A Case of He Said, He Said

Equities gave back some ground this week, though their performance looks commendable given the challenging backdrop of Comey’s testimony, another surprise election result in Britain, and heightened tensions in the Middle East.

Market Review

Contributed by Doug Walters

Equity markets weathered another challenging news cycle, with big headlines at home and abroad failing to have a significant impact on stocks. Yet some cracks appeared. The S&P 500 ended the week down 0.3%, with Technology selling off into the close, while bond yields rose.

Lordy Me

The big spectacle domestically this week was former FBI Director James Comey’s congressional testimony. Despite some damning claims that the President lied and made inappropriate requests of Comey, the market reaction was subdued. It is Comey’s word versus the President’s, and, in the absence of “tapes” (Lordy!), we see no near-term conclusion to this episode. For now, equities are content to focus on improving economic fundamentals and hope for corporate-friendly policies.

Mayday!

British Prime Minister Theresa May is likely regretting her decision to call a snap election to consolidate her Brexit support. Rather than improving her bargaining power, she lost the outright majority that her Conservative Party had enjoyed. She should still be able to form a government but in a weakened position. The result may be a more gradual British exit from the European Union, which is likely to be perceived positively by companies and investors.

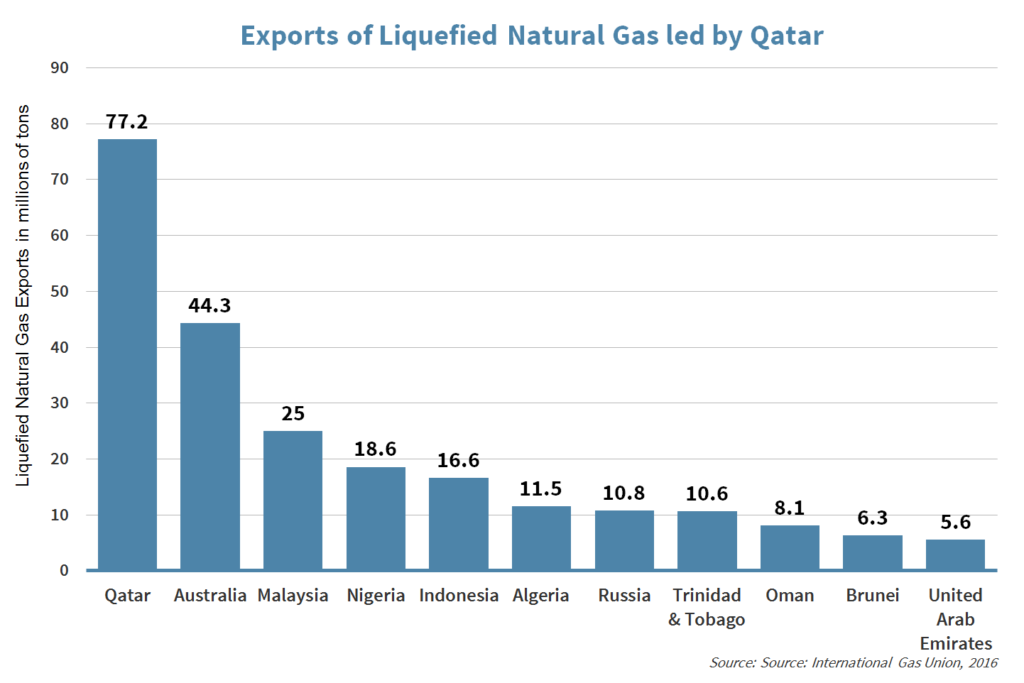

Elsewhere abroad, the peninsula country of Qatar, became more like an island, as many of its neighbors cut diplomatic ties and instituted sanctions. From a markets perspective, there could be implications for commodities like liquefied natural gas (see our Economics section).

Economic Commentary

Qatar, an LNG Game Changer

Saudia Arabia, Bahrain, Yemen, the United Arab Emirates and Egypt cut off diplomatic relations with the small natural gas-rich country of Qatar, which has the highest per capita income in the world and the third largest gas reserves. Qatar’s total population is 2.6 million with only 313 thousand local citizens and 2.3 million expatriates. The small country has over the past decade gained outsized regional power through funding of political movements and control of the regional news company Al Jazeera.

For years, Qatar has been known to support Islamist groups including the Muslim Brotherhood, Hamas and Al-Nusra Front. Their backing of Al-Nusra Front is especially worrisome to their neighbors, as the terrorist group is affiliated with Al-Qaeda and is a force within the Syrian civil war. While the support and backdoor financing of terrorist groups set the backdrop for Qatar’s neighbors to abandon relations, it appears that hackers and fake news were the final catalysts.

There are rumors now in the Middle East that the diplomatic cut off could be a preliminary move towards military action. Qatar hosts the largest U.S. military base in the Middle East with 11,000 personnel and has security guarantees. If the United States government drops the security protection, the tiny country could be swiftly invaded by its neighbors in the same way Kuwait was invaded by Iraq.

A Qatari war would be a game changer for certain commodity prices. Qatar only produces 0.5% of the world’s oil and 3% of worldwide natural gas, but they dominate the Liquefied Natural Gas (LNG) market where gas is liquefied and shipped by sea. If Qatari LNG shipments were disrupted, that would be a major game changer to the LNG and global natural gas markets. Chinese, Japanese, Indian and South Korean customers that purchase and re-gasify the liquefied natural gas would pay higher prices for the product while LNG shipping competitors would benefit.

Week Ahead

It’s CRUNCH time!

Consumer Price Index reading from several countries including the U.S., Great Britain, Germany, and France is out next week.

- The index reading is an important measure of inflation.

- With years of stimulus from Central Banks, investors are closely watching for any signs of rising inflation.

Retail sales are expected to show growth of just 0.10% in May. Economists are expecting growth of around 4% for the full year. Much of this growth is contributed by e-commerce, which is expected to increase by 14% this year. However, brick-and-mortar stores are expected to be flat or even negative, as many department stores are closing doors.

U.S. Fed is widely expected to increase the Federal Funds rates for a second time this year by 0.25% Wednesday. The rate decision will be followed by Chairwoman Janet Yellen’s press conference and the Central Bank’s economic forecasts.

NY Fed Survey of Consumers will be presented by NY Fed Governor Jerome Powell. According to Reuters, Mr. Powell has remained a centrist on interest rates. Therefore any Dovish language could move the market.

Core Inflation growth for May is expected to remain around 1.9%. The estimates will be released before the FOMC Fed rate decision, and most likely will not influence the decision makers.

Housing Starts and Building Permits are out. Housing Starts are expected to grow by 3.7% in May to 1.225 million houses vs. previous month growth of -2.6%, while building permits are expected to show 1.25 million authorized permits for new housing units.

- The estimates are often a leading indicator as they show builder’s level of confidence in the U.S. economy.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

On the Move

Small capitalization stocks are finally making a move, after sitting on the bench for the first half of the year. The iShares Russell 2000 ETF (IWM), which tracks the MSCI USA Small Capitalization Index, is up nearly 5.4%. Over one-third of IWM’s market value is allocated to the Financial and Technology sectors, which explains some of the deviation from larger capitalization indices.

The Fear of No Fear

The CBOE Volatility Index, also known as the “VIX” or the “fear gauge”, reached its lowest levels since 1993 this week, before climbing toward week’s end.

- The “fear gauge” is not used to predict the direction of financial markets, but to measure the magnitude of expected asset prices moves.

- The low reading indicates complacency from investors and lack of fear in significant moves higher or lower (see our recent Economic Commentary).

STRATEGIC GROWTH

Dollar Versus Dollar

Crude did move lower all week, but the Energy sector still managed to bounce back. Consumer Discretionary was the laggard on the week with one company being the culprit…

- Dollar Tree, Inc. (DLTR) the discount retailer focusing on the $1 price point was sued by former rival Dollar Express. The Express is accusing the Tree of driving it out of business. The Tree was required to sell stores to receive approval for the acquisition of Family Dollar. Express claims it purchased those properties, only to have the Tree use confidential information to open new stores in proximate locations to drive the Express out of business. Dollar Express eventually did file for bankruptcy, and damages that are being sought from the Tree are in the $500 Million range. The Tree counter-sued, claiming the Express had withheld payments and took extra funds from the Tree. The legal drama is an unwelcome development.

STRATEGIC EQUITY INCOME

Oncor Will Not Occur

Utilities were a laggard as interest rates moved higher this week. Financials, on the other hand, caught fire. A return to the old playbook was responsible. Post the Comey testimony, markets jumped aboard the stronger economy, higher interest rates, and lower regulatory burden to push banks in particular higher…

- NextEra Energy Corp. (NEE) owner of Florida Power & Light and the world’s largest generator of renewable energy has been tied up in a long battle to acquire the bankrupt Oncor Energy in Texas for $18 Billion.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters