A Big League Plan

The S&P 500 was up this week as the White House signaled it would be targeting tax reform rather than health care first. Investors were encouraged, but there will be winners and losers with any change.

Market Review

Contributed by Doug Walters

U.S. equities had a strong week thanks to optimism over tax reform, and despite the New England Patriot’s dramatic Super Bowl win (which supposedly is a bad omen for the stock market, see Super-stitious Investing). We have no details on what the White House is pushing for with its tax plan. So far all we know is that they expect to announce it in two to three weeks, it will lower taxes on businesses “big league”, and will be “phenomenal”.

Made in America

Due to the complexity of the current tax code, reform will be a challenge, but investors are encouraged that taxes appear to be taking priority to health care reform, which Trump has stated may not come until next year.

- There will undoubtedly be winners and losers in any overhaul of the tax code. It is not clear how closely the White House plan will mirror that proposed by House leader Ryan. Ryan’s plan reduces the base corporate tax rate, but penalizes companies that import goods.

- Retailers are particularly concerned about the Ryan plan. His proposal is that corporates pay a 20% flat tax rate, which is much lower than the 35-40% effect tax rate that many retailers currently pay. However, imported goods would not be a deductible expense, so any retailer who relies on imported goods (most), could see a dramatically higher tax bill.

- We know that the current administration has a protectionist agenda, so it would not be surprising to see some form of import tax. It appears we will get some clarity on this in a few weeks.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.8 | 3.5 |

| S&P 400 (Mid Cap) | 0.8 | 3.6 |

| Russell 2000 (Small Cap) | 0.8 | 2.3 |

| MSCI EAFE (Developed International) | -0.4 | 3.0 |

| MSCI Emerging Markets | 0.7 | 7.3 |

| S&P GSCI (Commodities) | 0.3 | 0.9 |

| Gold | 1.3 | 7.3 |

| MSCI U.S. REIT Index | 1.1 | 1.4 |

| Barclays Int Govt Credit | 0.3 | 0.3 |

| Barclays US TIPS | 0.3 | 0.9 |

Economic Commentary

All natural

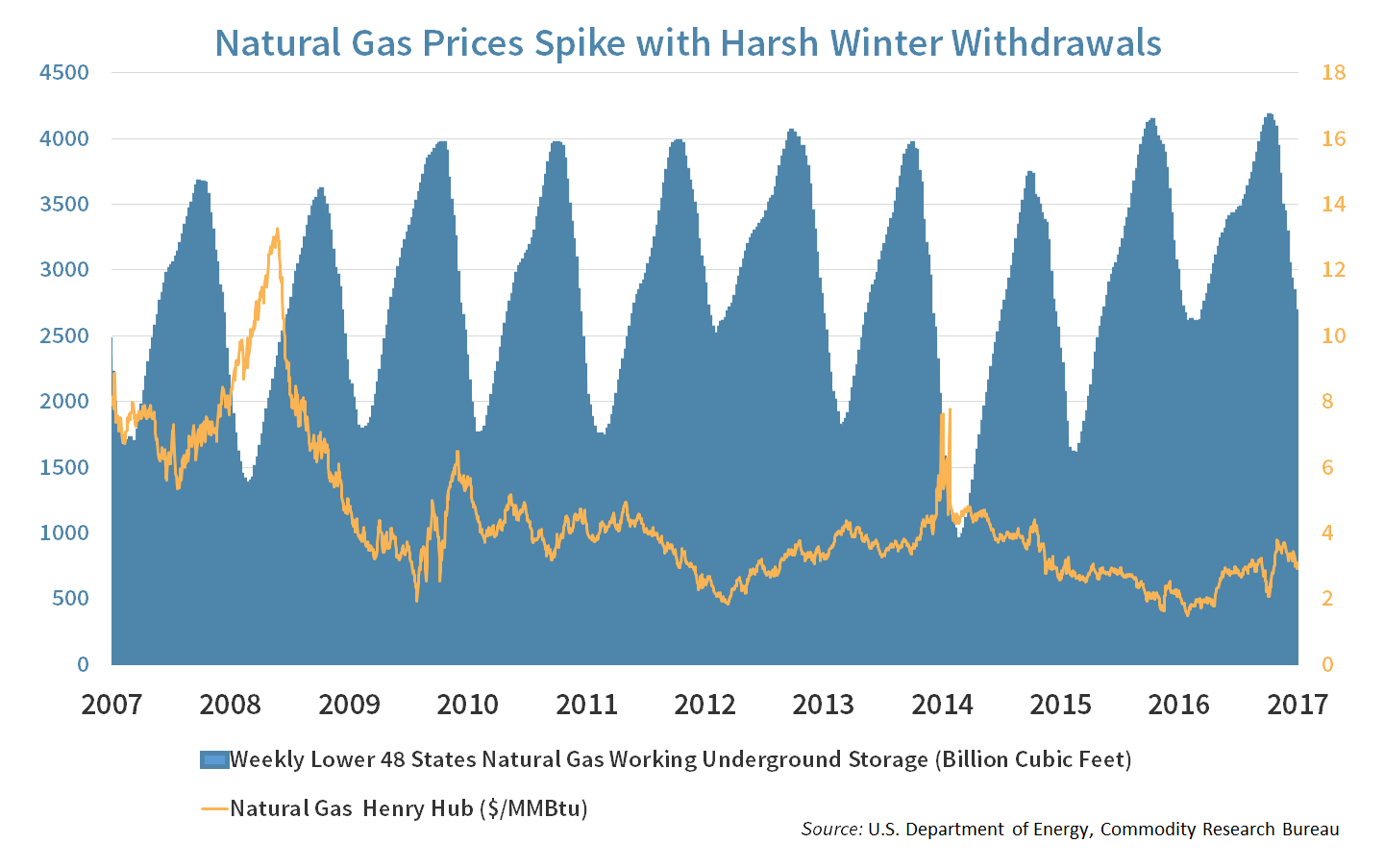

As the natural gas rig count is still well below its historical norm, analysts expect less gas production and therefore less supply. When supply tightens, natural gas prices rise as they did this past year. The Henry Hub natural gas spot price rose from $1.60 per MMBtu last March to a price of $3.10 today. As the price rose, exploration and production companies were incentivized to hire more rigs and the U.S. natural gas rig count increased from 94 last March to 149 today. This count is still far lower than the 10-year high of 1,606 in 2008, which is the reason many energy analysts remain bullish.

That said, the winter weather plays a large part in determining natural gas spot prices and drives its short term volatility. Although New Yorkers this week may tell you that winter is here in full force, the truth is, temperatures nation-wide have been mild. Warmer weather has weighed on natural gas prices as seasonal storage withdrawals have been measured.

As winter approaches its end, we may not see the natural gas withdrawal rates seen in previous years. The Strategic Financial Services investment team closely monitors the supply levels of commodities, but weather and demand associated with it is always unpredictable.

As winter approaches its end, we may not see the natural gas withdrawal rates seen in previous years. The Strategic Financial Services investment team closely monitors the supply levels of commodities, but weather and demand associated with it is always unpredictable.

Week Ahead

January boom or bust

Retail sales, housing starts and inflation data will come in for the month of January. Economists expect…

- Retail sales (ex-autos) to grow 0.5%,

- Housing starts to come in higher at 1,235K vs. 1,226K in December, and

- Consumer Price Index to remain flattish at 0.3%.

Sweet-less tooth

PepsiCo, along with Deere and Cisco Systems are scheduled to report next week.

- PepsiCo undoubtedly will reveal the initial progress of their new premium water brand “LifeWTR”. It is Pepsi’s newest attempt to gain market share as consumers purchase fewer carbonated and sugary beverages.

- A brief mention of Cisco Systems channel checks indicates that the second quarter may be better than analyst expectations. The highly acquisitive company has scooped up 45 companies in the past 5 years, but has not been able to translate the transactions to higher revenue so far.

- Deere investors will be looking for guidance, as many expect the U.S. agricultural market to bottom in 2017.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Earnings check-up

A key takeaway from earning releases thus far is that companies forecast growth to continue. While this is a positive theme in the equity markets, and continues to fuel the equity melt-up, so far earnings have not justified the market multiple. Perhaps this explains why large companies continue to outperform smaller companies, whose stock prices had a nice run-up during the back-end of last year.

Revived optimism

The 10-year yield was heading lower earlier in the week as investors began to question economic growth. Both Federal Reserve Bank Presidents Bullard and Evans see no reason to make any sudden rate hikes but reaffirmed expectations of two hikes later this year.

- The Federal Reserve is targeting an inflation rate of 2%, but is comfortable to let it run slightly higher.

- Per the Bureau of Labor Statistics, the U.S. inflation rate at the end of 2016 was 2.1%.

Look both ways

Equities continue to march higher as the economy and future expectations strengthen. While this makes us incrementally more cautious on equities due to elevated valuations, we find the alternative (bonds) expensive as well and thus prefer to keep building liquidity to take advantage of any real dislocations. This is particularly important for our stock strategies, as the current environment is creating valuation disconnects within some sectors.

STRATEGIC GROWTH

Under pressure

Commodity related sectors had a forgettable week, with the Materials sector in particular ending the week as the big laggard. On the other side of the coin, Technology was a leader thanks to one company…

- Cognizant Technology Solutions Corp. (CTSH) the technology consulting and services company reported an inline quarter, but it was a cooperation agreement with an activist investor Elliot Management that caught the eye of investors. Elliot Management owns roughly 4% of the company’s stock and used the leverage to force the company to adopt some of its suggestions to increase shareholder value. The company will return $3.4 billion to shareholders via dividends and share buybacks. The company will add three new independent members to its board of directors, accelerate the company’s shift to digital and target margin expansion. In return Elliot Management will halt its agitation and support the plan.

STRATEGIC EQUITY INCOME

A day on the pharm

Consumer staples came back with a vengeance to be the leader this week, while the Energy sector was the laggard. In other strategy news…

- CVS Health Corp. (CVS) a retail pharmacy and pharmaceutical benefit manger (PBM), reported a consensus topping quarter. The company reported a 12% revenue increase for the quarter and a 14% increase in earnings. The company’s PBM unit is the middle man between drug companies and insurance companies and thus receives attention for adding to the cost of drugs.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters