Glass Half Full

We are halfway through the year and U.S. equities have put in a strong performance, with the total return on the S&P 500 exceeding 8%. Equity valuations are pointing to a bountiful economic future, while bonds are indicating caution. We side with optimism.

Market Review

Contributed by Doug Walters

Despite giving up some ground this week, U.S. stocks finished this year’s second quarter with a 2.6% total return and they gained over 8% for the year. Not bad for a market that many claimed was overvalued. While equities sent the signal that fundamentals were strong, bonds spun a different tale.

Mixed Signals

Is equity optimism misplaced, or are bonds overly pessimistic? We lean towards optimism.

- Economic fundamentals are solid. Growth is positive, while unemployment is low and falling. Wage growth has lagged, but could face upward pressure if the above dynamics persist.

- A corporate-friendly administration may continue to push for regulatory and policy changes that could boost profitability.

- Despite the rise in equities, there is still an enormous amount of cash on the sidelines that will continue to find its way into equities given the lack of return available elsewhere in the market (particularly in fixed income).

Bond yields are low globally. This unusual phenomenon kept demand for U.S. treasuries high even as their yields press against historical lows. While yields are low here in the U.S., they are even lower in other developed countries. We do not see any near-term catalyst to change this dynamic.

The H2 Playbook

While we see reason for optimism which can justify relatively high equity valuations, we believe that these lofty levels could lead to lower average returns in the coming years. In a low equity return and low bond yield environment, our goal is to:

- Stick to our process for identifying Quality and Value. We continuously seek out opportunities to exit more expensive asset classes and securities, and rotate into those offering the best combination of Quality and Value.

- Keep our bond duration low until the longer maturity bonds offer better value. If yields begin to rise, a short duration portfolio allows us to rotate into higher yielding instruments as bonds mature.

What we will not be doing in H2 is attempting to call a top in the market. Market timing is the most dangerous game that investors play and is the biggest source of long-term wealth destruction. Staying invested at an appropriate level of risk is the best way for investors to achieve their financial goals.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.6 | 8.2 |

| S&P 400 (Mid Cap) | 0.2 | 5.2 |

| Russell 2000 (Small Cap) | 0.0 | 4.3 |

| MSCI EAFE (Developed International) | -0.3 | 11.8 |

| MSCI Emerging Markets | -0.1 | 17.2 |

| S&P GSCI (Commodities) | 5.3 | -6.5 |

| Gold | -1.2 | 7.7 |

| MSCI U.S. REIT Index | -1.5 | 0.6 |

| Barclays Int Govt Credit | -0.4 | 0.8 |

| Barclays US TIPS | -0.8 | 0.2 |

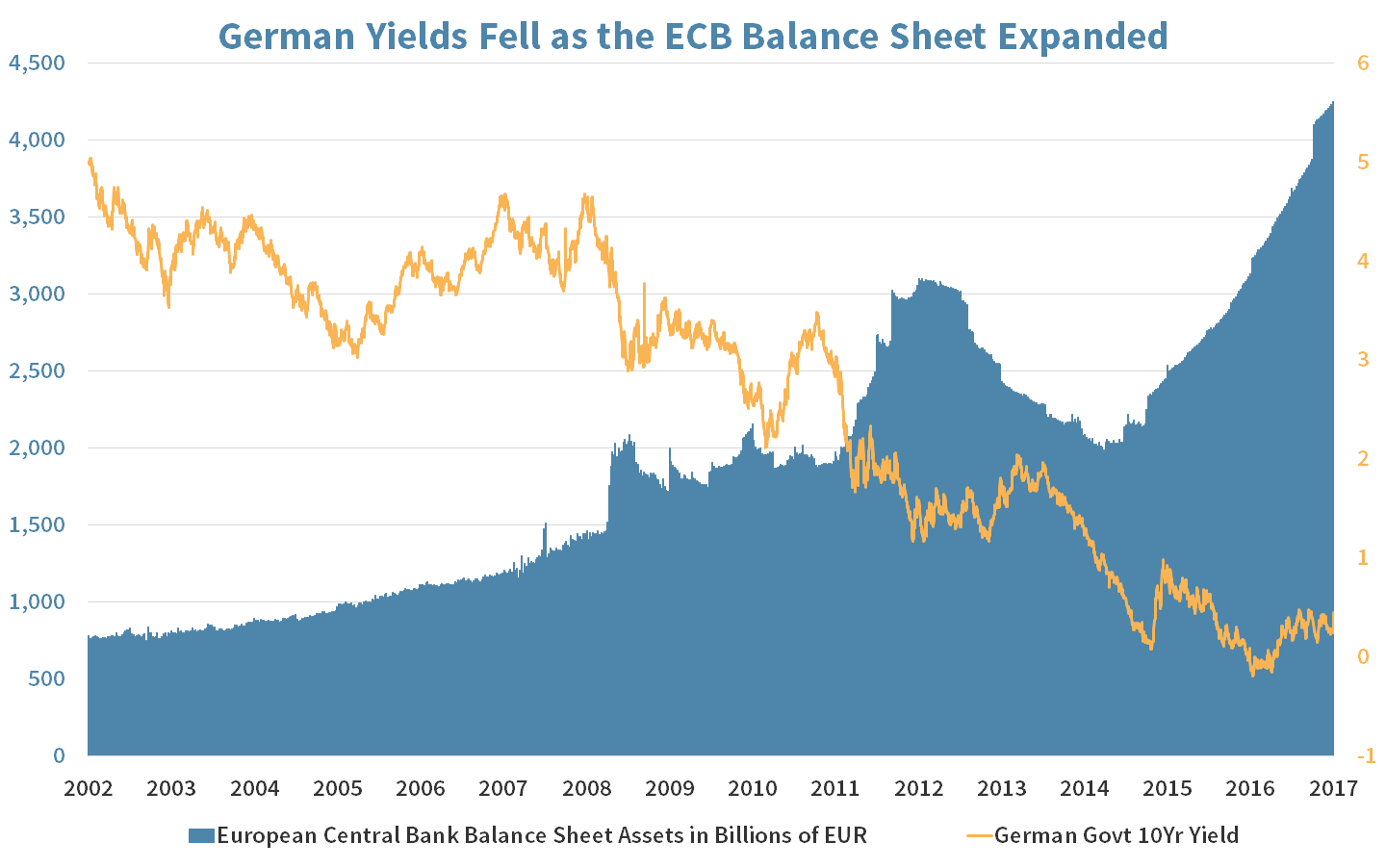

Economic Commentary

Much like the United States Federal Reserve Bank, the European Central Bank (ECB) aggressively expanded the money supply over the past decade to fight off deflation and spur economic activity. Now consensus expectations are for the ECB to lay out a plan in September to begin winding down its quantitative easing program. ECB President Mario Draghi recently declared “deflationary forces had been replaced by reflationary ones.” The strong statement moved the market with investors anticipating less bond buying by the Central Bank.

Source: European Central Bank

The ECB is entering a tricky period where it must balance ending the quantitative easing program without spooking the market. The end of the program can drive interest rates higher which would strengthen the Euro and hurt European Union exports, thereby slowing economic activity. As the European inflation rate is still below Draghi’s stated goal of “below but close to 2 percent,” the Central Bank does not want to move too fast in ending the expansion of the money supply.

Europe is recovering from a recession and the ECB is shifting from fighting off deflation to being more consistent with the United States Federal Reserve which is looking to unwind its balance sheet.

Week Ahead

Contributed by , Max Berkovich

We celebrate FREEDOM next week.

Federal Open Market Committee (FOMC) minutes from June meeting will be released on Wednesday.

- A closer look at key points and data from the last Federal Reserve meeting, especially regarding the Central Bank’s balance sheet will be in focus.

Redbook Index, which tracks retail sales in US, is expected to continue to improve in the first half of July.

- Any large deviations from the forecast may bring more volatility for retail stocks.

ECB Policy Meeting minutes will be released on Thursday.

- Investors will be looking for any changes in language that might hint of faster than expected tightening in EU’s bond buying operations.

Employment data as always is a key focus for the first week of a new month.

- June Non-farm payrolls are expected to increase by 138,000 while the ADP Employment report is projected to show an increase of 253,000 jobs.

Day off for most government agencies and banks will begin on July 3rd through July 4th to celebrate 241st Birthday of America’s independence.

- On Monday U.S. stock markets will close at 1 PM and Bond markets at 2 PM. Both markets will be closed on July 4th.

Orders for Durable Goods ex-Transportation are expected to show slight growth while Durable Goods Orders (including motor vehicle sales) are expected to decline around 1.1%.

- Overall Factory Orders are expected to decline slightly in June.

Mortgage Bankers Association’s Mortgage Applications will be reported on Thursday. The survey tracks approximately 50 percent of all U.S. residential mortgage applications.

- While there is no consensus for growth or decline for the last week of June, the mortgage applications grew on average by nearly 1% for the first four weeks of June and declined by 0.15% in May.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC Asset Allocation

Emerging Developments

Emerging and Foreign Developed equity markets have outperformed US equities this quarter. Major contributors to outperformance in international markets were: cheaper valuation vs. U.S. markets, strengthening economies, weaker dollar and reassurance of European Union’s stability.

- US economic growth and a weaker dollar had a positive impact on Emerging Markets.

- French elections results were a big win for European Union after pro-EU candidate Emmanuel Macron won the presidency.

Technically Speaking

Technology has been the dominant segment in US equity markets and it has been the major contributor to the outperformance of Russell 1000 Growth over Russell 1000 Value. Energy was the major drag on Russell 1000 Value Index’s performance.

- Energy sector accounts for almost 10.5% of Russell 1000 Value index and is down about 13.5% so far this year. While Technology sector is 8% of the Russell 1000 Value index and is up about 11% year to date.

- Energy sector is less than 1% of Russell 1000 Growth Index and is down about 17% so far this year. While Technology sector is 36% of the Russell 1000 Growth Index and is up about 19% year to date.

Closing Doors

As mentioned in “Real Deal” in the Investing in the Age of Disruption issue of Strategic Insights our review of the Real Estate asset class lead us to an exit from the asset class.

Strategic Growth

Disruptive behavior

The second quarter witnessed a decline in crude prices dragging down the energy sector, making that sector the biggest laggard. Health care sector was the leading sector, with biotech leading the way. Noteworthy stories this past quarter include…

- EQT Corp. (EQT) acquiring Rice Energy to become the biggest domestic natural gas driller.

- Nike Inc. (NKE) announced a “Pilot” program to sell sneakers on Amazon directly to consumers.

- Qualcomm Inc. (QCOM) still is unable to close the acquisition of NXP Semiconductors (NXPI) as the $110 price may be too low.

- Praxair Inc. (PX) merging with Linde Ag (LNAGF) to form the world’s largest supplier of industrial gases.

STRATEGIC Equity Income

Stress Relief: Telecom was the biggest laggard thanks to a costly pricing battle for wireless data plans. Health Care was the biggest gainer. Although, Financials had a strong finish to the quarter, driven by bank’ strong bank stress test results with dividend hikes and stock buyback announcements helping. Noteworthy stories this past quarter include…

- GE Corp. (GE) announced a new CEO John Flannery.

- There is a rumor that Kraft-Heinz (KHC) is lining-up to acquire Colgate-Palmolive Corp. (CL) after the CEO of Colgate implied the company is for sale at $100 per share.

- Verizon Communications, failed to get a deal done in acquiring Charter Communications (CHTR) but did win a bidding war for Straight Path Comm. (STRP) and paid $4.4 Billion dollars for Yahoo!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Max Berkovich

Max Berkovich