Not Your Cinderella

After falling behind early in the year, the performance of U.S. equities over the past five weeks has been stellar. But the U.S. market is no underdog, and we continue to see it well placed to navigate the ups and downs of the big dance.

Market Review

Contributed by Doug Walters

Back in Black

The S&P 500 is comfortably back in positive territory for the year as stocks rallied for the fifth week in a row. The comeback has been exciting to watch, but this is no Cinderella story. The U.S. was a stimulus leader coming out of the financial crisis, and as a result is well-placed to weather the current economic volatility.

- Helping stocks this week were incrementally more dovish comments from the Federal Reserve (see our Economic Commentary), and an oil price that continues to strengthen as major oil producing countries discuss supply agreements.

Not so Valeant

While the broader market was enjoying a bounce, the stock of specialty pharmaceutical company Valeant, was declining in spectacular style. The shares fell about 60% on the week, and are down nearly 90% from their mid-2015 peak.

- This is a case study in the importance of Quality. Valeant’s growth was built on a shaky foundation – acquire companies and slash research and development. Reliance on a procession of acquisitions raises Quality concerns, and we were not surprised to see this end with an SEC investigation and accusations of fraud.

- At Strategic, we set a high standard for investment Quality, and see it as an essential ingredient to protecting and compounding assets over the long-term. Needless to say, we do not own any shares of Valeant on behalf of our clients – unlike one very high profile hedge fund manager, the so-called smart money.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.4 | 0.3 |

| S&P 400 (Mid Cap) | 1.6 | 2.2 |

| Russell 2000 (Small Cap) | 1.3 | -3 |

| MSCI EAFE (Developed International) | 0.9 | -3.3 |

| MSCI Emerging Markets | 2.0 | 2.9 |

| S&P GSCI (Commodities) | 2.0 | 8.4 |

| Gold | 0.3 | 18.1 |

| MSCI U.S. REIT Index | 2.1 | 3.5 |

| Barclays Int Govt Credit | 0.6 | 1.6 |

| Barclays US TIPS | 1.3 | 3.5 |

Economic Commentary

Fed Madness

The economy is doing well but not well enough for Federal Reserve Chairwoman Janet Yellen to raise interest rates. For this to happen, inflation needs to pick up. Yellen understands the economy is growing but slowly and doesn’t want to jeopardize that growth. In our view, nominal GDP (real GDP + inflation) has to grow at 5% before Yellen raises interest rates. The Chairwoman is keeping an eye on several factors including::

- The unemployment rate: this metric has fallen over that past six years to 4.8%.

- The labor force participation rate: this metric has been week due to people choosing to leave the workforce for personal reasons.

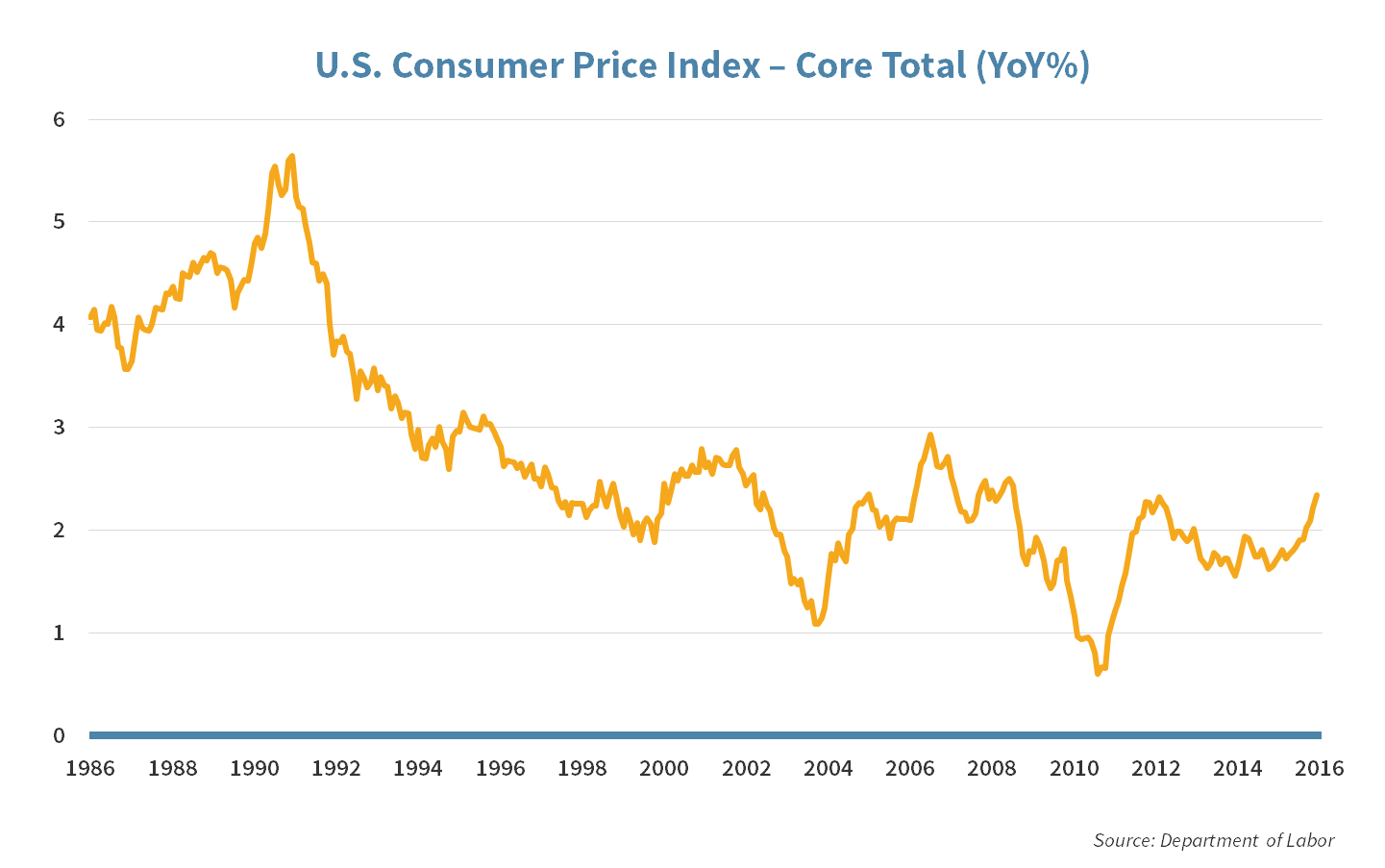

- Inflation: this metric has been below target (see below).

Winners and Losers

Inflation, although often viewed negatively, is a sign the economy is doing well as consumers are wealthy enough to pay more for the same goods. There are winners and losers when inflation happens. Borrowers win as the money they borrowed becomes worth less (in real terms) while lenders lose as they receive back less valuable dollars. Janet Yellen wants more inflation and expects it to rise over the next two to three years. As a result, core consumer prices (shown below) will likely increase.

Week Ahead

Contributed by Doug Walters

High tops

Strategic holding Nike (NKE) reports Q3 earnings on Tuesday.

- Over the past year, Nike has outperformed the S&P500 by over 30%. To justify further upside, the company will need to show it can continue to grow despite its size.

- Not likely to impact next week’s results is the Nike HyperAdapt 1.0 self-tying shoe unveiled on Wednesday.

Havana bound

President Obama will become the first sitting president to visit Cuba in 88 years next week.

- Relaxed travel restrictions have U.S. companies, like Carnival Corporation (CCL), scrambling to be first in line to capitalize.

Sweet Friday

U.S. Stock markets will be closed March 25th in observance of Good Friday.

- Those with the day off can enjoy watching the conclusion of the Sweet 16, while here at Strategic we will be open for business.

Strategy Update

Contributed by David Lemire , Max Berkovich

STRATEGIC asset allocation

Shootin’ Bricks

the front page of the WSJ points to central bankers missing from the charity stripe (rate cuts). Despite repeated efforts to drive down currencies to boost domestic growth, the U.S. Dollar continues to weaken. The upside is stronger returns on International markets. Emerging Markets have benefited the most from this currency impact, but their markets also are performing strongly in local terms.

Bracket Buster

While gold has eased off from its strong moves this quarter, it remains to be seen whether this Cinderella asset class can remain in front through the 4th quarter.

Starting-5

This month’s volatility has yet to trigger the need to make any tactical substitutions to our long term investing line up. A focus on the fundamentals of Quality and Value is our best defense for whatever madness March may throw our way.

Strategic Growth

PaaS the Rock

Tech, Industrial and Materials sectors all had solid weeks, going down to the wire for top seed. The Health Care sector missed the dance. In other strategy news…

- Database software giant Oracle Corp. (ORCL) reported earnings that at first seemed in-line and unexciting. But, Software as a Service (SaaS) and Platform as a Service (PaaS), two high priority segments of the cloud infrastructure for the company, reported bookings growth of 77% ex-currency for the year. The company also announced a $10 Billion buyback, about 6% of current shares.

Strategic Equity Income

Missed lay-up

the health Care sector was a bracket buster for Equity Income as well, but lackluster performance from Financials thanks to the Fed was also noticeable. Another earnings report worth noting…

- William-Sonoma, Inc. (WSM), the kitchenware and furnishings retailer, missed expectations. The miss was well telegraphed by a competitor a few weeks earlier. The company stumbled with its Pottery Barn stores having same-store sales drop 2% for the quarter and e-commerce sales growth of 2.9% looked light. The company did throw down a 6% dividend hike and dished out double digit EPS growth guidance.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters