Should I Stay or Should I Go?

Stocks lost ground this week as all eyes were on the Fed and the pending British EU exit referendum. The clash between “Leavers” and “Remainers” is heating up, but despite recent polls, we believe evidence points towards Britain remaining in the EU.

Market Review

Contributed by Doug Walters

Winning the Race

The Fed opted to leave rates on hold this month, despite previous indications that June was in play for a rate rise. This surprised no one given the weak May jobs report and deteriorating international sentiment ahead of the Brexit vote. In addition, they lowered expectations for the path of future rate increases, believing that slower and steady will win this economic race.

- While low rates are meant to be a positive for economic activity, the market was unimpressed, with the S&P 500 down on the week. Investors were perhaps hoping the Fed was seeing reasons for optimism that were not obvious to the rest of us.

Much Ado About Nothing

The market has been obsessed with the upcoming Brexit vote next week, where Britain will decide whether or not it will exit the European Union. Opinions on the impact of an exit are as varied and disparate as the countries and cultures that make up the EU. The equity markets, however, have a clear opinion. European equities have lagged this year, and Financial companies like Deutsche Bank and Credit Suisse have seen their market caps cut in half. But is an exit likely?

- A recent poll (by Ipsos MORI) finds 53% in favor of leaving while 47% prefer to remain. Yet the poll is misleading as it excludes the nearly 20% of those that are undecided. It is these undecided voters that will ultimately determine the outcome of the referendum.

- This bodes well for those in the “Remain” camp. Indecision is driven by fear of the unknown. We are wired to avoid situations where we do not fully understand the consequences. Better the devil you know than the devil you don’t. For this reason, undecided voters are likely to vote in favor to stay (and it would not be surprising to see some “Leavers” get cold feet in the voting booth).

- Popular UK betting sites provide support to this view. Based on the current betting odds for Brexit, the probability for leaving is about 35% compared to 65% for remaining. Based on this, Brexit may prove to be much ado about nothing.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.2 | 1.3 |

| S&P 400 (Mid Cap) | -1.3 | 5.8 |

| Russell 2000 (Small Cap) | -1.7 | 0.8 |

| MSCI EAFE (Developed International) | -4.4 | -8.6 |

| MSCI Emerging Markets | -2.9 | 0.7 |

| S&P GSCI (Commodities) | -3.5 | 18.0 |

| Gold | 1.8 | 22.2 |

| MSCI U.S. REIT Index | 1.0 | 7.0 |

| Barclays Int Govt Credit | 0.2 | 2.8 |

| Barclays US TIPS | -0.4 | 5.2 |

Economic Commentary

The New Normal

Although coined by Economist Mohamed El-Erian back in 2009, Fed Chairwoman Janet Yellen used the term “the new normal” when announcing her decision to keep interest rates level this week. Many economists had previously predicted multiple interest rate hikes this year, but may now be changing their calculus. Yellen is concerned with a slow labor market as nonfarm payroll numbers came in very weak this month. She is less concerned with the low inflation rate of 1.1%.

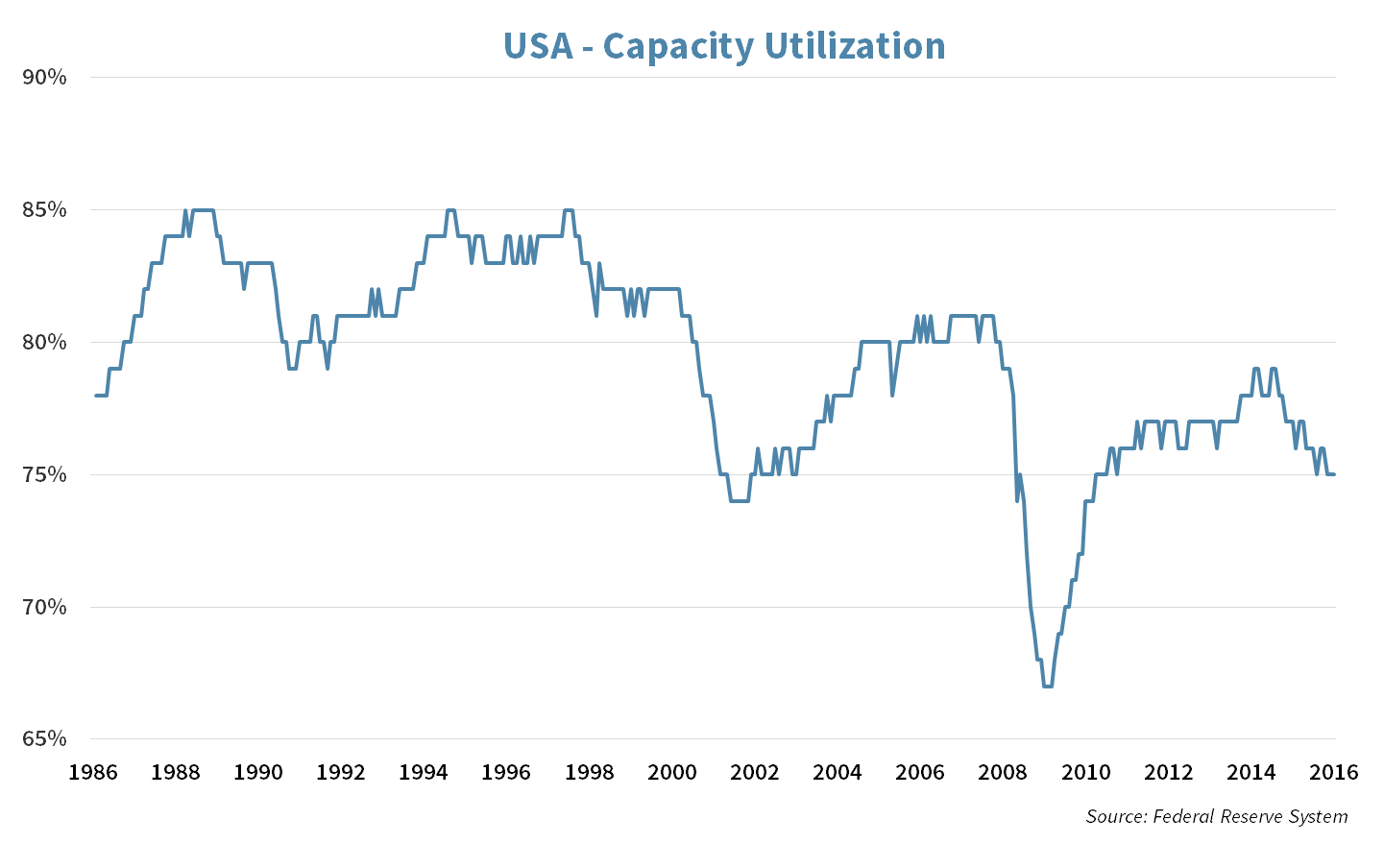

A further warning sign on the economy is the declining capacity utilization rate. This metric measures how much slack exists in US plants and factories. The more slack that exists, the less likely corporations will be to commit capital to future production.

Causes of the drop in capacity utilization include:

- weak global demand

- a strong dollar weighing on exports, and

- an overbuild of capacity due to easy money policies.

That said, companies have recently trimmed stockpiles of their inventory on hand. If demand does pick up, utilization rates could tighten quickly as companies would be forced to rapidly increase production.

Given these macro-economic dynamics, we believe it is important to focus on Industrial companies that have quality balance sheets, strong management teams and exposure to growing end markets.

Week Ahead

Should I Stay or Should I Go?

That is the famous question asked by the English band “The Clash” and the exact question facing voters in Britain next week when they decide whether or not they will continue the nation’s membership in the EU. This has popularly been known as the “Brexit” vote.

- Voting will happen Thursday and polls between “Leave” and “Remain” have recently been too close to call.

- Markets have been volatile heading into the vote and investors will look for stability after the vote has been decided.

More Negative Rates?

The world economy has been on alert as the nations of Japan, Germany and Switzerland all saw 10-year bond yields dip into negative territory.

- Rates around the world, including in the US, have seen downward pressure on yields due to this realitive pressure.

- A “Remain” Brexit result could help alleviate some of this downward pressure in the weeks to come.

U.S. Open and Father’s Day

The U.S. Open golf tournament is underway and will conclude on Father’s Day.

- Strategic’s Holding Nike (NKE) will be giving all of its sponsored golfers personalized golf balls, with kid’s/father’s initials on each, for use in the tournament.

- Strategic would like to wish happy Father’s Day to all the Dads out there.

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset Allocation

Bonding with Gold

The yellow metal hit a new 52-week high hovering near 25% gains since mid-December. At the same time fixed income markets hit multi-year highs as yields around the globe remain low and lower with no increases in sight.

Tea time

Equity markets have been shifting focus between central bankers and British voters with risk aversion being the dominant trend lately. The European Union has been hit harder than most other regions although dollar weakness has softened the blow somewhat.

Tug Boats

Portfolios generally remain on course with the recent ebb and flow of the markets nudging down equity allocations.

Strategic Growth

Up in the Cloud

In a down week, the financial and tech sectors were the big laggards.

- Oracle Corp. (ORCL), the database software giant, reported an in-line quarter, but they reported an expectation of a 65% jump in FY ’17 cloud revenue. The company also expects total revenue to be up 2-5% year over year next quarter. Lastly, the company hinted that the currency concerns that have weighed on earnings in the past may no longer be a concern.

Strategic Equity Income

Linking-Up

The consumer discretionary sector joined the telecom and the utilities sectors at the top of the heap. Technology and financial sector found a place at the bottom. In other strategy news…

- Microsoft Corp. (MSFT) made big news by entering the social networking service space by shelling out $26.2 Billion for LinkedIn (LNKD). The deal will be funded with debt and it will not prevent the company from completing its $40 Billion share buyback program by year end. Instantly Moody’s credit rating agency put the company’s AAA bond rating on review for a downgrade. Rumors circulated that Salesforce (CRM) was looking to buy the social networking company, which probably forced Microsoft’s hand.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters