Investing in the Age of Disruption

Heading into the Father’s Day weekend, equities were flat on the week. Yet we were reminded that the world is changing at a breakneck pace, with disruption running rampant. Future fathers will have more fodder than ever for, “when I was your age” stories.

Market Review

Contributed by Doug Walters

U.S. equities remained largely range bound, despite a week of big headlines. The Federal Reserve’s talk of reducing its balance sheet and Amazon’s foray into grocery, kept Wall Street on its toes, while the shooting in Virginia, provided a somber opportunity for Washington to show much-needed unity.

Not Your Father’s Grocery Store

It seems nary a week passes that Amazon does not announce a new industry that it is preparing to disrupt. Recently we have heard plans to expand into private label clothing and pharmacy. Each of these announcements had an impact on competitor share prices, but none so much as Friday’s announcement that they are jumping feet-first into grocery with an acquisition of Whole Foods. The ramifications were immediate, with shares in some grocery peers falling more than 10%.

We live in a remarkable period of disruption, which is a challenging environment for investors. Traditional and profitable industries are being dismantled overnight by nimble tech-savvy competitors. Amazon is just one example. We also see it in automotive where Tesla, Apple, and Google are all threatening the traditional business model. “Blockchain” is another example. This technology (which is used to enable Bitcoin) is being implemented elsewhere in the financial services industry and has the potential to make entire segments of the services market redundant.

Valuations of these disruptors are often very expensive, and in many cases prohibitively so in our view. Given the influence of some of the larger disruptors like Amazon, investors are questioning if ownership at high valuations is necessary as an “insurance policy” for their other holdings which may be at risk of the next unforeseen disruption.

Five O’clock Shadow

Amazon’s news overshadowed the Federal Reserve’s rate hike and balance sheet news. We discuss that in more detail in our Economics section.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.1 | 8.7 |

| S&P 400 (Mid Cap) | -0.2 | 5.6 |

| Russell 2000 (Small Cap) | -1.1 | 3.7 |

| MSCI EAFE (Developed International) | 0.0 | 12.4 |

| MSCI Emerging Markets | -1.5 | 16.3 |

| S&P GSCI (Commodities) | -1.5 | -8.5 |

| Gold | -1.0 | 8.9 |

| MSCI U.S. REIT Index | 1.3 | 2.1 |

| Barclays Int Govt Credit | 0.2 | 1.2 |

| Barclays US TIPS | -0.4 | 0.5 |

Economic Commentary

Time to Unwind

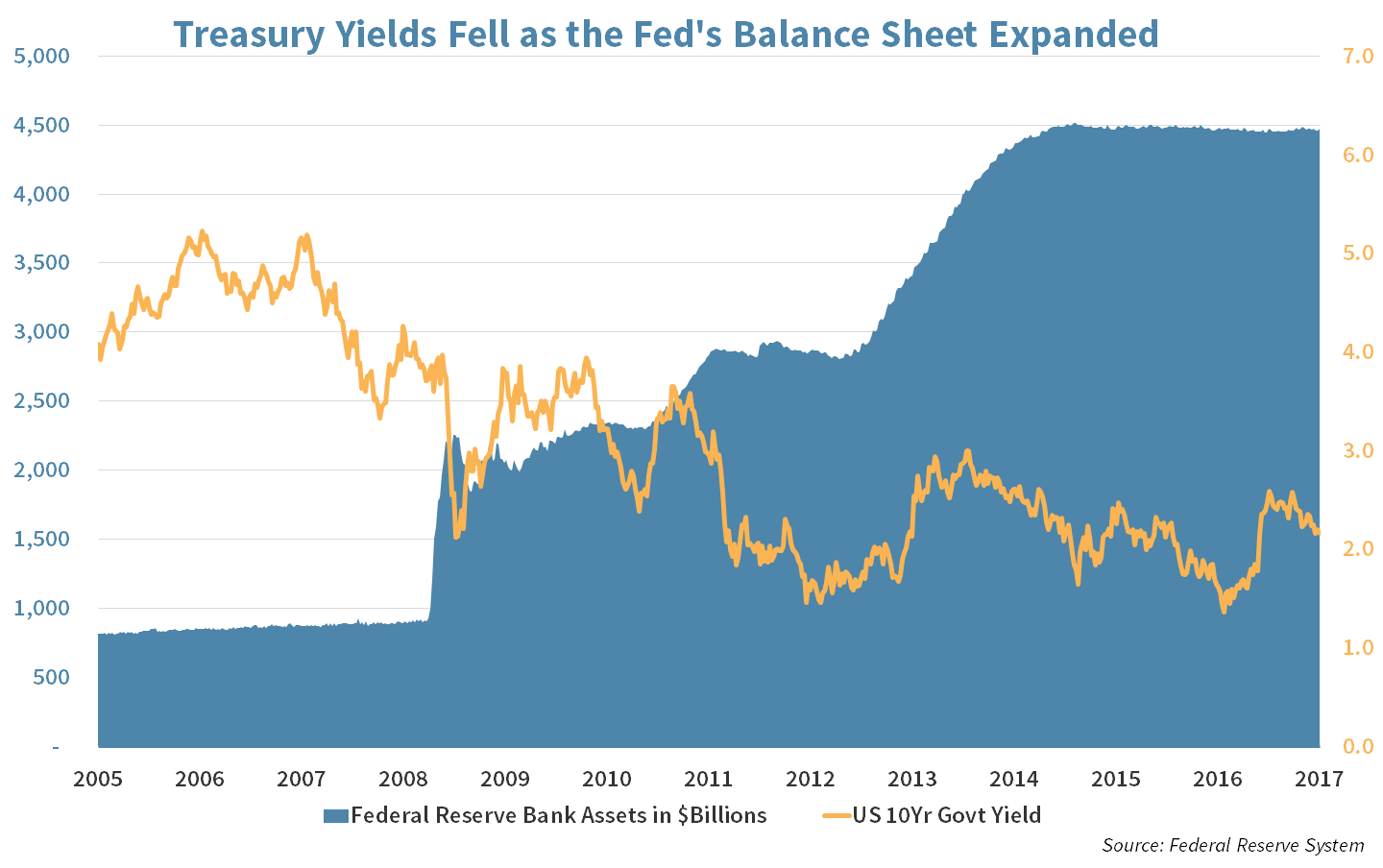

The Federal Reserve raised interest rates this week and spoke of a plan to reduce their $4.5 trillion balance sheet “relatively soon.” The consensus now is for them to start unwinding their positions in September or October this year. In fact, they stopped adding to their holdings in 2015 but continue to reinvest the proceeds of maturing assets to maintain the $4.5 trillion balance sheet. Now they want to start letting the proceeds expire without reinvesting them.

Details of the Federal Reserve’s plans include allowing up to $10 billion of Treasury and Mortgage bonds to mature without reinvestment every month. They will then gradually allow a maximum of $30 billion a month of Treasury bonds and $20 billion of mortgage-backed bonds to expire every month, which would tighten the money supply.

Allowing these securities to mature without reinvestment can cause long-term interest rates to rise. Increasing interest rates helps to reduce inflation, and Fed Chairwoman Yellen mentioned officials are “monitoring inflation developments closely” as they project inflation this year to be 1.6%. This is down from a previous 1.9% projection, but the Central Bank still expects it to hit 2% by the end of next year.

Yellen will most likely accelerate or decelerate the unwinding of the Fed balance sheet based on inflation levels. Her concern is that too much money circulated in the economy will lead to inflation. But with low oil prices, flat wages, falling wireless telephone plans and low food prices, inflation has yet to materialize.

Week Ahead

Contributed by Max Berkovich

Busting Dad’s CHOPS

China’s stock market may receive a boost next week when index provider MSCI Inc. makes a decision on whether to include A-Shares (stocks that are listed on domestic exchanges in Shanghai and Shenzhen) in its global indices.

- Currently, MSCI indices use shares listed in Hong Kong or other developed markets as holdings in its indices.

- MSCI has three times declined to include the A-Shares in the past, but this time may be different as China has been moving to meet the index provider’s criteria for inclusion.

- This is important. If approved, it will increase the allocation that the emerging market index currently attributes to China.

- There are $1.5 Trillion dollars benchmarked to the MSCI Emerging Market Index.

Housing data will be released next week including Existing Home Sales & Housing Price Index.

- Economists are expecting sales to decline but prices to move slightly higher.

Oracle Corp. (ORCL) reports earnings for the fiscal 4th Quarter of 2017 on Wednesday.

- The non-traditional reporting period allows Oracle to be the first Tech company to provide a view into cloud computing sales.

- Investor focus will continue to be on the company’s success in converting to cloud-based services to compensate for declines in its “on-premise” license business model.

Purchasing Managers Index is due out next week.

- The index is a measure of optimism of managers that make spending decisions.

Speeches from the Federal Reserve Regional Presidents pick up again next week after a silent period after its monthly meeting. Prominent members Dudley (New York), Evans (Chicago) and Kaplan (Dallas) will be making the rounds.

- After a rate hike from the Central Bank, the focus will turn to the Federal Reserve’s Balance Sheet (see our Economics section above) and how the balance sheet reduction may occur.

Strategy Updates

Contributed by Max Berkovich

STRATEGIC ASSET ALLOCATION

Keeping it Real

Real Estate has received a notable bump from lower interest rates this week. Our exposure to the asset class is through the Vanguard REIT ETF (VNQ). We halved our exposure earlier in the year, as we expect retail headwinds to persist and higher interest rates as the Federal Reserve raises rates.

- While we were right on both assumptions, it failed to play out as planned.

- Retail REITs are down 14.7% on average but are only 22% of the holdings of VNQ

- And short rates are higher on the year, with the 10 Year U.S. Treasury reaching a 2017 low yield of 2.12% this week.

- Our reasoning behind the trim has not changed and our outlook for the asset class remains negative, with our position under review.

Real Deal

With short-term interest rates higher (see our Economics section above), the 2 year U.S. Treasury is now at 1.30% yield. The space is beginning to look more appealing, especially as the reward for extending your maturity out ten years now only adds 0.80% of yield.

- If the Federal Reserve continues to raise rates and starts to reduce its balance sheet, the longer-term interest rates should move higher.

- With less reward and increased future risk, staying short now looks more attractive than in the past.

STRATEGIC GROWTH

Call it a Victory for PAH

Consumer sectors were laggards thanks to a transformative acquisition in the consumer space (see Market Review above), while the Energy sector flipped from last to first this week on the heels of a jump in natural gas prices in response to smaller inventory versus forecasts. In other news…

- Johnson & Johnson (JNJ), the health care behemoth, got a little bigger this week as it completed its acquisition of Swiss pharmaceutical company Actelion Ltd. For $30 Billion dollars. The deal in itself is big, but in the context of JNJ’s $362 Billion market capitalization, it is modest. Actelion specializes in rare disease. In particular, the company has a strong pulmonary arterial hypertension (PAH) franchise. With Johnson & Johnson’s resources and distribution, Actelion’s medicine is expected to reach more patients.

STRATEGIC EQUITY INCOME

New Generals

Consumer Staples experienced a major shake-up in the aftermath of the previously-mentioned M&A, with pharmacies and consumer goods all now facing disruption. Despite another stellar week from Utilities, Industrials ended up as the top sector on the week thanks to a leadership change at…

General Electric Co. (GE) replaced its Chairman & CEO, as Jeff Immelt ends his 16-year reign. His replacement will be John Flannery, previously the leader of GE Healthcare. The domino effect of leadership changes followed as Kieran Murphy replaced him at GE Healthcare. The new boss will have an integration of the Baker Hughes (BHI) acquisition to contend with and a reported $31 Billion of unfunded pension liabilities. Immelt’s 16 years at the top witnessed a 38% value drop in the stock. Thus a change at the top is well-received by investors.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters