An Economic Treat

The S&P 500 ended the week down, continuing the modest slide that U.S. equities have been experiencing for the last two months. The very positive Q3 GDP report on Friday may be the economic treat the market needs to lift the specter of Halloween gloom.

Market Review

Contributed by Doug Walters

The Walking Dead

U.S. equities were in zombie mode this week, continuing the lifeless lumber that we have been experiencing since early September. Despite the decline, the S&P 500 is still 17% above the February lows, and up over 4% on the year. Uncertainty is the enemy of equity markets and we have no shortage of it these days. The conclusion of the U.S. presidential election will bring welcome closure to at least one major source of market unease.

- The news this week was not as gloomy as the stock market would suggest. Corporate earnings have, on balance, been much stronger, year-on-year, than last quarter. In addition, on Friday, the economy showed renewed life, with Q3 gross domestic product (GDP) growth of 2.9% reported, up from 1.4% in Q2 and 0.8% in Q1.

So Gross

In their last debate, one of the presidential candidates pointed out that our country is “dying at one percent GDP”. While many of us have a basic understanding that GDP is an economic measure, and that more is better, the candidate’s point may have been a bit technical for the average listener. We attempt to demystify the term.

- U.S. GDP is simply a measure of the value of all the goods and services produced in the U.S. over a particular period of time. The 2.9% GDP growth reported in the third quarter means that from Q2 to Q3 of this year, the U.S. economy grew at an annualized rate of nearly 3%.

- What exactly goes into GDP? Let’s take Halloween spending as an example. GDP includes: consumer spending on candy and costumes; Hershey investing in a new facility to manufacture candy; and any candy we sell to our international neighbors, like Canada and Mexico. Government spending is also included, however, imports, like costumes we buy from China are subtracted from GDP.

- Is 2.9% GDP growth good? In the U.S., over the past 30 years, GDP growth has averaged at about 2.5%. A sustained rate above that average would likely be received very well by equity markets.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.7 | 4.0 |

| S&P 400 (Mid Cap) | -1.8 | 7.2 |

| Russell 2000 (Small Cap) | -2.5 | 4.6 |

| MSCI EAFE (Developed International) | -0.4 | -3.0 |

| MSCI Emerging Markets | -0.8 | 13.8 |

| S&P GSCI (Commodities) | -1.5 | 18.7 |

| Gold | 0.6 | 19.8 |

| MSCI U.S. REIT Index | -3.6 | 0.6 |

| Barclays Int Govt Credit | -0.4 | 2.2 |

| Barclays US TIPS | -0.4 | 5.4 |

Economic Commentary

The inflation Boogeyman

Inflation has been long forgotten. Now the economy has picked up as GDP grew at a 2.9% annual rate last quarter, the labor market has tightened with unemployment below 5%, and comments from Federal Reserve Chairwoman suggest she would allow inflation to run above the official guideline. Inflation may therefore start taking off. Federal Reserve banks around the world have, after all, been using monetary stimulus to boost growth and push inflation upwards in fear of deflation. There is a risk that their goals of reaching higher inflation rates may be met but then also surpassed.

Real returns on fixed income investments would be negatively impacted by inflation as the nominal dollar returns would be worth less in terms of purchasing power. This is perhaps the biggest risk to low yielding investment grade bonds as they are unlikely to default but are still subject to inflation risk.

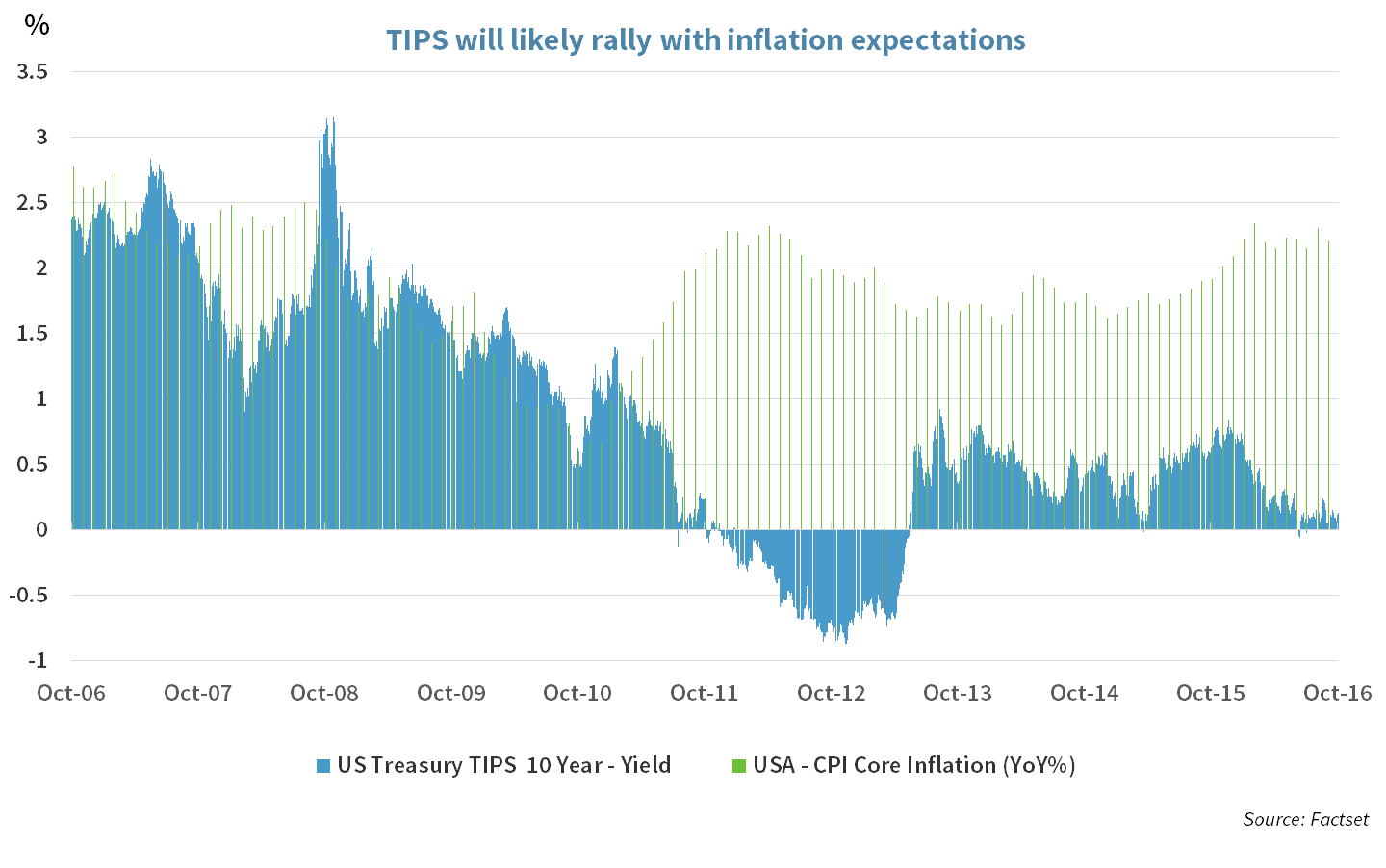

Equities can provide some protection against inflation, but a fixed income portfolio manager can also invest a portion of the portfolio in Treasury Inflation Protected Securities, also known as TIPS. TIPS pay the investor a set rate plus an additional amount tied to the inflation rate. As inflation begins to spook investors, TIPS can offer protection.

Week Ahead

A cauldron of data

A large set of data is scheduled to be released next week; the final week before the presidential elections.

- The Purchasing Managers’ Index or Markit PMI will provide data for October. A number over 50 will signal an improvement in private sector spending, while a reading below 50 means weakness. The prior month index level was 53.2.

- Eurozone will release their 3rd quarter GDP. It is expected to show expansion of 0.3% for the quarter and 1.6% for the year.

- Most importantly, the U.S. non-farm payroll will be released on Friday. Any meaningful surprise may weigh heavily on the Fed’s rate rise decision. Consensus expectations call for 195,000 new jobs created in October.

Darker times are up on us

Don’t forget to set your clocks back an hour next Sunday (Nov. 6).

- Unless you live in Arizona, Hawaii, Puerto Rico, American Samoa or U.S. Virgin Islands, where they do not observe daylight saving.

- Fun fact: the entire country did not observe this tradition between 1918 and 1942. President Woodrow Wilson signed a law removing daylight savings, to help the War effort by preserving candles. President Franklin Roosevelt brought it back.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Election hedging

There has been a noticeable decline for the week and the month in Small Cap Equities and REITs (real estate). Investors are being cautious and have taken some chips off the table while waiting for the U.S. election results and the Fed’s rate hike decision.

- Small Cap tends to be a proxy for the U.S. Economy and REITs can serve as a proxy for interest rates.

Don’t fear the Fed

The U.S. 10-Year Treasury Note’s yield reached 1.85% this week; a level the bond market has not seen since May. Rising yields have sent bond prices down. In June the 10-Year yield flirted with 1.35%. The market appears to be pricing in the next 0.25% rate increase (and then some) from the Federal Reserve. As such investors should not be startled if the Fed says Boo! in December.

- In general, we have positioned for this and are beginning to benefit from our conservative duration. In addition, our underweight to fixed income has us ready to capitalize on a rising rate environment.

Strategic Growth

Health (S)care space

Big winners and losers drove sector direction during the busy week of earnings, for example…

- In industrials, Stericycle Inc. (SRCL), the medical waste disposal company, reported a strong quarter with revenue growth and margin improvement. The company completed five small tuck-in acquisitions in the quarter and treated investors to a bump in its guidance. Most importantly, the company did not spook investors with bad news as it had the past two quarters.

- McKesson Corp. (MCK), the pharmaceutical distributor, threw some rotten eggs at the entire Health Care space when it reported results that were way short of expectations. The company lowered guidance as well. Management blamed the lackluster results on pricing pressure in the entire pharmaceutical supply chain. Those words from the company spread like wild fire and took down the sector.

Strategic Equity Income

Catching Fire

As interest rates marched higher, the financial sector did too. Earnings took center stage as well…

- Apple Inc. (AAPL) walked into earnings with hefty expectations. While the report was largely in-line with consensus expectations, some investors expected more. Looks like there are supply constraints for the new iPhone, which may prevent the company from taking market share from Samsung (SSNLF), whose Galaxy Note 7 has a habit of catching on fire.

- Also, Boeing Co. (BA) reported a quarter that soared way above expectations. The significant beat allowed the company to increase guidance. The company added 107 new orders in the quarter bringing its backlog to $462 billion (5,600 new planes).

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters