Your investment portfolios deserve the attention and depth of experience offered by our dedicated in-house investment team. With expertise in equities, fixed income, asset allocation and valuation, we have built disciplined and repeatable investment solutions engineered to help you reach your goals.

Whether you are a large institution, a high net worth individual or just beginning your investment journey, we have a solution catered to your unique financial needs. As your circumstances change, we change with you; always ensuring that your investment plan remains focused squarely on your objectives.

The Strategic Advantage

- Risks, costs and taxes controlled through in-house active management.

- Diversification achieved through complementary and cost-efficient passive funds.

- Securities selected using our rigorous fundamental processes.

- Transparency provided above and beyond the industry standard.

- Access provided to our investment decision makers.

The Strategic Philosophy

In our experience, an emphasis on Quality, Value and Diversification supported by the fundamental research and macroeconomic analysis of our in-house investment team, is the best foundation to enable your portfolio to reach its full potential.

We do not subscribe to the narrow view that there is a “better” approach when it comes to active vs. passive investing. Rather, we believe that clients benefit most when portfolios are constructed using the best attributes that each approach has to offer.

Quality

A high standard of operational and financial excellence

A portfolio with quality at its core is designed to help you sleep at night even in times of turbulence. Factors that help form our view of an individual security’s quality include: high and consistent returns, proven management, strong balance sheet, exposure to a positive long-term secular trend, consistent economic value creation, growth, a defensible business model and financial transparency. For passive investments, we focus on the four P’s: People, Process, Performance and Proven.

Value

Where the market place provides a reasonable margin of safety

Cheap is not the same thing as value. We consider value relative to quality. The higher the quality of the investment, the more we should be willing to pay to obtain it. It is our goal to identify those securities where the market is currently undervaluing the quality of the business.

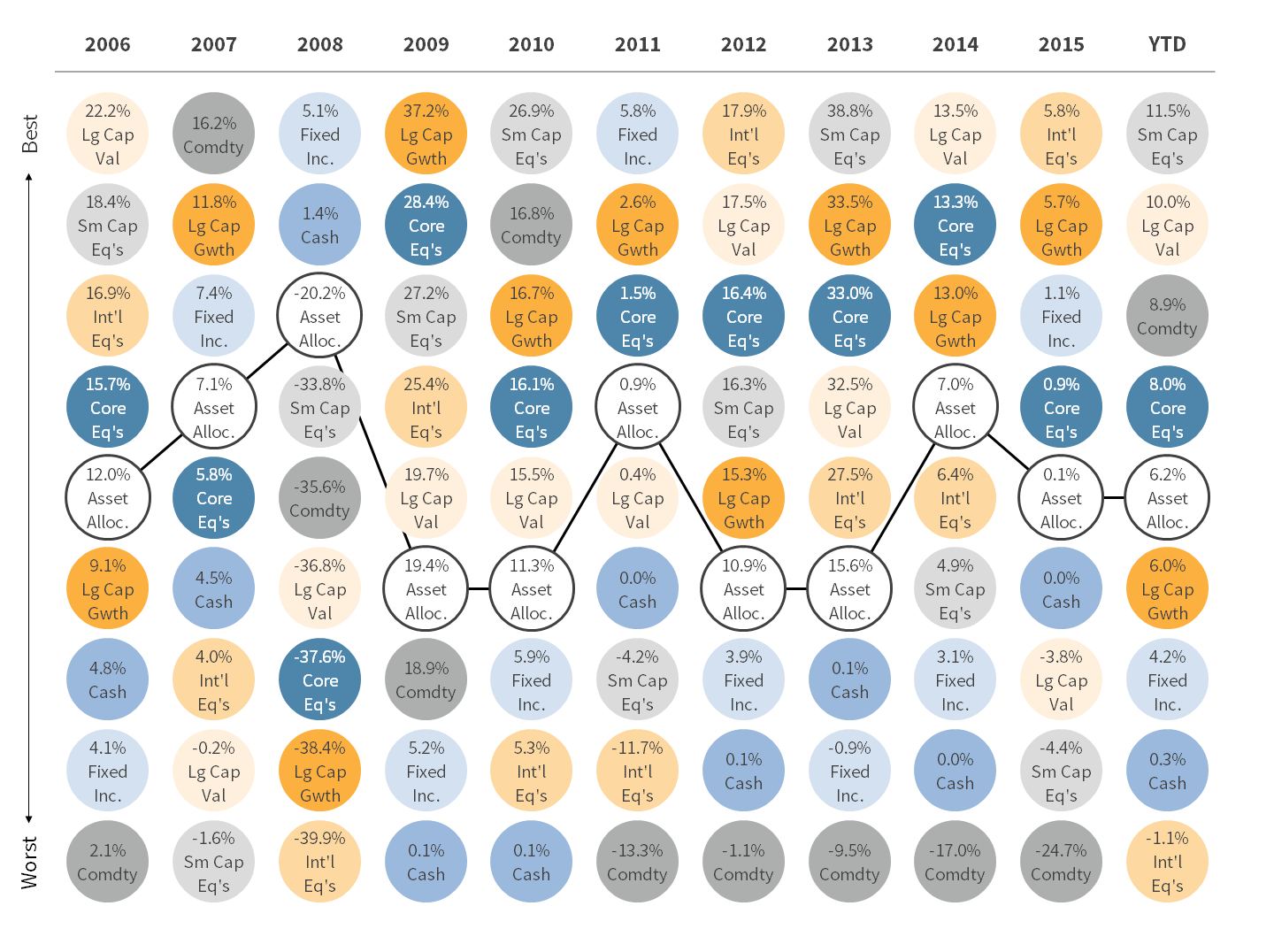

Diversification

A systematic source of risk management

Where appropriate, we combine active in-house management of your core portfolio with the diversification benefits of complementary, passive funds. The result is a high-quality, cost-effective solution catered to the unique needs of your strategic vision. A well-diversified asset allocation, as shown below[i], helps your portfolio avoid the volatility of the individual underlying markets.

[i]Based on a 70/30 allocation of equities and fixed income. As of March 31, 2016.

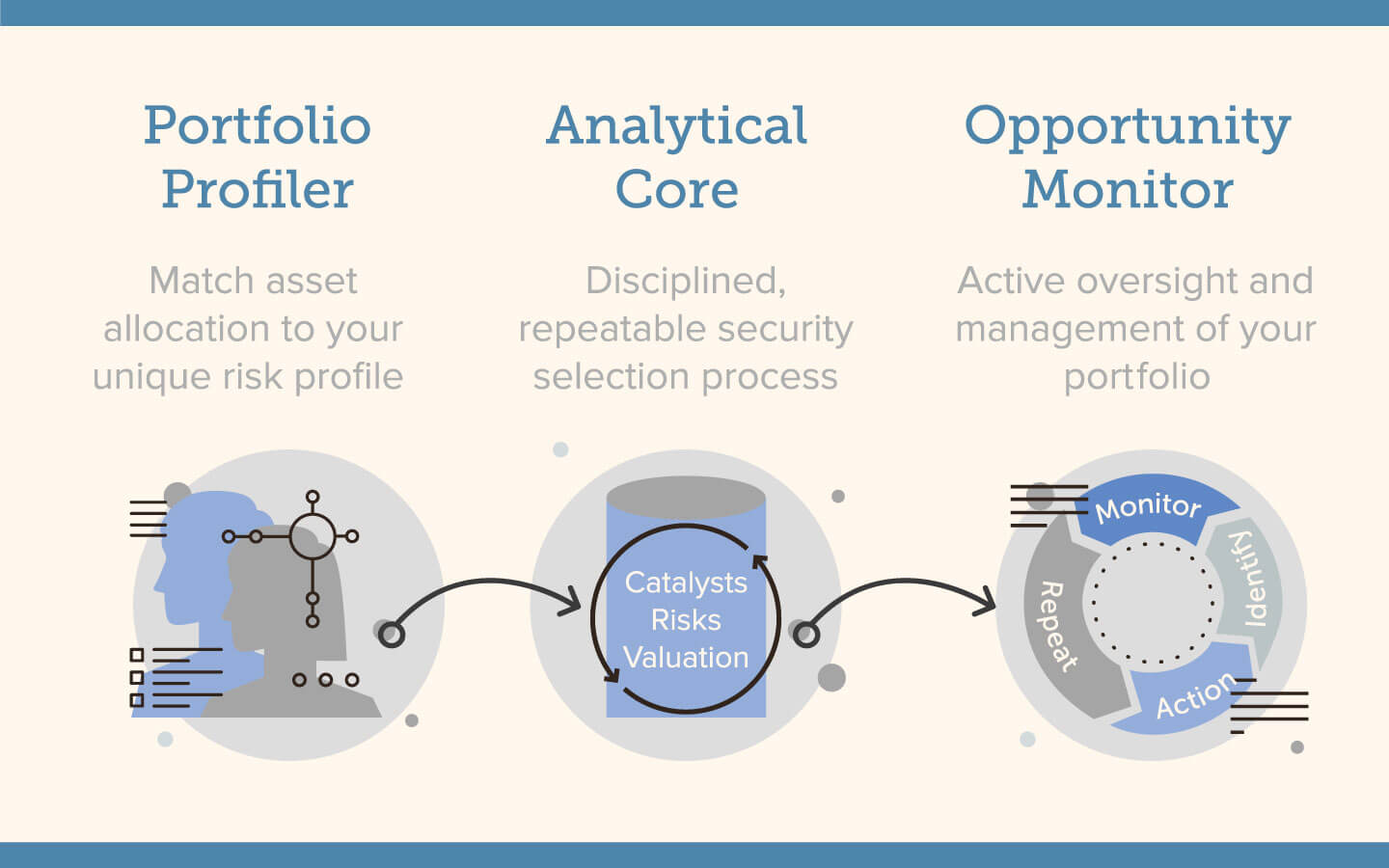

The Strategic Investment Process

A key to life-long portfolio growth is a well-constructed investment process that filters out the day-to-day noise, and maintains a steadfast focus on your long-term financial goals.

Portfolio Profiler

We marry our comprehensive understanding of your unique needs, risk tolerance and tax sensitivity with our work on optimal asset allocation to create the framework for your Strategic portfolio. Asset allocation is a dynamic process. We constantly compare our long-term view of optimal portfolio investment allocation with our current analysis of asset class valuations and macroeconomics, to arrive at our target allocation. Your portfolio is a reflection of this dynamic process.

Analytical Core

Our in-house team of investment professionals hand-picks the investments in your portfolio using a disciplined and repeatable security selection process. For qualified clients, the core of your portfolio is comprised of individual equity and fixed income securities actively managed by the Strategic Investment Team. Diversification is typically achieved using low-cost, passive or near-passive instruments which are hand-picked to ensure overall portfolio alignment.

Each Strategic holding must pass through the analytical rigors of our Catalysts, Risks and Valuation (CRV) process. For a stock to enter the portfolio, the Investment Team must be satisfied with the answers to the following questions:

- What is going to cause the value to be unleashed?

- What could potentially derail the investment?

- Does the price provide a reasonable margin of safety?

Once this analysis is complete, the investment idea is presented to the entire Investment Committee for a 360° review. At the completion of the evaluation, a decision is made whether or not the investment should be added to our pipeline of portfolio ideas.

Opportunity Monitor

Your Strategic advisory team will ensure that we always have a complete understanding of your goals and risk tolerance. The investment team has developed a consistent and continuous review process that will keep your portfolio aligned with these long term goals.

Your investments are well looked after. We systematically:

- Check that your asset allocation is aligned with your risk tolerance and goals.

- Identify opportunities to capture tax efficiencies.

- Monitor asset class valuation for opportunities to tweak broad allocation weightings.

- Monitor fundamentals and valuation of individual investments for opportunities to alter holding size.

- Monitor valuation of pipeline securities for opportunities to add them to the portfolio.

- Rebalance the portfolio back to target allocations as necessary.

In short, we do the worrying about your investments for you, so that you can get on with the pursuit of your ideal life.