The Ride of a Lifetime

The S&P 500 ended the week slightly higher, but the ups and downs were reminiscent of a roller coaster. While it is easy to get caught up in the emotions of the ride, remember that the track is long and over time has tendency to go up more than down.

Market Review

Contributed by Doug Walters

Hold on Tight

If you are feeling a little nauseous from the market undulations this week, you are not alone. While the S&P 500 ended the week slightly up, thanks in part to Apple (APPL), the daily volatility was impressive. The steep drop the previous Friday was followed by a week of ups and downs that were just big enough to take your breath away.

- The market roller coaster was propelled by investors’ incessant focus on the Federal Reserve’s upcoming September rate decision. As the Fed entered their one-week quiet period ahead of next week’s decision, each word appeared to take on increasing importance.

- While the prevailing wisdom is for no rate change in September, there have been plenty of data points supporting an early raise, such as the positive wage trends we discuss in our Economics section.

Keeping Emotions in Check

When you are on a roller coaster it can be an all-encompassing emotional experience. Anxious anticipation builds as you climb higher and higher, while fear consumes you as your train begins to descend. Such emotions are often felt by investors as the market rises and falls. Unfortunately, when it comes to investing, emotions are often our worst enemy.

- We regularly hear from investors wanting to reduce their exposure to equities because they are “near an all-time high”. Likely, these are emotions, rather than logic speaking. As tempting as it is, market timing is a proven fool’s venture on which few are likely to succeed.

- At Strategic, we recognize that the daily, weekly, quarterly, and even yearly ups and downs are a mere sideshow in a much longer ride. Our disciplined and repeatable process is designed to withstand this short-term volatility and help you reach your long-term financial goals.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.5 | 4.7 |

| S&P 400 (Mid Cap) | -0.5 | 8.8 |

| Russell 2000 (Small Cap) | 0.5 | 7.8 |

| MSCI EAFE (Developed International) | -2.5 | -3.0 |

| MSCI Emerging Markets | -2.6 | 11.5 |

| S&P GSCI (Commodities) | -1.9 | 11.7 |

| Gold | -1.3 | 23.3 |

| MSCI U.S. REIT Index | -0.8 | 6.8 |

| Barclays Int Govt Credit | 0.1 | 2.6 |

| Barclays US TIPS | -0.1 | 4.8 |

Contributed by Michael Leist

Editors Note: Strategic Webinar this Wednesday @ 12PM

Speaking of Emotions – In partnership with the Central New York Business Journal, Doug Walters, CFA and Aaron Evans, CFP, CFA, will be hosting a live Webinar this Wednesday at 12:00PM. The presentation will be an interactive and entertaining look at how human behavior can lead to poor investing decisions. Why is it so hard to simply buy low and sell high? Doug and Aaron will bring to light some shortcomings of the average investor, and provide practical advice on how to overcome them.

To register please click here

Economic Commentary

2015 Economic Growth

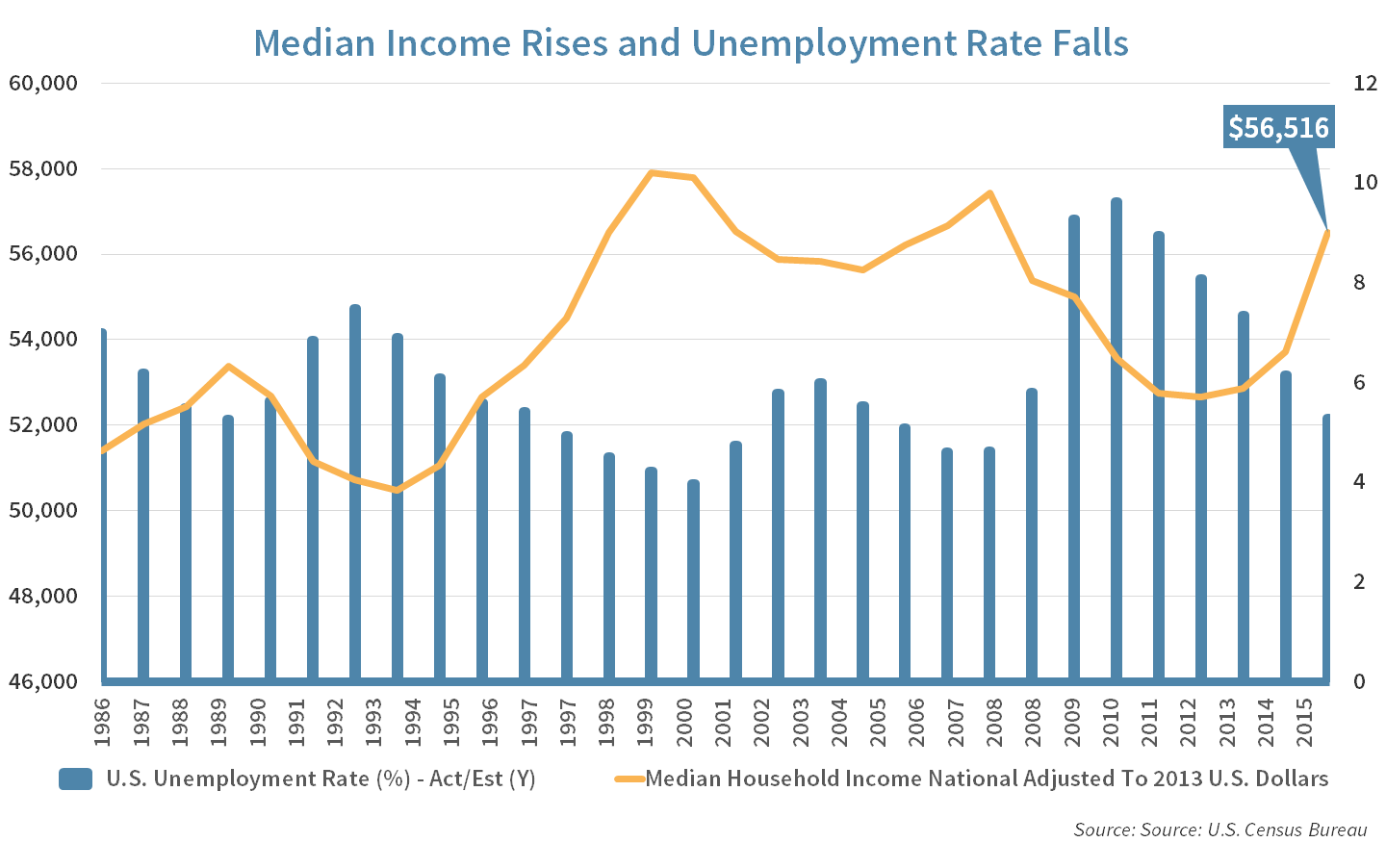

The Census Bureau announced this week that median household income surged 5.2% last year to $56,516, the highest it has been since 2007. The Bureau also reported other encouraging news of, 1) three and a half million less people in poverty and 2) four million people fewer without health insurance. A tightening labor force with unemployment now down to 4.9% from a peak of 10% in 2009 has been driving income levels higher. The American worker is approaching his or her pre-recession earning power.

The Northeast and West regions of the nation have the highest median incomes followed by the Midwest and then the South last. That said, the South region has the highest income growth rate with Southern cities of Memphis, Nashville, Birmingham, Orlando, Austin, and Raleigh growing rapidly. Highly educated millennials are choosing to live in cities instead of suburbs which is causing suburban median incomes to lag. The wealthiest metropolitan areas in the country in terms of median income are San Jose ($102k), Washington D.C ($93k) and San Francisco ($89k).

The Northeast and West regions of the nation have the highest median incomes followed by the Midwest and then the South last. That said, the South region has the highest income growth rate with Southern cities of Memphis, Nashville, Birmingham, Orlando, Austin, and Raleigh growing rapidly. Highly educated millennials are choosing to live in cities instead of suburbs which is causing suburban median incomes to lag. The wealthiest metropolitan areas in the country in terms of median income are San Jose ($102k), Washington D.C ($93k) and San Francisco ($89k).

Overall, the report is very positive and demonstrates the economic progress that has been made in the aftermath of one of the largest recessions in decades. Wage and employment level increases appear poised to continue to fuel the recovery of our heavily consumer-based economy.

Week Ahead

Federal Expression

The Federal Reserve’s Open Market Committee will meet on Tuesday and Wednesday. After the conclave of bankers, Chairwoman Yellen will hold a news conference on Wednesday afternoon.

- Markets are expecting the Fed to leave interest rates unchanged. Bond markets are implying a 22% chance of rate hike in September, based on Bloomberg’s implied probability measure. Either way there should be little action early in the week, with elevated volatility Wednesday afternoon no matter what the FOMC decides.

- The Fed’s release will surely be more anticipated than the first quarter earnings report of FedEx Corp. (FDX) or Bank of Japan’s board meeting.

Getting ready for the next race

Thursday will begin the next Fed Watch, with Weekly Jobless claims, Chicago Fed Activity Index, Consumer Comfort Index, and Kansas City Fed’s Manufacturing report all due out Thursday.

- Obviously Wednesday’s rate decision will determine whether we start looking for another hike or if the next Fed meeting will be “the one”.

- We would expect that whether September rate hike occurs or not, October will be off the table until after the Presidential election.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Take it or leave it

US equities finished higher for the week with Technology leading the pack. REIT’s are down for the second week and most likely are responding to interest rate moves. Despite the volatility, most investors expect no rate hike next week from the Fed and this week’s loser have a potential to become next week winner if the Fed does leave rates unchanged.

Harvest

Earnings season will start on October 10th, as the last days of harvest are upon us. Judging by the positive S&P500 earnings revisions, analysts are expecting a stronger 3rd quarter. This earning’s season will give us a good sense of the stability of earnings and companies’ outlook heading into year end and the all-important holiday shopping season.

- Economic data has been improving and it only make sense that some of that positive economic development should make its way into Corporate America’s bottom line. On this note, we continue to prefer domestic equities, leaving our asset allocations unchanged.

STRATEGIC Growth

Technically speaking

The Technology sector was a clear leader this week. Even one not so hot earnings report could not derail the strong week. The not so hot report came from…

- Oracle Corp. (ORCL) the database software giant missed expectations both on the top and bottom line. A Wall Street analyst was quick to point out that the 2017 cloud revenue growth will offset licensing revenue decline. Evidence is the 59% growth in total cloud revenue. CEO Mark Hurd, had gloated that the company added more customers in the quarter than a rival Workday Inc. (WDAY) has in its history.

STRATEGIC Equity income

Juicy Apple

The Utilities sector had an impressive week, even without a significant move lower in interest rates. The Technology sector though finished at the top, thanks to two companies…

- Apple Inc. (AAPL) started selling its newest version of the iPhone this week. The company decided to not release first week sales as they have in the past, which forced investors to look to cellular phone retailers for color. The retailers indicated strong pre-orders.

- Intel Corp. (INTC) the microchip manufacturer decided to increase its third quarter guidance. The company adjusted its revenue outlook higher by about $600 Million. The company noted that personal computer demand was turning positive. Additionally, a tear down of the new iPhone 7 showed there are two Intel RF transceivers used.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters