Flat-footed

A flat performance by U.S. equities masked a volatile week of trading spurred by the ever-changing odds of successful tax reform. Economic data and corporate earnings remain promising, but a flattening yield curve is raising eyebrows.

Market Review

Contributed by Doug Walters

U.S. stock performance was flat this week, with volatility high as investors try to digest the daily change in sentiment around tax reform. Also flatter this week was the yield curve. The continued flattening likely has the Fed more seriously considering “taper.”

Ahead of Schedule

Stocks experienced violent swings this week courtesy of the economic roller coaster known as “tax reform.” We have spoken ad nauseum on tax reform in recent weeks for good reason: it matters for stocks. This week the House was able to pass their version of the bill, keeping their promise to have a bill to the Senate by Thanksgiving. The Senate Finance Committee has voted to advance their own version of tax reform. A full Senate vote is expected after Thanksgiving. The challenge, and what continues to have equities on edge is the reconciliation process, which could push tax reform into 2018.

Taper Trigger

With so much focus on taxes, it is easy to forget there are other economic factors at play. Earnings season is wrapping up. With 95% of companies reported, sales are up an impressive 6%, indicating that U.S. companies are benefiting from a buoyant global economy. In our Economic Commentary, we highlight positive trends in Industrial Production, which will help boost GDP. With stock valuations above average, it is important for investors that the economy does not show any cracks.

The fixed income market, though, may be indicating that the cracks are out there somewhere. We witnessed further flattening of the bond yield curve this week. A flat yield curve, historically, has been the canary in the coal mine for an economic downturn, and if nothing else, discourages banks from lending. The Fed has indicated that it would be willing to entertain “tapering” its bond purchases to help prop up the long end of the curve. The recent flattening may have moved Janet Yellen and the Board of Governors a step closer to pulling the taper trigger.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.1 | 15.2 |

| S&P 400 (Mid Cap) | 0.8 | 10.8 |

| Russell 2000 (Small Cap) | 1.2 | 10.0 |

| MSCI EAFE (Developed International) | -0.7 | 17.9 |

| MSCI Emerging Markets | -0.3 | 30.5 |

| S&P GSCI (Commodities) | -2.3 | 5.2 |

| Gold | 1.4 | 12.1 |

| MSCI U.S. REIT Index | -0.4 | 2.1 |

| Barclays Int Govt Credit | 0.1 | 0.4 |

| Barclays US TIPS | 0.4 | 0.8 |

Economic Commentary

Contributed by Doug Walters

Beyond the Headlines

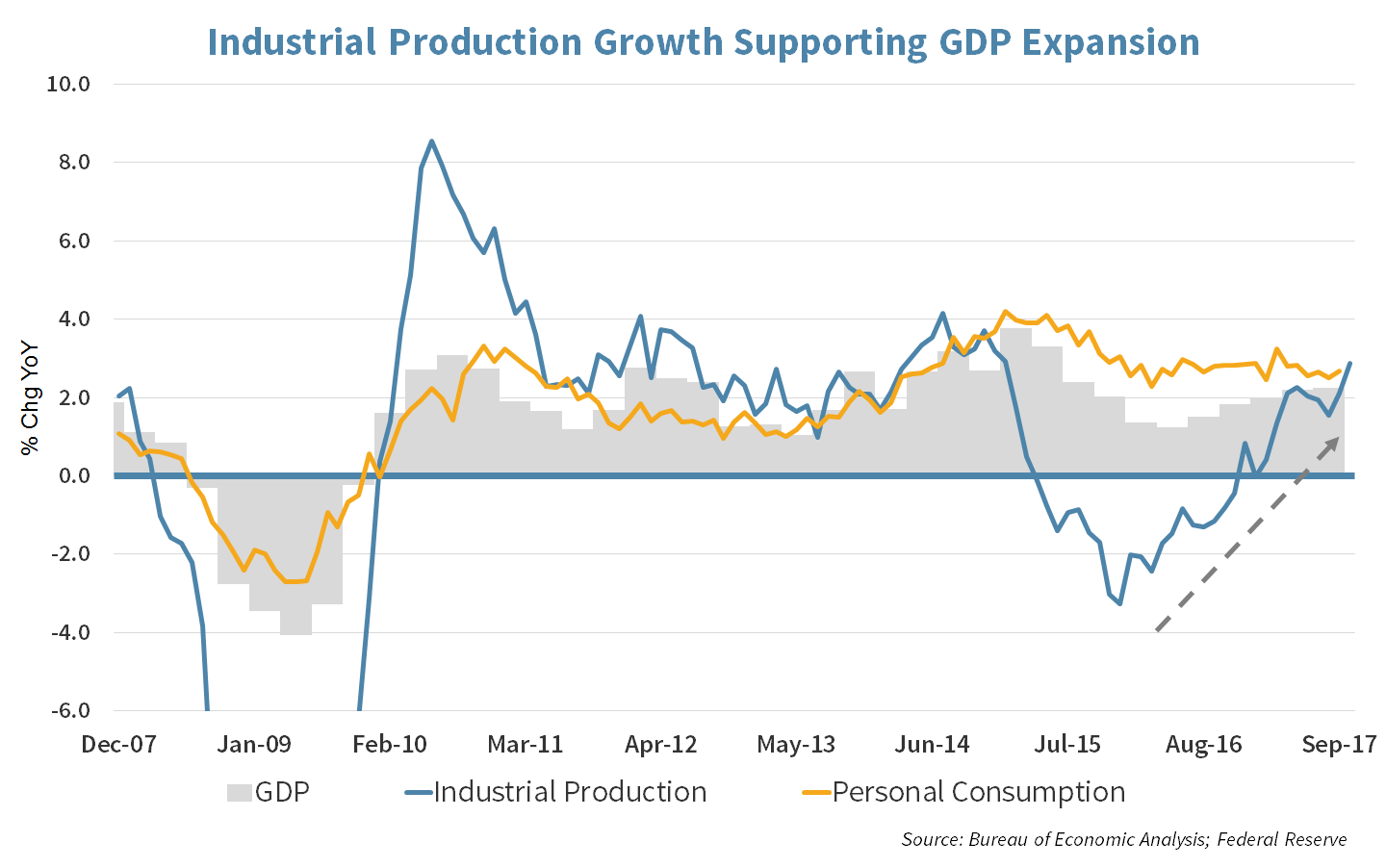

Industrial Production was in the spotlight this week with headlines focusing on a better-than-expected 0.9% jump in October. As with most “month-on-month” growth data, we find it largely useless, especially against the backdrop of a September that saw a big impact from hurricanes. The seemingly random gyrations of the monthly growth data for the past eight years could easily be confused with an EKG, a polygraph, or seismograph readings. To understand the actual trend, we must look at the year-on-year change. As the chart below shows, that measure has been improving since the beginning of 2016, and the October print has helped to continue that upward trajectory.

Industrial Production is a sign of manufacturing activity in the U.S. and an (indirect) input into GDP. Robust production is likely to be a good indicator of GDP growth, but it is much more volatile than GDP which is more a function of consumer activity. As the chart shows, growth in personal consumption is tightly linked to GDP. With both Industrial Production and Personal Consumption approaching 3%, higher GDP growth may not be far behind. Investors need to see this continued growth to justify current equity valuations.

Week Ahead

DEFT at Navigating a Holiday-Shortened Week

Draghi will be speaking on Monday in front of the European Union Parliament in Brussels.

- The European Central Bank President’s comments may give additional insights about the direction of the EU’s interest rate policy.

Earnings season is slowly wrapping up with our Equity Income strategy’s Medtronic (MDT) and Deere (DE) on deck.

- Deere Co. (DE) is expected to show a ramp up in sales as well as better profitability. Analysts expect nearly 60% growth in earnings vs. the same period a year ago.

- Medtronic (MDT) has set the bar low, by pre-announcing a $55-65 million negative impact from Hurricane Maria.

FOMC minutes are scheduled to be released on Wednesday.

- No surprises are expected, as a rate hike is in the queue for December.

Thanksgiving, Football, and Black Friday round out the week.

- Markets will be closed on Thanksgiving and will be open until 2 PM on Friday.

- The football schedule for turkey day has Detroit facing Minnesota, Dallas squaring-off with Los Angeles, and Washington battling the New York Giants at primetime.

- Black Friday has taken a bit of a hit as many retailers are starting their sales and door-busters at mid-day on Thursday. The start of holiday shopping will be closely watched as an indicator of the health of the consumer, the primary driver of GDP growth (see our Economics Commentary section).

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Moody’s Boosts Modi

Moody’s credit rating agency has rewarded India PM Narendra Modi’s government and economic reform policies with a credit upgrade for the country’s sovereign debt. Moody’s credit rating went up from Baa3 to Baa2. While both are investment grade ratings, the upward movement towards a higher quality of debt is a major positive for India’s economy and financial markets. Also, the rating agency assigned a stable outlook to the debt.

- Moody’s stated, “The decision to upgrade the ratings is underpinned by Moody’s expectation that continued progress on economic and institutional reforms will, over time, enhance India’s high growth potential.”

- Sovereign credit ratings help to measure the country’s credit profile as well as economic strength. India’s sovereign bonds have had the same rating for nearly 14 years.

- Moody’s boost comes on the heels of a bump from the World Bank of India, who moved the country up 30 places in its Ease of Doing Business rating for 2018. Strategic recently moved India up in its asset allocation as discussed in our “Sticker Shock” edition of Insights.

STRATEGIC GROWTH

A Cat Call

The consumer sectors had a nice week, with Consumer Staples was the leading sector. The Energy sector had a tough week with a drop in crude prices. In other news…

- Caterpillar Corp. (CAT) reported retail sales for August, September, and October. The report indicated that sales grew 19% year-over-year for the three-month period. More impressive numbers came from Asia and the Pacific where sales grew over 40% each month, while the Resource Industry (mining) experienced sales growth over 50% each month.

STRATEGIC EQUITY INCOME

General Knocked Off His Horse

Several names witnessed notable moves thanks to newsworthy earnings releases. The Energy sector joined Consumer Discretionary at the bottom, with Consumer Staples on top. The noteworthy earnings came from…

- Wal-Mart Stores, Inc. (WMT) topped expectations, raised guidance, grew sales by 4.3% and reported strong eCommerce numbers, with online sales up 50% in the quarter.

- Cisco Systems, Inc. (CSCO) likewise beat consensus, raised guidance, and increased recurring revenue to 32% of total revenue.

- On the negative side, William-Sonoma Inc. (WSM) reported an in-line quarter but lowered guidance.

- The new CEO of General Electric Co. (GE) did some slashing, of the dividend. He reduced it in half to shore up cash flow by $4 Billion. The new boss also served up guidance short of consensus, but he did purchase $1 million of shares himself this week.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters