Growth and Value – Mind the Gap

U.S. equities put in a positive performance (barely), while oil continued its downward slide. Disruption remains a theme this week, with the gap between Growth and Value opening wider. Investors should not chase this trend.

Market Review

Contributed by Doug Walters

After a big increase on Monday, the S&P 500 only barely managed to hang on to positive gains. Oil weakness continued, with the commodity now down about 17% over the past month. Last week’s discussion about disruption (see Investing in the Age of Disruption) is playing out in real time in the oil industry. Meanwhile, Growth stocks continue to outpace their Value peers this year.

Disruption Reprise

The slide in oil prices is multifaceted. The use of alternative energy sources, combined with the growth of hybrid and electric vehicles is all chipping away at demand growth. That is and should be a long-term concern for oil companies. However, the more relevant near-term disruption in the sector has been excess supply, where the U.S. has played a major role as an increasingly competitive swing producer. We discuss this in more detail in our Economics section below.

Last week we talked about how disruption is impacting individual stocks, but we also see it at the macro level. This week, Growth stocks outpaced Value by about 1.5%. That’s a big number for just one week. Year-to-date, the gap is even more impressive. The Russell 1000 Growth Index is up over 15%, while its counterpart, the Russell 1000 Value Index is up only about 4%. Some of this is due to Energy, which is weak and has very little presence in the Growth Index. But more has been driven by the disruption “winners” in the Tech space. It may be tempting to chase the momentum in Growth, but we remind investors that over the long-term, Value has tended to outperform Growth. Rather than putting all of your eggs in the Growth basket, our preference is a more balanced approach.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.2 | 8.9 |

| S&P 400 (Mid Cap) | -0.5 | 5.0 |

| Russell 2000 (Small Cap) | 0.6 | 4.2 |

| MSCI EAFE (Developed International) | -0.2 | 12.2 |

| MSCI Emerging Markets | 0.9 | 17.3 |

| S&P GSCI (Commodities) | -2.8 | -11.2 |

| Gold | 0.1 | 9.0 |

| MSCI U.S. REIT Index | 0.0 | 2.1 |

| Barclays Int Govt Credit | 0.0 | 1.2 |

| Barclays US TIPS | 0.6 | 1.0 |

Economic Commentary

An Oversupplied Market

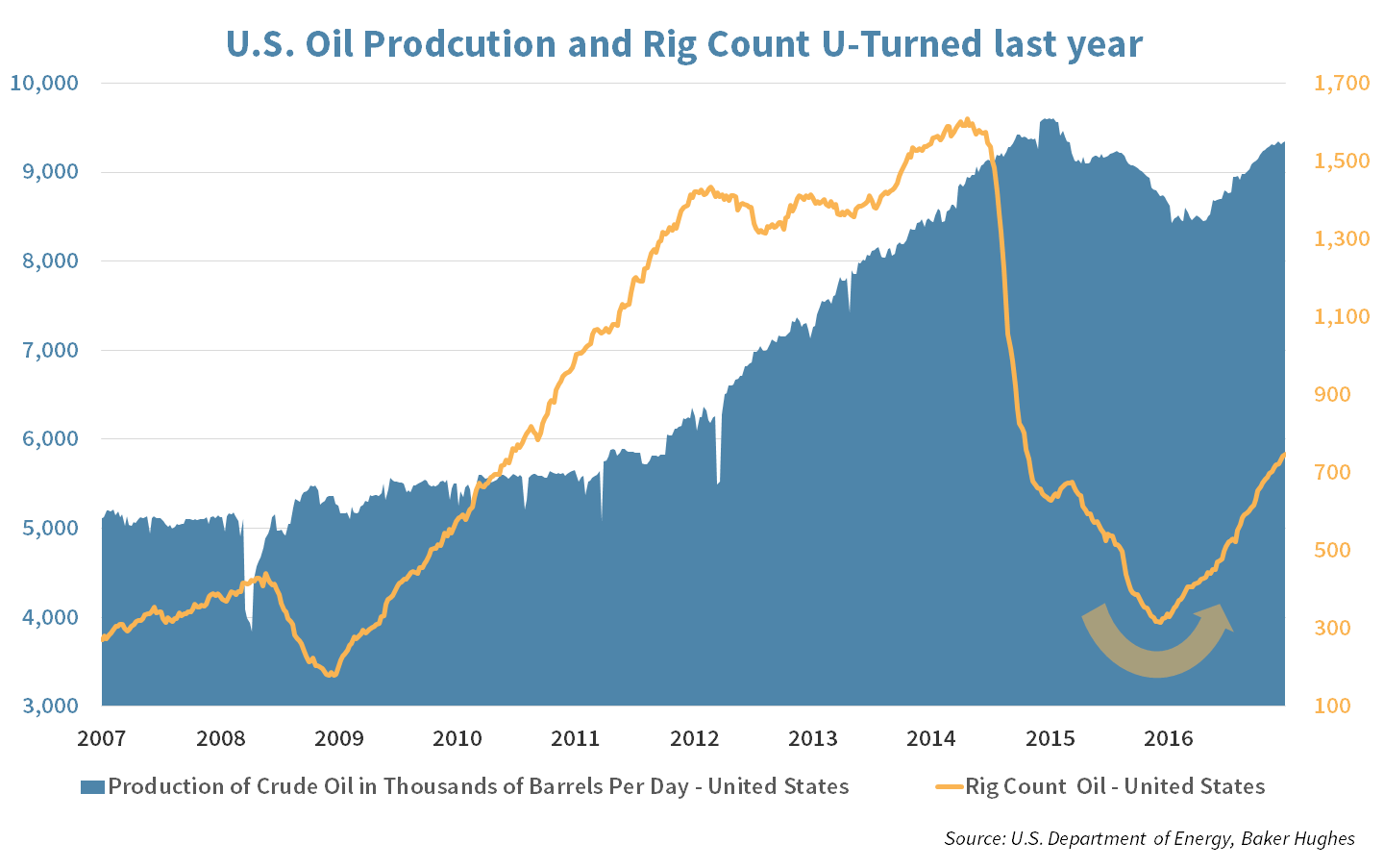

Wall Street analysts have significantly downgraded many oil companies and lowered their forecasts for the price of oil this past week. Despite OPEC cuts in conjunction with Russia, the market is oversupplied due to increased production from Libya and Nigeria, not to mention the United States. The U.S. rig count has risen at a steady pace since early last year indicating exploration and production companies are happy to invest capital at a $45 oil price. Crude inventories have come down only slightly after reaching record high levels in May of this year.

U.S. Production and the Rig Count U-Turn

Low oil prices in 2015 forced exploration and production companies to stop drilling and take rigs off their fields. Since then they have lowered their costs by paying less for oil field services as well as frack sand and become more efficient through increasing wells per pad and pipe length laterals. With the U.S. taking a prominent role as an ever more efficient swing producer, it is possible that oil cycles going forward will be shorter, with less dramatic peaks and troughs. Time will tell.

1 IHS provides information and analysis to support the decision-making process of businesses and governments in industries such as aerospace, defense and security; automotive; chemical; energy; maritime and trade; and technology.

Week Ahead

Contributed by Max Berkovich

Our Two CENTS

Central banks from across the world will meet in Portugal for a “Forum on Central Banking.”

- This retreat is important as European, British, and Japanese Central Banks are attending.

- Each Central Bank is looking for a strategy to eventually unwind their easing policies, also known as “tapering”.

- It might be best for the global economy if their efforts are coordinated to avoid unintended consequences.

Economic reports of note next week include the Case-Schiller Home Price Index, a final read on 1st Quarter GDP, Personal Spending, and Durable Goods.

- In addition, survey-based reports, Chicago Purchasing Managers Index & Michigan Consumer Sentiment Index, come out Friday. The survey results are forward-looking as opposed to the above-mentioned reports that look back.

Nike Inc. (NKE) a Strategic Growth strategy holding reports 4th Quarter earnings on Thursday.

- Growth has been muted as competition from Adidas (ADDY) and Under Armour (UA & UAA) has been fierce.

- Also, several retailers of athletic shoes and gear have had a tough go, with Sports Authority & Golfsmith going bankrupt this year.

- This past week Nike Inc. announced it will partner with Amazon (AMZN) to sell directly to consumers. The earnings call will most likely focus on this decision.

Treasury Department will reveal the results of its annual Comprehensive Capital Analysis and Review (CCAR) of big banks.

- Some of the thunder of this report was stolen by results of the Dodd-Frank ACT Stress Test (DFAST) released on Thursday, where all banks passed the test.

- The CCAR is different as this test is used to determine how much of the banks’ capital can be returned to shareholders as dividends or stock buybacks.

- Based on DFAST result improvements, investors are expecting bigger dividend hikes and buybacks from banks. The size of these increases will be used as an indicator of banks’ strength.

Semiannual report from the Board of Governors of the Federal Reserve to Congress is due next week.

- After a rate hike earlier this month, we expect the testimony from the Chair to focus on the Central Bank’s plans for its $4.5 Trillion balance sheet.

Strategy Updates

Contributed by Max Berkovich

STRATEGIC ASSET ALLOCATION

A Numbers Game

The MSCI Index provider announced its decision to add Chinese A-shares (shares listed in mainland China) to its Emerging Market Index in 2018. The decision was long awaited and expected (see last week’s “Week Ahead”). The specifics are that it will cap the included stocks to 5% of their floating market cap. China is already this biggest weighting (roughly 30%) in the index, and this would increase it by about 0.73%.

- Experts predict this action will increase the amount of investment capital headed to China by $30 Billion in time, but MSCI will act in stages to allow markets time to adjust slowly.

- Initially, that equates to roughly $8 Billion of inflows.

MSCI also made two other decisions this week as it relates to Emerging markets:

- It decided not to add Argentina to Emerging Markets and keep it as a Frontier Market but will review the decision again next year.

- Also, MSCI decided not to add Saudi Arabia to the Emerging Markets index. Observers believe that the timing of a highly public offering of oil giant Saudi Aramco may influence the decision.

One More Note on Indices

On Friday, FTSE Russell, another index provider, will rebalance and reconstitute its indices. $8.5 Trillion dollars are benchmarked to these U.S. indices.

- Due to individual stock performance, mergers, delisting, IPOs and other corporate actions, it is necessary to change the weights and holdings of the indices.

- Because so much money is investing in passive investments tracking these indices, it creates significant volatility in individual stocks and volume of transactions is abnormally large that day.

- JC Penny (JCP), Dillard’s (DDS), Groupon (GRPN), Fitbit (FIT) and Yelp (YELP) are getting the boot from the Russell 1000 index.

STRATEGIC GROWTH

Pass the SaaS

The Health Care sector was on fire this week in response to news of new health care legislation from Washington. The Energy sector was the laggard thanks to oil weakness and an acquisition by…

- EQT Inc. (EQT) of Rice Energy Corp. (RICE) for $6.7 billion dollars. EQT’s market capitalization is about $9 Billion; thus dilution is feared. When the deal closes, EQT will be the largest natural gas producer in the U.S, with combined output of 3.6 Billion cf/day. On Friday, the shares reclaimed much of their losses, suggesting investors may be warming to the deal.

- Also, Oracle Corp. (ORCL) the database giant blew away expectations when it reported its quarterly results. Software as a Service (SaaS) reported revenue of $1 Billion, a 75% increase on the year. Cloud-based revenue was also 42% higher on the year. All in, the company reported a 6% revenue bump, which means the cloud conversion has helped overcome a sales decline in traditional software.

STRATEGIC EQUITY INCOME

Aerial Battle

Expectations for Financials to be the leading sector this week after strong DFAST stress test results did not materialize as Health Care was the top sector. Telecom was the biggest laggard, with the Energy sector not too far behind. In other strategy news…

- The Boeing Company (BA) concluded an extremely successful Paris Air show with huge gains over rival Airbus (EADSY). Boeing received 571 orders versus Airbus’ 326. Boeing received 361 commitments from 16 airlines for its new single-aisle jet 737 MAX 10. Earlier in the week, Boeing raised its 20-year industry forecast for deliveries of planes to 41,030 jets, equating to $6 Trillion at list price.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters