It’s Not Too Late

While the calendar has turned to 2017, there is still time to plan for 2016 retirement contributions with potential tax savings. Traditional and Roth IRA contributions can be made up until your 2016 tax return is filed (as late as April 15th). There are income limitations and restrictions for these contributions, so be sure to confirm with your Advisor prior to making the contributions.

Resolution Time

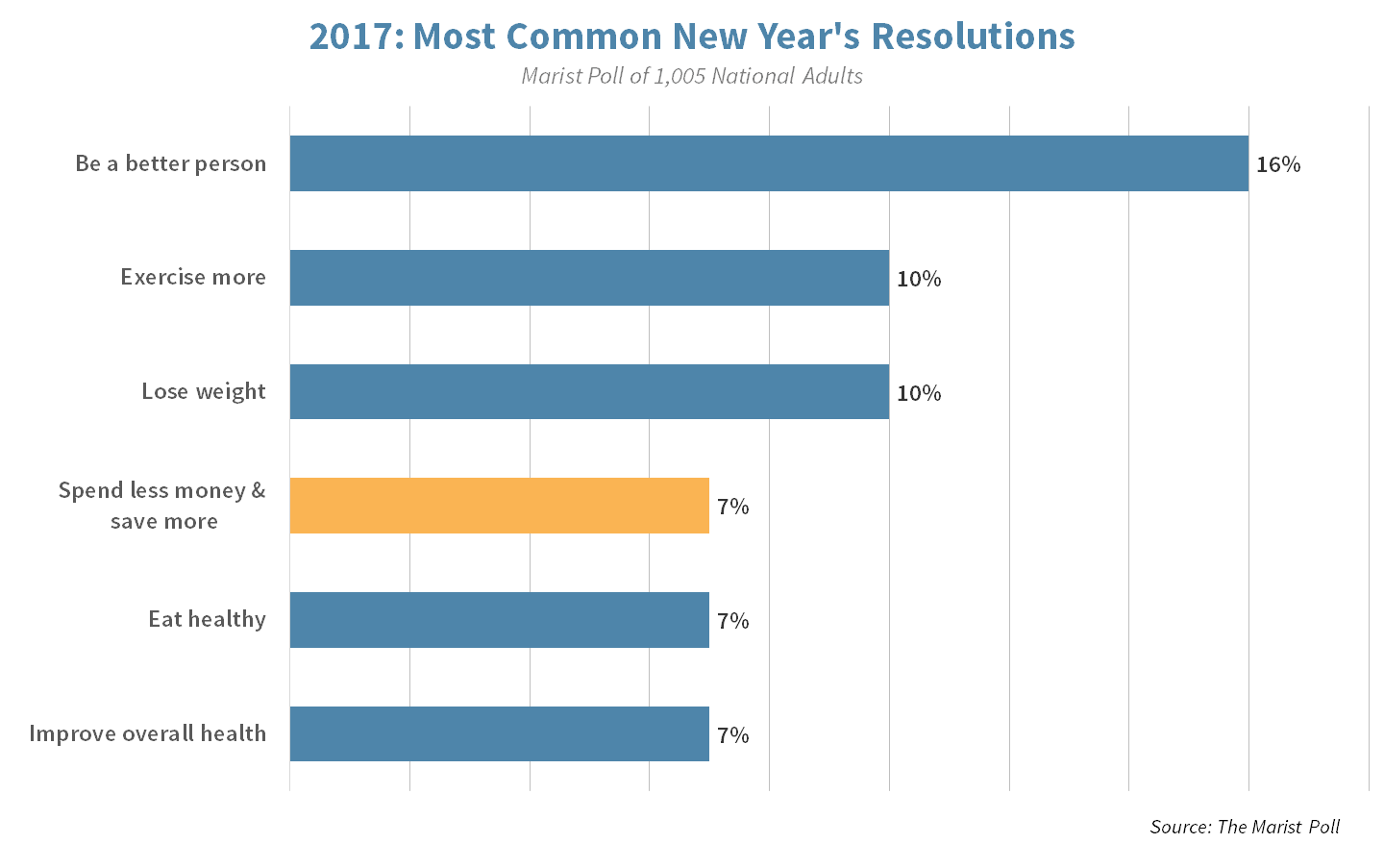

According to a Marist Poll, “spend less money & save More”, comes in as the 4th most popular New Year’s Resolution for 2017. Here are a few tips to consider that will allow you to focus on other resolutions and set you on a path to spend less and save more in 2017 and beyond:

According to a Marist Poll, “spend less money & save More”, comes in as the 4th most popular New Year’s Resolution for 2017. Here are a few tips to consider that will allow you to focus on other resolutions and set you on a path to spend less and save more in 2017 and beyond:

Those in their early working years

Check-in with your Human Resources to confirm your current retirement plan savings amount. We recommend that folks try to increase this amount a little each year, with a goal of deferring at least 15% of your salary to your retirement plan.

- Make sure that you are contributing a percentage (%) amount of pay if your plan allows for that. By deferring a percentage rather than a flat dollar amount, you are giving yourself a “raise for retirement” each time your compensation increases.

Those nearing retirement

Maximizing these contributions ($18,000 for 2017 with an additional $6,000 if you’re over the age of 50) will get you one step closer to achieving your retirement goals.

Those in retirement

You’ve done a great job saving to get here! To stay on course in achieving your 2017 goals, it will help to prepare an estimated budget, even more so if you have a big purchase planned this year (vacation, vehicle, etc.).

New Year, New Rates?

While everything remains in the proposal stage, the consensus remains that income tax reform is coming over the next few months by the new administration. Whether this reform brings about changes to our current tax law will likely have minimal, if any, impact on achieving your 2017 financial goals. Sticking with a disciplined savings or spending plan has proven to always come out on top.

As always, Strategic is here to partner with you on creating this path for a successful 2017!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Michael McGraw

Michael McGraw