2018: Year in Review

A Year of Highs and Lows (and Highs and Lows)

2018 was a year of contrasts. The S&P 500 was on a tax cut high in January, jumping up 8%, only to fall over 10% by mid-February. The market then ground out 15% returns through September, before giving it all back and then some by year-end. There was money to be made this year by the mythical “market timer” who can accurately see into the future. For the rest of us living in the real world, where market timing is a proven long-term losing strategy, we were content to enjoy the ride knowing that our clients are in well-diversified portfolios grounded in Quality and Value that will survive the inevitable downturns and should flourish when markets rebound. Investing is not about trying to time the peaks and troughs of the market, but rather about taking on an appropriate level of market risk and having the resolve to stick to the plan throughout the market highs and lows.

A Litmus Test of a Year

This year’s market volatility is a departure from the relative calm of 2016 and 2017 which saw unusually consistent market advances. The ups and downs of 2018 are understandably frustrating for investors but are not unusual. Equity markets are inherently risky in the short term, and holders of stocks should expect from time-to-time to experience sizeable declines. Treat this year as a Litmus test. If the poor performance of stocks was too uncomfortable for you as an investor in 2018, then it is likely that you are taking on too much risk. That is not to say we are recommending clients de-risk — quite the contrary. The decline in stocks will have reduced equities in the average portfolio, and we see now as an attractive opportunity to rotate some fixed income assets back into equities which are inherently cheaper than they were just a few months ago. All else equal, investors should be adding to risky assets like stocks when the market declines, not running for the stability of fixed income. As we outlined in our note last week (Why We are Buying (Reprise)), our preferred asset class to add to is small-cap equities.

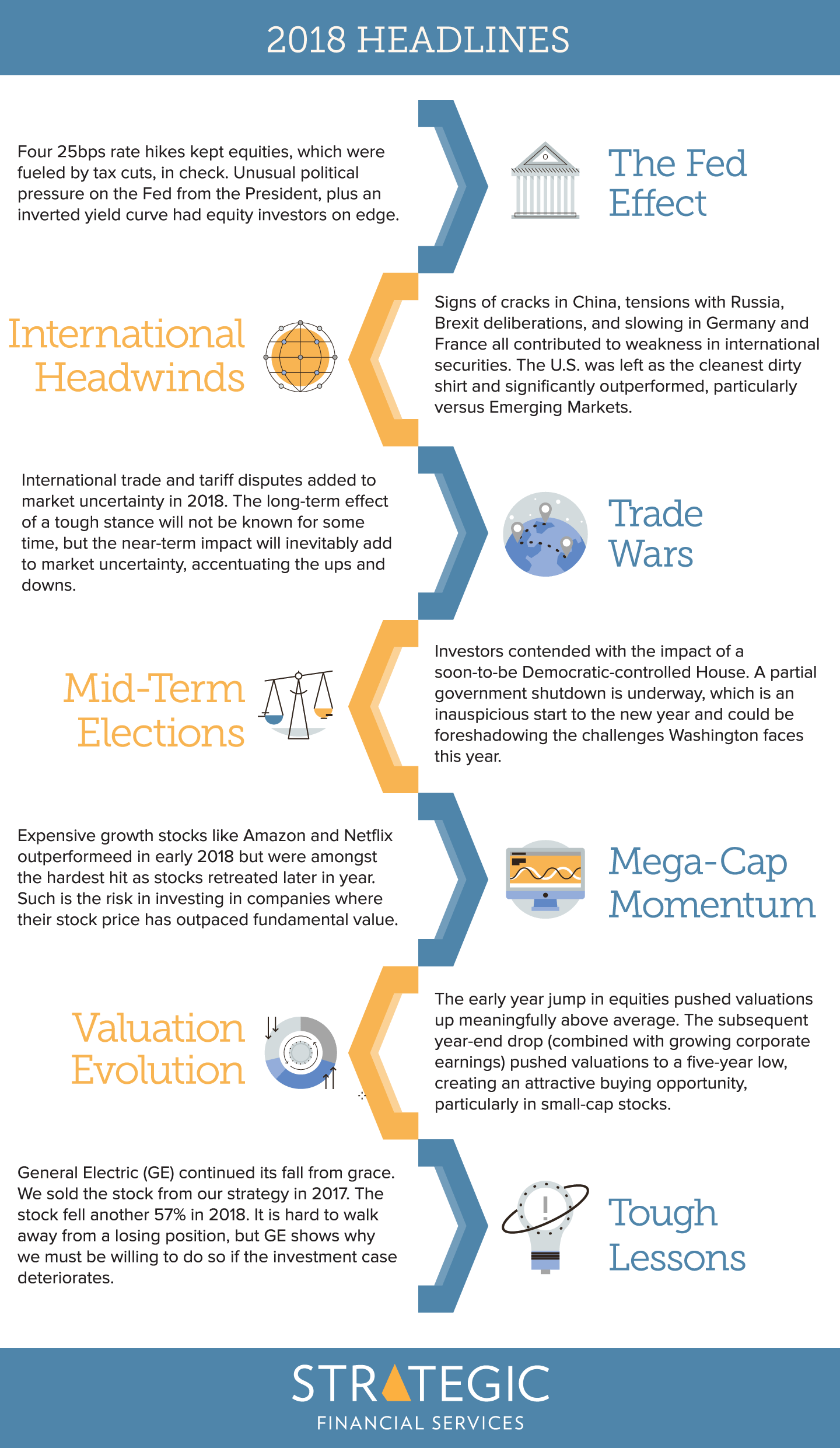

Below we summarize some of the major events of 2018 that impacted portfolio investment performance.

We enter 2019 with stock valuations reset to an attractive level, but with uncertainty elevated. As investors, we cannot control market fluctuations. So, rather than concern ourselves with where the markets will move next, we continuously seek to identify the most attractive exposure to the markets today. When they inevitably advance, our clients should be well-positioned to enjoy the upside. Our approach is not flashy, nor should it be. In the words of Nobel Prize-winning economist Paul Samuelson, “Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

On behalf of the entire Strategic team, I would like to thank you for entrusting your financial future to Strategic. We wish you a New Year where every day brings you closer to your ideal life.

Sincerely,

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters