Flirting with History

The Dow finally found its way through the elusive 20,000 barrier, as stocks rose for the first time in several weeks. The move came despite a volatile week in Washington.

Market Update

Contributed by Doug Walters

U.S. equities found reason for optimism, ending the week up around 1%. The move was enough for the Dow finally to break through the 20,000 milestone. But the real action was in the political space, with Trump beginning talks with his foreign counterparts.

Big flirt

Investors and the media love to wax lyrical about the Dow Jones Industrial Average even though it is arguably the least useful of the major U.S. stock market indices (see Chasing a Ghost). After teasing its adoring followers for over a month, the widely-followed index finally crested 20,000 on Wednesday.

- As we wrote a few weeks ago (see Milestone 20,000), this latest achievement of the stock market was actually very slow to come.

- More important as we hit new highs is whether there is still room to run at these valuations. We believe this will all come down to the direction of economic growth which is highly dependent on the success of the new administration.

May day

President Trump hosted U.K. Prime Minister May in his first official face-to-face meeting with a foreign leader. This was somewhat overshadowed by a contentious Twitter exchange between the President and his Mexican counterpart which led to the cancelling of their upcoming meeting. With politics being conducted via tweets, how is that Twitter (TWTR) has not been able to translate this publicity into profits? While the FANG stocks have been rallying this year, Twitter continues to be left behind.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.0 | 2.5 |

| S&P 400 (Mid Cap) | 1.3 | 2.2 |

| Russell 2000 (Small Cap) | 1.4 | 1.0 |

| MSCI EAFE (Developed International) | 1.2 | 3.3 |

| MSCI Emerging Markets | 2.6 | 6.3 |

| S&P GSCI (Commodities) | 0.3 | 0.6 |

| Gold | -1.4 | 3.5 |

| MSCI U.S. REIT Index | -1.0 | -0.3 |

| Barclays Int Govt Credit | 0.1 | 0.1 |

| Barclays US TIPS | 0.2 | 0.7 |

Economic Commentary

Home economics

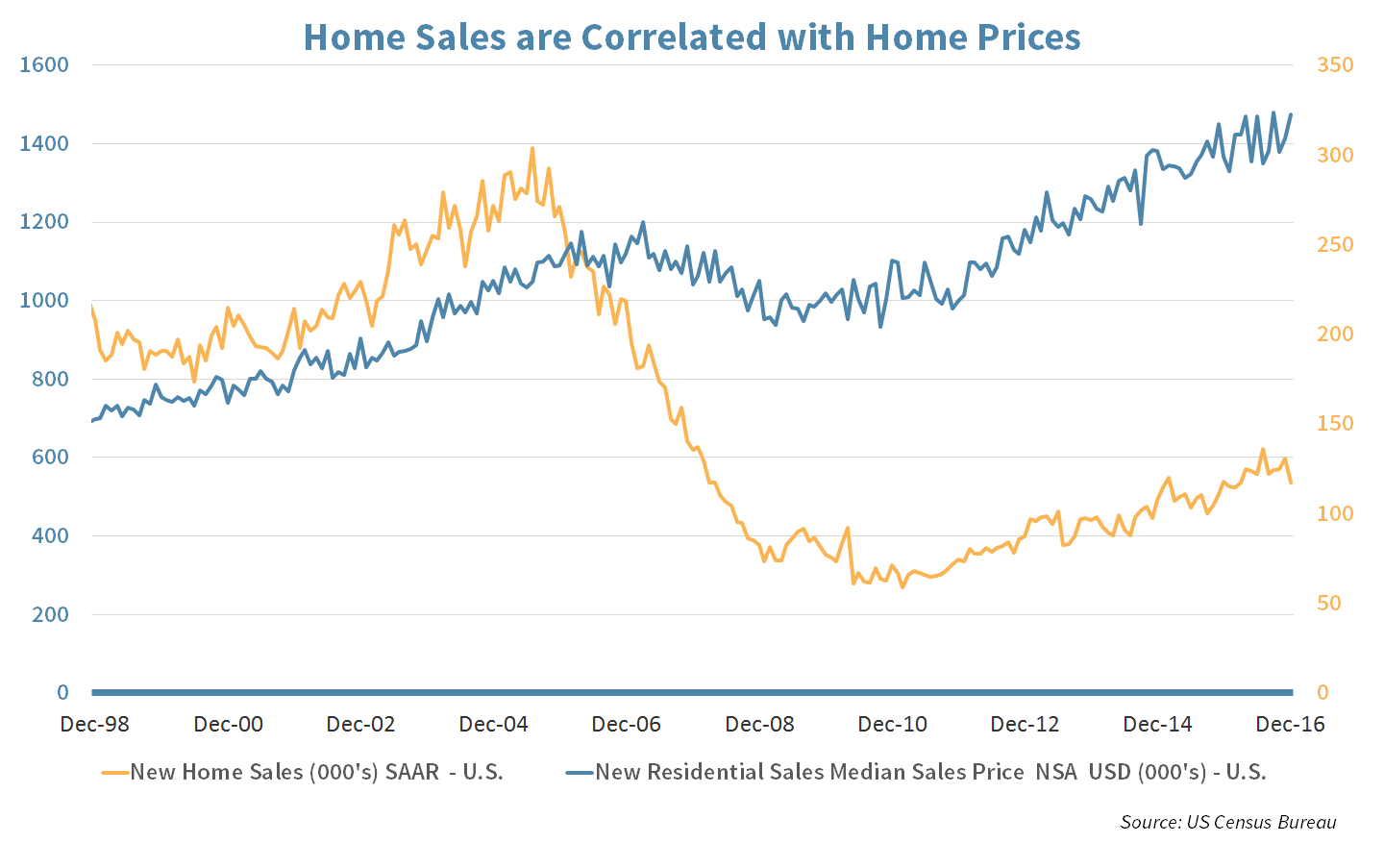

New home sales in the United States dropped by 10.4% in December from November, and 0.4% from a year ago. This is a notoriously volatile data series, but a slowdown in sales would not be surprising given:

- Higher Prices: the median sales price of a newly built home was $323k in 2016, up from $289k in 2015

- Higher Mortgage Rates: the average 30-year mortgage rate rose from 3.5% in November to 4.2% this week, and

- A lack of new home inventory.

New home sales fell 10.4% in December 2016.

As inventory levels of new homes remain low and their prices high, home builders are incentivized to build more homes. A greater supply of new homes could lead to lower prices and further drive new home sales. A recovering economy with increased wages could help drive the market even more.

Looking at the above chart, we see new home sales are still well below their pre-recession annual peak rate of 1.4 million. With December new home sales coming in at a seasonally adjusted annual rate of just 536 thousand, there is still plenty of room for the cycle to continue its upward trend, despite the recent tick downwards. As the labor market and overall economy look robust, the economic fundamentals for new home volumes remain strong.

Week Ahead

Big data

Next week is loaded with economic data and we expect the street to keep a close eye on the following key metrics:

- Personal Income is expected to grow by 0.4% in December vs. being flat in the prior month.

- Consumer Confidence Index, a survey which measures the public’s confidence in the direction of the economy, is forecast to come in at 113 vs. 113.7 the prior month. The higher the number the better. Currently consumer confidence is running at a 15-year high.

- Non-farm Payrolls report is expected to show the addition of 175,000 jobs in January.

Earning one’s keep

Tuesday night the biggest company by market capitalization Apple Corp. reports in a busy week of earnings releases. We will also keep a close eye on the energy sector with Exxon Mobil, Chevron and a EQT Corp. due up on the back end of next week.

Strategy Updates

Contributed by , Max Berkovich

STRATEGIC ASSET ALLOCATION

Emerging worries

Equity markets around the globe have made small advances on strong 4th quarter earnings, with Emerging Markets leading the pack for the week and for the year.

- Emerging Markets advanced further in January on the heels of a strengthening U.S. dollar.

- Protectionist U.S. policies may hurt Emerging Markets the most as their economies depend on exports to U.S..

- A stronger U.S. economy could increase demand for raw materials, benefiting some commodity exporting emerging countries like Brazil and Chile.

A Twitter war

The friction between Mexico and the U.S. has escalated over the “U.S.-Mexican border wall” and import taxes. Foreign investors rushed to buy U.S.-Treasury bonds this Thursday, slightly dampening the week’s earlier gains.

- While investors still expect interest rates to rise, new concerns about trade wars and its negative effects on U.S. economic growth continue to drive investors into the arms of the U.S. Treasury.

Staying put

While the U.S. equity markets have celebrated new highs, there were no immediate signals that warrant major rebalancing of our portfolios.

STRATEGIC GROWTH

Royal pain

The Industrial and Financial sectors were the leader on the week, while Technology was a laggard thanks to…

- QUALCOMM Inc. (QCOM) a mobile communication microchip maker received unwelcome news when Apple Corp. (AAPL) sued the company for unfairly charging royalties. The company receives significant revenue from royalty payments so the news has snowballed into fear that other phone makers will do the same. More important, this suit is an attack on the company’s business model. QUALCOMM counter-suing Apple and Wednesday’s uneventful earnings report failed to lift the stock.

STRATEGIC EQUITY INCOME

Wrong number

Financials returned to leader status this week, while the Telecom sector was a clear laggard because of an earnings report from…

- Verizon Inc. (VZ) reported a less than stellar quarter. Though the headline was only a slight miss, forward guidance was light. Analysts identified lackluster growth from wireless as a major concern for the stock and identified a need for an acquisition, especially to match activity of rival AT&T (T). It didn’t take very long for rumors of an acquisition of Dish Networks (DISH) or cable network Charter Communication (CHTR) to take hold. By week end, Verizon denied the rumors.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters