April Showers…

Stocks sold-off for the 2nd straight week on earnings disappointments, yet another economic speed bump and a surprising lack of action from the Bank of Japan.

Market Review

Contributed by Alan Leist, III

GDP Flatline

Despite the hopes of a Federal Reserve at the ready to raise rates, the U.S. economy just cannot gain any momentum.

- With annualized growth of just a 0.5% in the 1st quarter, the worst performance in two years, the deflation fears and recession talk that drove the January sell-off have begun to creep back into the market noise.

- D.C., along with their international counterparts (including Japan), need to get off of the monetary stimulus kick that is masking all sorts of fiscal, tax and regulatory sins.

- Based on the dysfunctional election cycle and the myriad of flawed candidates, we are left still hoping for a better direction than the current course. Hope, however, is not an investment strategy as the old saying goes and we may be left mired in a risky slow growth world for quite awhile.

- For more on the economic picture, please see Mark’s comments below.

Earnings Recession

In a related item, corporate earnings look to be on the decline for the 3rd straight quarter as slow global growth and the oil price slide weigh on results.

- Ultimately, stock prices will reflect corporate fundamentals and the market is starting to give up the free pass that has helped to define the recent two-month rally.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.3 | 1.0 |

| S&P 400 (Mid Cap) | -1.0 | 4.5 |

| Russell 2000 (Small Cap) | -1.4 | -0.4 |

| MSCI EAFE (Developed International) | -0.3 | -1.0 |

| MSCI Emerging Markets | -0.1 | 6.3 |

| S&P GSCI (Commodities) | 3.3 | 15.4 |

| Gold | 4.9 | 21.9 |

| MSCI U.S. REIT Index | -0.1 | 2.6 |

| Barclays Int Govt Credit | 0.3 | 2.2 |

| Barclays US TIPS | 0.9 | 4.7 |

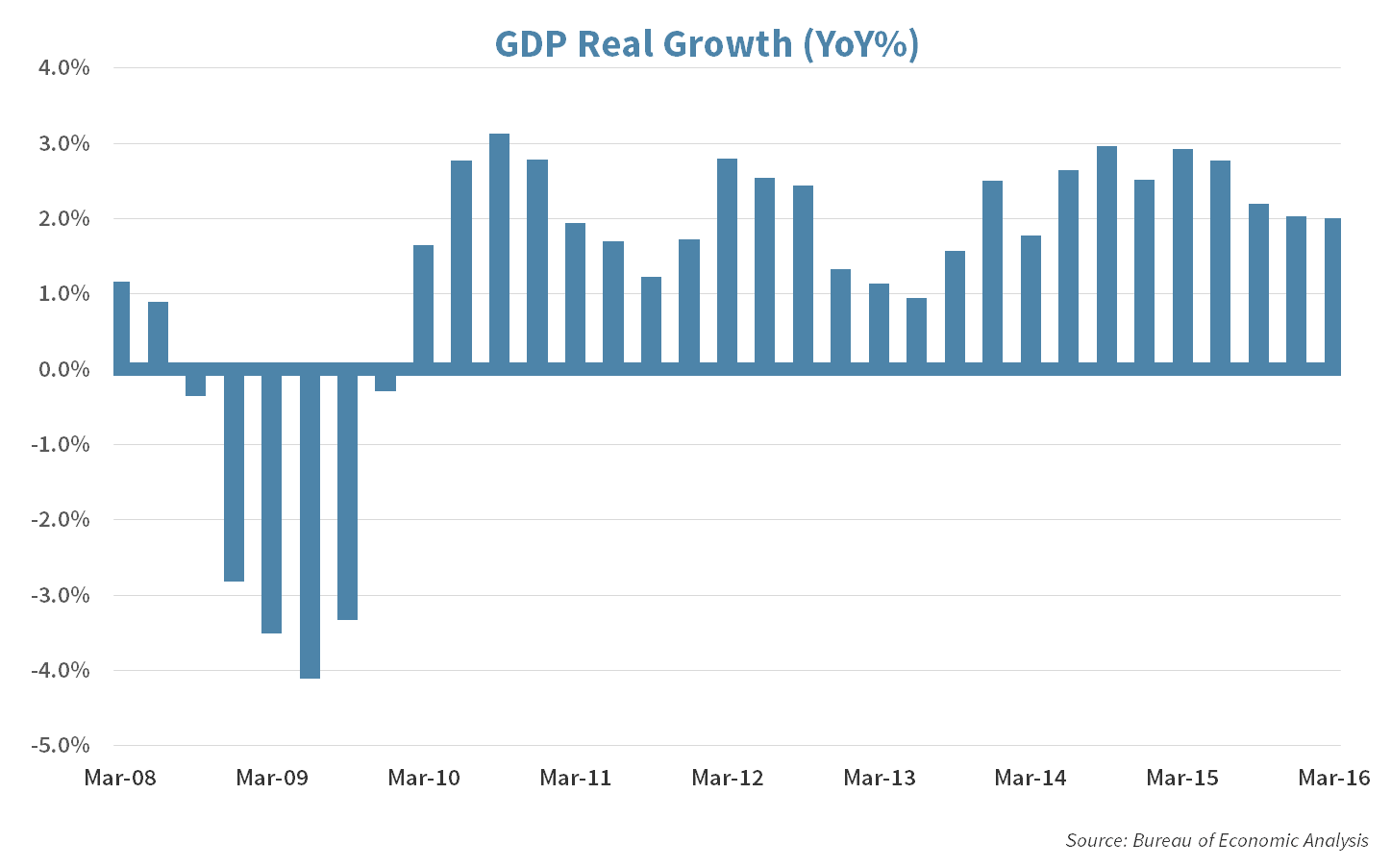

1st Quarter U.S. economic growth

the weakest quarter for GDP since the first quarter of 2014

Economic Commentary

The New Norm

From 1986 to 2006, Gross Domestic Product (GDP) adjusted for inflation grew by an average of 3.2%. The past two years, it has grown substantially less than that at 2.4% annually. Data released this week confirms that the economy is still growing at the same recent sluggish pace. The so-called “New Norm” remains in play

Economic Drag

The mining sector, which includes the oil and coal industries, continues to be a drag on economic growth and the pain is now spreading to other sectors. Financial companies that gave out credit cards or auto loans to previously employed miners and oil service men are now facing higher default rates. Mining equipment manufacturers are closing down plants, laying off employees and reducing their capacity.

Economic Drivers

Economic growth is being driven by low interest rates and a recovering job market as they push consumers to spend more. This is important as personal consumption makes up 70% of overall GDP and consumers have been spending on everything from remodeling their homes to buying new cars. In fact, last year was a record year for new car sales. Auto dealerships profited as sales were driven by

- cheap credit

- cheap gasoline

- job creation

Week Ahead

Contributed by Aaron Evans

Where’s the Beef?

Berkshire Hathaway and its famed CEO/investor Warren Buffet, will hold their annual shareholder meeting over the weekend where the itinerary includes a shopping day, company movie, picnic, 5k road race and an Omaha steak dinner.

- It might surprise some that Berkshire Hathaway has grown to become the fourth largest company in America, (between #3 Chevron and #5 Apple), all stemming from Buffet’s investment in the then dwindling textile company in 1965.

Making Gains

Next Friday brings us the latest report on U.S. job growth and unemployment data.

- All signs are pointing towards another solid month of job gains with yet another 200k+ expected to be reported for the month of April.

- Early reports for number of Americans who filed to receive unemployment benefits held at historic lows which should keep the overall unemployment rate near 6%.

Strategy Update

Contributed by David Lemire , Max Berkovich

STRATEGIC Asset Allocation

April Showers and May Flowers

A deluge of tech disappointments soaked an otherwise decent month. This type of pullback can help new growth take root, however, the macroeconomic soil seems somewhat depleted of the needed nutrients for a sustainable rally.

June Hike Eases April’s Spike

Treasury yields trended higher leading up to this month’s Fed meeting. However, while some parsing of the Fed statement raised prospects for a June rate increase, Treasury markets remained doubtful and rates declined post-meeting.

Dollar Fear Hits High for the Year

The week also saw recent U.S. dollar weakness continue. This time it was a double whammy of Japan declining to provide more stimulus and the Fed postponing further rate increases. Both moves served to weaken the dollar further thereby giving a boost to international stock and bond funds.

Strategic Growth

Consumer Square

Earnings continue to dominate news flow. The consumer sectors both had a good week, while technology and health care did not. Earnings highlights…

- Expedia Inc. (EXPE): The online travel agent topped expectations and reported gross bookings up 32% year over year.

- Carters Inc. (CRI) The children’s clothing retailer also topped expectations and bumped up guidance. The company expects double digit growth in EPS for 2016.

Strategic Equity Income

Exxon-erated

The industrials joined utilities at the top. the technology sector was not so lucky as one big name (Apple) dragged the whole sector down. In other strategy news…

- Energy giant Exxon Mobil Corp. (XOM) caught several headlines this week. Credit rating agency S&P downgraded Exxon debt to AA+ from the top rating of AAA. S&P lists doubling in debt in recent years, low commodity prices, and high investment requirements as cause for the cut. Exxon returned fire the next day with an increase of its dividend for the 34th consecutive year. More importantly, the company’s Friday earnings report handily beat expectations. The strength in its chemicals business was the driver.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III