Giving Thanks

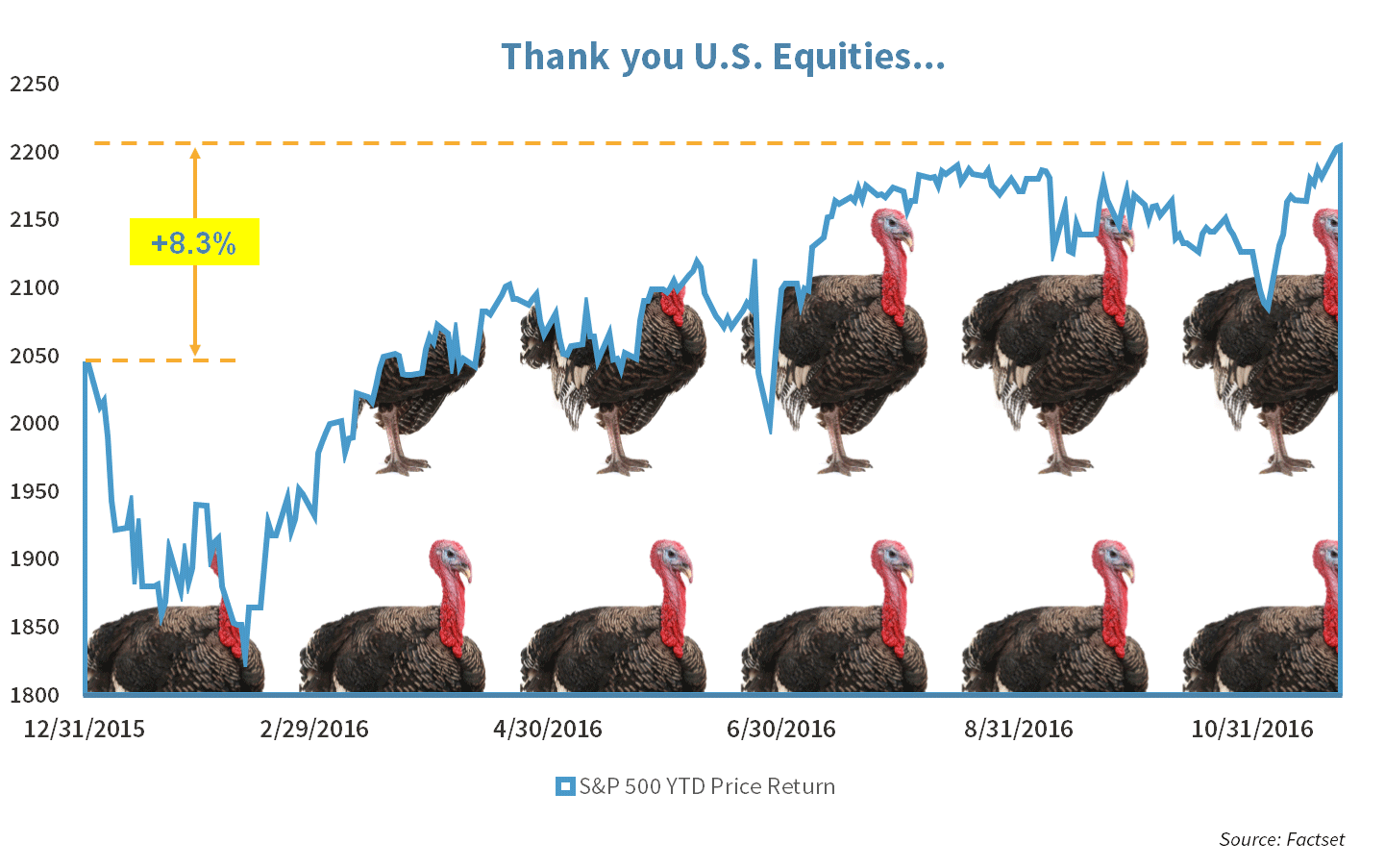

As Americans turn their attention from giving thanks to bargain hunting, we take a moment to reflect on investment performance. There is much to be thankful for, including a resilient S&P 500, which is up 8.3% this year (10.45% with dividends).

As we bid farewell to Thanksgiving and turn our attention to holiday shopping, the Strategic Investment Team would like to take a moment to reflect the drivers of portfolio performance. This has been a tumultuous year in many ways. Despite this, there are numerous bright spots in the securities universe to which we owe thanks. We take a moment on this Thanksgiving weekend to recognize a few of them:

- Thank you U.S. Equities… for posting positive returns this year, despite the challenges of Brexit and the U.S. Presidential election.

- Thank you investment bankers… for convincing acquisitive companies to bid for stocks like Spectra Energy (SE), Time Warner (TWX) and NXP Semiconductors (NXPI).

- Thank you President-elect Trump… for a protectionist agenda, which has helped make U.S.-centric small cap the best performing asset class in our model allocation.

- Thank you infrastructure spend optimism… for breathing life into forgotten quality cyclicals like Caterpillar (CAT).

- Thank you uncertainty, doomsdayers & Mr. T… for propping Gold up as the second best performing asset class in our model allocation.

- Thank you OPEC… for attempting to show signs of cooperation; helping boost Energy to the best performing sector this year.

- Thank you selfies… for driving up demand for makeup and Ulta Salon’s share price.

But most of all

- Thank you clients of Strategic Financial Services… for the continued trust and confidence you have placed in the entire Strategic Team.

Happy Thanksgiving,

The Strategic Investment Team

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters