Chasing a Ghost

The S&P 500 ended the week flat, after registering an all-time high on Thursday. With news flow slow, investors focused on department store results. However, time would be better spent watching Olympic trampolining than chasing these stocks.

Market Review

Contributed by Doug Walters

Department Leader

The Olympics in Rio provided a welcome distraction to an otherwise uneventful week for investors. The S&P 500 closed on Friday little changed and still near its all-time high. So slow was the news flow that ailing department store results were a major highlight.

- Traditional department store stocks such as Macy’s (M), Kohl’s (KSS) and Nordstrom (JWN) were surprise market leaders, as results were not as negative as expected.

- All three reported declining sales, yet their depressed share prices rallied as even worse was forecast. We see structural challenges that are unlikely to abate anytime soon, and would not chase this near-term momentum.

Triple Threat

The financial media loves random facts, and this week provided a good one. On Thursday, the S&P 500, the Dow Jones Industrial Average (DJIA) and the Nasdaq Composite indexes closed at all-time highs together for the first time since 1999. This is admittedly surprising, but we take this as an opportunity to explain why only one of these indexes has relevance for us.

- The DJIA: This is the granddaddy of indexes, having launched in 1896; but also the most useless. The index is a hand-picked portfolio of 30 blue chip industrial companies that a committee at Dow Jones have deemed ‘representative’. It is more akin to a fund than an index.

- The Nasdaq: Often quoted, but frequently misunderstood. Many equate this index to the Technology sector. However, this is only partially true. The Nasdaq reflects all stocks listed on the Nasdaq exchange, which currently happens to be Tech heavy. However, the mix of Tech and other sectors can and does change over time, making it an inconsistent benchmark.

- The S&P500: Of the three indexes, this is the most relevant. It is simply an index of the 500 largest U.S. companies by market capitalization. By definition this is a representative cross-section of corporate America, and therefore a quality index.

It can be unnerving to hear that U.S. equities are at historically high levels. However, we still see plenty of opportunities for disciplined, long-term, fundamental stock pickers.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.0 | 6.9 |

| S&P 400 (Mid Cap) | -0.3 | 11.4 |

| Russell 2000 (Small Cap) | -0.1 | 8.3 |

| MSCI EAFE (Developed International) | 2.7 | -0.3 |

| MSCI Emerging Markets | 2.8 | 14.6 |

| S&P GSCI (Commodities) | 3.2 | 13.3 |

| Gold | -0.1 | 25.6 |

| MSCI U.S. REIT Index | -0.2 | 13.0 |

| Barclays Int Govt Credit | 0.2 | 3.2 |

| Barclays US TIPS | 0.3 | 5.8 |

Economic Commentary

The Value of Gold

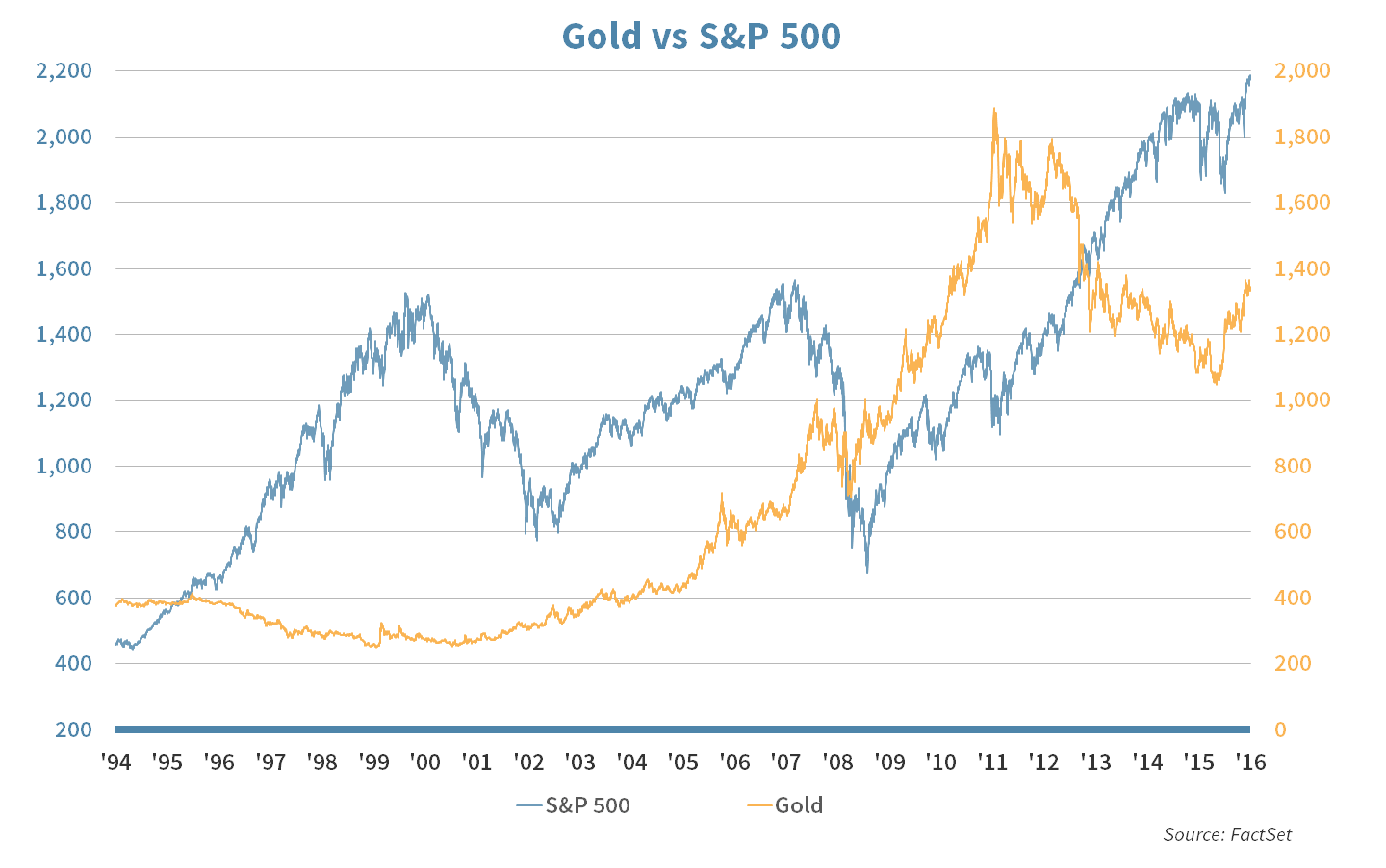

As Michael Phelps rakes in his 22nd gold medal this Olympics, we take a fresh look at the value of the metal behind the medal. In isolation, gold has historically been a poor long-term investment holding, not even managing to keep up with the pace of inflation. Typically, it has been viewed as a recession hedge, benefitting investors in the form of capital preservation as equities and other economically sensitive asset classes decline. Over the past decade, however, the dynamics have changed. Year-to-date, gold has surged 27% with demand being driven by

- Record low interest rates,

- Economic and political uncertainty, and

- Investor speculation.

One reason why investors find gold attractive is due to its negative correlation with the stock market. According to our internal analysis, gold had a negative 34% correlation with the S&P 500 index from 1986 to 2006. However, since then, we see no statistically significant correlation. As the graph below shows, gold fell in value during the 1990s/early 2000s as the stock market rallied.

More recently, gold has acted as an alternate currency to the US Dollar. Investors that are uneasy with unknowns associated with negative interest rates have turned to gold, taking comfort in its finite supply.

Week Ahead

Fed Minutes

On Wednesday, the Federal Reserve Board will release minutes from their July meeting. This will serve as an indication as to whether or not a September rate increase will be in play.

- There remains about a 35% chance of a rate hike according to Bloomberg, while some on The Street are still skeptical that we will see a rise before 2018.

Running on Retail

Strategic Holding Wal-Mart (WMT) will look to continue the run of good quarterly earnings reports by stocks within the Retail space.

- WMT may benefit from lower than average summer gas prices and growth in e-commerce.

- They are up over 20% year-to-date and have beat expectations in three of the last four results.

Watch for the Deere

Deere & Co. will be reporting quarterly earnings this Friday. They have a history of beating results, but the focus will be on guidance which was recently lowered.

- The agricultural cycle appears to be at a bottom, so investors will be looking for emerging signs of improvement.

Cisco Renaissance

Cisco (CSCO) is shedding its reputation as an old-school Tech company with a number of growth initiatives.

- Investors will be watching their results Wednesday for continued evidence that growth initiatives in data centers, wireless, security and collaboration are outpacing declines elsewhere.

Strategy Update

Contributed by , Max Berkovich

Strategic Asset Allocation

Fundamental Value

As equities reach new highs, investors may be beginning to question their valuation. However, correlation has been high among asset classes, so we do not see a need to trim equity exposure. At these levels, the fundamentals of individual companies become very important, and disciplined active investment management can uncover pockets of value.

Heat Wave

Energy heated up this week, with the sector advancing 1.3%. A driver was rising oil prices on Thursday after OPEC commented on future production plans. The oil cartel is hoping to halt declining prices. Gold was settled at $1,343 an ounce Friday, down 0.3% for the week. Despite the small price decline, gold is still holding on to most of its 2016 gains.

Strategic Growth

Frozen in Time

The Consumer Discretionary sector took the lead this week, while the Health Care sector was dragged down by Biotech. In other strategy news

- The Walt Disney Co. (DIS) reported a strong quarter this week. The standout results came from its movie studio division, where revenue of $2.85 Billion was up 40% from last year. The company had a successful launch of Disney Shanghai with over a million visitors already. Now the company has to find a franchise that can rival Frozen to top some tough comps it will face ahead; maybe A Star Wars Story.

Strategic Equity Income

Jet Set

Financials gave up a little ground this week after a hot run the past few weeks. Consumer Discretionary on the other hand got a boost from a bounce in retailers. Speaking of the consumer…

- Wal-Mart Stores, Inc. (WMT) made a splash on Monday by announcing a $3 Billion acquisition of privately owned online retailer JET.com. The acquisition is the largest e-commerce acquisition in history. Analysts point towards Wal-Mart’s need to get JET’s bulk shopping algorithm. This is the second e-commerce deal in the past couple of months. In June, Wal-Mart boosted its stake in China’s online retailer JD.com to 10%.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters