to set monetary policy including the key interest rate.

- Amidst the January market pullback, all expectations are for the committee to keep rates “as is”, for now.

Bits and Bites

Several Strategic holdings are set to report Q4 earnings next week including Apple, McDonalds, Caterpillar and Chevron amongst others.

- Apple CEO Tim Cook will address concerns about iPhone supply chain issues and China iPhone demand.

- McDonald’s should show improved same store sales for the quarter which could be offset by currency effects.

Investment Strategy Update

STRATEGIC Asset Allocation

Central Bank Tourniquet

Soothing talk of stimulus from Europe and Japan seeks to halt the equity markets’ hemorrhaging. Stronger economic data out of the U.S. could be needed for a more sustainable recovery.

Calm before the storm

Oil markets saw some gains as colder weather boosted the demand side of the equation. However, a fresh supply wave from Iran could put the market back under pressure.

Commodity Rotation

We recently put some of the cash from our exited commodity position into gold, as we seek to maintain the diversification benefits of the broader asset class without the issues from the futures markets.

STRATEGIC Growth

Optumum Velocity

Consumer Discretionary lead the way this week, with Consumer Staples joining the Materials and Energy sectors at the bottom of the heap. In other strategy news…

- Health insurer UnitedHealth Group (UNH) reported a strong quarter. Revenue for the company was 20% higher than the year before. The health technology unit Optum was a standout, reporting a revenue increase of 42% for the year.

STRATEGIC EQUITY INCOME

We hear you loud and clear

Financials had a tough week as earnings reports failed to light a spark. Speaking of earnings…

- Telecom behemoth Verizon Inc. (VZ) topped earnings expectations. Investors focused on new wireless subscribers of 1.5 million as a positive sign that Verizon is adding customers despite major discounts from competitors. The most reliable wireless network had a sub 1% churn rate, which indicates that customers remain very loyal to the company.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III