Investing in Chaos

Politics once again moved markets this week with the S&P 500 falling almost 2% on Wednesday. We discuss how we approach investing in a political environment that increasingly feels more like Hollywood than Washington.

Market Review

Contributed by Doug Walters

U.S. equities took a nosedive on Wednesday and bonds rallied as the ever-mounting chaos in Washington reached a fever pitch. The political mayhem brought equity volatility back to life at least temporarily (see last week’s economics section). But as we have repeatedly seen in this rally, the market was quick to shake off the negative headlines.

Ignorance is Bliss

We will forgive you if you have had your head in the sand to avoid the latest episode of the Washington soap opera. If you missed it, here are the highlights:

- A memo from the recently fired FBI Director James Comey was leaked, which hinted that Trump had tried to convince Comey to close down the investigation into former national security advisor Michael Flynn who himself was fired for receiving improper payments from foreign governments as well discussing sanctions with Russia;

- Deputy Attorney General Rob Rosenstein, whose letter was used as justification by Trump in the Comey firing, announced the appointment of former FBI Director Robert Mueller as special counsel to investigate Russian interference in the U.S. presidential election.

Sometimes real life is stranger than fiction. Equity markets reacted negatively to these developments initially, but as investors should we worry about any of this?

An Apolitical Market

Sometimes we are guilty of talking about “the market” as if it is an emotional sentient being. The reality is that U.S. equity markets are simply a composite reflection of investor sentiment. “The market” does not care about politics. It has no political affiliation. All that matters to the market is what investors believe future corporate cash flows are going to be and how certain they are in those predictions.

- In weeks like this, we see significant market moves on political news. The explanation is simple. The current administration came in with big promises of lower corporate taxes, reduced regulation and higher infrastructure spending. All of these promises point toward higher corporate cash flows. When any news comes out of Washington that makes those corporate-friendly policies less likely to be implemented, the shares will react negatively.

- How do we invest in a politically charged market such as this? No differently than we would any other market. We look for the best quality investments at the best value and diversify. We cannot control politics, but we can control portfolio construction.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.4 | 6.4 |

| S&P 400 (Mid Cap) | -0.4 | 3.1 |

| Russell 2000 (Small Cap) | -1.1 | 0.8 |

| MSCI EAFE (Developed International) | 0.8 | 11.8 |

| MSCI Emerging Markets | -0.7 | 15.5 |

| S&P GSCI (Commodities) | 3.0 | -1.8 |

| Gold | 2.2 | 8.9 |

| MSCI U.S. REIT Index | 1.1 | -0.8 |

| Barclays Int Govt Credit | 0.4 | 1.1 |

| Barclays US TIPS | 0.7 | 1.3 |

Economic Commentary

Sky High Inventories

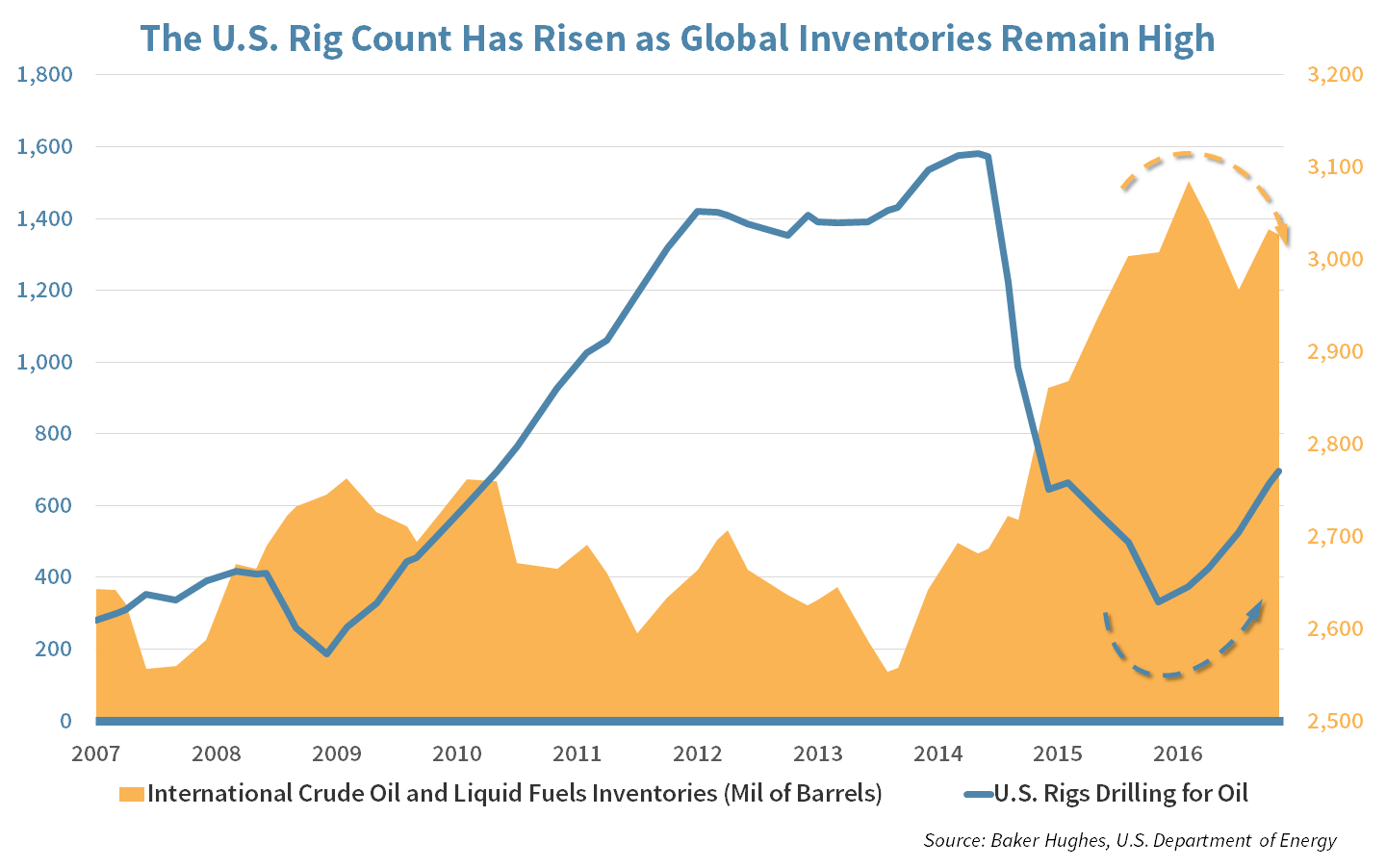

The price of oil ticked upwards this week as the two biggest oil producers, Saudi Arabia and Russia, announced they would like to extend their production cuts from the end of this year to March of 2018. The Organization of the Petroleum Exporting Countries will meet next week and is expected to maintain its decision to reduce production by one million barrels a day which will help balance an oversupplied oil market. That said, any price rally would be tapered by sky-high inventories and a rising U.S. oil rig count which will lead to rising production.

The ability of U.S. producers to ramp up production in a $50 oil environment has left many commodity investors wondering if OPEC’s control over the market has waned. Saudi Arabia’s energy minister Khalid al-Falih said on Monday, “we’re not where we want to be” regarding the high inventory count. The question for investors is whether further OPEC cuts will lead to a price rally or simply be filled in by U.S. producers unconstrained by any production quotas. Inventory levels, gasoline demand and time, will give us the answer.

Week in Review

ONWARD and Upward

Oil prices have been very volatile as OPEC members are getting ready to meet on May 29th.

- Any comments from OPEC members before the meeting have the potential to be oil price sensitive.

New home sales are expected to slow in April to 606,000 homes from 621,000 new homes sold in March.

William-Sonoma (WSM) is scheduled to report their earnings on Wednesday. The decline in mall traffic has made it challenging for the company to grow their sales.

- Analysts are expecting $0.49 cents in earnings per share with $1.1 billion in sales.

- Shares in William-Sonoma’s furniture peers like Restoration Hardware (RH) and Wayfair (W) have nearly doubled year-to-date (RH 88%, W 78%).

Advances in Markit PMI, which tracks services and manufacturing growth, is expected to remain stable in May. With unemployment at its lowest levels in over a decade, even slight improvements in growth can cause further labor tightening.

The Retail sector has been under pressure from Amazon (AMZN), but the grocery business has been somewhat immune. Costco (COST) is expected to report $1.31 EPS with $28.5 billion in sales for their third quarter.

- The expectation implies nearly 9% growth in earnings and sales comparing to last year’s 3rd quarter.

Dollar Tree (DLTR) will report their earnings on May 25th. A shift in consumer spending towards discount stores could give the company’s sales a boost.

Strategy Updates

Contributed by , Doug Walters

STRATEGIC ASSET ALLOCATION

Licking Wounds

The U.S. Dollar is licking wounds after declining for a third straight month against the basket of major currencies tracked by the ICE US Dollar Index (DXY). The economic improvements in Europe and Emerging Markets have fueled strength in their currencies. Also, the political risk to the Euro has declined with the election of President Emmanuel Macron in France, who is pro-E.U. And finally, Greece has agreed to an additional round of austerity, which should help to secure additional lending from the IMF.

- DXY is down nearly 5% year-to-date.

- In the short term, the weaker dollar has helped lead to the relative outperformance (in U.S. dollars) of international index funds.

- In the medium term, dollar weakness makes U.S. exports cheaper abroad which can boost U.S. manufacturing and U.S. exports.

STRATEGIC GROWTH

Generic Commentary

Consumer Discretionary stocks like Carters (CRI) continue to get dragged down on general retailing concerns. Meanwhile, Healthcare got a boost this week from…

- McKesson (MCK) reported Q4 earnings which beat expectations, but it was the commentary around generic drug pricing that got the stock moving up. The pharmaceutical distributor has been facing challenging pricing pressure in recent quarters in its core business. Thursday’s results indicate that the worst may be behind them.

STRATEGIC EQUITY INCOME

Network Error

Takeover talk surrounding Colgate (CL) and surprisingly good results from Deere (DE) helped push Consumer Staples and Industrials towards the top of the pack this week. Technology took a breather and received no help from…

- Cisco Systems (CSCO), the internet networking hardware giant, reported disappointing guidance in their Q3 results, blaming headwinds from their exposure to government spend and heightened competitive pressures. We see Cisco as a quality name in the Tech space with exposure to the secular growth of cyber security and robust cash flow supporting an attractive dividend. The weakness could prove a good entry point for long-term, patient investors.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters