Apple: A Trade Wars Story

The force was with the S&P 500 on Friday, but stocks still closed down for the week. Apple was a notable rebel, resisting the market’s recent slide to the dark side…

Market Review

Contributed by Doug Walters

U.S. stocks were flat this week despite a standout solo performance from one of it’s largest constituents, Apple (AAPL), and a broad-based bounce on May the Fourth. The Federal Reserve left rates on hold while indicating that inflation was approaching its target, and the jobs report missed expectations but did not dampen investor spirits.

A Solo Performance

Apple reported results this week with a couple of positive surprises driving the shares up over 13% for the week. iPhone X sales topped expectations despite the flagship product’s lofty $1,000 price tag. The company also announced the launch of a new $100 billion share buyback as well as a 16% boost to its dividend. Investors interpreted this as a sign of confidence.

Apple has found itself in the crosshairs of the Trump administration’s trade war with China. With a large percentage of its products assembled in China and shipped back to the U.S., they are a material drag on the U.S. trade deficit with China. Perhaps this has helped motivate Apple’s previously disclosed intention to repatriate most of its $200+ billion in liquid assets from overseas to the U.S. The government has hoped the lower repatriation tax would encourage companies to invest their overseas cash in domestic facilities and jobs. Apple does have plans for building new U.S. facilities, but this week’s buyback and dividend announcement appears to signal that most of the cash will be going right back to stockholders.

Time will tell if this year’s tax reform will broaden economic participation as promised or further widen the wealth gap that was a large source of the political discontent in the 2016 elections.

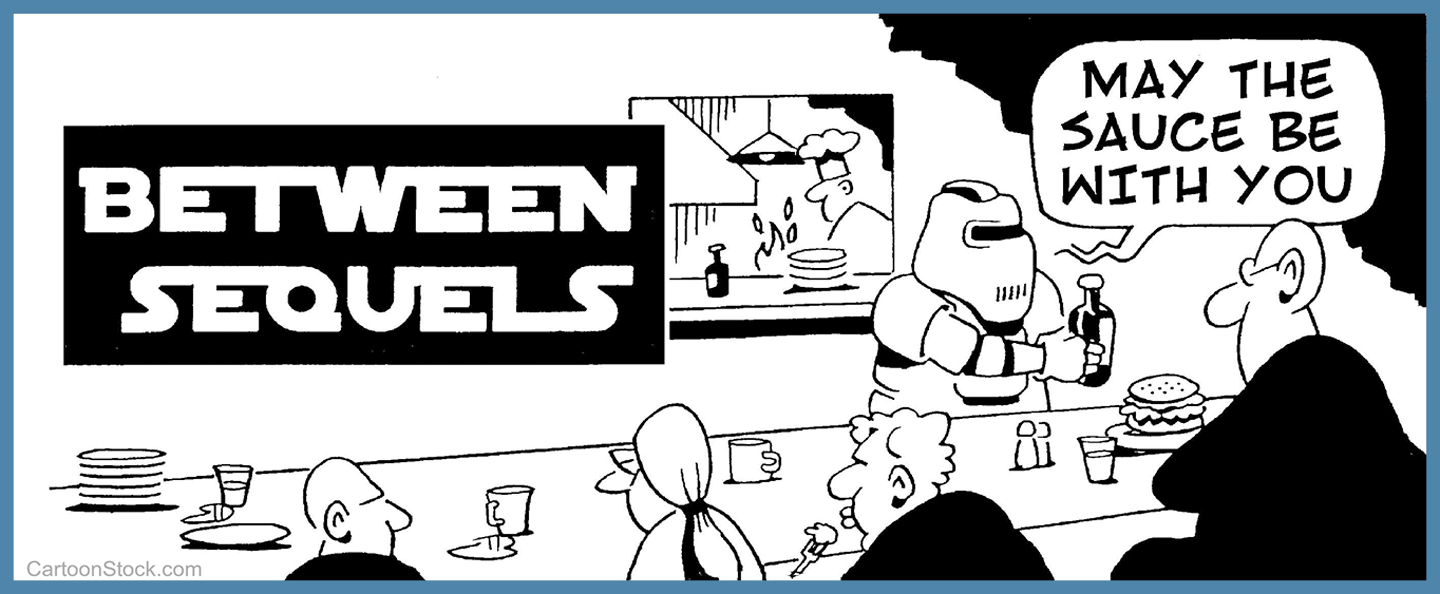

May the 4th Be with You

Star Wars fans were out in force on Friday celebrating their special day. The first use of the May the Fourth pun goes back a long time ago (the 70’s), but it is only in the last decade that it has gained broad popularity (at least among us Star Wars fans). Disney (DIS), the owner of the Star Wars franchise, now actively promotes the day, but missed an opportunity (in our view) to release the new Solo movie (Trailer Below) on May 4th rather than May 25th. Presumably, they did not want Solo to impinge on the success of Avengers: Infinity War, which is busy breaking box office records (right on the heels of Disney’s record-breaking Black Panther). We keep hearing that theaters are struggling, but the force appears to be with Disney’s studio business for now.

Strategy Update

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

When Will the Force Awaken?

Both equities and fixed income finished slightly in the red for the week. Since February, equity investors have endured high volatility. Even an outstanding earnings season could not awaken the force to move the market higher. Alas, not everything is gloomy for equity investors…

- The majority of S&P 500 companies that reported have topped consensus estimates.

- Reported Q1 earnings are up 25% (compared to Q1 2017), based on results from the 409 companies that have reported.

- Capital expenditure (investment in their business) growth is better than expected.

- Companies have announced record levels of stock repurchases.

- Valuations have improved dramatically, thanks to increasing earnings and cheaper stock prices.

STRATEGIC GROWTH

A New Hope

Technology was the top sector mostly due to Apple’s (AAPL) earnings release, especially since it boosted several suppliers as well. The Health Care sector was the undisputed laggard. In other strategy news…

- Snack food giant Mondelez International Corp. (MDLZ) reported a slight beat, but some sweet segment breakdowns captured our attention. Emerging market sales increased 5.5% to $2.58 billion for the quarter. Developed markets also grew revenue over 4% to $4.1 billion. While the company was able to reduce selling and administrative expenses, input costs rose to offset the progress. The company expects double-digit earnings growth for the full year 2018, with 1-2% organic revenue growth. A decline in cocoa prices should restore a new hope for stronger profits.

STRATEGIC EQUITY INCOME

Attack of the Clones

The Technology sector had a standout week, while Health Care had a week we would rather forget. Speaking of Health Care…

- Pfizer Corp. (PFE) and Merck & Co. (MRK) both reported earnings this week. Pfizer’s numbers were in line, while Merck was able to top expectations and bump up guidance. Both companies did report slight misses on the top line. Big pharma is continuously fighting an attack from generic clones on their blockbuster drugs and political pressure to cut prices. Merck has its hopes riding on Keytruda a cancer drug, while Pfizer is betting big on Tafamidis a nerve function drug for future growth.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.2 | -0.4 |

| S&P 400 (Mid Cap) | 0.3 | -0.2 |

| Russell 2000 (Small Cap) | 0.6 | 2.0 |

| MSCI EAFE (Developed International) | -0.6 | -1.0 |

| MSCI Emerging Markets | -1.7 | -1.9 |

| S&P GSCI (Commodities) | 1.3 | 8.4 |

| Gold | -0.8 | 0.7 |

| MSCI U.S. REIT Index | 1.1 | -6.5 |

| Barclays Int Govt Credit | -0.1 | -2.2 |

| Barclays US TIPS | -0.4 | -1.7 |

The Week Ahead

JEDI-like Focus on Next Week’s Market Movers

Job Openings and Labor Turnover Survey (JOLTS), Consumer Credit report, University of Michigan Consumer Sentiment Index and NFIB Small Business Index are the notable economic releases next week.

- JOLTS may gain scrutiny as a tight employment environment has investors questioning if there is room for much further growth.

- The two sentiment indexes are projected to continue to hover at decade highs.

Earnings from Strategic Growth holdings include Cognizant (CTSH), Booking Holdings (BKNG), Albemarle (ALB), and Henry Schein (HSIC).

Disney’s (DIS) quarterly results will include excitement over the Avengers: Infinity War success and big expectations for the Star Wars franchise’s Han Solo movie due out later this month, even though neither of these will be in the quarterly numbers.

- ESPN subscription, an over-the-top app and the pending acquisition of Fox’s assets will also play a significant role on the call.

Inflation measurements, Producer Price Index (PPI) and Consumer Price Index(CPI), are expected to reveal inflation near the Fed’s target.

- CPI (ex-Food & Energy) is expected to grow at annual rate of 2.2% for April.

- PPI’s monthly growth is expected to remain unchanged in April.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters