When Good News is…Good News

Equity markets took a breather this week as they absorbed somewhat hawkish Fed comments coming out of Jackson Hole. Despite the decline, talk of higher rates is good news for investors, as long as it is in response to strong economic data.

Market Review

Contributed by Doug Walters

Great Expectations

The S&P 500 declined 0.7% this week, a marked departure from the relative calm of the past month. All eyes were on Janet Yellen (once again) Friday as she spoke at the annual Jackson Hole Economic Symposium.

- The Fed Chair stated that the case for an interest rate hike has strengthened in recent months. This is no surprise to us data watchers; unemployment is low and falling, and GDP growth, while low, is beginning to inflect up.

- While her comments are broadly in line with recent musings from other Fed board members, investors now see a greater potential for a rate rise in the coming months. These heightened expectations helped pressured stocks into negative territory for the week.

Paradoxical Reaction

You would be forgiven for finding it odd that when the Fed discusses evidence of economic improvement like they did on Friday, the market’s reaction is for equities to fall. Is good news, bad news? Not in our opinion.

- Let’s put rates aside momentarily. If the U.S. economy is improving, all else equal, that is generally going to be good for equities. Low unemployment and high consumption should lead to bigger profits for corporations and rising stock prices.

- Now let’s overlay interest rates. Rates impact how we value a company’s future. The higher the rate, the less valuable future profits are to us today. So a rise in rates (or increased expectation for rate rise) will drive corporate valuations down.

- So is good economic news, bad news for stocks? No. A good economy is always preferred. While higher rates mechanically reduce stock prices, this effect can, over time, be outweighed by strong fundamentals. Some of the greatest bull markets in history have been accompanied by rising rates.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.7 | 6.1 |

| S&P 400 (Mid Cap) | -0.2 | 11.5 |

| Russell 2000 (Small Cap) | 0.1 | 9.0 |

| MSCI EAFE (Developed International) | 0.1 | -0.8 |

| MSCI Emerging Markets | -1.3 | 13.1 |

| S&P GSCI (Commodities) | -2.0 | 16.5 |

| Gold | -1.5 | 24.2 |

| MSCI U.S. REIT Index | -0.5 | 10.4 |

| Barclays Int Govt Credit | -0.2 | 2.8 |

| Barclays US TIPS | -0.3 | 5.5 |

Economic Commentary

Is OPEC’s Strategy Working?

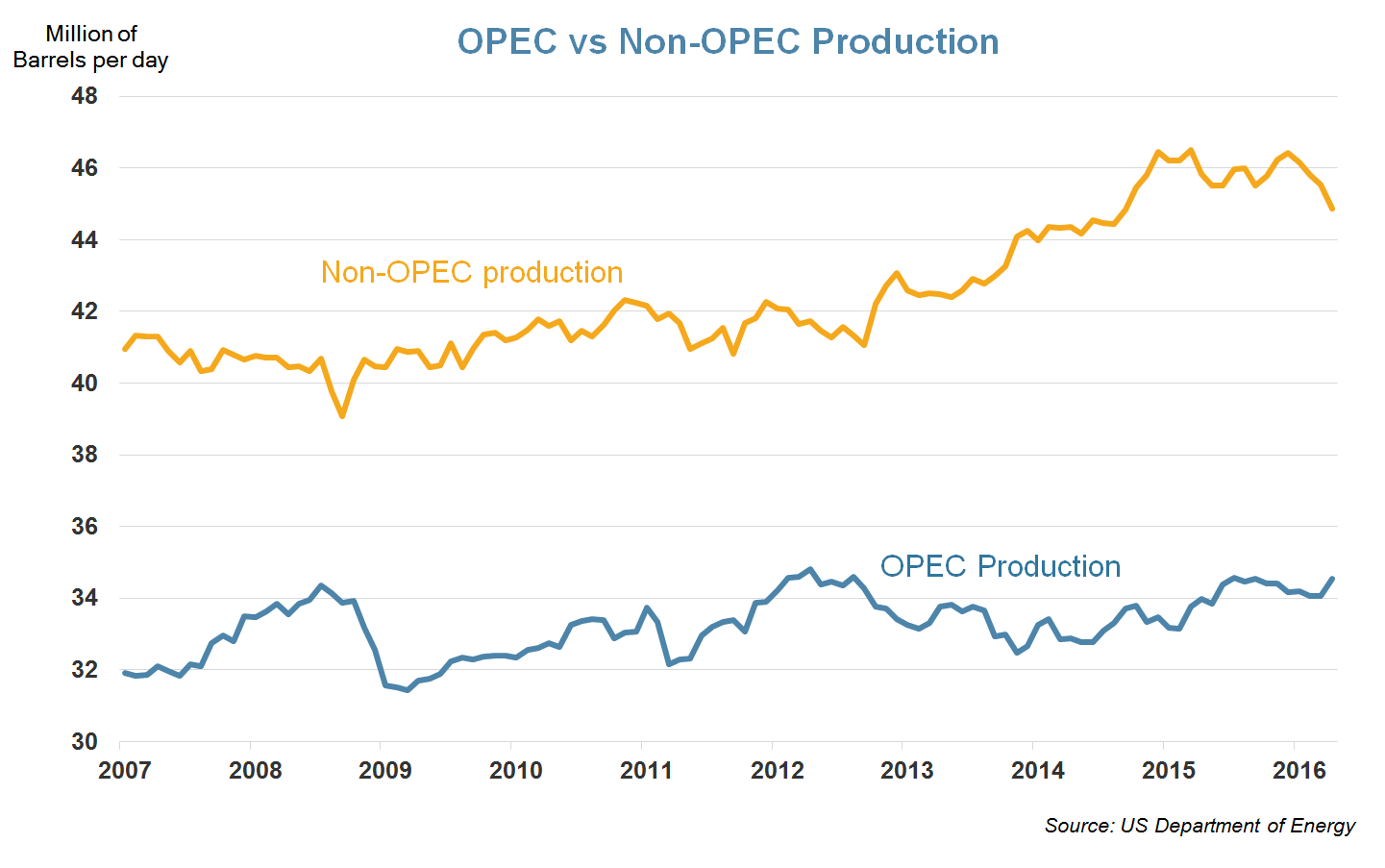

Two years ago, the Organization of Petroleum Exporting Countries (OPEC) embarked on a strategy to protect their market share by increasing their oil production. The member nations, led by Saudi Arabian oil minister Ali Al-Naimi, figured they should pump out oil at full capacity and force higher cost producers off the market. After the higher cost competition is forced out, they can then return to their cartel based production quotas they have used for decades.

As the chart above shows, OPEC nations are producing two million more barrels than they did in 2014. The three biggest producers within OPEC: 1) Saudi Arabia, 2) Iraq, and 3) Iran have each increased production by one million barrels per day.

Non-OPEC oil production makes up the majority of total supply with the United States and Russia producing the most. While the United States has decreased their production levels by 11% since 2014, Russia has surprised oil analysts by adding production even at the lower price. While the OPEC strategy may be forcing some high cost production off the market, the marginal cost of production has fallen and OPEC’s strategy is taking much longer than they had initially expected.

As a result of these dynamics, we view a “lower for longer” oil price scenario as more likely and have trimmed our Energy exposure within our core strategies.

Week Ahead

Data Dependence

At Jackson Hole, the Fed reiterated that the next rate decision will be dependent on the economic data trends. In the coming week we get two major data points.

- Inflation: On Monday we get July Personal Consumption Expenditure (PCE) data. The Fed extracts its preferred measure of inflation from this data set. Currently inflation is running below their 2% target rate.

- Jobs: On Friday we get an updated view of the current employment situation with the Non-Farm Payrolls report. Analysts are looking for a robust +230K increase.

- The September rate decision will be made on the 21st.

Strategy Update

Contributed by , Max Berkovich

Strategic Asset Allocation

Emerging Decline

U.S. Equities were down on the week, but not as much as Emerging Markets. However, EM, remains one of the better performing assets on a year-to-date basis.

Ratings Game

Both bonds and gold were volatile post Janet Yellen’s speech on Friday, ultimately ending the week down. She made an incrementally stronger case for a rate hike, which is reflected in the implied probabilities. The likelihood of a December rate hike advanced higher, and is still seen as more likely than a September move. With that said, the Fed deliberately left the door somewhat open for a rate increase next month.

We trimmed our Energy holdings and increased our exposure to Biotech, but there were no significant movements in the major assets classes to prompt a larger rebalance.

Strategic Growth

Consumer Square

Energy sector lagged this week. Even the poor week for the Consumer Discretionary sector couldn’t knock it out of the bottom. Speaking of the consumer…

- Dollar Tree, Inc. (DLTR) reported a slight miss when they released their earnings. The company grew same-store sales by 0.6% and increased full year guidance. It was the 34th consecutive quarter of sales growth for the company.

- Ulta Salon (ULTA) posted another strong quarter, topping expectations. This was the 7th straight quarter of double digit growth. The company expects full year earnings per share to be 20% higher than the previous year.

Strategic Equity Income

Xtandi-ng its Reach

Consumer Discretionary took charge this week while the Health Care sector was stuck at the back of the line. In other strategy news…

- Pfizer, Inc. (PFE) the pharmaceutical giant got a little bigger this week. The company acquired biotech Medivation, Inc. (MDVN) for $14 Billion. When the acquisition closes, Pfizer will include the leading prostate cancer drug Xtandi in its portfolio. The drug is expected to produce sales of $5.7 Billion by 2020.

- Also this week, Pfizer acquired AstraZeneca PLC’s (AZN) small-molecular antibiotic unit. The second deal will cost the company as much as $1.575 Billion, with $550 Million up-front and another $175 Million in January. The remainder will be based on milestones and sales targets.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters