Expect the Unexpected

Very few had predicted a Trump victory heading into Tuesday’s election, and fewer still predicted the subsequent market reaction. From panic to rally, we take a moment to untangle what was a wild week for investors.

Market Review

Contributed by Doug Walters

Make Up Your Mind

A few weeks ago, in Insights (Election Survival Guide) we made the fairly unremarkable proclamation that “nobody knows how the market will respond to the election results”. We had no idea how true this would prove. Even as the election result became certain, the market was struggling to find a consensus view. Below we recap the S&P 500’s wild ride this past week.

- The previous week: stocks fell 2% as the FBI found new information related to the Clinton server investigation

- Monday & Tuesday: stocks rose 2.6% as the FBI concluded it was not changing its conclusions on the Clinton case

- Overnight Tuesday: stocks fell 5% as a Trump victory looked inevitable

- Wednesday – Friday: stocks fully recovered from the 5% drop and added another 1.2%

There is an important lesson here. Trying to predict how investors and the market will respond to big events is an impossible task with only two potential outcomes: getting burnt or getting lucky. Our approach is to expect the unexpected, and build portfolios that can survive shocks, with an eye on long-term performance not short term riches.

Pricing Policies

So why has the market rebounded from the depths of despair Tuesday night, into positive territory? In general this is the market’s knee jerk reaction to what it believes are the likely policies of Trump and the Republican legislative majority. Some of the major policies likely driving prices this week:

- Infrastructure stimulus: This is a fairly bipartisan issue and would have likely been on either candidate’s agenda. Nonetheless, with Republicans sweeping control, the market sees a higher probability of a bill and Industrial stocks rallied.

- Deregulation: Trump has made clear that he would like to reverse some of the legislation put in place to safeguard consumers. The most obvious benefactors of this are Financials, Biotech and Pharmaceuticals. Wall Street has been under heavy regulation post the financial crisis and health care companies have come under scrutiny from the Obama administration due to rising drug prices.

- Corporate tax reform: Trump has proposed cutting taxes on corporations significantly. Lessening the tax burden across the board would provide a boost to any company paying anywhere near the current corporate tax rate.

In our Economic Commentary we discuss how these and other policies may impact inflation and growth.

“Trying to predict how investors and the market will respond to big events is an impossible task with only two potential outcomes: getting burnt or getting lucky.”

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 3.8 | 5.9 |

| S&P 400 (Mid Cap) | 5.7 | 11.8 |

| Russell 2000 (Small Cap) | 10.2 | 12.9 |

| MSCI EAFE (Developed International) | 0.4 | -4.1 |

| MSCI Emerging Markets | -0.5 | 10.3 |

| S&P GSCI (Commodities) | 2.0 | 14.3 |

| Gold | -5.9 | 15.4 |

| MSCI U.S. REIT Index | -0.5 | -2.0 |

| Barclays Int Govt Credit | -1.3 | 1.1 |

| Barclays US TIPS | -1.4 | 4.2 |

Economic Commentary

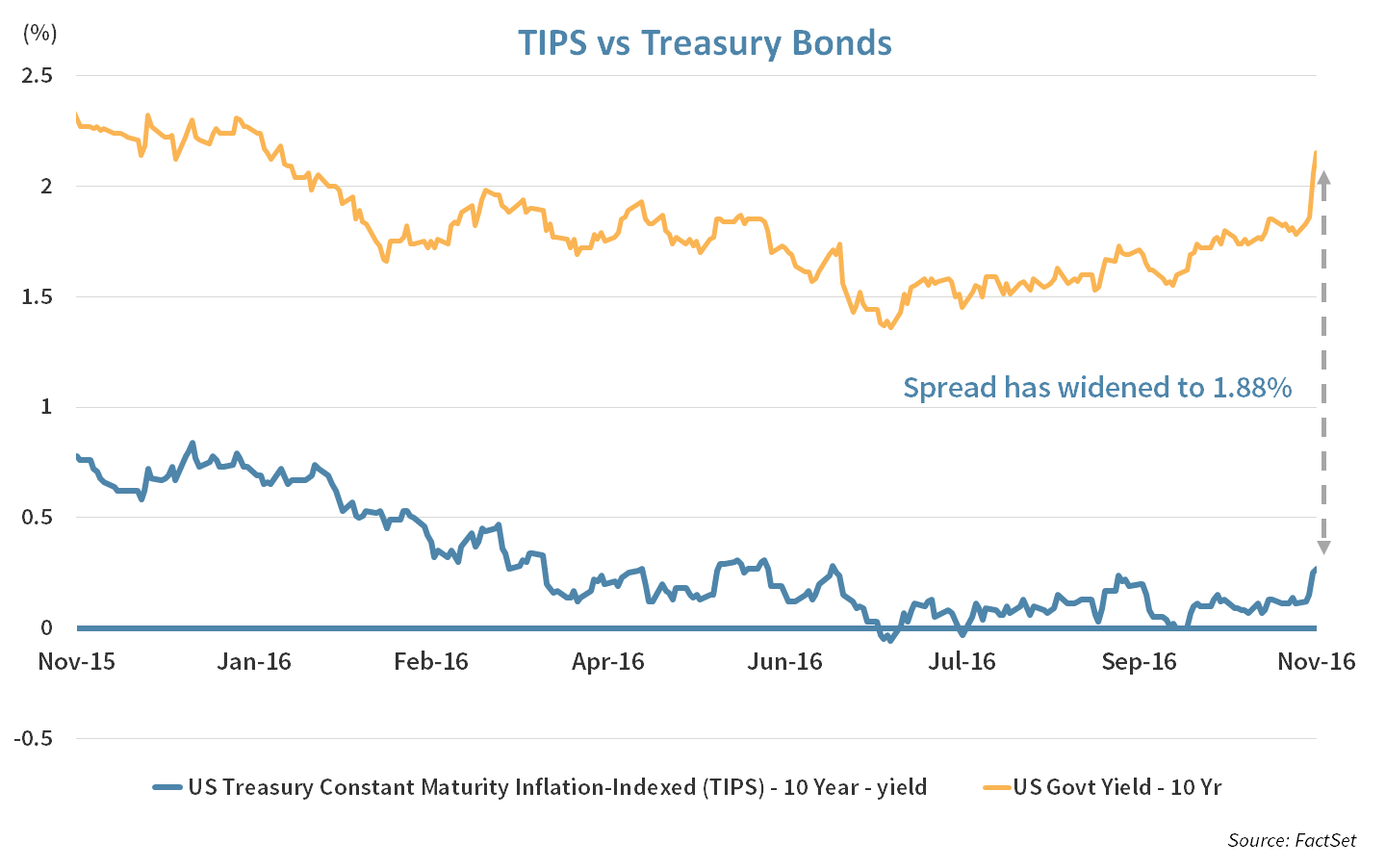

The Inflation Boogieman Rises

Two weeks ago, we wrote an economic piece in Insights called the “The Inflation Boogieman.” We see this boogieman growing in prominence as investors anticipate higher inflation rates. Before we get to the reasons for this, let’s define a few inflation-related terms:

- Inflation: prices of goods or services rising over time. The Federal Reserve has targeted a 2% inflation rate.

- Deflation: prices of goods and services falling over time. This generally happens in a prolonged period of weak economic demand and can wreak havoc… just ask Japan.

- Disinflation: A slowdown in the inflation rate, and a potential prelude to deflation.

- Stagflation: This happens when both the inflation rate and the unemployment rate become high. Stagflation is very problematic for economists as it creates a dilemma for economic policy. Typically, policies intended to lower inflation hurt employment.

- Reflation: This is the act of stimulating the economy through increased government spending (i.e. on infrastructure) while reducing taxes. This action helps the economy grow as inflation rates increase towards normalized levels. The policy is typically recommended at the bottom of an economic cycle.

Reflation may be on the horizon if President Elect Trump delivers on his promise to increase infrastructure spending and cut taxes. These actions would promote growth and further squeeze an already tight labor market, forcing wages up and putting upward pressure on inflation.

However, stagflation is also a possibility given Trump’s protectionist agenda. Reducing the amount of undocumented workers, tightening the flow of legal immigration, or even possibly scaring away would-be immigrants all stunt population growth (a major contributor to GDP growth) and put upward pressure on wages. Likewise, closing borders to free trade and heavily taxing imports is likely to dampen economic activity and raise prices. Rising labor expenses and higher cost of goods could lead to the unwelcome combination of inflation without growth.

Time will tell if either of these scenarios plays out.

Week Ahead

Data Flow

- The Eurozone will report Industrial Production for September, while Russia and Japan will report Preliminary third quarter GDP. Both Russia and Japan are expected to produce weak GDP numbers from the 2nd quarter. For Russia a contraction of 0.06% and for Japan 0.02% growth.

- On Tuesday retail and food service sales data will be released for October with growth of 0.06% forecast, matching September’s rate.

- Housing starts are expected to rise 10.8% for the month of October, with total housing unit starts of 1,160,000. The prior month’s housing starts was 1,047,000 units.

Banking on Congress

- Fed Chair Yellen is set to give a testimony on the economic outlook to a joint committee in congress.

- Dudley from New York and Evans from Chicago will lead off with opening remarks.

Moon Shot

- On Monday, the moon will be closest to Earth since 1948. The Supermoon will be bigger and brighter by almost 14%. But don’t wait until Monday. For people in North America, the Supermoon might be bigger and brighter on Sunday.

- Fun (or maybe not so fun) fact: a Supermoon can in fact create super tides.

Strategy Updates

Contributed by , Max Berkovich

Strategic Asset Allocation

Salute

U.S. equities roared higher this week, bravely saluting the peaceful transition of leadership. With election uncertainty out of the way, stocks have erased the recent declines. Small caps led the way as they are more exposed to the domestic economy, while emerging markets lagged in the face of potential policies perceived to be more protectionist. Investors began making early bets on segments of the market they believe would perform best under the new regime.

For reasons we discussed in our Market Commentary, the most embraced sectors this week for the S&P 500 were: Financials, Industrials, and Healthcare.

The worst performing sectors this week in S&P 500 were: Utilities and Consumer Staples.

- Most utilities were down as inflation expectations are rising and the probability for a Fed rate increase remains strong. Utilities that generate power from solar and other renewables fell the most while fossil fuel utilities have gained some ground.

- Consumer Staples were also weak from the interest rate pressures.

Falling Down

Interest rates jumped higher, causing bonds and bond-like assets to lose value. A few of the reasons…

- The pre-election anxiety may be subsiding, causing Treasury hoarders to lighten up on “risk free” assets.

- Fear that lower taxes and fiscal stimulus at the same time would require the U.S. government to borrow more and add to the supply of bonds, causing rates to go higher.

- The business friendly policies of the new administration could cause inflation, forcing the central bank to tighten monetary policy.

- Fear of a more hawkish central bank president when current Chair Yellen’s term is done.

Cadence Call

Despite the volatility surrounding the election, we do not yet see the need for major rebalancing in our asset allocation.

Strategic Growth

Name Dropping

The Industrials and Health Care sectors roared on the heels of the election results. Consumer Staples was the clear laggard, sitting out the big week. In earnings news…

- Priceline Group Inc. (PCLN) reported another solid quarter. The company reported a strong increase in room rates and bookings across all of its properties. Bookings in the quarter were 24.9% higher than last quarter. The company also guided for +20% bookings growth for next quarter. The “name-your-own” program was dropped in September.

- Walt Disney Co. (DIS) reported a light quarter, but managed to convince investors to overlook the weakness. Pressure on the ESPN network from subscription losses, according to CEO Bob Iger, was said to be abating and the non-media segment is doing well.

Strategic Equity Income

A Little Venting

Consumer Staples came unstapled this week, with only Utilities doing worse. Rising interest rates was only one culprit. Financials, especially banks, enjoyed a tremendous week. In other strategy news…

- Ventas, Inc. (VTR) a Health Care REIT found itself in the middle of a perfect storm: interest rates marching higher, election results weighing on the sector and a skilled nursing operator of 36 of Ventas’ properties announcing it was retrenching from the skilled nursing facilities (SNF) business. The company is looking to sell these properties outright as part of a strategic decision to get out of the SNF business. Ventas currently has only 4% of net operating income coming from SNF as it spun-out that business into a separate company in August of 2015.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters