Eye on Employment

U.S. Stocks were up once again this week, but not before we saw some cracks in the high-flying Tech sector. Tax reform continues to be closely watched by the market, while the Fed has its eyes on Friday’s jobs report.

Market Review

Contributed by Doug Walters

Stocks found a path to higher ground as a rotation out of high-growth, expensive Technology stocks reversed throughout the week. Tax reform remains a significant driver of market sentiment, while other Washington theatrics were largely ignored. A better than expected jobs report all but ensures that the Fed will raise rates when they meet next week.

Angle of Rotation

Hidden under the cover of a strong two week run for U.S. equity markets was a dramatic rotation out of Technology stocks. Last week, in Off to the Races, we discussed the rotation from growth to value. Within that rotation, Technology stocks fell 4% over the four days ending this past Monday. While Tech clawed half of that decline back this week, we remain cautious on valuations in the sector. Quick and severe pullbacks like we saw last week in Tech are not unusual when valuations are stretched.

Reduced SALT

The tax bill continues to be a driver of equities as the House and Senate work to reconcile their respective versions of reform. One of the many items of contention is the elimination of the state and local tax deduction (SALT). Should it go through, those in higher tax states like New York will feel this impact the most. However, the debate continues, and there is talk that the 20% corporate tax rate could increase modestly to pay for concessions.

With tax reform nearly done, attention is expected to shift to infrastructure. The president’s version of a spending plan is, ironically, believed to call on states to raise taxes.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.4 | 18.4 |

| S&P 400 (Mid Cap) | -0.2 | 13.9 |

| Russell 2000 (Small Cap) | -1.0 | 12.1 |

| MSCI EAFE (Developed International) | -0.3 | 18.6 |

| MSCI Emerging Markets | -1.4 | 27.6 |

| S&P GSCI (Commodities) | -3.0 | 4.6 |

| Gold | -2.6 | 8.1 |

| MSCI U.S. REIT Index | -0.7 | 1.3 |

| Barclays Int Govt Credit | 0.0 | 0.2 |

| Barclays US TIPS | 0.1 | 0.5 |

Economic Commentary

Contributed by Doug Walters

Rust Belt Jobs

In November we added William Rust to the Strategic team, and on Friday the monthly Non-Farm Payrolls report gave us an opportunity to see if other U.S. firms were also hiring last month. They were. The Department of Labor reported the addition of 228,000 jobs in November. While the headlines always focus on the short-term monthly change figures, which are highly volatile, we find better value looking at more meaningful longer-term trends.

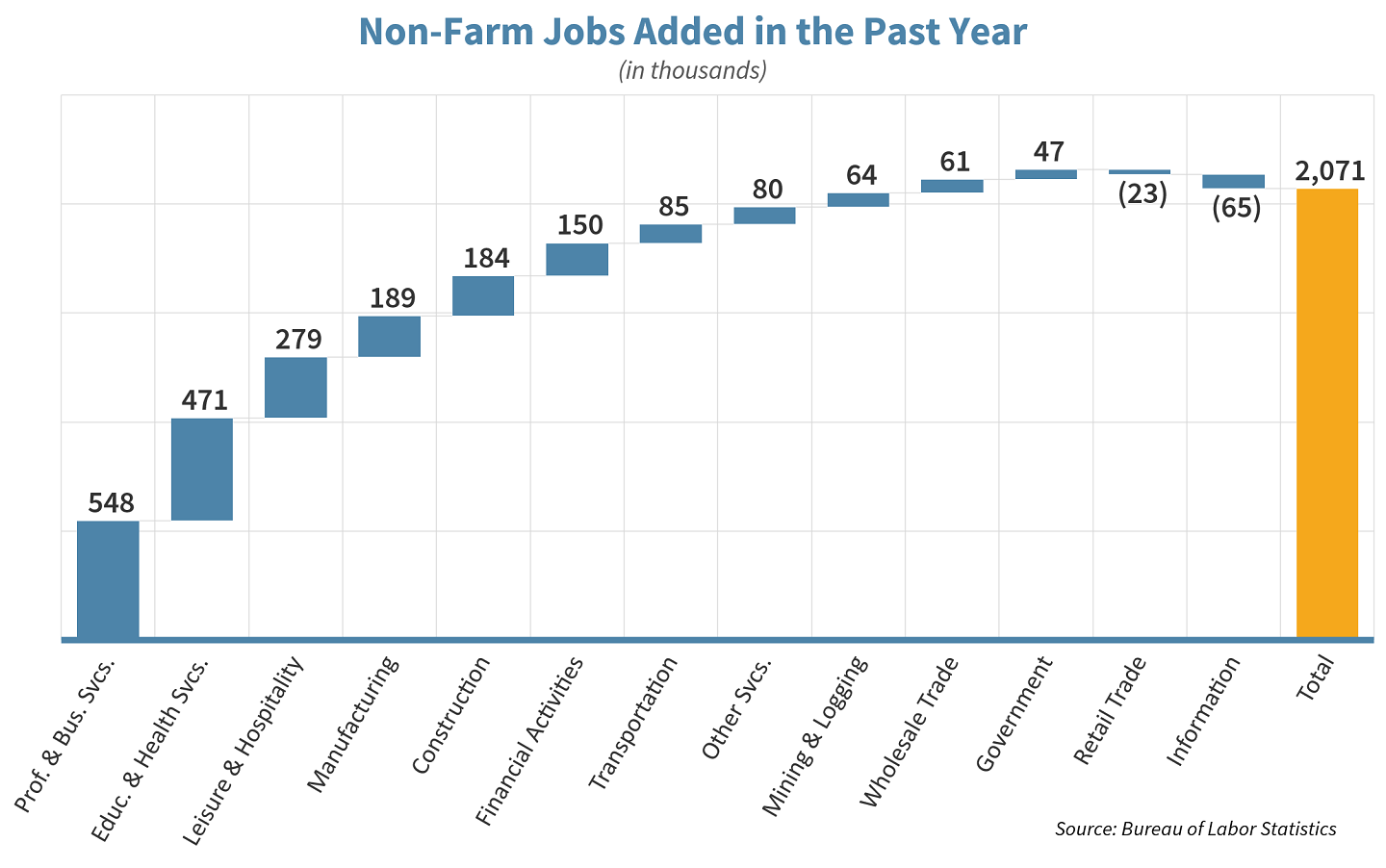

This month we dissect job growth over the past year to see what is driving the expansion of payrolls. As the chart shows, over half of the roughly two million jobs created in the past year came from two service categories, “Professional & Business” and “Education & Health.” The only drags on expansion came from “Retail Trade” and “Information” (which despite the name, does not include anything internet related).

Professional & Business Services is not only one of the largest segments of the market but is also one of the fastest growing (up 2.7% from a year ago). It is a broad category that includes professionals such as Lawyers, Accountants, and Engineers.

Manufacturing jobs are a much smaller portion of the workforce than they once were. From 1979 to 2010, manufacturing jobs fell over 40% from a peak of about 19.5 million. However, starting in 2010 these Rust Belt jobs are slowly and steadily rising with the economy. While growth is still well short of that in some of the services sectors, we do take this as an encouraging sign for continued economic expansion (which we need to better justify current equity valuations).

With a decent jobs report in the books, we see a Fed rate increase next week as inevitable.

Week Ahead

Will Progress on the Tax Bill Continue to Fuel the Market’s FIRE?

Federal Open Market Committee meeting is scheduled for Wednesday at 2 PM.

- The Federal Reserve is expected to raise the federal funds rate from 1.25% to 1.50%.

- Goldman Sachs sees four rate hikes in 2018.

- The committee also releases its economic outlook for the next two years.

- This will be Chairwoman Yellen’s last meeting as a member of the Central Bank.

Inflation is expected to remain stubbornly low, with 1.8% forecast. Both the Consumer Price and Producer Price Indexes will be released.

- Core inflation, which excludes two of the most volatile components (food and energy), remains below the Federal Reserve’s target rate of 2%.

Retail Sales are estimated to show a slight improvement in November.

- Sales growth in the U.S. is expected to reach nearly 5% for 2017.

Earnings from Strategic Growth holdings Costco (COST) and Oracle (ORCL) are on deck for Thursday evening.

- Last quarter, Costco (COST) reassured investors that they remain a robust competitor despite a challenging retail environment. Analysts will be looking for sales growth and gross margin improvement after a strong monthly sales report (up 11%) for November.

- Oracle’s (ORCL) efforts to expand their cloud business have begun to pay off. The stock is up nearly 28% year-to-date. Investors will remain focused on the prospects for further growth in this area.

- We are expecting both companies to be quizzed on the impact of the proposed tax bill.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Taxing Situation, Helping Valuation

The proposed tax bills aim to cut the corporate tax rate to 20% from 35%. Even if the final number is not 20% (we hear 22% mentioned as a compromise), this will reduce corporation’s effective tax rate, which currently averages around 27% for the S&P 500. Any reduction in taxes will increase earnings for 2018. According to FactSet, earnings for the S&P 500 are estimated to grow by nearly 10.2% next year. Some analysts predict earning’s growth to double in 2018 if the corporate tax rate is reduced to 20%. As a result, we could see earnings-based valuation metrics for the S&P 500 index decline from today’s above average levels.

- The current P/E ratio for the S&P 500 is around 22.3 and is estimated to decline to about 18.6 in 2018.

- Nearly a quarter of S&P 500 companies already paid less than 20% effective tax rate in 2016.

- The S&P 500 Utilities stands to be the biggest winner with an 11-year median tax rate of 32.6% according to FactSet. Technology has little to gain, with a relatively low, 25% tax rate.

- Not all companies will be winners. A lower tax rate will decrease the value of deferred tax assets which are created when companies lose money. Citigroup estimates they alone could suffer a $20 billion hit.

We have focused only on the tax rate, but the eventual impact will be company specific, as there are other implications from tax reform to consider such as foreign cash repatriation.

STRATEGIC GROWTH

Optumizing DaVita

The Materials sector managed to outpace the smoking hot week from Consumer Discretionary. The Energy sector had another forgettable week as rig counts continue to rise and U.S. natural gas inventory fails to decline. In other strategy news…

- United Health Group (UNH) made another big acquisition this week by buying the medical practice unit of DaVita HealthCare Partners (DVA) for $4.9 Billion. The new acquisition will be rolled up into UNH’s OptumCare unit which houses most of the medical service providing assets.

STRATEGIC EQUITY INCOME

New Name, Same Game

The Health Care sector was the laggard on the week possibly in response to a heavy dose of transformative M&A in the health insurance arena. The Industrials sector was the leader, buoyed by an expected boost from tax cuts. In other news…

- Wal-Mart Stores, Inc. (WMT) changed its name this week. The company, known for slashing prices, decided to slash a dash and the word “Stores” from its name to now be known as Walmart Inc. The new name may be a way to emphasize the company’s recent gains in eCommerce. Also this week, Walmart responded to reports of tardy deliveries from one of the major shipping companies by pushing same day pick-up in store. Now walmart.com orders can be picked up in store until 6 P.M. Christmas Eve.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters