No matter what your goals are, a key building block in every financial plan is figuring out how to save (pre-retirement) and manage expenses (pre and post-retirement). When it comes to saving and spending, almost everyone is faced with a constant battle between short-term satisfaction and long-term rewards. One of the most powerful steps you can take to face this dilemma is also one of the simplest…….develop a spending plan.

Back to Basics – Regular Expenses

The best place to begin your spending plan is by tracking expenses that can be easily quantified. This would include any recurring amounts such as debt repayment (mortgage, vehicle, etc.), bills/utilities or retirement savings (pay yourself first!). It’s also recommended to have a set budget for regular discretionary expenses (dining, shopping, travel).

Tracking these basic living expenses has become easier and more streamlined with the help of account aggregating software and mobile apps. These tools help simplify the process of tracking activity across multiple accounts and maintaining a household budget.

Life Happens – Irregular Expenses

A plan can be thrown off when expenses come up that are not known ahead of time. These “life happens” moments can and should be planned for. An emergency savings fund can ease the pain of these inevitable instances. Other longer-term expenses, such as a new vehicle purchase, college savings for a child or an annual family vacation, should be built into your monthly expenses as part of the spending plan. This, in most instances, will avoid unnecessary debt financing, which is of particular importance in your retirement years.

Get Started

The most effective spending plans allow you to clearly identify opportunities to save more or spend less. Whether it be through retirement plan contributions, debt consolidation or setting a budget, spend some extra time this month focusing on your spending plan and see where you can make some positive changes. As always, we are here to help with this very fluid, ongoing process that will go a long way in helping achieve your financial goals.

Elevate Your Trajectory

Don't wait another day to build a successful, secure future with Strategic.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

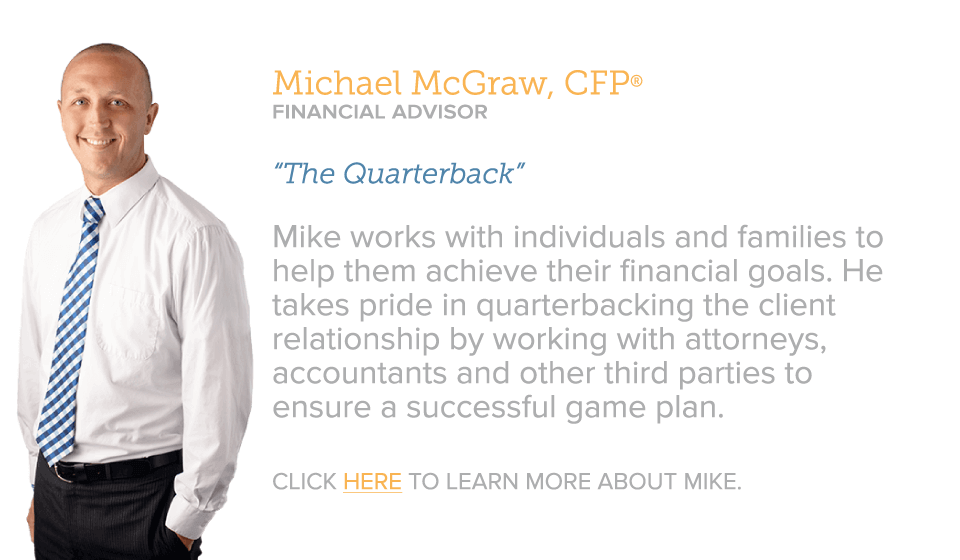

Michael McGraw

Michael McGraw