Disappointing Year for Fortune Tellers

In our letter last year, we pushed hard against those who were tempted to time the market by cutting exposure to equities. With the S&P 500 up over 20% this year, we hope you listened! We are not claiming to have seen this coming in our crystal ball … in fact, quite the opposite. Yes, we can value companies and markets, and will adjust portfolios based on our analysis, but we are humble enough to know our limits. Markets are inherently unpredictable, and we always recommend a well-diversified portfolio, built on Quality and Value… not fortune telling.

Feeling Stressed Out

But we understand why investors feel angst and a need for defensive action. As we entered 2017, we were facing:

- An untested, impulsive President,

- Above average stock valuations, and

- Rising global populism and unrest.

Uncertainty only grew throughout the year, thanks to:

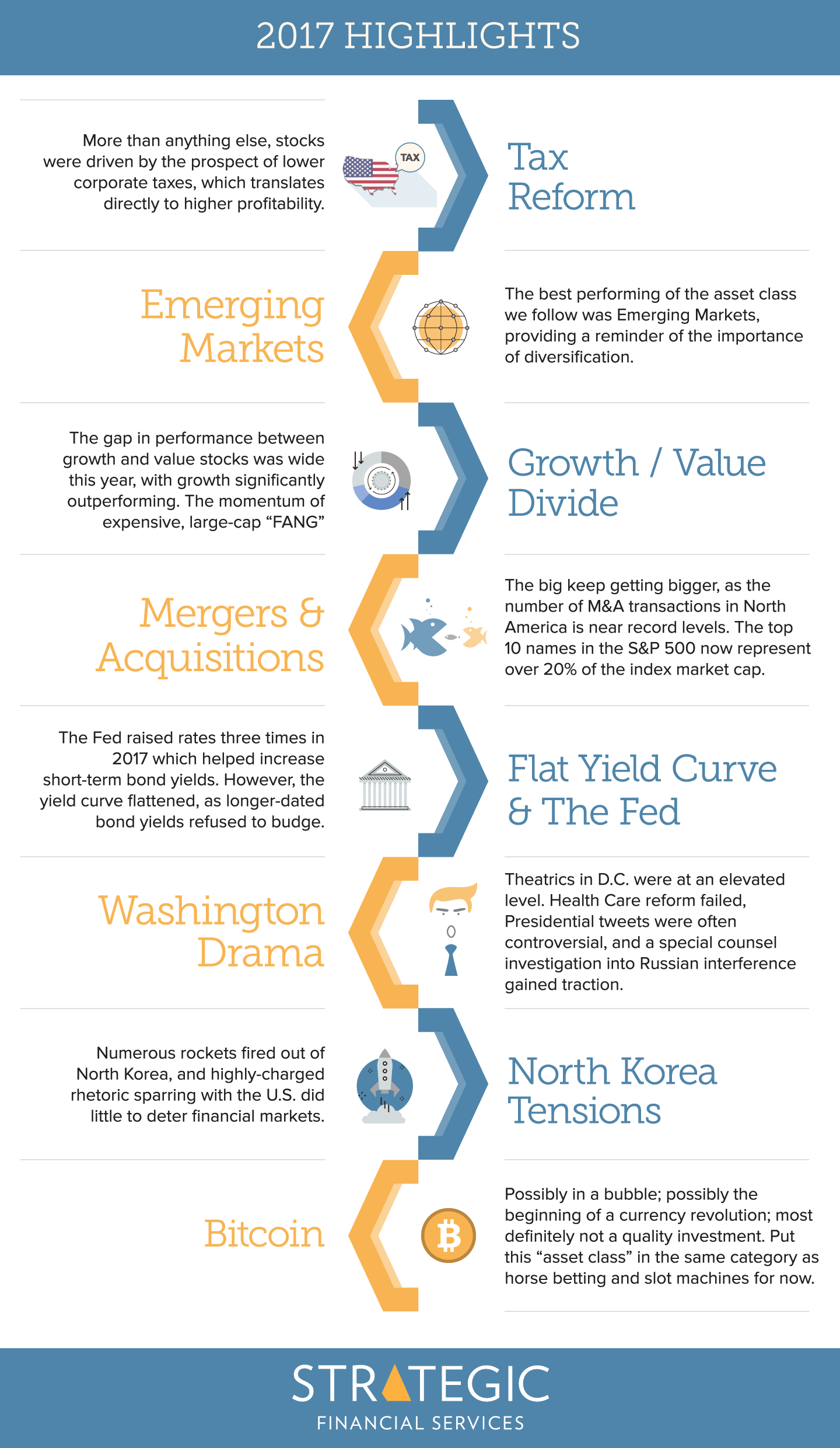

- Rising tensions with North Korea,

- A disconcerting Russia investigation, and

- Even higher stock valuations.

The American Psychological Association (APA) reported in November that stress levels in the U.S. are unusually high. The top fears are: “The Future of Our Nation” and “Money.” They go on to report that nearly 60% of Americans believe we are at “the lowest point in our nation’s history.” This belief was held even by those that lived through WWII.

The Market Dichotomy

Despite high levels of anxiety and uncertainty, stock markets continued to rise! How do we explain this dichotomy? The market, for the most part, does not share our emotional biases. Stocks are primarily concerned about future corporate profitability. With Congress holding the carrot of drastically lower corporate taxes in front of companies all year, investors were willing to look past the geopolitical noise.

Below we summarize some of the major events of 2017 that impacted portfolio investment performance.

We enter 2018 with the knowledge that earnings are likely to be significantly higher thanks to a generous tax cut for corporations. However, stocks are already reflecting a lot of this good news. Rather than pretend to have a window into the future, we rely on our investment process to continuously identify Quality assets at a reasonable Value, with which we construct a well-diversified portfolio. We see this as the best foundation to enable your portfolio to reach its full potential, and to ensure you sleep well at night.

On behalf of the entire Strategic team, I would like to thank you for entrusting your financial future to Strategic. We wish you a New Year full of happiness, success and restful sleep.

Sincerely,

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters