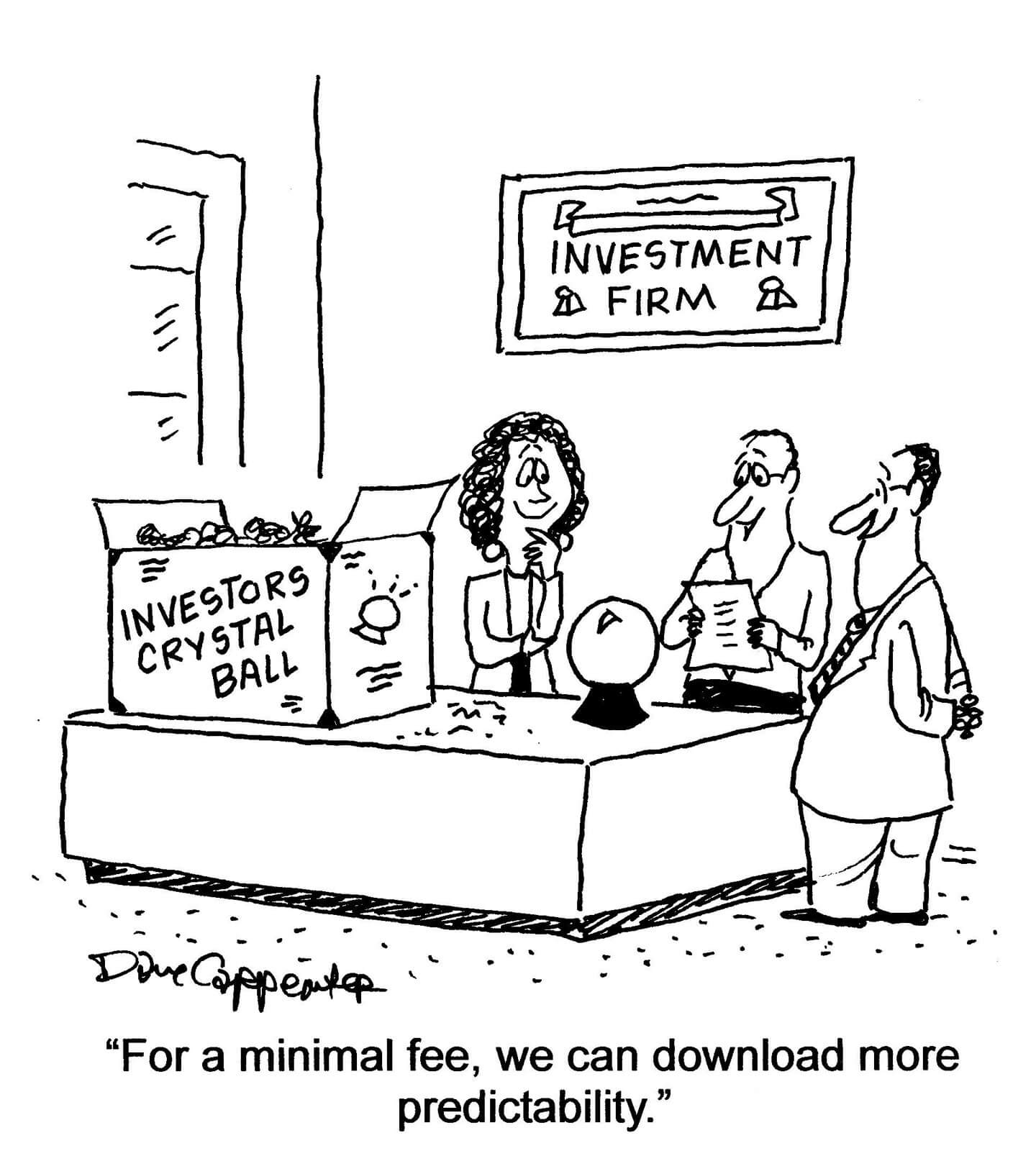

Fortune Tellers Beware

A mixed bag of news put pressure on stocks this week. We caution investors from trying to predict the outcome of the current crisis. Your financial plan should not depend on knowing the future.

Contributed by Doug Walters , Max Berkovich , ,

U.S. stocks fell this week with Small-Cap and Value indices hit the hardest. It was a mixed bag of news flow with optimism around states beginning to reopen hampered by the concerns that too much too soon could just extend the crisis. Only time will tell if politicians are striking the right balance. Speculators beware. Positive news on treatment or the trajectory of new cases could send stocks soaring. It is also possible that stocks could slump if reopening efforts reaccelerate the spread of the virus.

Trying to predict any market, let alone this incredibly uncertain one, is just market timing, which is proven to be detrimental to investor returns over time (see our white paper on the subject). As Mark Twain said, “Prediction is difficult, particularly when it involves the future.” That is not to say we subscribe to pure passive investing, though. There is a middle ground between active and passive, which we see as most beneficial to investor portfolios.

You can do better than owning the whole market passively. At the core of our portfolios are funds that target specific rewarded factors. Why own the entire market, the good and the bad, when you can own stocks with characteristics that have historically outperformed? We will also shift allocations gradually as parts of the portfolio become more attractive than others. There is no timing involved. It is gradual tilts as the data we track changes – science, not speculation.

Headlines This Week

Slow but steady

- States around the country have been cautiously reopening their economies.

- New York state has begun reopening certain public parks and is planning to open its beaches on Memorial Day weekend.

- Governor Andrew Cuomo gave his blessing to begin reopening the Finger Lakes, Central New York, Mohawk Valley, Southern Tier, and North Country regions.

Stay home shopping

- While retail sales fell over 16% in April, no one was surprised.

- Categories like clothing, electronics, and furniture sales suffered the most.

- Non–Store Retailers like Amazon and ETSY reported an 8.4% increase in sales for April.

- Grocery store sales declined 13.2% from March as consumer stockpiling cooled off.

- Consumer confidence was better than expected as the University of Michigan Consumer Sentiment Index topped expectations and increased slightly from last month.

Earnings Update

- Over 90% of the companies in the S&P 500 reported their earnings.

- S&P 500 first-quarter earnings have declined by around -13.8% year-on-year.

- On a positive note, more than half of the companies have beaten their revenue and earnings per share estimates.

Extraordinary Measures

- The Federal Reserve balance sheet has reached nearly $7 Trillion.

- Several of the emergency facilities announced have yet to be implemented.

- The Federal Reserve only this week started buying Corporate Bond ETFs, and the first round of activity ($305 Million) was less than anticipated.

- Chairman Powell this week insisted that the Central Bank does not intend to join other developed countries with negative interest rates.

The Week Ahead

Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin are scheduled to testify before the Senate Banking Committee next Tuesday.

- As a result of the CARES Act, the pair are required to provide updates to Congress on the economic program.

- Powell is also set to hold a speech on Thursday regarding how the COVID-19 pandemic has affected everything ranging from the labor market to inflation.

- The Federal Reserve will release its Federal Open Market Committee meeting minutes on Wednesday.

Next Thursday will bring yet another Initial Jobless Claims report.

- Since late March, over 36 million Americans have filed for unemployment.

- The unemployment rate during the pandemic has reached nearly 15% – the highest since the Great Depression.

The preliminary Manufacturing and Services PMI figures for May will be released on Thursday.

- Some experts expect sentiment to improve slightly, but still, be far below any sort of reassuring level.

- While these figures typically play a more significant role in investor sentiment, the reports are likely to hold less weight as the fallout from the pandemic continues.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters