Much Ado… for Nothing

Capital Hill was the center of attention for financial markets this week. Unprecedented commentary from the intelligence services combined with a contentious fight over health care left equities struggling to find sure footing.

Market Review

Contributed by Doug Walters

U.S. equities posted their worst week since the election as news from Washington dominated market sentiment. Early in the week it was testimony from FBI director Comey and NSA director Rogers which cast a shadow of uncertainty over the market. We often preach that equity markets have an aversion to uncertainty, and this was on full display Tuesday as the S&P 500 fell over 1%. Later in the week, it was health care that continued to weigh on shares.

Healthy Dose of Reality

Lawmakers were reminded this week that once you give, it is hard to take away. The House’s American Health Care Act failed to gain enough support to justify a vote. As the news broke late in the trading day on Friday, equity markets attempted a rebound.

- The proposed act appears to have not cut benefits enough to satisfy the Freedom Caucus, yet went too far for those whose constituents have benefited from The Affordable Care Act (aka Obamacare).

- While lawmakers are busy with their partisan finger pointing, and arguing about “repeal” or “repair”, the average American only cares about getting good health care at an affordable price.

The pullback this week is modest in the grand scheme of things, and not surprising given how strong equities have been. Our focus remains on Quality and Value to help ride out this volatility.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.4 | 4.7 |

| S&P 400 (Mid Cap) | -2.1 | 2.0 |

| Russell 2000 (Small Cap) | -2.7 | -0.2 |

| MSCI EAFE (Developed International) | -0.1 | 6.8 |

| MSCI Emerging Markets | 0.4 | 12.4 |

| S&P GSCI (Commodities) | -1.3 | -5.0 |

| Gold | 1.6 | 8.4 |

| MSCI U.S. REIT Index | 0.1 | -0.6 |

| Barclays Int Govt Credit | 0.4 | 0.3 |

| Barclays US TIPS | 0.6 | 1.1 |

Economic Commentary

Car Wreck

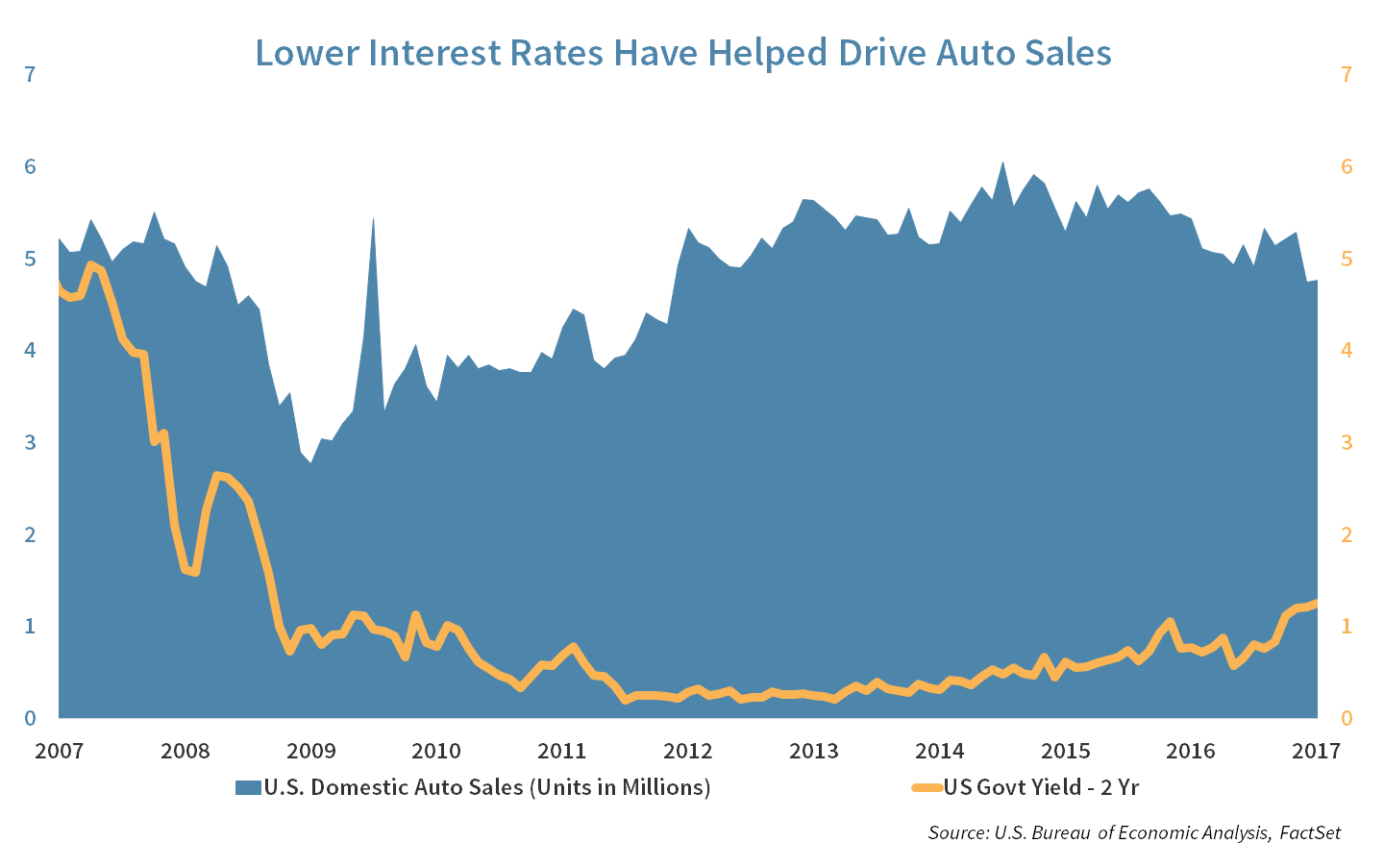

We have shied away from investing in the OEM automobile industry within our Equity Income and Strategic Growth strategies as our analysis pointed to the cycle being at its peak. This week, automakers came out and warned that the industry is facing a slowdown in sales. Ford Motor’s (F) management forecast lower profits next quarter and lower sale volumes in the U.S. as well as China for this year and next. The reasons for these lower expectations include:

- Higher auto loan payments as interest rates rise,

- A glut of used cars for sale as leased cars return to the market, and

- Higher labor costs as the unemployment rate drops.

Ford stock fell 6% this past week on the lower revenue expectations. Auto makers need to reinvent themselves and invest more in the advance of electric vehicles as well as autonomous cars. Factors that bode well for them include:

- Lower gasoline prices (as compared to a few years ago).

- Advances in technology that may drive new car demand.

Week Ahead

Rally on FUMES

FOMC member Charles Evans of Chicago is scheduled to speak on Monday. Evans has been a big advocate for delaying increases in interest rates. Any changes in his views can move the markets.

UK has set the stage, with no barriers from Parliament or the House of Lords, to File Article 50. Prime Minister Theresa May can now submit Article 50 and begin negotiations with EU members.

Mortgage Applications and Pending Home Sales data will provide some additional color on the health of the real estate markets in the U.S. The decline in housing inventory and the rush to get ahead of rising rates may help boost real estate prices further in the near term.

Euro-zone’s light week of economic data will give the EU little breather. Investors will be watching closely the region’s inflation data as the ECB has been seeking further strength in the EU’s inflation numbers before they can begin thinking about raising rates.

Spending from U.S. consumers has been light and is expected to remain flat when reported next week. However, the Consumer Confidence index remains near its record highs. The two indices contradict each other, as the public’s confidence about the health of the U.S. economy is not translating into higher consumer spending.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

A New Boogeyman

Interest rates moved lower this week giving a little boost to dividend paying stocks, gold, and REITs. The markets are ready for the Fed to continue their gradual rate hike policy, as long as it is gradual and well telegraphed. The fear is that any change in the size of the $4.5 trillion balance sheet would do more harm to the global bond market than several 0.25% increases in the short-term interest rates. Additionally, the balance sheet reinvestment policy may be used to alter the shape of the yield curve.

Double Trouble

Rising rates can bring further headwinds for some REIT investments as they are already weighed down by allocations to malls and shopping centers. Conventional retail has been under pressure and malls are fighting to find a creative way to bring people back. Major malls turned to restaurants and entertainment to fill the vacancies while major retailers like Macy’s (M), Sears (SHLD) and JC Penny (JCP) continue to close more locations. Retail is roughly 22% of the index, and is the biggest sub sector. We reduced our exposure already and are reviewing the asset class further.

STRATEGIC GROWTH

No Swoosh This Time

The relative leader this week was the Materials sector, while the Financial sector was the biggest laggard. In other strategy news…

- Nike Inc. (NKE) reported a notable earnings beat when it announced its quarterly results, but it was not a clean beat. Revenues came in on the light side, and the earnings beat was attributed to lower taxes, cost cutting and share buybacks. The company offered weaker guidance for future orders, a key metric followed by Wall Street. On the positive side, annual revenue grew 7% for the Nike brand and 3% for the Converse brand on a constant currency basis.

STRATEGIC EQUITY INCOME

Dynamic Workflow

Another rough week for banks weighed on the Financial sector due to a continued decline in interest rates. On the other hand, the REIT, Telecom and Utility sectors had a hot week thanks to lower interest rates.

- Two of the strategy’s Technology holdings made small, under the radar, acquisitions this week. Apple Inc. (AAPL) acquired Workflow, a private app developer. Financial terms are not available. The acquisition gives the company control of an app that automates processes that use multiple mobile and tablet apps. This should help tighten the grip on the iOS ecosystem. Also, Cisco Systems Inc. (CSCO) acquired AppDynamics for $3.7 Billion, hours before the company was going to go public. AppDynamics focuses on tools that manage the performance and availability of cloud computing environments. This should complement Cisco’s move into fast growing cyber security and data collection.

Elevate Your Trajectory

Don't wait another day to build a successful, secure future with Strategic.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters