Cloudy with a Chance of Uncertainty

The S&P 500 ground out new highs despite a jobs report that failed to meet expectations. An expected, but controversial, exit from the Paris Agreement on global warming was also taken in stride, despite condemnation from corporate executives.

Market Review

Contributed by Doug Walters

U.S. equities shrugged off a somewhat disappointing jobs report and harsh words from our NATO allies to put in another positive performance. The S&P 500 was up about 1% on the week, once again pushing all-time highs, with the “2500” milestone only a few percent away now.

The Investing Climate

The Trump administration “exited” the Paris Agreement on Thursday. The move received condemnation from global leaders as well as many U.S. corporations. Executives must answer to their shareholders and thus could have several motivations to their objections. It is possible that they are concerned that foreign governments and corporations will avoid the purchase of American goods in protest of the withdrawal. Also, the Paris Agreement calls for the U.S. to provide hundreds of billions of dollars in climate aid to developing countries, and U.S. corporations were likely expecting to cash in on this government spending spree.

In the near-term, we see little impact on companies. Compliance with the Paris Agreement is not slated to begin until 2020. A lot can happen in the next three years, and clearly, the market is not concerned.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.0 | 8.9 |

| S&P 400 (Mid Cap) | 1.4 | 5.5 |

| Russell 2000 (Small Cap) | 1.7 | 3.6 |

| MSCI EAFE (Developed International) | 1.6 | 13.8 |

| MSCI Emerging Markets | -0.2 | 17.7 |

| S&P GSCI (Commodities) | -2.9 | -6 |

| Gold | 0.9 | 10.9 |

| MSCI U.S. REIT Index | 1.0 | 0.6 |

| Barclays Int Govt Credit | 0.1 | 1.2 |

| Barclays US TIPS | 0.4 | 1.5 |

Economic Commentary

Contributed by Doug Walters

Stubborn Wages

U.S. Non-Farm Payroll data for the month of May was released on Friday. The 138,000 jobs created was below the 184,000 predicted by analysts. While the result disappointed, this is one of the more volatile and unpredictable economic releases and investors should avoid putting too much weight on one data point. We always focus our attention on the broader employment trends, which are still positive.

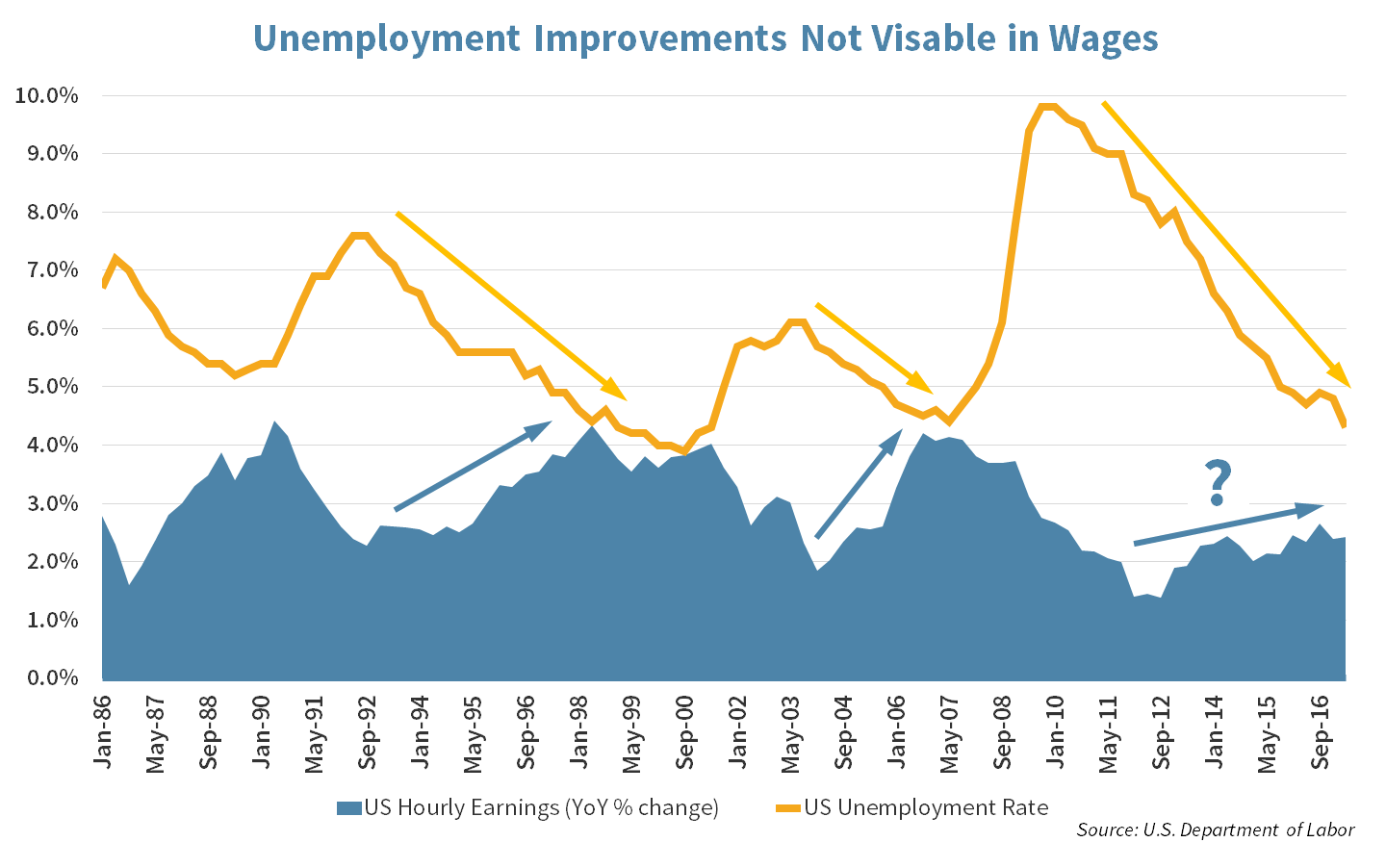

Also included in this report is the current unemployment rate, which was reported to be 4.3%. This is very low by historical standards. History would suggest that this low unemployment rate should be accompanied by higher wage growth. As jobs become scarce, employers should have to pay their employees more to retain them. However, the chart below shows that this relationship is not as strong today as it has been in previous expansions.

What Is Driving This?

- One possible explanation of this is that employment participation is depressed. While the unemployment rate is low, there are many who have exited the workforce, which benefits the unemployment figure, but puts an overhang on wages if these individuals reenter.

- A more concerning cause could be automation and artificial intelligence. While breakthroughs in technology have been a boon for engineers and the high-tech industry, they have made obsolete some good paying manufacturing and service jobs.

Microsoft founder Bill Gates has suggested we start taxing companies that use automation to replace human jobs. While this sounds far-fetched, somehow as a society, we will have to figure how to operate in a world increasingly dominated by technology. As investors, we will continue to look for opportunities in tech and automation, while attempting to avoid those businesses heading towards obsolescence.

U.S. unemployment rate fell to 4.3 percent in May 2017 from 4.4 percent in the previous month. Source: U.S. Department of Labor

Week Ahead

Contributed by Max Berkovich

ABJECT Reality

Application for mortgages will be released for May by the Mortgage Bankers Association.

- Expectations call for a drop of 3.4%, but will lower interest rates this past month help surprise on the upside?

British Parliamentary Election (“snap”, which means out of cycle) are on Thursday.

- Prime Minister May called for the election in hopes of gaining a stronger majority for her Conservative party, which would allow for less opposition in her attempt to navigate BREXIT.

- At the time of the election declaration, PM May looked like a lock to pick up seats. Now the outlook is not so clear, and the markets are on edge.

JOLTS (job openings and labor turnover survey) report from the Department of Labor has become a key economic report, as it is Chairwoman Yellen’s preferred labor market indicator.

- This report helps fill in the picture of how tight the labor market is. With unemployment running at 4.3% this survey should help gauge if there are further jobs available in the economy.

European Central Bank is expected to keep rates unchanged on Thursday.

- More importantly will be comments from Mario Draghi on plans for Europe’s tapering of asset purchases down the road.

Consumer Credit report from the Federal Reserve should shed light on individual balance sheets of U.S. consumers.

- The last quoted number from the Central Bank was $12.73 Trillion, exceeding the level of debt reached before the financial crisis.

- Generally, economists believe that higher debt levels mean higher confidence in the economy for the future.

Trade Balance reports from Great Britain, France and China are due out Friday.

- The results from China will be under review by the President to see if progress is made on swinging the trade balance to the U.S.’s favor.

- The British report should shed some light on how much trade the country does with the EU.

Strategy Updates

Contributed by Max Berkovich

STRATEGIC ASSET ALLOCATION

Rate Check

Interest rates made another move lower, despite elevated expectations for a rate hike from the Federal Reserve during its June meeting.

- The 10-year U.S. Treasury slipped to a 2.15% yield (yields go down as bond prices go up) after the May non-farm payroll report.

It’s a Flat World

The 10-year U.S. Treasury’s yield moving down is coinciding with the Federal Reserve pushing short rates higher. The 2-year U.S. Treasury at 1.27% or so, is far greater than the sub 1% it was a year ago. The 0.88% difference between the 10 and 2-year U.S. Treasuries, means investors only demand 0.88% more in annual interest to tie up their money for an extra eight years. This is the lowest level since the Presidential election and only 0.14% from the August 2016 low.

- Traditionally, a flattening yield curve is indicative of a slowing economy, but right now U.S. equity markets are at an all-time high.

Two Different Tales

Since we are getting conflicting signals from the stock and bond markets, we still feel that building up cash is the prudent move until both markets start telling the same story.

The “Ill” in Illinois

The municipal bond credit of the State of Illinois was downgraded once again by S&P credit rating agency. The credit rating is now BBB- and came with a warning that more is to come “unless…”

- Any further downgrade would put the state into “junk” territory. This is the lowest credit rating for a U.S. state on record. In addition to pension obligations, the state also faces a dysfunctional legislature that has failed to pass a budget in two years.

STRATEGIC GROWTH

What’s the Deal?

Crude oil still well below the $50 level means the Energy sector continues to lag. The Health Care and Materials sectors were leaders. Merger news was abundant this week, so we take a moment to update where we stand…

- Praxair, Inc. (PX) an industrial gasses company, finally announced a done deal in an all-stock merger of equals with German peer Linde Group (LNGAF).

- Qualcomm’s (QCOM) acquisition of fellow strategy microchip holding NXP Semiconductors (NXPI) received another hurdle as the deadline for NXP holders to approve the merger was extended yet again. The $110 take out price now seems low, and activist investors are calling for a higher price.

- Hexcel Corp. (HXL) purchased French company Structil SA, a supplier of composite materials to the aerospace and industrial markets. Terms are undisclosed.

STRATEGIC EQUITY INCOME

On the Hunt

Utilities and Telecom received a boost as interest rates moved lower. The Energy sector was joined by Consumer Discretionary at the bottom. Deal news here as well…

- Deere Co. (DE) was the hunter this time and bagged a privately held construction machinery company, Wirtgen Group, for €4.6 Billion including debt assumption. This is the biggest acquisition for the company and is expected to be accretive immediately and grow the company’s infrastructure exposure.

- On the other hand, telecom giant Verizon Communications (VZ) took a shot and missed. The company made a reported $100 Billion offer for cable company Charter Communications (CHTR) which was rejected. Also, the rumor of an offer for Sirius XM (SIRI) radio did not materialize. At least for right now.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters