Don’t Fear What Comes Next

Fear and panic are natural human responses to the crisis investors face today. The remedy is an evidence-based process that ensures emotions do not keep you from enjoying what comes next.

Contributed by Doug Walters , Max Berkovich , ,

There are times that test the mettle of the long-term investor, and this is one. Since 1926 the U.S. stock market has provided investors a total return of 9.6% per year. This return comes despite the recent declines, and not to mention the Great Depression, WWI, WWII, the Flash Crash of 1962, Black Monday, the Tech Bubble bursting, and the 2008 Financial Crisis. In other words, it has not been easy; and nor should it be. The price one pays for that attractive long-term return is near-term volatility. And while we may currently be short of face masks and hand sanitizer, one thing we have plenty of today is volatility.

As a financial professional during both the Dot Com bubble and Financial Crisis, I saw firsthand how wealth can be destroyed in trying times, and it always came down to “doubt.” Doubt in the markets, doubt in your process or even doubt in yourself. There is a tendency to begin to question everything and then to start making changes; changes to your investments, changes to your process, and changes to your plan. With change comes mistakes and often failure to participate in the inevitable rally.

These experiences reinforced in me the importance of not just having a process, but a process in which you genuinely believe. That is precisely what we have created at Strategic. A process should be designed to get you through both the good and bad times. We are often asked, “what are you doing differently to address the Covid-19 risk?” Nothing. Our process is designed for this.

- We build well-diversified portfolios with persistent factors at the core

- We regularly rebalance to trim our winners and add where there may be better value

- We harvest tax losses where it makes sense to offset future gains

- We reallocate assets towards bargains as they emerge

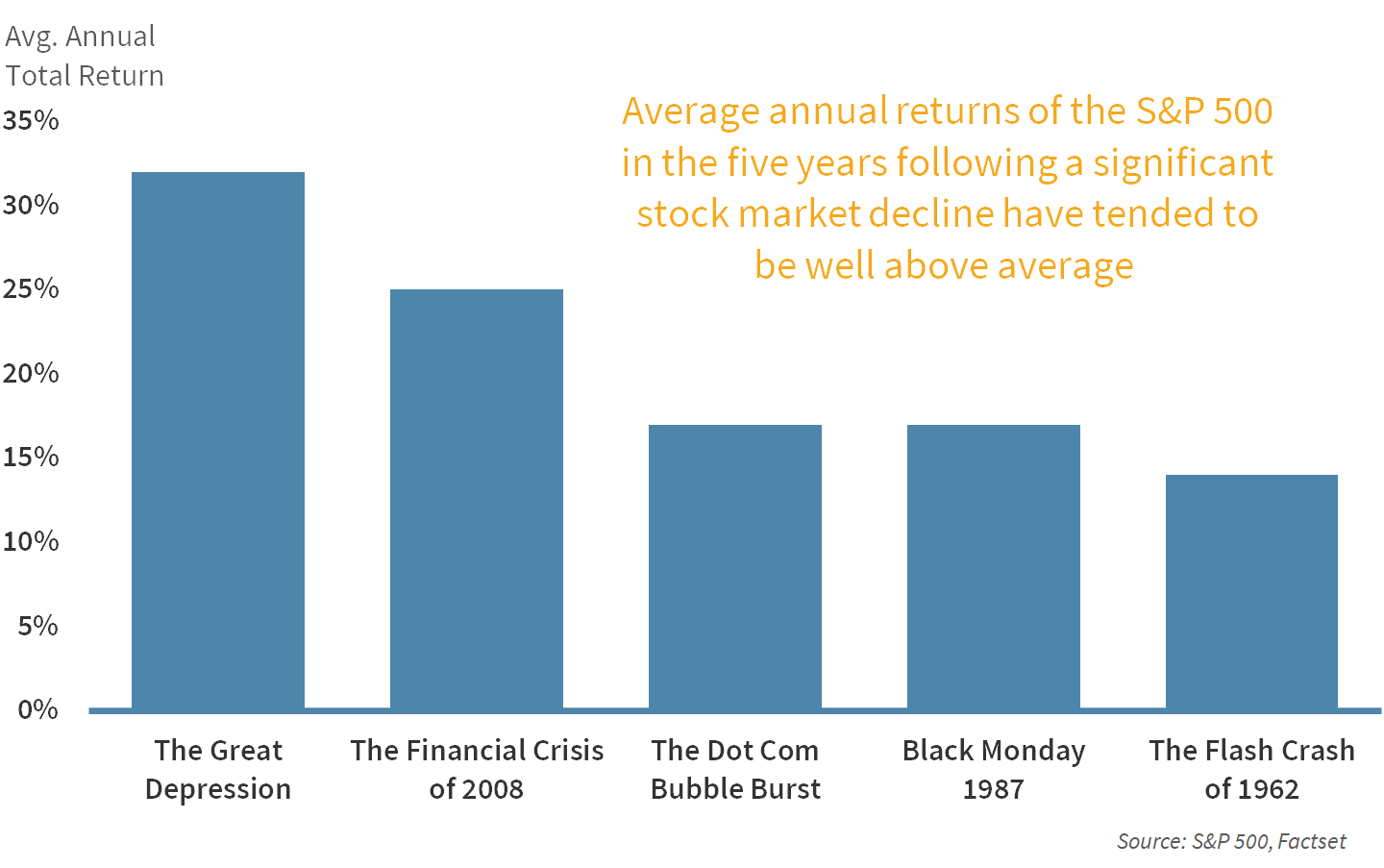

The biggest mistake an investor can make is to abandon their plan just as things are at their worst. Why? The best market returns often come on the heels of crisis (see chart below). This, too, shall pass, and when it does, you want to make sure you are ready and waiting to enjoy the rally. Strategic is here to help you on this journey!

A History of Rebounds

While stocks have returned over 9% per year over the last century, some years are better than others. We looked back at our data and found that some of the best performance has come in the wake of steep declines. These are rebounds you would not want to have missed!

Headlines This Week

An Eye on the Market

- Stocks fell another 15% this week as the market grappled with pandemic uncertainty.

- 12% of this week’s decline came on Monday.

- The rest of the week was less volatile by recent standards, perhaps a good sign.

A Massive Stimulus Plan

- The Senate’s $1T+ economic stimulus bill began negotiations on Friday.

- The Senate Majority Leader McConnell is hoping to pass the bill on Monday.

- The centerpiece involves checks of $1,200 per adult and $500 per child.

- The tax filing deadline is officially delayed until 15-Jul.

Keep Calm and Stay Healthy

- New York State Governor Andrew Cuomo ordered all non-essential businesses and their employees to stay home.

- New York, along with California, is hoping that containment will reduce the rate of infections.

- A countrywide quarantine helped China to defeat the spread of the virus. As of Thursday, China reported zero new local infections.

The Week Ahead

Unsurprisingly, most significant developments ahead center around combating the coronavirus.

Perhaps the most anticipated report next week will be the Initial Jobless Claims on Thursday.

- The report is expected to show the highest level ever on record.

- Some forecasts place the number as high as 2.25 million.

- Due to many states enforcing restrictions on some businesses remaining open, high unemployment numbers could be sustained for quite some time.

The U.S. Congress could be in a position to vote on the “Phase 3” portion of the coronavirus stimulus bill next week.

- The current iteration of the bill, proposed in the Senate, has caused bipartisan disagreement over whether the measures ultimately benefit the employees or the businesses, both of which have had their livelihoods come to a halt.

- A successful vote will require agreement on these matters.

Across the Pond, the United Kingdom is taking action to combat its deteriorating economy.

- The Bank of England is set to inject over 645 billion GBP through quantitative easing measures.

Some significant economic reports slated for next week may not hold their usual weight given the focus on the current state of the economy.

- Annualized GDP for the fourth quarter will be reported on Thursday.

- The Nondefense Capital Goods Orders (ex Aircraft) for February will be released on Wednesday.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters