Forward Progress

The S&P 500 hit new highs this week as Congress made forward progress in their quest to lower corporate taxes.

Market Review

Contributed by Doug Walters

Stocks got a boost this week from progress on the tax front and comforting words from the Federal Reserve. The S&P 500 jumped about a half a percent on Friday to end the week up around 0.7% and setting a new all-time high.

One Step at a Time

Passing of comprehensive tax reform is still a somewhat distant dream for corporate America, but after this week they likely feel a little closer, and share prices celebrated. The Senate passed a budget resolution to help facilitate the eventual passage of tax reform. Part of the aim of the resolution was to include language that would make it difficult, if not impossible, for Senate Democrats to use a filibuster to block a future tax bill. It still seems unlikely to us that we will see comprehensive tax reform in 2017, but forward progress was demonstrated.

Undisrupted Growth

The Fed released its Summary of Commentary on Current Economic Conditions, affectionately referred to as the “Beige Book” by economists. The Beige Book contains a treasure trove of economic data and is provided to the Fed governors ahead of their Open Market Committee meeting. A review of the data shows “modest to moderate” growth, which is impressive given the hurricane disruptions. Labor remains tight, but wage and price inflation remains paradoxically stubborn. Despite low inflation, a Fed Funds rate increase still appears to be in the cards for December.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.9 | 15.0 |

| S&P 400 (Mid Cap) | 0.9 | 10.5 |

| Russell 2000 (Small Cap) | 0.4 | 11.2 |

| MSCI EAFE (Developed International) | 0.1 | 19.1 |

| MSCI Emerging Markets | -0.8 | 29.5 |

| S&P GSCI (Commodities) | -0.4 | 0.7 |

| Gold | -1.8 | 10.9 |

| MSCI U.S. REIT Index | -1.3 | 1.2 |

| Barclays Int Govt Credit | -0.4 | 0.6 |

| Barclays US TIPS | -0.6 | 0.2 |

Economic Commentary

Bankers Playing Musical Chairs

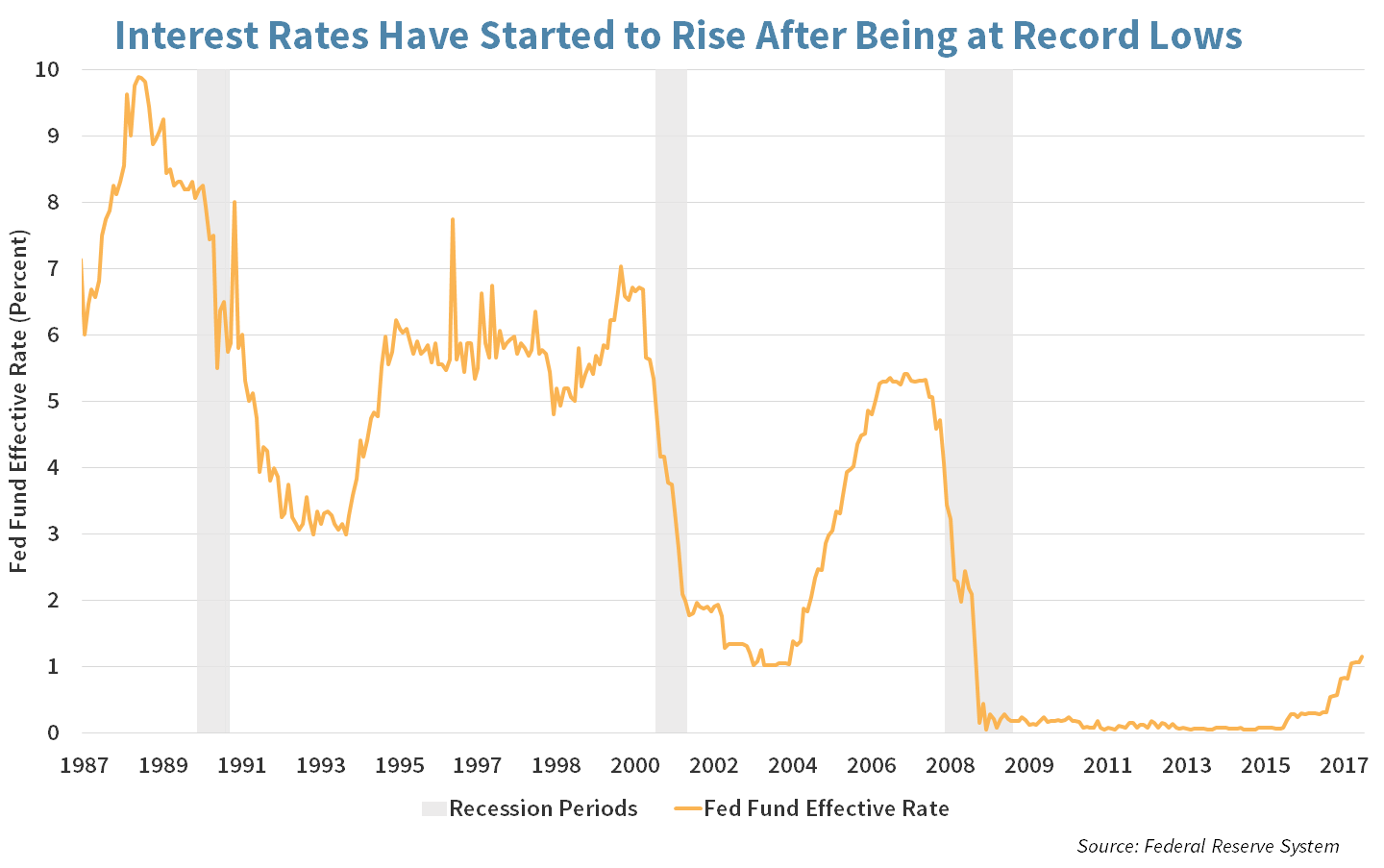

Interest rates matter to investors as higher rates can weigh on the performance of both stocks and bonds while lower rates can help both asset classes as they stimulate the economy. When the financial crisis hit the economy in 2008, the US Federal Reserve lowered its key Fed Fund rate to drive overall interest rates for loans lower. Now that the economy has recovered, with unemployment dropping to “normal” levels, albeit with below normal inflation levels, the Federal Reserve has been gradually raising rates and is expected to do so again in December as well as several times in 2018.

The Federal Reserve bank policy is set by a governing board led by Chairwoman Janet Yellen. As we discussed in, The Eve of Change, her term is ending in February 2018. President Trump has now said he will pick the successor before November 3rd with the following five candidates believed to be on the short list:

- Current Fed Chairwoman Janet Yellen, who would represent a complete continuation of current policy.

- Fed Governor Jerome Powell, who has only recently made his views clear that he supports a gradual increase in interest rate hikes.

- Fed Governor Kevin Warsh, viewed as more hawkish on fighting possible future inflation with higher interest rates.

- National Economic Director Gary Cohn, who would represent a break from current Federal Reserve bank policy.

- Stanford University Professor of Economics John Taylor, popular amongst conservatives that want to see interest rates rise and the effective fund rate be based on a methodical “Taylor rule” formula.

According to a recent Reuters poll amongst economists, the favorite to win the position is Jerome Powell, who Treasury Secretary Steven Mnuchin has mentioned favorably. One thing is certain; anyone other than the incumbent Chairwoman Yellen will create a new level of uncertainty for the markets.

Week Ahead

Get Your BEERS Here!

Baseball season is nearing the end with the Los Angeles Dodgers awaiting the winner of the New York Yankees/Houston Astros series to face-off in the World Series on Tuesday.

- Go Yankees! One more win over Houston and the Bronx Bombers will play in the World Series for the 41st time.

Earnings focus will be on the Industrials sector early in the week with Strategic holdings Caterpillar (CAT), Union Pacific (UNP) and Boeing (BA). Technology bats second with Microsoft (MSFT), Alphabet (GOOG, GOOGL), and Intel (INTC) mid-week. Batting clean-up will be the Energy sector with Strategic Equity Income holdings Exxon Mobil (XOM), Chevron (CVX), and Phillips 66 (PSX) on Friday.

Economic data will take a backseat to earnings, but durable goods orders, existing home sales and Gross Domestic Product (GDP) will be closely watched.

- Durable goods orders track the conditions of manufacturers’ shipments, inventories, and orders.

- September existing homes are expected to show slight growth and newly built home sales are expected to remain unchanged.

- Third quarter GDP is expected to increase by almost 2.2% vs. the third quarter in 2016.

Rate decision from European Central Bank (ECB) will dominate the headlines across the pond.

- No rate move is expected, but any comments on the bond-buying program will be closely watched.

Snap elections in Japan take place on Sunday. Prime Minister Shinzo Abe’s gamble on holding an early election is paying off thus far.

- The polls show that Mr. Abe is set for an easy victory in Sunday’s election, which would make him the longest-serving PM in post-war Japan.

- The easy victory was not certain a few weeks ago as Abe faced a real challenge from Party of Hope candidate Yuriko Koike, who has since faded.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Behind the Curtain

High-yield bond funds are rejoicing this year’s strong performance in the fixed income category. Some of the top performing funds are up nearly 10% year-to-date. The secret to some of their outperformance is allocating a material portion of the funds to stocks, with some holding as much as 25% in equities.

With bond yields relatively low, even for low-quality junk bonds, high-yield fixed income fund managers are choosing to increase allocation to equities.

- Fidelity Capital & Income Fund (FAGIX) holds 23.5% in equities.

- Lord Abbett Bond Debenture Fund Inc. (LBNDX) holds 14.9% in equities.

- The Loomis Sayles High Income Fund (LSHIX) holds 7% in equities.

At Strategic our Quality and Value mandate leads us to invest the fixed income portion of our portfolios in only high-quality investments. High-yield bonds do not qualify. Also, we only recommend funds that have a simple and transparent investment mandate to ensure they are not adding unseen risk to our overall portfolio. For those seeking equity-like risk, we will always prefer stocks with a good balance of Quality and Value, and not low-quality high-yield bonds.

STRATEGIC GROWTH

Optum-izing Healthcare

Consumer Staples had an unpleasant week. The Health Care sector was the top sector, despite Biotechnology taking a breather. Speaking of Health Care…

- UnitedHealth Group, Inc. (UNH) a managed care company, reported a very strong quarter topping consensus estimates. Highlights include revenue hitting $50 Billion in the quarter, 9% higher from last year. Adjusted net earnings per share of $2.66 were 23% higher year over year, and the company announced it is expecting $9.45-$10 per share in earnings for 2017. Also, the Optum unit, which includes pharmacy benefit management (PBM), data management and billing and health care delivery, reported earnings growth of 16%, with all divisions growing earnings double-digits.

STRATEGIC EQUITY INCOME

Planes, Trains…

The Energy sector had a tough week thanks to crude prices falling. The Telecom sector was the leader, but the Financial sector was in the spotlight as multiple banks reported earnings. In other strategy news…

- General Electric Co, (GE) reported an ugly quarter on Friday, but that was expected as the “kitchen sink” of bad numbers was already assumed (see our Three’s a Crowd edition). The company did kick the can down the road on a dividend cut decision to November 13, when the new CEO meets with investors. Also in the news were rumors spin-offs or sales of various units including the unit formerly known as GE Rail and a story that former CEO used two company planes for corporate travel, one as a back-up. The new CEO has a lot to tackle.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters