An End to Summer Doldrums

The S&P 500 sold off over 2% Friday on concerns that, absent Fed rate action, the economy could overheat. Selloffs like this are commonplace, and no cause for concern. However, they are a good reminder of the importance of diversification.

Market Review

Contributed by Doug Walters

Overheating Fears

The calm in equities that has persisted for much of the summer ended abruptly Friday as reality appears to be sinking in that the Fed may need to go on the offensive with rates. The S&P 500 fell over 2%, closing near the lows of the day.

- The selloff was sparked by Boston Fed President Rosengren, who noted in a speech that there is a “reasonable case” to be made for a rate increase. This has been said before, and should not be new news to anyone. However, what likely spooked investors were comments that waiting to hike poses a growing risk to the economy overheating.

- We have been writing for some time that there are number of indicators pointing to economic strength in the U.S., including: strong housing, low unemployment, rising wages, improving industrial production and increasing personal consumption. There should be no surprise that the Fed is taking a more hawkishness tone.

Embrace Diversity

In times of uncertainty, the value of diversification often shines. For much of the last five years, it would be easy to be complacent, and focus solely on U.S. equities. While they have been a standout performer for much of this time period, that is not always going to be the case, and this year we are seeing that first hand.

- Thus far in 2016, the best performing asset class in our asset allocation model is gold, followed by Emerging Markets, Real Estate and International Bonds.

- The optical challenge with a well-diversified portfolio, is that there is always a worst performing asset class that you wish in hindsight that you did not own. However, this is short-sighted thinking. Market timing is a fool’s game. It is a well-diversified portfolio, combined with thoughtful rebalancing that has more potential to beat the market over time.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -2.4 | 4.1 |

| S&P 400 (Mid Cap) | -3.2 | 9.3 |

| Russell 2000 (Small Cap) | -2.6 | 7.3 |

| MSCI EAFE (Developed International) | 1.3 | 1.0 |

| MSCI Emerging Markets | 3.1 | 16.8 |

| S&P GSCI (Commodities) | 4.3 | 16.2 |

| Gold | 0.1 | 24.9 |

| MSCI U.S. REIT Index | -3.9 | 7.7 |

| Barclays Int Govt Credit | -0.2 | 2.5 |

| Barclays US TIPS | -0.4 | 4.9 |

Economic Commentary

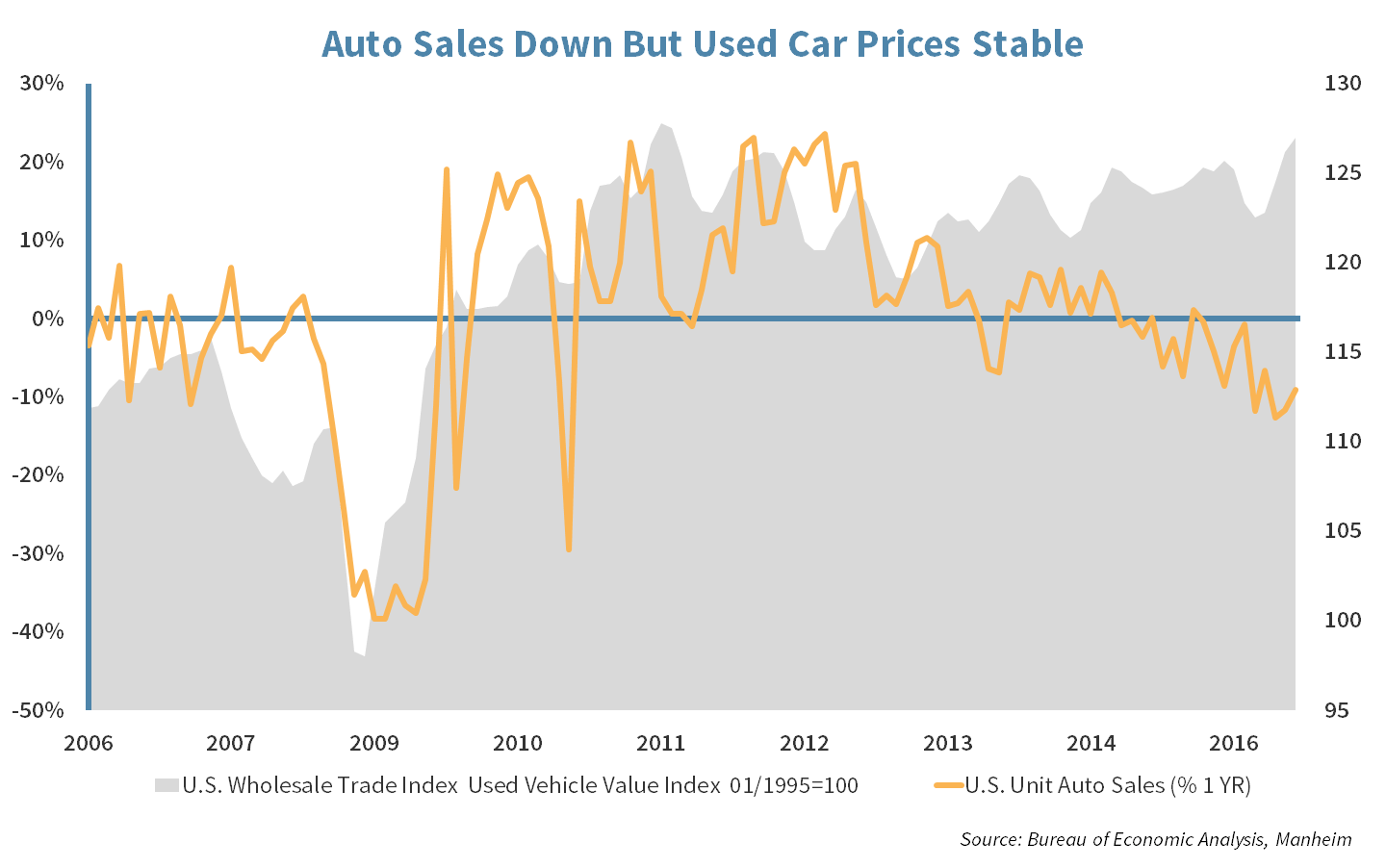

Has the auto cycle peaked?

The auto industry is closely followed by economists as it is viewed as a good leading indicator of overall economic strength. Strong auto sales imply that consumers are gaining confidence and are willing to take out major loans that they would only do if their personal fortunes look bright. When consumers have the confidence to consume, industrial output increases and the economy expands.

The auto sector has had a strong run since 2008, having been driven by low interest rates, low gas prices and a recovering labor force. The industry however is cyclical and is showing signs of turning downwards from a peak with total August vehicle sales reported at 17.2 million units, 4% below the same month last year. As interest rates are expected to increase in the near term, auto sales may face further pressure.

One bright spot for the auto industry has been used car sales which have been strong this year. Consumers are choosing to save money by buying used instead of new vehicles. If used car prices were to fall, this would put more pressure on car manufactures to compete through further technological innovation.

Source: U.S. Bureau of Economic Analysis

Week Ahead

Industrialization

Next week’s release of Europe and China’s industrial production data hang over the market.

- EU Industrial Production is expected to come in at .8% for the 3rd Quarter vs .4% last quarter.

- China Industrial Production is expected to come in at 6% for the 3rd Quarter vs 6% last quarter.

Back to School Sale

On Thursday we will get August Retail Sales data, which will give us a peek at the consumer’s willingness to spend. The numbers have the potential to be boosted by last minute back to school shopping.

Inflation Nation

On Friday we will get the Consumer Purchasing Index (CPI) data. While this is not the Fed’s preferred measure of inflation, it may give them some insight into whether their 2% inflation target is in sight yet. Forecasts however, are for just a 0.2% reading for August.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

It’s alive

After months of low volatility, investors were waiting for some direction in the market. On Friday they got it, reaffirming investors that the market is alive and well. U.S. Equities finished lower this week with REITs and income stocks the worst performers in Friday’s correction. Gold was also lower on Friday but finished in the green for the week.

Sentiment changes

In the short-term the market is very sensitive to the changes in the interest rates. However, the rise in an interest rates is a positive sign because it solidifies the notion that the economy is strong enough to sustain rising rates. For long-term investor, dips like we saw on Friday create opportunities. While we did not see the need to make any changes to asset allocation weighting, we did take advantage of the dip at the individual stock level.

Strategic Growth

Permian Acreage

Consumer Staples, the historically defensive sector, did not offer much protection this week. The Energy sector survived Friday’s melee to hold on to some gains from earlier in the week thanks to some M&A news from…

- EOG Resources, Inc. (EOG), the exploration and production energy company, spent $2.5 billion on acquisitions this week. The company acquired privately held Yates Petroleum and its subsidiaries. EOG will issue 26 million shares to go along with $37 million in cash to pay for the premium drilling locations.

Strategic Equity Income

It’s Spectra-cular

Dividend paying stocks felt the wrath of rising bond yields this Friday. Banks though reacted positively to the same development. In other Strategy news…

- Spectra Energy Corp. (SE), the natural gas distribution company, was acquired by a Canadian rival this week. Enbridge Inc. (ENB) offered $28 billion (all in stock) to acquire the company. While the initial premium was only about 11.5%, the deal has a very low probability of regulatory objection, as the two infrastructure company have little overlap. When the deal closes, Enbridge Inc. will be North America’s largest infrastructure company, with an enterprise value of roughly $127 billion. Early indications call for $415 million of synergy savings, most of which will be realized in 2018.

Elevate Your Trajectory

Don't wait another day to build a successful, secure future with Strategic.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters