Nice Work

The S&P 500 ended the week strong, thanks in part to an employment report which showed continued healthy improvement, but not so much as to force the Fed into early action on rates. Behind the scenes, the consumer has quietly been gaining confidence.

Market Review

Contributed by Doug Walters

Payday for Equities

Labor Day took on extra meaning Friday as the much watched Non-Farm Payroll number came out (see our Economics section). The slightly below expectations print struck the right balance for U.S. equities, helping the S&P 500 end the week in positive territory.

- Once again we find ourselves in that counter-intuitive world where below expectations economic data results in a positive reaction in equities. As we discussed last week (in “When Good News is… Good News”), news that pushes out the timing of the next Fed rate rise will typically boost equity valuations.

- However, importantly, even though the number was below expectations, it was still a respectable number, showing a healthy jobs environment.

Confidence Builder

For U.S. Presidential race followers, it would be easy to conclude from the candidate’s commentary that the economic situation in the U.S. is highly challenged. However, the data is telling another story, which is good for equity holders who are concerned about rising valuations.

- This week there was a robust Consumer Confidence report from the Conference Board. The “Present Situation” measure is at its highest level in nearly a decade.

- There is good reason for this: home prices are buoyant, unemployment is falling, and wages are on the rise. The latter point has been somewhat under the radar, yet growth in hourly wages has unmistakably accelerated over the past year.

We have been saying for some time that to sustain current valuations, corporate top line growth eventually needs to improve. A strong and confident consumer would be a great start.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.5 | 6.7 |

| S&P 400 (Mid Cap) | 1.2 | 12.9 |

| Russell 2000 (Small Cap) | 1.1 | 10.2 |

| MSCI EAFE (Developed International) | 0.4 | -0.4 |

| MSCI Emerging Markets | -0.2 | 13.3 |

| S&P GSCI (Commodities) | -4.4 | 11.4 |

| Gold | 0.4 | 24.7 |

| MSCI U.S. REIT Index | 1.5 | 12.0 |

| Barclays Int Govt Credit | 0.0 | 2.8 |

| Barclays US TIPS | -0.1 | 5.4 |

Economic Commentary

Yellen’s Labor Day

The US economy added 151,000 new jobs in August, slightly below expectations of 180,000 but still positive enough to show proof of an economic recovery. Main street, wall street and the Federal Reserve all look to this number to gauge economic strength and plan accordingly. Not only does the job number point to the level of strength embedded in the recovery, but it may also determine whether Fed Chairwoman Janet Yellen raises interest rates this year.

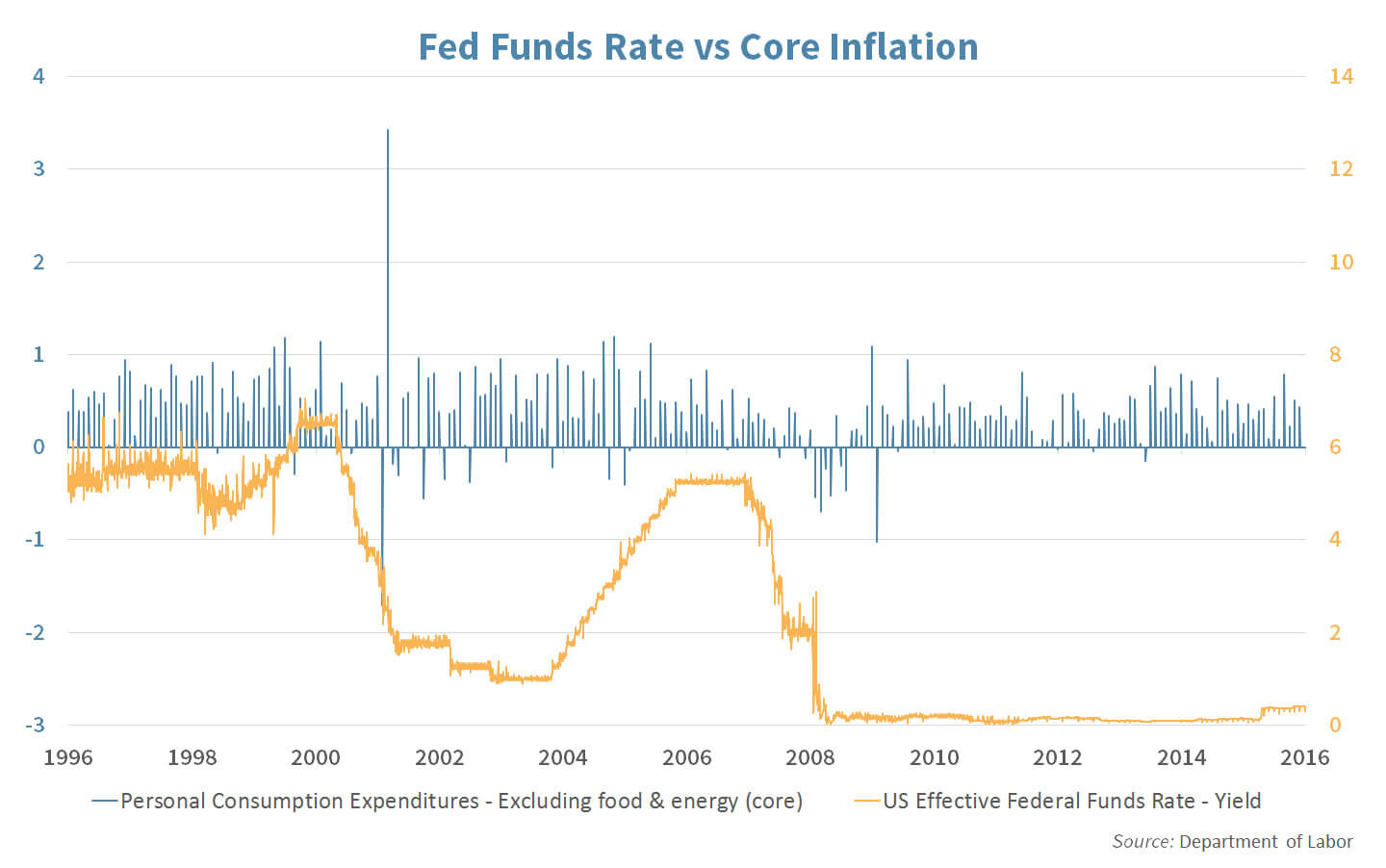

So far this year, Yellen has been cautious on raising rates even though the labor market has improved to 4.9% unemployment. Generally speaking, Yellen must balance her decision between improving the job market and fighting inflation. Inflation levels have been low enough recently allowing her to focus on unemployment and she has kept rates close to zero. Now that wage and employment levels are rising, she may turn towards a higher and more normalized interest rate level. This week’s job number can help her decide when to take this step.

Part of the stock and bond market rally this year has been due to the search for yield. If Fed rates go up, demand for other securities could lessen and the market could be in turmoil. Yellen understands this and will likely raise rates very gradually over a long period of time.

Week Ahead

Contributed by , Max Berkovich

Hard at Work

While the U.S. will be enjoying a Labor Day weekend and back-to-school shopping, the G20 summit will gather in China on September 4th and 5th. The leaders will discuss “…economic structural reform, international financial organization reform, and cooperation in the energy and anti-corruption fields.”

- This will be President Obama’s last G20 appearance before his term is up.

Supply Side

On Tuesday we get an update from the Institute of Supply Management on the non-manufacturing sector.

- A reading over 50% signals that businesses are expanding.

Coloring book

On Wednesday, Federal Reserve’s Beige Book will provide some insights on any economic changes in 12 Major U.S. Districts since the last Fed’s meeting in July.

- The data may offer further color on what conditions the Federal reserve is focusing on.

Are you Ready for Some Football?

The NFL season kicks off in Denver on Thursday. The Super Bowl 50 champs Denver Broncos will face runner up Carolina Panthers in a prime time re-match.

- Employment research firm Challenger, Gray & Christmas claim that a whopping $17 billion in lost productivity afflicts U.S. employers due to fantasy football. Amazingly the NFL only produced $13 Billion in revenue last year.

- Challenger also reports 57.4 Million Americans and Canadians participate in Fantasy Football.

Investment Strategy

Contributed by Max Berkovich ,

Strategic Asset Allocation

Data Dependent

U.S. Equities finished the week slightly higher, though were outpace by Developed Markets and REITs. Steadily improving U.S. economic data (highlighted in the Market Review) has helped U.S. equities to put in a positive performance for the month. Small cap performed particularly well, along with Emerging and Developing Markets.

Keep Calm and Muddle On

Equity allocation continues to be above our longer-term targets while interest rates muddle near all-time lows. There were no asset class moves this week that prompted the need for rebalancing.

strategic growth

Farewells

The Financial sector was the clear leader this week, while the consumer discretionary sector continued last week’s slide. In corporate action news…

- As Labor Day is the unofficial farewell to the summer, we also say farewell to long-time strategy holdings. EMC Corp. (EMC) and Johnson Controls Inc. (JCI).

- EMC is being taken private by Dell Corp., but even though EMC will be gone, we will receive a VMware, Inc. (VMW) tracking stock. Leaving us some exposure to the fast growing cloud software and service space.

- JCI is merging with Tyco Intl. Ltd. (TYC) to combine the HVAC supplier with security and fire protection company. As part of the deal, the new company will be domiciled in Ireland and spin-off its automotive unit into a new company Adient Ltd.

STRATEGIC Equity Income

Labor pains and LIBOR gains

The Financial sector continues to sparkle. The inter-bank (LIBOR) lending rate had a significant jump the past month as money market reform is distorting the market set rate. A jump in this rates seems to be a gift to the banks. In other strategy news…

- Wal-Mart Stores Inc. (WMT) announced it was cutting 7,000 back office jobs across the U.S. These are positions in accounting and automation. Also, Wal-Mart will feel the pain of distribution issues as a bankruptcy of a shipping company is causing logistical problems for the retail giant. Employees of the now bankrupt Hanjin Shipping are refusing to work for fear of not getting paid. The strike has halted trans-pacific shipping.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters