The silly season is undoubtedly upon us in full force. Granted, that could refer to the ongoing pandemic, the rapidly approaching holidays, and a dozen other things in these extraordinary times. But no, I refer to election season.

We are descending upon the November elections and the assault is on. Internet, social media, print, television, radio, mail, texts, phone calls – no matter which way you turn, you are being told why one candidate is the Anti-Christ and the other is our blessed Savior.

Over and over again. It creates stress and a lot of it. And when you’re stressed, it is only natural to look at other areas of your life to see what is buttoned up and what could be in danger. Your gaze falls upon your investments and your heart rate quickens – how will my savings and the market be affected by this election?

- What if Biden wins?

- What if Trump wins but Congress changes?

- What if Biden wins and Congress changes?

- What if everything stays the same?

All these “what ifs” don’t work to soothe our nerves but instead fray them like a long-clawed cat on a mission to destroy.

The election and its’ effect on the market have been a prime topic of conversation in recent client meetings and promises to be for weeks to come. Yet, despite our personal political beliefs about which party is better for the stock market and what we “know” to be true, it is interesting to look back at history and see that things aren’t always what we think them to be, no matter how certain we are.

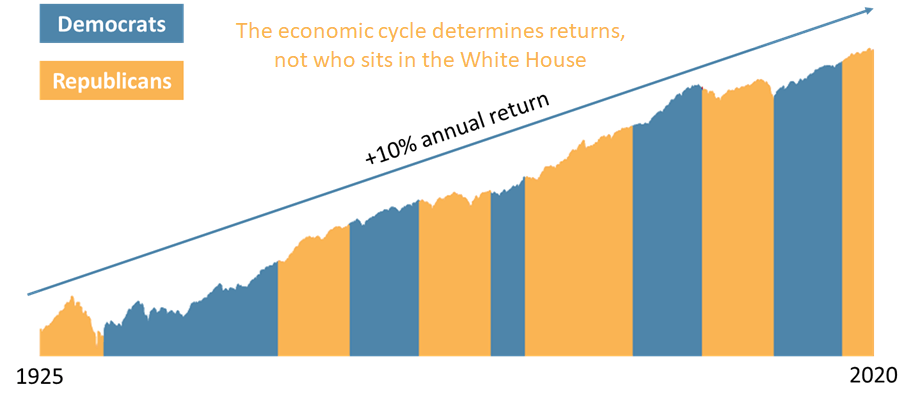

First and foremost, no matter what it feels like on a day to day basis, and what doomsday prognostications are currently dripping out of the pundits’ pie holes, the truth of the matter is that history has shown that the stock market, over time, will consistently go up. Since 1926, $1000 invested in the S&P 500 would have grown to $8.96M as of June 30, 2020. Think of all that transpired from 1926 to now – all the calamities, all the massive, shifting events that have taken place. Now, think of all the presidents who have served in that time. Democrats, Republicans, those you loved, those you didn’t – the market has consistently performed over time no matter who sits in that oddly shaped office.

Chart 5: Historical Stock Performance and Political Party

The U.S. stock market has been a good investment over time, regardless of which party is sitting in the White House. The economy is a bigger driver of the stock market than the President.

OK, you say, fine – over a long period of time the S&P will average a consistent gain. But that doesn’t mean that certain presidents haven’t been better for the market than others and indeed, a conservative Republican is going to be better for the market than a liberal Democrat – right?

This can be debated in several ways but consider this — in his first 44 months of office, President Trump saw the Dow Jones Industrial Average increase by 30%. This is clear evidence that a Republican in the White House is better for the market – isn’t it? Well, at the same point of his presidency, President Obama saw the Dow Jones increase by nearly 68%. It can boggle your mind, I agree.

Certainly, some presidents implement policies that positively affect specific sectors of the market. And others may help different sectors. This will go round and round through time eternal.

The election does not warrant losing sleep if your investments have been properly structured and diversified. If you have a robust portfolio, invested in accordance with your goals, timeline and risk tolerance and it is diversified across a multitude of sectors and factors — the inhabitant at 1600 Pennsylvania Avenue will matter very little to your investments in the long run. Now, if your entire life savings is in Apple or Tesla or Netflix – well, then you may have some worries. No matter how pretty it is, no basket should house all your eggs.

And as always, if you are worried, you should seek the guidance of a professional financial advisor. It never hurts to get another point of view. It may help you get through the silly season just a little bit easier (and staying off social media altogether). Be well.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Greg Mattacola

Greg Mattacola