Inauguration of Uncertainty

The peaceful transfer of power is now complete and investors hope this will bring clarity on the direction of the new administration. However, given the relative unpredictability of the President, we expect uncertainty to remain a theme throughout the year.

Market Review

Contributed by Doug Walters

U.S. equity markets were down slightly this week as the market struggled to hang on to early gains Friday. With the presidential inauguration dominating the airwaves, it would be easy to forget that the corporate earnings season has begun.

Peaceful transfer

The inauguration of our 45th president is now in the books and the stock market continues to take a relaxed attitude toward the transfer. This is somewhat surprising.

- The stock market dislikes risk and uncertainty. With big changes expected from the new administration, but little known about specifics, one would expect investors to proceed with caution.

- High expectations are built into valuations, but we believe our focus on quality and value, combined with diversification, is positioned well to take advantage of any short-term pull-backs if investors lose their nerve.

Corporate earnings season kicked off in earnest. Traditionally, Financials are the first to report, and about a third of them have done so thus far. What is most notable is the lack of conviction in guidance, with management forced to wait and see what the new administration has in store for their sector.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.1 | 1.5 |

| S&P 400 (Mid Cap) | -0.8 | 0.8 |

| Russell 2000 (Small Cap) | -1.6 | -0.5 |

| MSCI EAFE (Developed International) | -0.9 | 1.7 |

| MSCI Emerging Markets | -0.2 | 3.7 |

| S&P GSCI (Commodities) | -1.2 | -0.8 |

| Gold | 0.8 | 5.0 |

| MSCI U.S. REIT Index | 0.6 | 0.7 |

| Barclays Int Govt Credit | -0.2 | 0.0 |

| Barclays US TIPS | -0.2 | 0.5 |

Economic Commentary

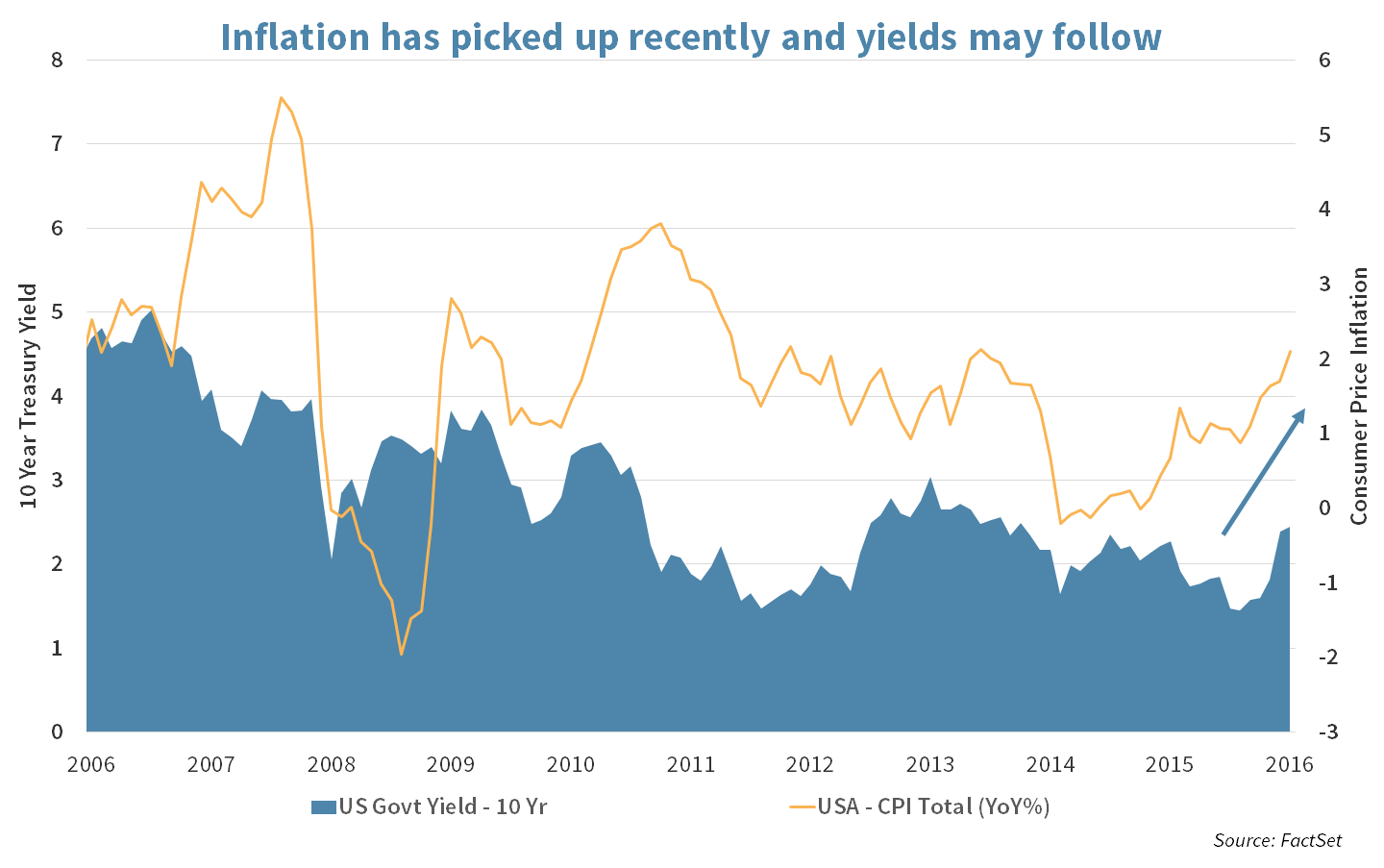

Inflation passes an inflection point

President Donald Trump is inheriting a recovering economy that is now showing signs of rising inflation. The consumer price index (CPI) showed overall prices rose by 2.1% in December from the year before, the most since June of 2014. Gasoline prices rose by 9.1%, medical care supplies by 4.7% and educational books by 5.5%, while used car prices dropped by 3.5% and public transportation by 2.3%.

Rising prices could increase the likelihood of the Federal Reserve raising rates multiple times this year, as evidenced by the 10-year Treasury yield rising. Chairwoman Janet Yellen said in a speech this Wednesday, “It’s fair to say the economy is near maximum employment and inflation is moving toward our goal.”

A strengthening dollar is one factor keeping prices in check. As the value of the dollar increases, goods priced in dollars tend to decrease. The incoming President said last week that he would like to see a weaker dollar but the value of the USD increases when interest rates rise as foreign money is redeposited in dollars. A stronger dollar makes U.S. exports more expensive which could hurt the US manufacturing sector that is operating only at 74.8% of capacity.

Week Ahead

50-50

The UK Supreme Court will decide if the government can submit Article 50 without Parliament’s approval. If the Supreme Court rules against Prime Minister May, this will give Parliament a chance to block Brexit.

- Many members of Parliament have hinted they may vote against Brexit, which may considerably delay the UK’s departure from the European Union.

Tech attack

The Technology sector will headline 4th quarter earnings, with Industrial and Consumer Staples companies adding to the mix.

- Notable Tech companies from our strategies to report are Microsoft Corp. (MSFT), Intel Corp. (INTC), Qualcomm Inc. (QCOM) and Alphabet Inc. (parent of Google) (GOOG).

First look

Preliminary Gross Domestic Product (GDP) results for the 4th quarter will wrap up the week. Economists are expecting 2.2% growth vs. 3rd quarter GDP of 3.5%.

- The expectation is well up on 4th quarter 2015 GDP growth, which was 0.87%.

Strategy Updates

Contributed by , Max Berkovich

STRATEGIC ASSET ALLOCATION

Small caps, big moves

Small caps gave up a little ground this week after rising nearly 20% since November. Last year, investors rushed to buy any stock that might benefit from the new administration’s policies such as corporate tax cuts, reduced regulation, foreign profit repatriation and higher taxes on imports.

- Domestic small caps do not have significant international exposure and thus may perform best during protectionist economic policies as prices for domestic goods become more competitive against imports.

Resume takeoff

As we discussed in the Economics section, interest rates have resumed their ascent this week after the Federal Reserve signaled a stronger case for rate hikes this year.

- The 10-year yield has jumped from 1.87% to near 2.5% since election day as investors are expecting stronger growth and higher inflation, on the back of increased fiscal stimulus.

STRATEGIC GROWTH

Ubiquitous connectivity

Consumer Staples finished as the top sector this week, but Technology made a strong push on Friday. Speaking of Technology…

- Skyworks Solutions Inc. (SWKS), a computer chip maker, reported slight beats on both top and bottom line. Most importantly growth returned to the company before release of the next version of an iPhone. The CEO attributed the success to continued demand for internet of things (IoT) and ubiquitous mobile connectivity.

- We exited a position in an asset manager this past week. The company was a core holding for over a decade for us, but we think growth for the company is in the rear-view mirror now.

STRATEGIC EQUITY INCOME

Mellon-choly

The Industrial sector rose to the top this week, just inching out Consumer Discretionary. Financials lagged this week as earnings reports failed to flame a further rally for the banks. Speaking of earnings and banks…

- The Bank of New York Mellon Corp.’s (BK) 4th quarter earnings were in-line with expectations. The custody bank reported that assets under management declined by 3.9% and assets under custody declined by 2% for the quarter. Cost reductions and interest income gains were offset by a strong dollar.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters