Ah, back to school. Freshly washed blackboards. Pristine pencils. New backpacks and lunch boxes. The sounds of football teams practicing. The sights of changing leaves. That crisp fall smell. The nervous anticipation.

Whether kindergarten or college, there is no denying that this time of year is an exciting one – a rebirth of sorts.

This isn’t limited to the school aged. The grown-ups of the world also seem to still operate on the school calendar. We ease a bit off the gas pedal in the summer months and take some time to recharge but once the last Labor Day hamburger has disappeared, we collectively kick it up a notch.

Myself, I love it. It’s a welcome intensity. There are four months left in the calendar year and there is plenty of time to revisit those goals and objectives you may have set in January.

Off track? No problem. It’s time to get back on track and finish the year strong.

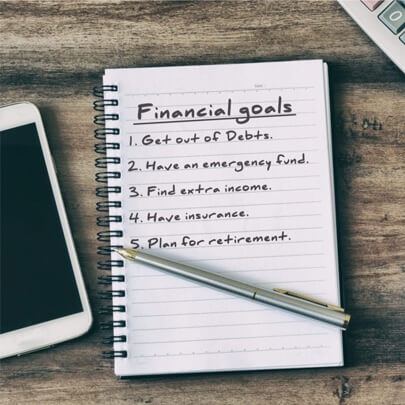

Toward that end – take this time to review your financial goals and take your financial temperature. It’s a perfect time to do it.

Holidays and their added expense loom on the horizon. Efforts taken now will ease that stress come November and December. Just like the back to school checklists that we use for our children, here are a few items to review so that you end the year strong.

Weekly/Monthly Expenses – do you see areas that can be trimmed/cut? Too many monthly streaming subscriptions? Dining out too often?

Regular contributions to your savings/emergency fund – can you survive three months on what is in there? If not, it’s an area to work on.

Are you maximizing your 401k contributions/employer match? Don’t ever turn down free money. Maximize the match.

Have you sat and done projections with your financial advisor that consider your current retirement savings, your ongoing contributions and your desired retirement age? The results of these can be sobering. It’s time to do it if you haven’t.

Have you gotten your basic estate documents into place? It’s never pleasant but it’s a load off your shoulders when it’s done.

With your little ones heading off to school, do you have regular, systematic college savings deposits going into a 529 plan? The rising tuition rate is bordering on criminal conduct, if it hasn’t gotten crossed over already. Every penny will help.

What is your mortgage interest rate? It never hurts to look periodically and see if there is a better rate which will save you money long term. Again, a tedious, annoying task but it could be well worth the effort.

As the kids get acclimated to the new school year, take the time to go through this list. It will help you prepare for those coming expenses and get you closer to achieving your 2019 financial goals.

And as football season kicks into full gear, I’d be remiss if I didn’t say “Go RFA Black Knights!” This will be my last year to watch my son play football and it saddens me to say the least. Here’s hoping for a safe and successful year for the team.

Live well, live with love. Until next time.

Original content provided by Gregory Mattacola, Esq., Financial Advisor at Strategic Financial Services.

Content is provided for informational purposes only and should not be used as the basis upon which to make investment or financial decisions.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Greg Mattacola

Greg Mattacola