Mother of All Pivots

President Trump made an about face on campaign promises while the S&P 500 ended the week down over 1%. The souring market sentiment had less to do with these shifting convictions and more to do with rising geopolitical tensions, particularly in North Korea.

Market Review

Contributed by Doug Walters

Equity markets have had a rough start to the second quarter, with the S&P 500 down over 1% on the week. Over the past few days, we have witnessed an unprecedented shift in stance from the President on some of his most high-profile campaign talking points. In general, he appears to be moving away from the populist rhetoric that helped motivate his base. While surprising, most of these shifts are likely to be viewed positively by investors. Rising geopolitical rhetoric more likely drove the declines we witnessed.

Policy shift

In recent days, it has been hard to keep pace with the changing stances at the White House. In general, we would argue that these revised opinions are incrementally more market-friendly. The major flip-flops include:

- Trump telling The Wall Street Journal that Fed Chairwoman Yellen is “not toast,”

- His increasingly harsh words for Russia for backing Syrian President Assad,

- The Export-Import Bank which he had previously cited as unnecessary is now “a very good thing,”

- NATO is, “no longer obsolete,” and

- The Chinese are “not currency manipulators.”

The challenge for investors will be to deal with this lack of certainty, which is likely the new normal.

War or words

Something else that has changed is President Trump’s take on what “America First” means. Initially, he promoted isolationism and nationalism, with substantial input from chief strategist Steve Bannon. However, Bannon’s sphere of influence appears to be shrinking, and the President may be recognizing that America First must include a substantial role in the world geopolitical stage.

- The use of a large MOAB bomb in Afghanistan (nicknamed the Mother of All Bombs), spooked the market. But the main concern of the market is North Korea. The U.S. is in a war of words with North Korea, who threatened nuclear retaliation following the U.S. deployment of an aircraft carrier into the region.

It is difficult, if not impossible to predict the eventual outcome of these geopolitical threats. As investment managers, we focus on managing the risks that are within our control. We seek out high-quality investments that we believe offer a reasonable margin of safety. Over the long-term, we believe that these investments have the potential to both protect and grow our client’s assets.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.1 | 4.0 |

| S&P 400 (Mid Cap) | -1.5 | 1.2 |

| Russell 2000 (Small Cap) | -1.4 | -0.9 |

| MSCI EAFE (Developed International) | 0.0 | 5.7 |

| MSCI Emerging Markets | 0.1 | 11.7 |

| S&P GSCI (Commodities) | 1.6 | 0.8 |

| Gold | 2.6 | 11.9 |

| MSCI U.S. REIT Index | 0.9 | 1.9 |

| Barclays Int Govt Credit | 0.6 | 0.9 |

| Barclays US TIPS | 0.8 | 1.8 |

Economic Commentary

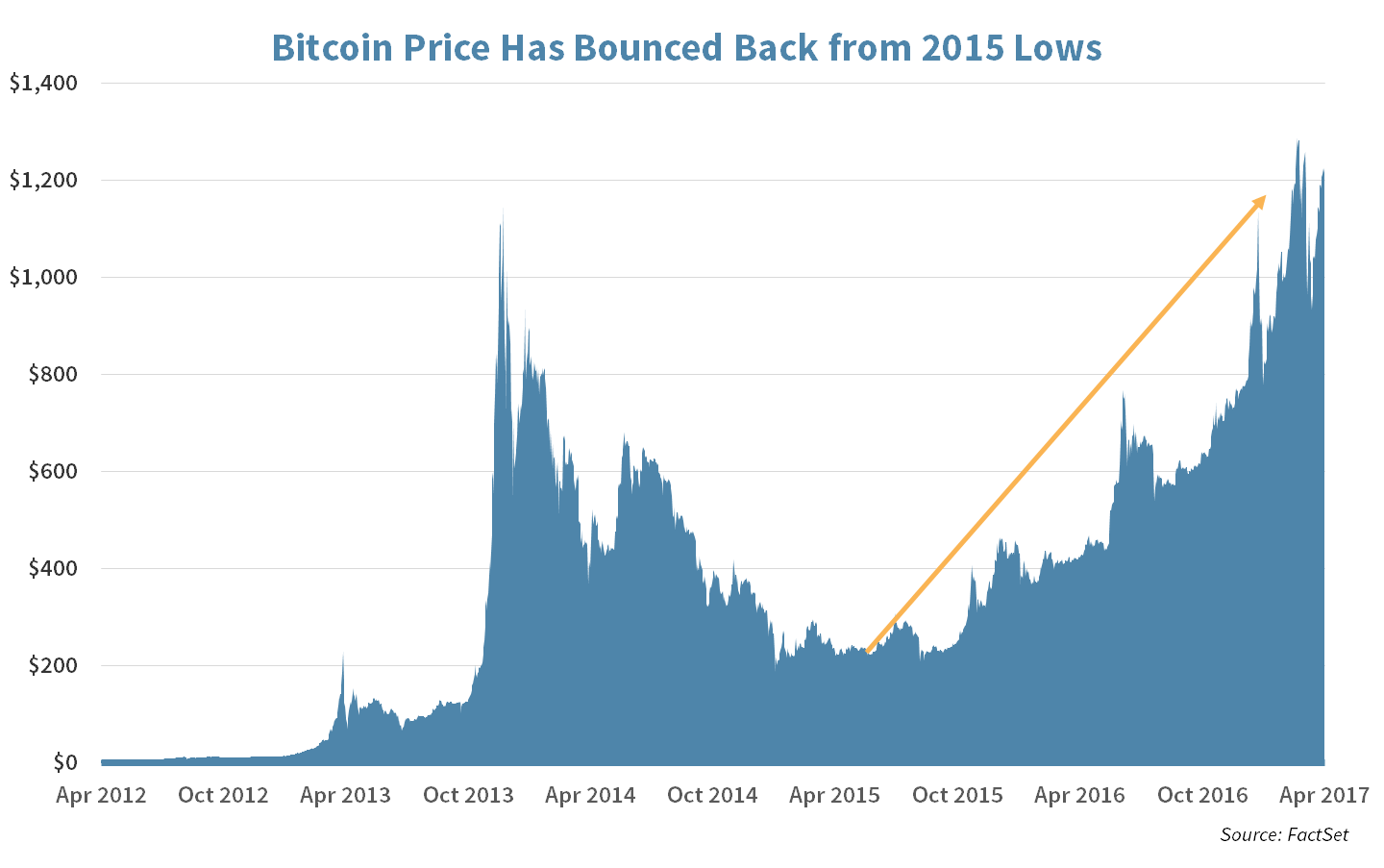

A bit of a bubble

On December 4th of 2013, former Federal Reserve Chairman Alan Greenspan went on Bloomberg television and claimed that the “Bitcoin price is in a bubble.” He was right. The price of Bitcoin dropped from $1,145 that day to a low of $183 thirteen months later. The price has rallied since then as,

- Supply is limited given Bitcoin is “mined” online through complicated algorithms,

- Demand has increased as a means of making online purchases,

- There has been speculation of a Bitcoin ETF (Exchange Traded Fund),

- It is a preferred currency for the procurement of illegal products and services, and has been used for funding terrorist groups.

A Bitcoin ETF could enable the virtual coin to become a mainstream investment product as the ETF would trade on the same platforms as stocks. The Securities and Exchange Commission last month, however, rejected the application by the Winklevoss twins (also known as Winklevi, famous for Olympic rowing and creating ConnectU which they claim was stolen by Mark Zuckerberg to create Facebook). The Commission stated that because the markets where Bitcoin is traded are unregulated and they have “concerns about the potential for fraudulent or manipulative acts and practices.”

The Strategic investment team would not recommend investing in Bitcoin as it does not come close to meeting our Quality and Value mandate. We take a strong stance against owning a cryptocurrency that helps to fund global crime and terrorism. We do however believe it can provide lessons on how bubbles are created and eventually burst. Caveat emptor.

Week Ahead

Hunt no further, here are next week’s Easter EGGS

Earnings season is set to kick-off next week with companies primarily in Healthcare (UNH, JNJ) and Financials (MTB, BLK, USB, BBT).

- With two rate hikes from the Federal Reserve in the past four months, close attention will be paid to Banks’ profitability.

Gross Domestic Product (GDP) in China is expected to grow 6.7% for the first quarter vs. previous year growth of 6.8%.

- 6.7% might be slow growth for China, but most of the developed world is growing at less than 2%.

Global trade will be reported from the European Union (EU). Any progress of EU’s trade surplus could signal a faster and stronger recovery in Europe.

- The data will also be used to try and quantify the initial impact of Brexit.

Surveys measuring overall manufacturing in the Philadelphia and New York Federal Bank regions are expected to contract a bit from their highs in February. Despite the expected contraction, manufacturing in both regions is forecast to remain robust.

- The Philadelphia Fed Index is expected to grow 25.5% in April versus 32.8% growth in March.

- The Empire State Index is expected to grow 14% in April versus 16.4% growth in March.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Retail scoop

- The effects of Amazon are becoming more visible as major retailers like Macy’s (M), Sears & K-mart (SHLD), and JC Penny (JCP) continue to close stores as they become unprofitable. In the world of finance, news networks spread bold headlines like “Conventional Stores are Dead,” but our channel checks show; stores are still busy serving their customers.

- It is clear that a significant amount of shopping is still happening at stores and not online. In fact, stores like Target (TGT) and Strategic Equity Income holding Walmart (WMT) are leveraging their locations to serve online consumers faster and cheaper than dot-coms that lack a traditional storefront. Even Amazon (AMZN) has built stores of their own and has floated the idea of opening more stores in the foreseeable future. This week we even mused at a rumor that Amazon was exploring an acquisition of Whole Foods Markets (WFM). Perhaps the real work of e-commerce is to put an end to the growing glut of stores, cluttered by bad business models and poor customer service, and allow better operators to flourish.

Extra noise

- Despite their decline, equity markets remain surprisingly resilient despite the U.S.’s response to Syria’s use of chemical weapons and North Korean tensions. The VIX, an equity volatility index, has spiked and the 10-Year U.S. Treasury yield of 2.25% is at a 2017 low, yet the S&P 500 is less than 3% away from an all-time high.

STRATEGIC GROWTH

Another chip shot

Consumer sectors were the leaders this week, while the Technology sector was the undisputed laggard thanks to the semiconductors…

- Qualcomm Corp. (QCOM) continues to get jabbed by mobile phone makers. This week BlackBerry (BBRY) received an $815 Million settlement award from Qualcomm for royalty overpayments.

- Skyworks Solutions Inc. (SWKS), though not directly involved, felt the sting of recent supplier consolidation by major customer Apple Inc. (AAPL) who is in-sourcing several microchips and cutting out some vendors.

STRATEGIC EQUITY INCOME

Getting down to the nuts & bolts

Consumer Staples were a notable standout week, while the Industrial sector was stung by an earnings report from…

- Fastenal Co. (FAST) reported a mostly in-line quarter, but it was not enough for investors eager for growth. Though sales grew 6.2% year-over-year and the vending machine units increase by 17% from last year, it was a decline in gross margins and store count that stuck out.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters