Domesticate Your Portfolio

Small cap stocks broke all-time highs while their globalized peers struggled to hold on to last week’s gains as trade talks stall.

Market Review

Contributed by Doug Walters

The S&P 500 gave back a little ground this week, but small-cap stocks continued to rally, as major small-cap indices hit new all-time highs. Trade talk dominated market sentiment for much of the week.

A Trade-Off

Trade talks with China and our NAFTA partners kept capital markets on their toes this week, as sentiment shifted multiple times between “encouraging progress” and “a deal unlikely.” We have seen how discussions with China can directly impact our strategy holdings. As we discuss in our strategy update, NXP Semiconductors (NXPI), has seesawed double-digit percentage points as China has used the pending acquisition by Qualcomm as negotiating leverage. But the trade talks have had a broader impact at the asset class level as well with the diverging performance of large and small-cap stocks.

As we discuss in our asset allocation section, U.S. small-cap stock indices have reached an all-time high in a week where large-caps struggled to find footing. Year-to-date, the resilience of small-cap has resulted in a four-percentage-point performance advantage of small-cap versus the S&P 500. Some of this gap is likely due to trade talks. Smaller U.S. companies will have less international exposure than their larger peers and are thus less likely to be negatively impacted by a protracted trade war. We continue to be positive on small-cap stocks whose domestic focus are likely to make them bigger beneficiaries of lower corporate taxes and potential M&A activity driven by cash repatriation.

Spotlight: Volatility - A Stock Picker's Friend

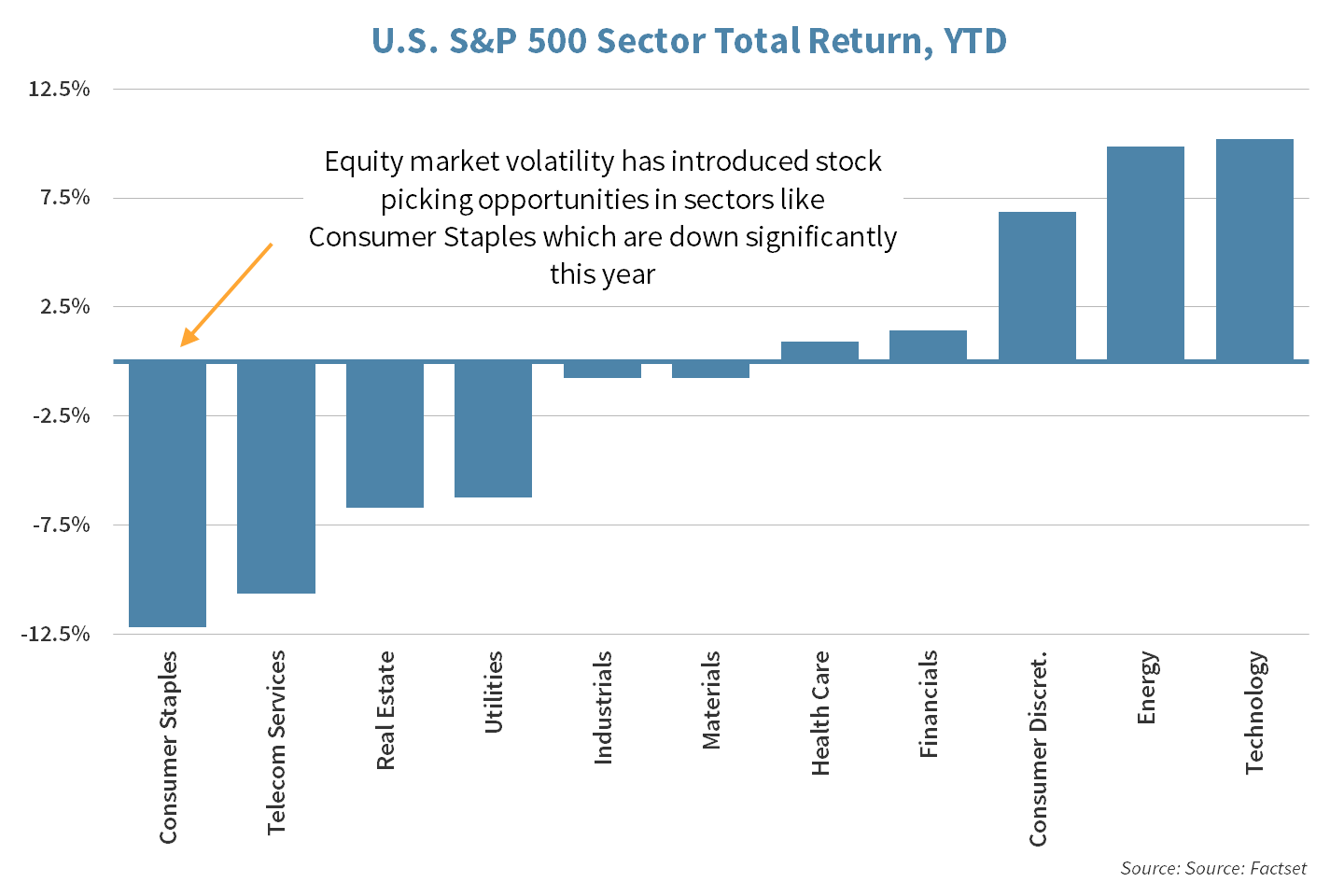

Often volatility is spoken of negatively when it comes to investments. However, the lack of volatility would also mean a lack of investment return. The return that investors earn is compensation for the risk taken. As stock pickers, we see volatility as an opportunity. For example, as the chart below shows, this latest bout of volatility has driven Consumer Staples stocks down 12% while Tech has rallied 10%. Undoubtedly there are bargains to be found in the Consumer Staples sector.

Strategy Update

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Sizing Up the Market

Both U.S. equities and bonds finished slightly in the red for the week, while U.S. small-cap stocks, as measured by the Russell 2000 index, advanced over 1.5% and are up nearly 6.4% for the year. From the February lows, small-caps are up over 10%. Robust earnings growth and reduced valuation are finally being noticed by investors. Speaking of small-cap earnings growth and valuations…

- In the last two quarters, earnings grew by nearly 41% versus a year ago.

- Analysts expect earnings to grow by nearly 23% in 2019.

- Unfortunately, sales growth and capital expenditures are expected to decline in 2018 and 2019.

- The one-year forward Price-to-Earnings ratio is near five-year lows, suggesting an attractive valuation relative to large capitalization stocks, especially large-cap growth stocks.

- We entered this year with an overweight allocation to small-cap and increased it further as the year progressed.

STRATEGIC GROWTH

The Middle Kingdom

Consumer Staples had a rough week, and that was before Friday when a soup maker reported an awful quarter that dragged all food companies down. The Materials and Energy sectors, on the other hand, had a terrific week. Speaking of a terrific week…

- NXP Semiconductors Inc. (NXPI) has been tied up in a long and eventful merger transaction with fellow strategy holding Qualcomm Inc. (QCOM). The deal has hit many snags, the most recent being the Chinese government. Earlier this week NXP received news that China will stop slowing its review of the deal. NXP is caught in the middle of trade negotiations between the U.S. and China. The recent thumbs-up came thanks to President Trump agreeing to give a Chinese company ZTE Corp. relief from sanctions. Further good news came thanks to China allowing a Bain Capital led group to acquire Toshiba’s memory unit, which was held-up in the same trade negotiation scrimmage.

STRATEGIC EQUITY INCOME

The Roll-Up

The Industrials sector was the leader, while high dividend paying sectors, Utilities and Telecoms, were laggards thanks to a 10-year high in bond yields. In other news…

- Enbridge Inc. (ENB), an energy transportation company, announced that it would undergo a transaction to untangle its complicated structure. The short story is the company will buy back its various pipelines for $8.94 Billion. The shareholders of the pipelines will be paid in stock at no premium to the market price. Tax law changes were a major reason for the move and should help boost cash flow.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.5 | 1.5 |

| S&P 400 (Mid Cap) | 0.2 | 2.3 |

| Russell 2000 (Small Cap) | 1.2 | 5.9 |

| MSCI EAFE (Developed International) | -0.6 | -0.2 |

| MSCI Emerging Markets | -2.3 | -1.8 |

| S&P GSCI (Commodities) | 1.0 | 10.6 |

| Gold | -2.1 | -1.0 |

| MSCI U.S. REIT Index | -3.5 | -8.7 |

| Barclays Int Govt Credit | -0.2 | -2.4 |

| Barclays US TIPS | -0.6 | -2.4 |

The Week Ahead

Investing HEFT

Housing Data such as building permits, new and existing home sales, as well as home price index data will be reported on Wednesday and Thursday. With interest rates on the rise, housing data will be watched for signs of cooling.

- New and existing home sales are expected to remain unchanged.

- Building permit growth is estimated to remain flat despite a tight housing market.

- Home prices have been on a steady climb. Higher commodity prices especially lumber which is up over 40% this year may be the culprit.

Eurogroup meeting, a gathering of the Finance Ministers of each Member State of the Eurozone, will commence on Thursday.

- During their last meeting, the group focused on Greece, after the country showed better than expected GDP growth as well as a budget surplus. The heavy debt load of the country will probably be a major topic again.

FOMC meeting minutes will be released on Wednesday. Also, Chairman Powell will speak at the Financial Stability and Central Bank Transparency panel in Sweden on Friday. Other FOMC members will be out on the speech circuit this week as well.

TJX Companies (TJX), William Sonoma (WSM), and Medtronic (MDT) from our Equity Income Strategy and McKesson (MCK) from our Strategic Growth strategy are scheduled to report earnings next week.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters