Life of the Party

U.S. equities had a big week, breaking through to new highs, as Fed Chairwoman Yellen made it clear to investors that the punch bowl is still in the room.

Market Review

Contributed by Doug Walters

After taking the month of June off, U.S. equities have returned to form in July, with the S&P 500 up around 1.5%. Fed Chairwoman Janet Yellen presented to the House and Senate, painting an economic picture that was received well by investors.

Plenty of Punch in the Bowl

Former Fed Chairman William Martin Jr. in 1955 equated an interest rate increase to “the chaperone who has ordered the punch removed just when the party was really warming up.” In the wake of the 2008 financial crisis, punch alone, was not enough to get the party started. A generous supply of cookies (quantitative easing) was also needed.

This week, Fed Chairwoman Janet Yellen, testified to the House and Senate regarding the state of the “party”. Her message was received well by investors. In the Fed’s opinion, economic growth is on solid ground and employment is full. There are some concerns about a recent dip in inflation, but Yellen assured that this is temporary and that a tight labor market combined with growth will inevitably lead to the wage and price increases needed to drive up inflation.

So, what is the “chaperone’s” plan? With the party gradually gaining momentum, she intends to continue walking the punch bowl toward the exit, albeit very slowly and with lots of warning. Also, while there are plenty of cookies on the table, the supply is likely to be replenished more slowly (see Chart 8 in Uncharted Territory).

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.4 | 9.8 |

| S&P 400 (Mid Cap) | 1.0 | 6.3 |

| Russell 2000 (Small Cap) | 0.9 | 5.3 |

| MSCI EAFE (Developed International) | 2.4 | 13.9 |

| MSCI Emerging Markets | 4.4 | 21.4 |

| S&P GSCI (Commodities) | 2.2 | -6.2 |

| Gold | 1.3 | 6.5 |

| MSCI U.S. REIT Index | 1.3 | 0.5 |

| Barclays Int Govt Credit | 0.4 | 0.9 |

| Barclays US TIPS | 0.5 | -0.1 |

Economic Commentary

Contributed by Doug Walters

Brazil – The Sleeping Giant

Emerging Markets has been one of the better performing equity assets in 2017, with China up around 25% in the first half of the year. That trend has continued in July. However, Brazil has been little help, with the FTSE Brazil Index up only 2% in U.S. dollar terms.

Brazilian President Michel Temer has recently been charged with accepting bribes and is deeply unpopular in Brazil with an approval rating of only 7%. His political party has been able to govern as part of a coalition, but his ability to deliver on much needed national reforms has been limited. Opposition parties have been calling for new elections and his impeachment, adding to the political uncertainty facing Brazil.

The South American government has a spending problem that may be crowding out private sector investments. The ratio of government spending to Gross Domestic Product is 36% and is one of the highest amongst comparable developing nations.

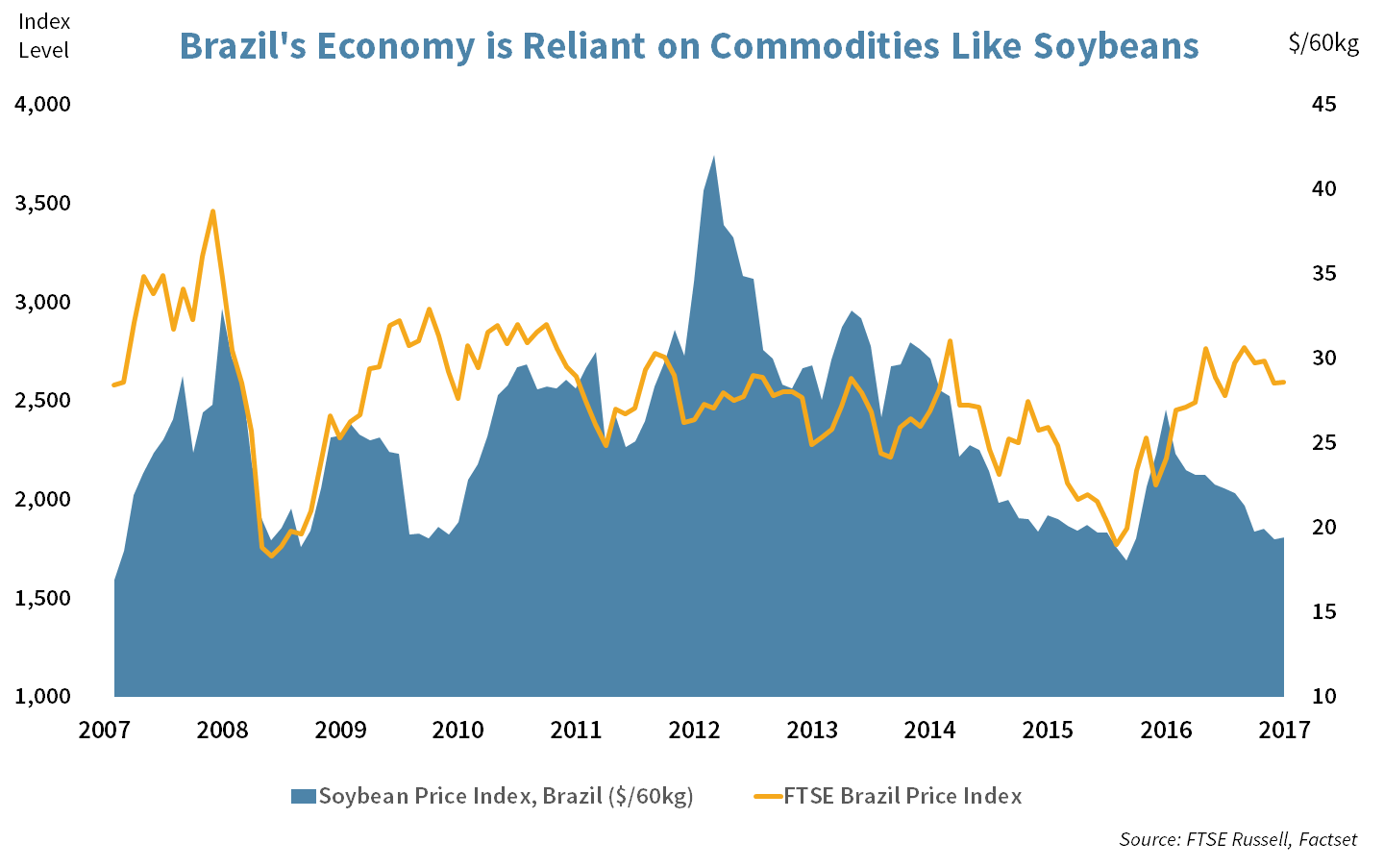

On the positive side, the country has an abundant amount of natural resources with an educated and growing middle class. Brazil has become a major player in commodities over the past decade as it supplies the world with coffee, soybeans, corn, sugar, crude oil and orange juice. Prices of these commodities have been low in oversupplied markets, but long-term demand for food such as soybeans is steadfast. As global populations grow, and with-it consumption, we can expect these commodity prices to rise over the long run, which would be a tailwind for the Brazilian economy.

As 7% of the iShares Core MSCI Emerging Markets ETF (IEMG), Brazil may be a sleeping giant within our Emerging Markets exposure. The question is, will it wake up?

As 7% of the iShares Core MSCI Emerging Markets ETF (IEMG), Brazil may be a sleeping giant within our Emerging Markets exposure. The question is, will it wake up?

The ratio of South American government spending to Gross Domestic Product. Source: FactSet

Week Ahead

THE BEAT Goes On

Technology earnings will begin to roll out next week with Strategic holdings QUALCOMM (QCOM), Skyworks (SWKS) and Microsoft (MSFT) due to report.

- Investors will be looking for more details from Qualcomm about its patent infringement case against Apple and the status of the acquisition of Strategic holding NXP Semiconductors (NXPI).

Housing data out next week includes…

- Housing Starts, which are expected to grow by 5.3%, with 1,150,000 houses started in June.

- Building Permits are expected to grow by over 3% during the same period.

Exports data will be released on Tuesday, with consensus for exports to remain flat in June.

- This would be an improvement over the prior month exports declined by 0.7%

Banks report earnings next week. Wednesday our focus will be on U.S. Bancorp (USB) and M&T Bank (MTB), while BB&T Corporation (BBT) and Bank of New York Mellon (BK) will report on Thursday.

- After a strong move post stress test and capital returns, will solid results be enough to continue the move higher by banks?

EIA crude oil inventories in the U.S. are closely watched as supply remains at elevated levels.

- Analysts expect the summer driving season to reduce inventories, but U.S. production continues to rise.

Asset manager BlackRock (BLK) will report its earnings first thing on Monday. Analysts expect earnings to grow nearly 13% as equity and bond markets continue to move higher.

- BlackRock’s CEO Larry Fink’s commentary on the asset management space is highly anticipated. Will Fink take the route of JP Morgan’s Dimon and comment on the political environment?

Transport companies C.H. Robinson (CHRW) and Union Pacific (UNP) report earnings on Thursday morning.

- Goods transportation serves as a reliable indicator of overall economic activity

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Big Tech Emerging

The iShares Core MSCI Emerging Markets ETF (IEMG) had its best week of the year, finishing up nearly 5%. It is no surprise, as emerging markets are sensitive to U.S. monetary policy and have benefited from a weaker dollar and somewhat higher commodity prices. However, technology stocks within IEMG have emerged to become the major driver of performance this year.

- Technology accounts for about 25% of the fund allocation.

- Year-to-date performance of the top four in U.S. dollars has been impressive: Samsung (005930) up 50%, Tencent (700) up 49%, Taiwan Semiconductor (2330) up 28%, and Alibaba (BABA) up 73%

- These stocks are responsible for over 6% of the nearly 24% return this year of IEMG.

Steady as She Goes

Chairwoman Yellen’s congressional testimony has reassured markets that future rate hikes will continue to be slow and gradual. She also reiterated that the inflation target is the major driver of the Federal Reserve’s policy making decision. Bond markets responded with a small move higher.

- On Friday, bond markets got another boost from weaker than expected retail sales and a soft inflation reading.

STRATEGIC GROWTH

Best Practice

The Energy sector was a leader as crude prices moved up above $46 per barrel and natural gas bounced up to $3 per thousand BTUs. Consumer Discretionary was the laggard. In other strategy news…

- Late last week, news broke that UnitedHealth Group (UNH) was very near to acquiring Advisory Board Company (ABCO), whose market cap is roughly $2.3 Billion. ABCO is a consulting firm that uses research and technology to help improve the performance of health care and education companies. UnitedHealth plans to partner with private equity firm Vista Equity Partners and take the health care part of the company, while Vista takes on the education consulting unit. If successful, UNH would add another business that is outside of its core health insurance business.

STRATEGIC EQUITY INCOME

Sounding Off

The Technology sector was the leader this week and Discretionary the laggard. The kickoff of 2nd Quarter earnings this week included…

- PepsiCo (PEP) handily beat consensus, thanks to organic growth of 3.1% in the quarter.

- Fastenal Co. (FAST) topped analyst expectations. Getting down to the nuts and bolts: 10.6% sales growth from a year ago and the addition of 51 national account contracts, contributed to the beat.

- JPMorgan Chase & Co.’s (JPM) 2nd quarter results topped expectations, but interest income outlook was revised lower. The actual earnings release took a back seat to the CEO’s comments on the call about political dysfunction. Hear Dimon’s comments below. Warning: clip contains strong language

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters