Holding Pattern

We came close to hitting a new all-time high in the S&P 500 this week, a fact we expect many find surprising given all of the negative news flow. The unfortunate reality is that investors have been in an 18-month holding pattern.

Market Review

Contributed by Doug Walters

Impenetrable Ceiling

After an excellent start to the week, U.S. equities ended modestly down. You would be forgiven for being surprised that the S&P 500 was threatening to break an all-time high earlier in the week. After all, the news flow has been predominantly negative for some time, with focus on: slow GDP growth, struggling international economies, a contentious battle for the White House, and the potential exit of Britain from the EU.

- While “an all-time high” sounds impressive, the catch is that the market has hit this ceiling numerous times in the last 18 months. Therefore, investors in equities have seen little improvement in their stocks since the beginning of 2015.

- In addition, wage inflation remains subdued. The result is little change in the Consumer’s ability to spend for the past year and a half. The lone bright spot (as discussed last week), is rising house prices.

Glass Ceiling

The presidential race continues to break new ground on numerous fronts. Secretary Clinton’s presumptive nomination is historic, but now we are ready for some more serious and substantive debate on how the candidates plan to keep the U.S. economy growing.

- It is premature to try to predict what the impact on investments will be. Huge questions still abound, like: What exactly is Trump’s agenda? Will Sanders imprint his stamp on Clinton’s policies? Will the Independent candidates play a role? Are there still more contenders to emerge?

- In such an environment, we believe our long-term approach and focus on Quality is well-placed to perform regardless of the election outcome. We stand poised to take advantage of any valuation opportunities that the coming politically-charged months present to us.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.1 | 2.6 |

| S&P 400 (Mid Cap) | -0.1 | 7.2 |

| Russell 2000 (Small Cap) | 0.0 | 2.5 |

| MSCI EAFE (Developed International) | -1.8 | -4.4 |

| MSCI Emerging Markets | 2.6 | 5.4 |

| S&P GSCI (Commodities) | 3.7 | 24.4 |

| Gold | 2.4 | 20.0 |

| MSCI U.S. REIT Index | 0.2 | 5.9 |

| Barclays Int Govt Credit | 0.3 | 2.6 |

| Barclays US TIPS | 0.7 | 5.6 |

Economic Commentary

Slower Growth

The World Bank lowered its projection for 2016 world growth this week, estimating the global economy will grow at 2.4%, down from their January estimate of 2.9%. The main factors dragging down world economic growth are:

- Lower commodity prices that have hurt exporting nations such as Brazil and Chile.

- Slower growth in countries that previously grew at unsustainable rates such as China.

- Lower demand from developed nations, as consumers pay down debt instead of consume.

- Cuts in capital expenditure budgets from companies in developed nations.

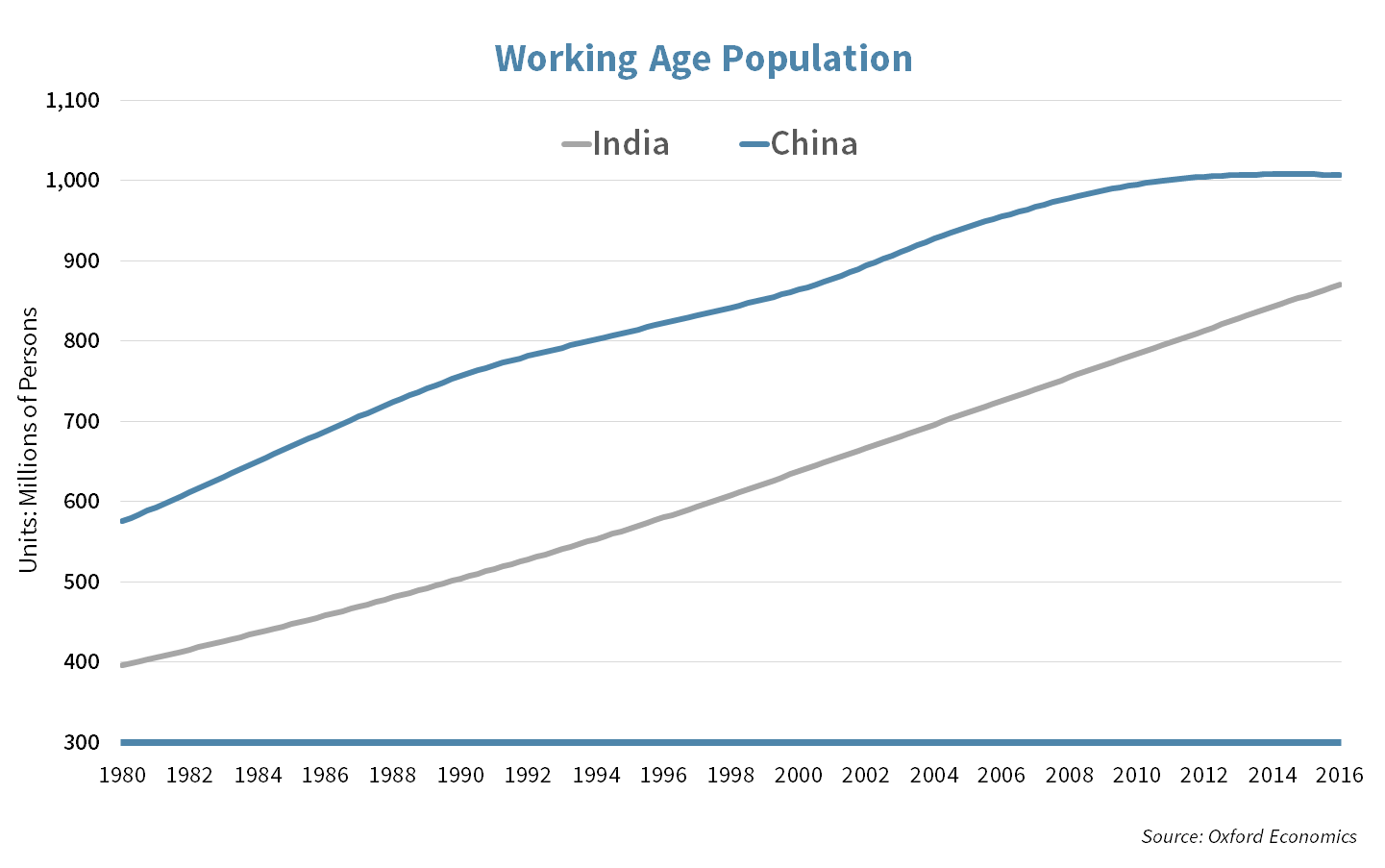

Chinese Slowdown

Although there are 1.4 billion people in China, their working age population actually declined last year which bodes poorly for economic growth. Their government realizes this problem and is addressing it by reversing their one child policy. Chinese debt levels are also problematic and have increased substantially. High debt levels can lead to an economic slowdown as consumer spending is diverted to debt repayments.

Indian Exception

India has bucked the trend of slower growth and has been resilient due to a talented and increasing working age population. Global companies from IKEA to Amazon are seizing on this growth by investing in the country with US companies alone having $45 billion of projects in the pipeline.

While India has been a better investment than China for stockholders in recent years, neither has matched the performance of U.S. equities, where quality continues to shine.

Week Ahead

Changes ahead for Apple?

Strategic holding Apple (APPL) will be hosting their annual Worldwide Developers Conference in San Francisco starting Monday. Investors hope to get a sneak peek at potential product additions and changes.

- Updates are expected to be announced on products such as the next iOS 10 for operating system, Apple Pay and the long awaited upgrade to their voice assistant Siri (in response to competition from Microsoft and Google).

- New products are also rumored to be on showcase with some expecting an announcement regarding the next generation Apple Watch and the release of the iPhone 7.

Oracle reports

On Thursday, Strategic holding Oracle (ORCL) will be reporting their fourth quarter and full year results.

- Investors are looking for Oracle to further this year’s gains, with a report showing that their transition to cloud services continues at an acceptably fast pace.

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset Allocation

Muted applause

Many broad measure of the bond market hit various milestones this past week. International markets touched new 52-week highs, TIPS hit a fresh 3-year high and our measure of the core U.S. market pushed to new post-crisis highs. New market highs generally are applauded and that remain true here, but the absolute gains are not eye-popping. Only international markets hit double digit gains off of recent lows. The other markets remain solidly in the single digit area of late.

With the timing of any Fed hikes an open question, the U.S. dollar has weakened giving an additional boost to international bonds. This currency impact is in addition to other concerns roiling international markets causing some European and Japanese yields to hit all-time lows. Relative value also has benefited Treasury markets as our yields can look downright “juicy” compared to other countries.

Coming off the boil

Equity markets also touched some near term highs this past week before retreating over the last two days. Large Value touched an all-time high briefly, while Small Cap popped over 25% from a February low.

Strategic Growth

All Aboard

The Energy sector was burning hot as crude prices danced around the $50 per barrel mark. Industrials joined the energy sector at the top, while Financials dropped to the bottom. In other strategy news…

- Higher crude prices helped railroad company Union Pacific Co. (UNP) and should lead to higher car loads for the company. It appears like depleted coal stockpiles and higher crop prices, should combine with some recovery in crude transports to lead to better business conditions. Rail traffic has been down 8% from the same period last year.

Strategic Equity Income

Looking for more runway

Financials felt the sting of another delay in rate increases. Utilities and REITs benefited from the same delay. In other news…

- Boeing Co.’s (BA) new defense chief Leanne Caret announced a sharper focus on its repairs and upgrade services to existing jets. This also means repurposing commercial jets for military use in order to maintain defense revenue above $25 billion annual level. A delay in KC-46 tanker for the U.S. Air Force puts some revenue recognition on delay.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters