Bond Backup

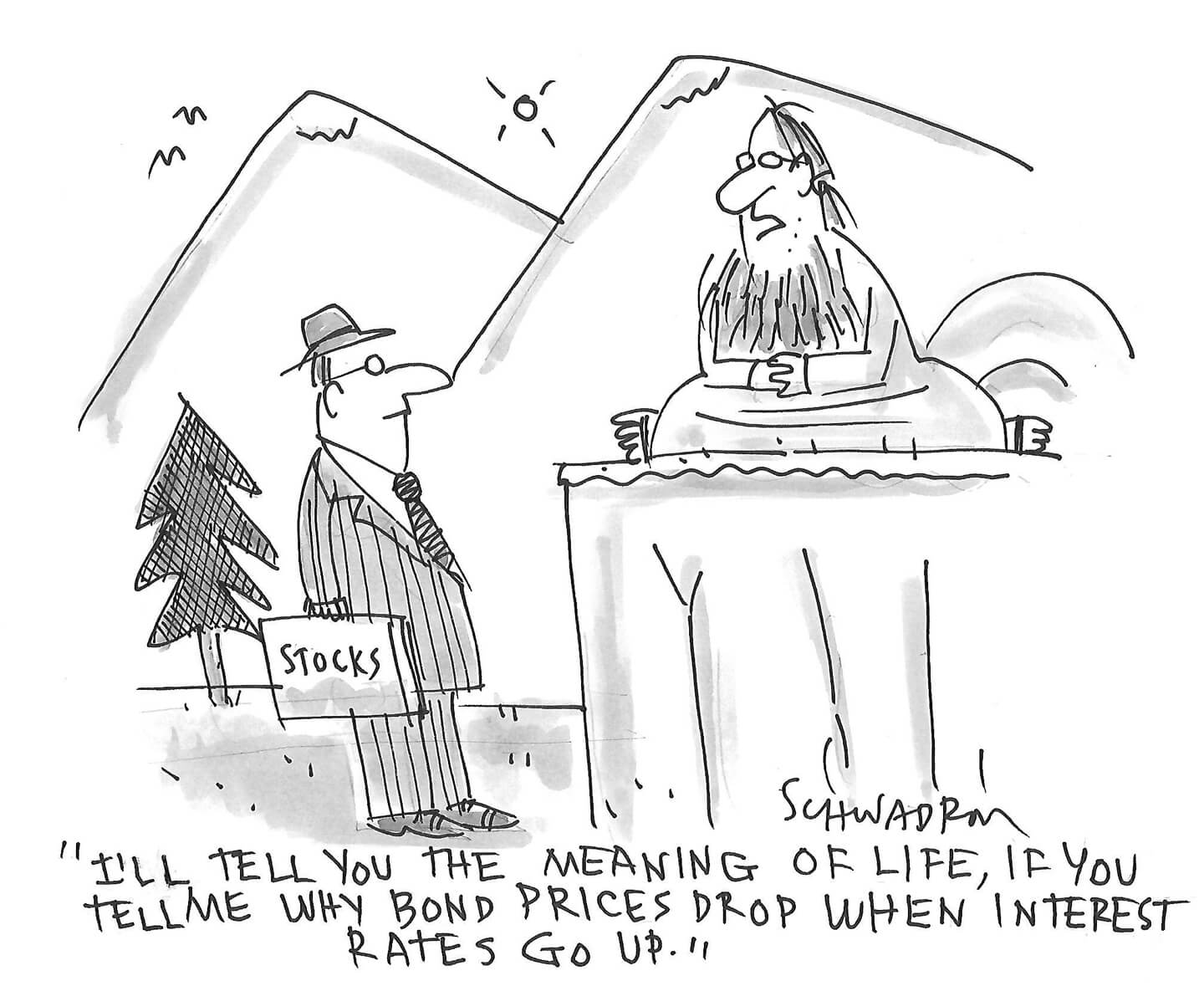

Equities benefited last year from unattractive, low bond yields. With bond yields rising, should stock investors be concerned?

Contributed by Doug Walters , Max Berkovich , ,

Expensive segments of the stock market, like Momentum, retrenched a bit this week. Concerns are being voiced that rising bond yields could pressure equities, particularly those that are more expensive. Countering that narrative are significant improvements in Covid new case data as well as vaccine supplies. So which force will win out in 2021?

As evidence-based investors, we would argue this is not the right question. Will rising bond yields make fixed income more attractive and drive down equity prices? Perhaps. Will big improvements in Covid cases and vaccine supply drive significant economic growth, job creation, and further stock market expansion? Perhaps. But we cannot predict which of these scenarios will play out. The right question is, “Are we prepared regardless of which version of the future wins out?” Evidence-based investors do not predict; we prepare.

So how are we preparing?

- Well-diversified portfolios, which avoid the concentration risk in traditional market-cap weighted indices

- Systematic rebalancing, designed to let winners keep winning while keeping risk in check

- Medium-term tactical tilts based on the economic cycle. Currently, we are tilting toward Value and Momentum.

Headlines This Week

Go big or go home

- Treasury Secretary Yellen stated that a large coronavirus relief package is necessary to get the economy back to full strength. She reiterated that the benefits of large stimulus far outweigh its costs.

- Some worry inflation will rise this year as the economy continues to reopen, coupled with additional stimulus. But the Fed is not concerned. The U.S. has not seen “high” inflation for nearly two decades.

- An infrastructure bill is next on the agenda for lawmakers. The spending will most likely be financed in part by select tax hikes.

Vaccinated

- According to Bloomberg, the U.S. vaccine supply is set to double in the coming weeks.

- Drugmakers stated that the number of vaccine deliveries should rise from 10 million doses per week to nearly 20 million per week. That means that every American will most likely get their vaccine in the next five months!

- According to a study in Israel, a single dose of the Pfizer/BioNTech vaccine reduced Covid-19 infections by 85%. By delaying the second shot, more people could get the first vaccine sooner.

Freeze-Out

- Texas remains in a state of emergency as the state struggles to get power and water to millions of its residents.

- Texas, a major oil producer, is halting about 3 million barrels of oil per day, pushing oil prices higher this week.

- Refineries are also shut down, which may contribute to higher gas prices at the pump.

Treasury Yields

- U.S. Treasury yields moved swiftly higher as investors are re-allocating out of bonds.

- Themes like inflation and pent-up demand when the economy re-opens are driving the money flows into equities.

- The 10-year U.S. Treasury note reached as high as about 1.33%. While there is still a ways to go to reach December 2019 levels of about 1.90%, the rise in yield, for now, is a net positive for equities.

Have a Question? Ask Us.

If you have any questions you want to ask our investment team or advisors, fill in the form below and look for your answer in an upcoming edition.

The Week Ahead

Powell Under Pressure

The Chair of the Federal Reserve will be testifying in front of Congress next week.

- Fed Chairman Powell will be delivering the central bank’s semi-annual monetary report to Senate on Tuesday and then before the House of Representatives on Wednesday.

- Considering the large stimulus package currently on the table in Congress, it is expected members could grill him on whether such tremendous spending is necessary.

- Markets will be trying to look for any hints on whether a withdrawal on quantitative easing is on the horizon but are unlikely to find any as Powell has been adamant it is too early to have that conversation.

Overseas Overflow

Next week will see a whole host of foreign events that could shift markets.

- On Monday, the People’s Bank of China will release its interest rate decision. Currently, its one-year Loan Prime Rate (LPR) sits at 3.85% and is not forecasted to change.

- UK Prime Minister Boris Johnson will be releasing his government’s “Reopening Roadmap” in a public speech on Monday.

- European leaders will be meeting next Thursday and Friday for an online EU27 summit. The summit will focus on COVID-19 on the ongoing vaccination effort.

- Wednesday, the Reserve Bank of New Zealand will be releasing numerous items, including its interest rate decision and a monetary policy statement.

February Finale

The second estimate of the U.S. Q4 Gross Domestic Product will be released Thursday along with several other key economic indicators.

- Consensus expects a revision of 0.1%, increasing January’s estimate from 4.0% to 4.1%.

- While the increase is small, it does show a step in the right direction.

- Alongside GPD, the numbers for durable goods orders in January be delivered.

- Other indicators to look out for next week are Personal Consumption Expenditures Prices for Q4, the Michigan consumer sentiment index, and personal income numbers for January.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters