Here is how we are approaching portfolio management in this environment:

We believe sell-offs create opportunities for disciplined long-term investors.

- We start with well-diversified portfolios.

- We rebalance the portfolios regularly to lock in relative performance (buying low and selling high).

- We look for tactical opportunities created by any pricing dislocations.

We encourage investors not to see this as an opportunity to reduce risk.

- Reducing risk after a market decline locks in the decline and will result in missing out on the inevitable rebound. This is market timing, which rarely pays off.

We believe the future cannot be predicted, only prepared for.

- It is possible that the combination of the oil price war and Coronavirus sends the U.S. into a technical recession, particularly if we start to see major cities begin to restrict activities.

- It is also possible that in a month, investors will begin to see past the peak impact of the virus epidemic and equity markets begin to rally as fast or faster than they fell.

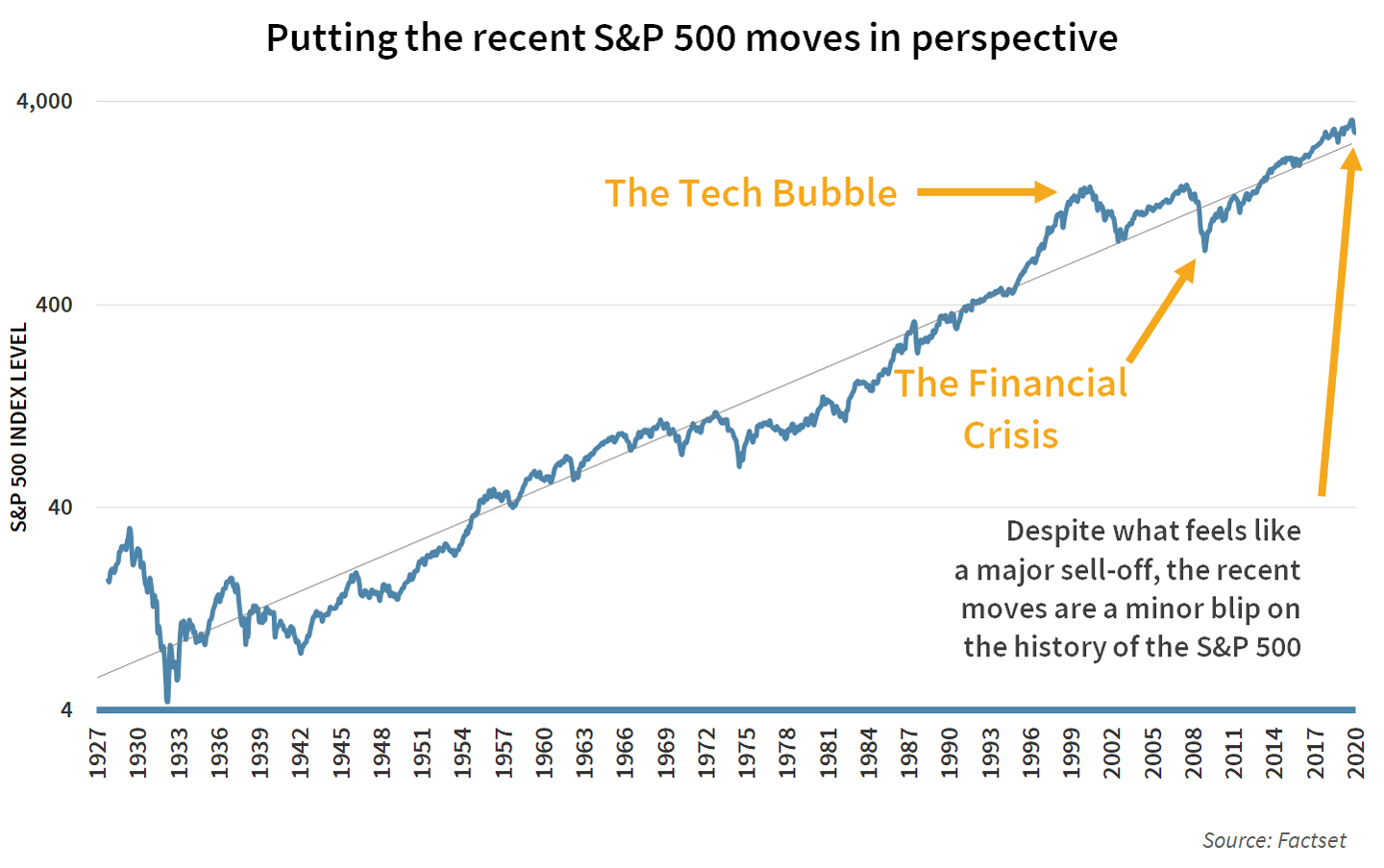

- Either way, we are prepared to take advantage of what the market has to offer. Two weeks ago in our report, Panic or Profit, we talked about the importance of staying calm in the face of market volatility. In the piece we provided some perspective by showing how the recent moves look compared to history. We update the chart below. While the moves feel dramatic, they are a minor blip on the history of the S&P 500.

Amidst the volatility, we are welcoming conversations with our clients and encourage you to set up a call by contacting our office at 315-724-1776. As always, thank you for your continued partnership.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters