A Lump of Coal for Platinum

U.S. Equities continue to hover near their highs, with the S&P 500 posting a small gain this week. As kids dream of toys, we study the economics of the alternative – coal. The outlook is poor, but better than that of Platinum (the failed hedge fund).

Market Review

Contributed by Doug Walters

Stock-ing up

Stocks held on to the gains of the past month, though volume ahead of the holidays was predictably weak. More of the same is expected next week. The stability of equities came even as economic news was unsupportive and geopolitical tensions rise.

- Growth in consumer expenditures slowed in November, and core PCE inflation (the Fed’s preferred measure) held flat. However, these are monthly measures, and subject to volatility.

- A terrorist attack in Berlin and thwarted plot in Australia were also unhelpful for sentiment.

On the naughty list

In our Economic section we discuss the challenges faced by the coal industry. This, despite yet another hedge fund being placed on the naughty list.

- This week, the founder and CIO of the hedge fund Platinum Partners, along with six other employees were indicted for securities fraud. The $1bn+ hedge fund has purportedly been operating as a Ponzi scheme.

- Hedge funds in general have had a difficult run, significantly underperforming equities over the past 5 years. This poses an additional reputational challenge given their high fees.

- The Platinum spectacle serves as a good reminder of the importance of simplicity, liquidity and most of all transparency when it comes to investing.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.3 | 10.8 |

| S&P 400 (Mid Cap) | 0.4 | 19.7 |

| Russell 2000 (Small Cap) | 0.5 | 20.7 |

| MSCI EAFE (Developed International) | 0.3 | -2.4 |

| MSCI Emerging Markets | -1.6 | 6.1 |

| S&P GSCI (Commodities) | -0.4 | 25.8 |

| Gold | -0.2 | 6.3 |

| MSCI U.S. REIT Index | -0.2 | 2.6 |

| Barclays Int Govt Credit | 0.3 | -0.2 |

| Barclays US TIPS | 1.3 | 2.6 |

Economic Commentary

Coal in your stocking

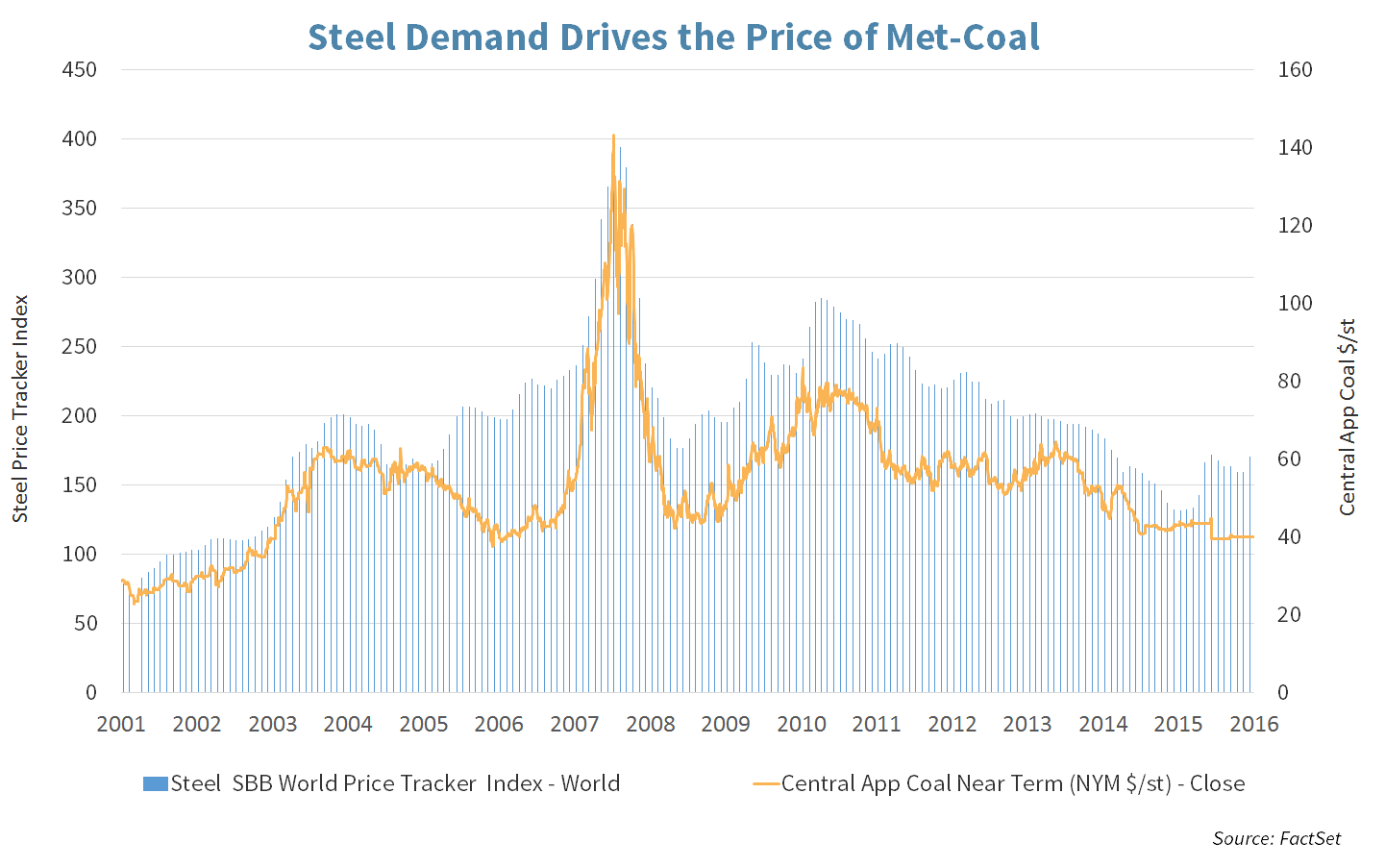

There are two types of coal: 1) Thermal and 2) Metallurgical. Thermal coal is ground into powder and fired in a boiler to produce heat and generate electricity. Metallurgical coal, also called met-coal or coking coal, is used to create iron and steel. Both types of coal have been under a lot of pressure the past few years.

Although 33% of electricity is still generated by thermal coal, the percentage has fallen from over 50% a decade ago, as coal is largely being replaced by cleaner natural gas, which now also has a 33% market share. Natural gas prices have been very low as there is an abundance of the fossil fuel being produced in the very prolific basins of Marcellus and Utica. This year, the national average price of natural gas has consistently been below the cost of coal delivered to power plants, fueling the switch. Other energy sources competing for market share include nuclear, hydropower and renewables.

The saving grace for coal producers needs to come from higher steel demand. Although met-coal prices have remained low due to a glut of supply, steel prices are up 23% from their bottom in January 2016 on hopes that the Chinese economy will grow at a higher than expected clip with strong steel-based construction levels. Even if these hopes come to fruition, we would still not wish for investors to find coal in their stockings this Sunday. Any recovery of coal in 2017 would likely be nothing more than a dead cat 2017 bounce.

Week Ahead

Lazy Monday

In observance of Christmas, Monday, December 26th is a holiday for both the stock and bond markets (as well as Strategic).

Silent week

While the economic data is very light for next week, there are a couple of key metrics being watched by the street…

- Consumer confidence, a survey which measures the public’s confidence, is forecasted to come in at 111 vs. 107 the prior month. The higher the number the better. Currently, consumer confidence is at 8 year high.

- Pending home sales index, a leading indicator of housing activity, is expected to grow by 0.1%. Last month, the index rose to 110.0 from 109.9.

Strategy Updates

Strategic Asset Allocation

Gift returns

U.S. equity markets finished the week little changed. The week was fairly uneventful, with the biggest laggards being REITs and Emerging Markets.

- Rising interest rates have hurt REITs which are up about 1% on the year, having been up by about 16% in August.

- A stronger U.S. Dollar, (a product of the rise in U.S. interest rates), have weighed on Emerging Markets which declined from their highs of around 12% in September, down to about 5% year-to-date.

A present for traders

Fixed income was the biggest winner for the week as interest rates retreated from their highs. The day-to-day volatility comes from economic data. Overall, the 10-year settled in to a 2.55%, providing a welcome gift of stability.

Good things come in small packages

The outperformance of U.S. Small Cap stocks has put the asset class on our radar for potential rebalancing.

Gift for some, but not really

Mutual Funds continue to pay out capital gains, with Large Cap funds in particular distributing more than 5%. While the distributions may look like gifts, they are not. Mutual funds are paying out cash, which will reduce the value of the fund, which leaves investors exactly where they were, but holding cash.

- Owning mutual funds in taxable accounts will most likely lead to a tax bill, which experts claim would be better deferred to 2017 given the potential for policy change.

- We, in general, do not reinvest distributions back to the fund, but choose to actively allocate the cash to where our process indicates is the best investment at the time.

Strategic Growth

Chemistry under a mistletoe

The Consumer Discretionary sector was pulled down by an unexplained selling in the retail space, but not enough to overtake Materials for top laggard. Speaking of Materials…

- Praxair, Inc. (PX) America’s largest industrial gases company agreed to a union of equals with Germany based Linde AG (LNEGY) to form the world’s largest industrial gasses company. The combined company would be worth roughly $66.6 Billion. This deal has been rumored since September. Given the deal is a merger of equals, there seem to be no premium attached and the only carrot for investors here is an expected $1 billion of cost savings for the combined entity. Since this would be an inversion (new company would be a German company) opposition from the new president is expected.

- Chemists, unlike investors, do not see a glass as half full, nor half empty. It’s just have gas and half liquid to them.

- Carl von Linde a German scientist, businessman, and Noble Prize winner in physics started predecessors of both companies in 1907.

Strategic Equity Income

Christmas gift

Telecom was the best sector this week, with Health Care chasing Consumer Discretionary for bottom finish. In other strategy news…

- BB&T Corporation (BBT) the North Carolina based bank, received a gift from regulators when it received approval from the Federal Reserve Bank to make an additional $200 million stock buyback before year end. This was an addition to $640 Million approved earlier in the year. Without this gift, the bank would probably have a less than nice holiday. BB&T consented to an FDC and North Carolina corrective action letter for its lax money laundering rules. While this does not impact earnings or operations of the bank, this action may delay any mergers and acquisitions for the immediate future.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters