Party Like It’s 1999.99

Stocks touched a 2 month high with the S&P 500 closing just below the symbolically important 2000 level.

Market Review

Contributed by Doug Walters , Alan Leist, III

Risky business

The ever escalating political fireworks were largely ignored by the stock market this week, as risk assets stayed in favor, buoyed by positive job creation and an upbeat economic assessment laid out in the Fed’s beige book. Negotiations to cut output continued amongst certain OPEC members and other major oil producing nations, helping to firm up oil prices. With commodities in general on the rise, Emerging Markets have been a particular benefactor.

Dirty rotten scoundrels

Super Tuesday and the debates that surrounded it escalated the political rhetoric (and insults) amongst presidential hopefuls. Trump was accused of being a con man, but he was not the only one. Brazil’s former president was detained this week while the current President Dilma Rousseff is facing impeachment charges, both being accused of corruption. Stocks cheered the move with the Brazilian market one of the best performing of the week.

With this week’s move, the S&P 500 has erased most of the losses of the first two weeks, and is now down just 2% on the year.

Rocky

With this week’s move, the S&P 500 has erased most of the losses of the first two weeks, and is now down just 2% on the year. We believe investors should come to expect this volatility. The uncertain political landscape will be with us for some time, and while the U.S. economy remains resilient, much of the rest of the world is still seeking a recipe for recovery. Investors can benefit from this rocky road, through diligent stock selection and patient rebalancing.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 2.7 | -2.2 |

| S&P 400 (Mid Cap) | 4.4 | 0 |

| Russell 2000 (Small Cap) | 4.3 | -4.7 |

| MSCI EAFE (Developed International) | 3.4 | -6.1 |

| MSCI Emerging Markets | 5.4 | -1.8 |

| S&P GSCI (Commodities) | 2.4 | -1.4 |

| Gold | 2.9 | 18.8 |

| MSCI U.S. REIT Index | 3.6 | -0.3 |

| Barclays Int Govt Credit | -0.4 | 1.2 |

| Barclays US TIPS | 0.2 | 2.6 |

Economic Commentary

It’s the Economy

Job numbers reported Friday came in much stronger than expected, albeit with a decline in wages and hours worked. Companies have decided to hire more, but on a part time basis with less pay. The best sectors for prospective employees have been healthcare, retail, restaurants, education and construction while manufacturers cut jobs in February. Mining, which includes oil & gas, has of course been the worst sector with job cuts for the past 17 months. The job market is going through a rotation with wages lagging behind.

Evidence on the Ground

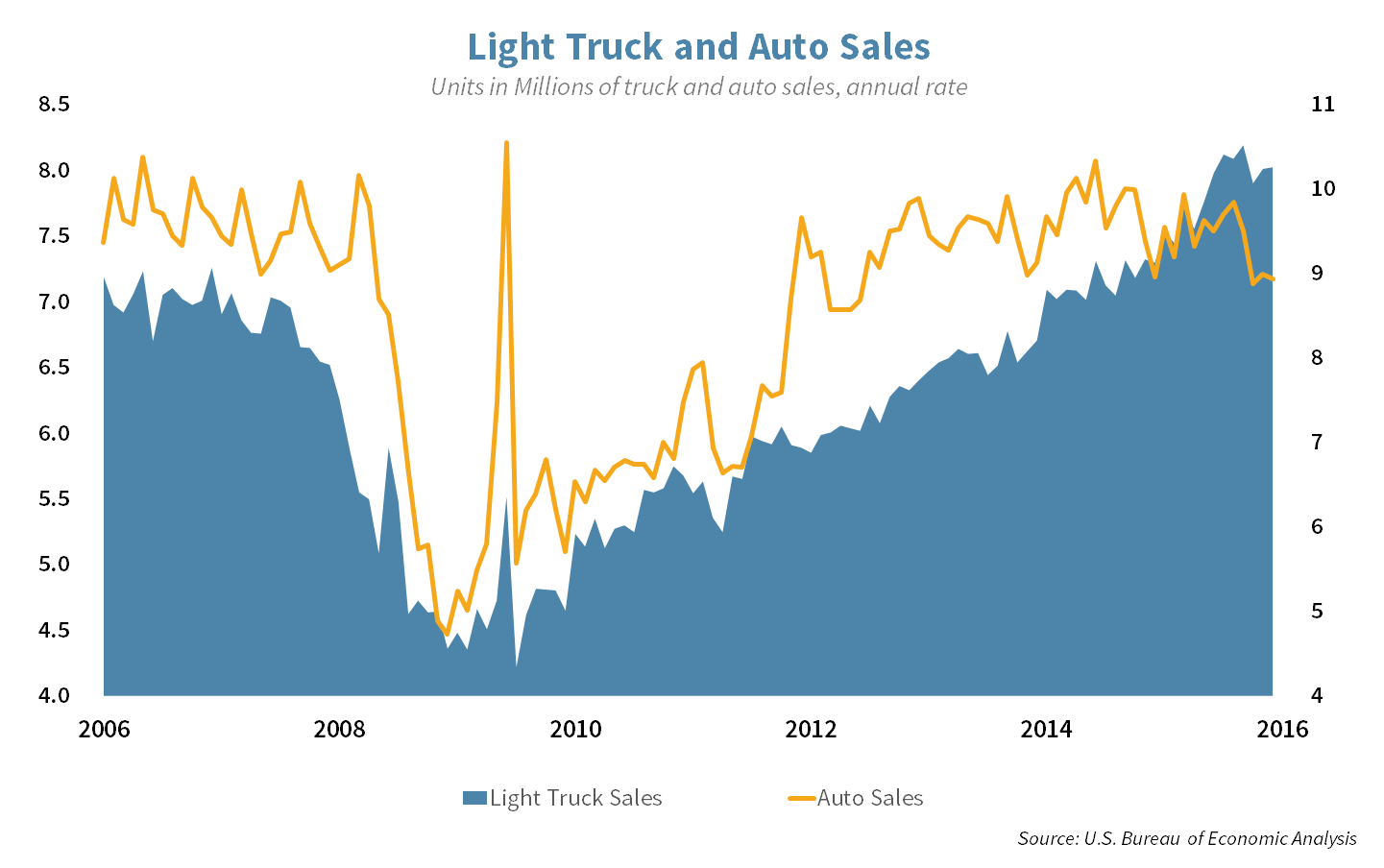

Cheap gasoline, easy credit and an improving job market has led to growth in car sales. In fact, US carmakers posted their best February sales number since 2001. Part of this was due to an extra day in the month and pent up demand from a January blizzard but the numbers do indicate confidence from consumers.

- Light trucks and SUVs combined have outsold cars for 30 months in a row with the larger vehicles making up 60% of total vehicle sales last month. With sub $2 gasoline nationally, this trend is likely to continue.

Week Ahead

Contributed by Aaron Evans

Big Government

In a calm week domestically, attention turns overseas where the annual session of China’s National People’s Congress, an almost 3,000 member legislative body, opens in Beijing next week.

- The annual NPC sessions and presentation of a new five year plan should provide insight as to how political leaders will address China’s slowing pace of economic growth and recent job losses.

Traveling Circus

With Super Tuesday in the past, another round of 12 states and territories will hold primaries and caucuses next including the candidates target dentation, the District of Columbia.

- Another round of debates is also on tap with both the GOP and Democratic contenders squaring off in Miami.

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset Allocation

Back in line

Stronger returns from risk markets coupled with some recent buying have pushed overall asset allocations back to target ranges. Gold has lead the way this year, approaching a near 20% gain thus far, although its overall portfolio impact remains small due to position sizing. International markets also have helped as recent currency headwinds shifted to tailwinds.

- Our core equity positions continue to dig out from a tough start to the year as they approach break even. Turning to the bond side, TIPS have been a pleasant surprise with the broad market recently hitting a 9-month high on the back of an almost 4% gain since mid-December.

Goldilocks Returns

Friday’s jobs report triggered the fairy tale references as a not too hot, not too cold job market could forestall the next rate increase. For now, we don’t anticipate any material alterations to portfolios. Cash levels have declined slightly but we continue to maintain some dry powder should any dislocations occur.

Strategic Growth

Cost to Cost

Energy and Technology sectors took the lead this week while the consumer sectors and health care sector jostled for bottom finish. Speaking of the consumer…

- Warehouse club Costco Wholesale Corp. (COST) reported a mixed quarter, results fell short of consensus, but comparable sales were strong despite the impact of currency and gas prices. A day later the company announced it will raise wages for its employees. The company is giving a raise of 2.5% to workers, while stockholders were told to expect earnings to be a penny or two lighter for the next 3 quarters as a result.

Strategic Equity Income

Bucking the trend

Utilities and Health Care stocks were laggards, after being leaders most of this year. Financials had a strong week but it was the Industrials that ultimately prospered. One stock was clearly a stag…

- Deere & Co. (DE) had no notable news out on the tape, but the stock had a terrific week. It may have more to do with other machinery stocks, but the story is similar. The global slowdown has weighed on the space and earnings may be pressured, but enough is enough. The stocks may have become too cheap. Time will tell if this is an infliction point for the stock.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters