2019: Year in Review

One for the Books

2019 is one for the books. The S&P 500 finished the year up over 30%. While U.S. large caps stocks were the star this year, most other equity asset classes (Small Cap, Emerging Markets, Developed International) all enjoyed double-digit returns. Even securities we hold for protection, like bonds and gold, produced above-average positive returns. Are 30% returns unusual for stocks? Looking back over 150 years of S&P 500 data, 30% returns is in about the 90th percentile, meaning we can expect such a year about once a decade. So, enjoy it, but do not get used to it.

Of course, prudent investors would not have seen anywhere near 30% returns in their portfolio if they were adequately diversified. Bonds, international exposure, and gold are all essential contributors to a well-diversified portfolio and lagged U.S stocks. That is okay. By definition, a portfolio will always have a best and worst performer. Each holding is deliberate and helps provide a long-term return at a level of risk that is appropriate.

A Lesson in Patience

Each year provides a fresh opportunity to learn from history. This year, the lesson is patience. Think back to the end of 2018. Heading into Christmas, stocks had fallen about 20%, and investors were on edge. To calm frayed nerves, we published a piece laying out the case for buying into the decline (Why We are Buying (Reprise)). The message was, “stay invested.” Market declines should not be feared; if anything, they are opportunities. We did not have a crystal ball, and the market could have fallen further, but it did not. In fact, most of this year’s gains occurred in the first two months of the year! Investors that stayed the course enjoyed a once in a decade rally. Patience is an essential virtue for investors.

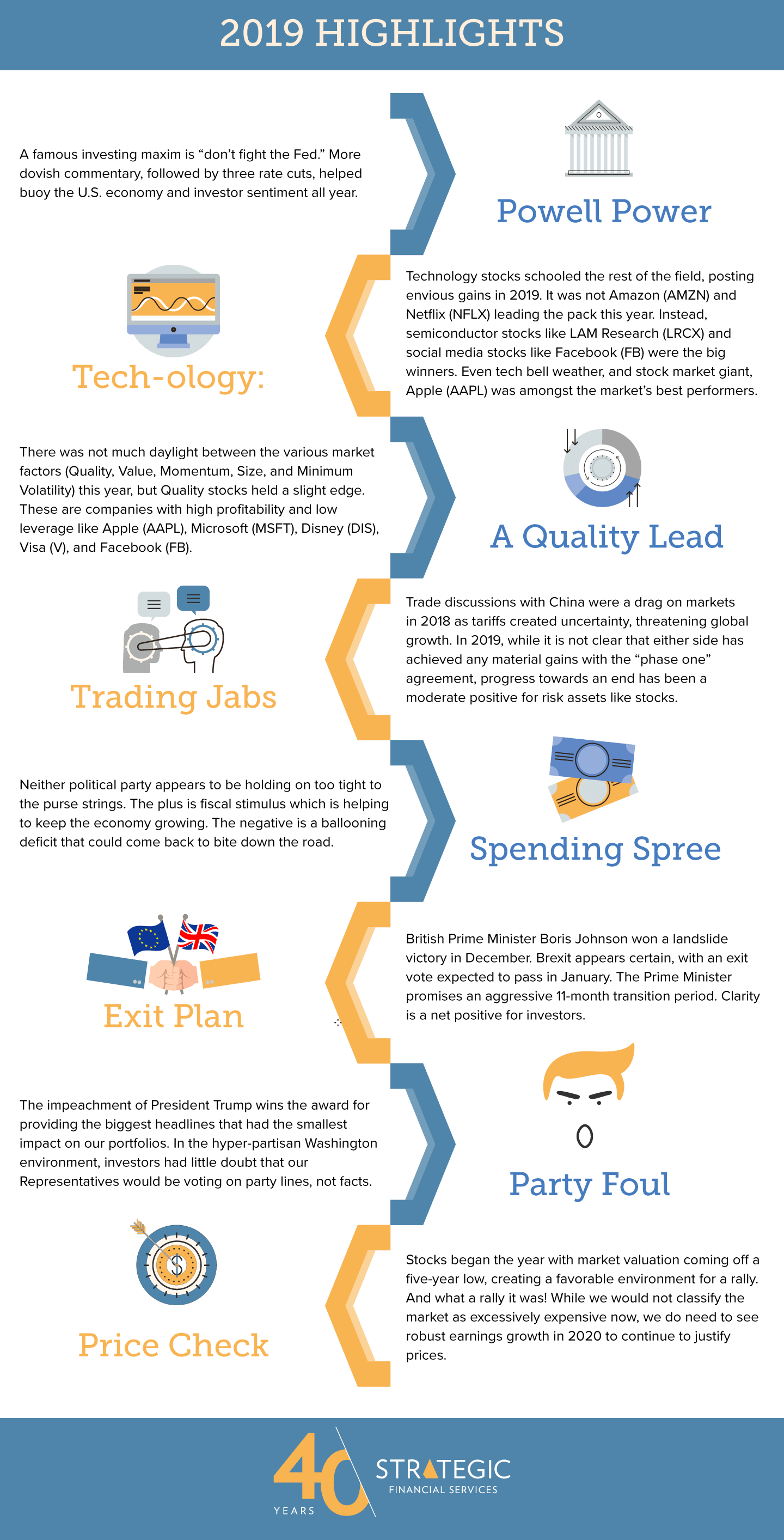

So, what helped shape this year’s banner returns? Below, we summarize some of the events of 2019 that impacted investor sentiment over the past year.

After a year like 2019, the obvious question is, “where to from here?” Will stocks give back recent gains? Will the rally maintain momentum? Markets are notoriously difficult (perhaps impossible) to predict, and unfortunately, we seem to have misplaced our crystal ball. Lucky for us, we do not believe in market timing. Yes, stocks were up 30% last year, but we cannot let recency bias taint our decision-making. Just look at what happened in the mid-1990’s. Stocks rose annually 31%, then 23%, then 26%, then 29%, then 12%! The economy is still robust, and the Fed remains accommodative, which is a powerful combination for investors. With that said, we also cannot ignore that with higher stock valuations comes the potential for higher market volatility. As such, we have begun adding some “low volatility” equity exposure to our portfolios. We see this exposure as helping us participate if the party continues in 2020, but at the same time helps protect on the downside should stocks stumble.

On behalf of the entire Strategic team, I would like to thank you for patronage and wish you all the best for a bountiful New Year.

Sincerely,

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters