Election Survival Guide

The S&P 500 was down 1% this week as investors fret about a rate rise and the election. Emotions are the Achilles heel for investors, encouraging action when none is necessary. Hang in there and grab a stress ball. The election is almost over.

Market Review

Contributed by Doug Walters

Glass half full

U.S. equities could not hold on to early gains Friday, leaving the S&P 500 down nearly 1% on the week. Most of the losses came on Tuesday, a day with no obvious catalysts. The usual suspects were blamed: rate rise concerns, political uncertainty and valuations.

- The S&P 500 is now down over 2.5% from mid-August.

- However, let’s not forget that mid-August was an all-time high for U.S. equities, so a more positive take on this is that we are just 2.5% from an all-time high.

No Need to Stress

With the final Presidential debate approaching, the light at the end of the election tunnel is fast approaching. However, according to a new study by the American Psychological Association, the election is a significant source of stress for more than half of Americans. This stress has a potential ramification for investors, as emotions, can often lead to irrational decision making. We are already seeing this manifested in: 1) questions about how the election will impact the markets, and 2) concerns about equity exposure during the election.

We do not have a crystal ball to predict the short-term and anyone who says they do is trying to sell you something. In the long-run, security prices will be driven by economic fundamentals which will not be immediately impacted by the election result.

Is there a Presidential candidate that is better for investors? We will never know. However, if we take the candidate’s criticism of each other as a guide, perhaps investors need not stress.

- According to Trump, Clinton would be four more years of Obama. In the nearly eight years of Obama’s tenure, we have largely recovered from one of the worst recessions on record and U.S. equities have tripled. Another four years of 15% annual equity returns would please most investors!

- According to Clinton, Trump only cares about Trump. Well, Trump is a businessman. If her criticism is accurate, one could speculate that any policies he would promote would be both business and investor friendly.

While we are clearly just having a bit of fun here, the reality is, nobody knows how the market will respond to the election results.

- While it can be emotionally satisfying to try to predict a major market event, history has proven market timing to be a primary source of investor underperformance. More often than not the best course of action is no action. It’s like the soccer goalie diving to save a penalty kick. It makes him feel better to take some action, but data shows his best chance of saving the ball is standing still.

- At Strategic, we believe our focus on Quality, Value and Diversification provides the best recipe for long-term investing success, regardless of what the election throws our way.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.0 | 4.4 |

| S&P 400 (Mid Cap) | -0.9 | 8.7 |

| Russell 2000 (Small Cap) | -2.0 | 6.7 |

| MSCI EAFE (Developed International) | -2.0 | -3.6 |

| MSCI Emerging Markets | -2.6 | 12.2 |

| S&P GSCI (Commodities) | 1.1 | 20.6 |

| Gold | -0.3 | 17.6 |

| MSCI U.S. REIT Index | 1.1 | 3.9 |

| Barclays Int Govt Credit | -0.1 | 2.3 |

| Barclays US TIPS | -0.2 | 5.2 |

Economic Commentary

Hurricane Economics

The impact of a hurricane on the economy can be massive. Hurricane Sandy destroyed an estimated $30 billion worth of households, offices and other infrastructure in 2012. Last week Hurricane Matthew barreled its way through Haiti, Florida, Georgia, South and North Carolina and while it wasn’t as severe as Sandy, it did cause an economic shock to the regions with property damaged and commerce lost. Now that the storm has passed, an investment in construction is needed as the process of rebuilding begins.

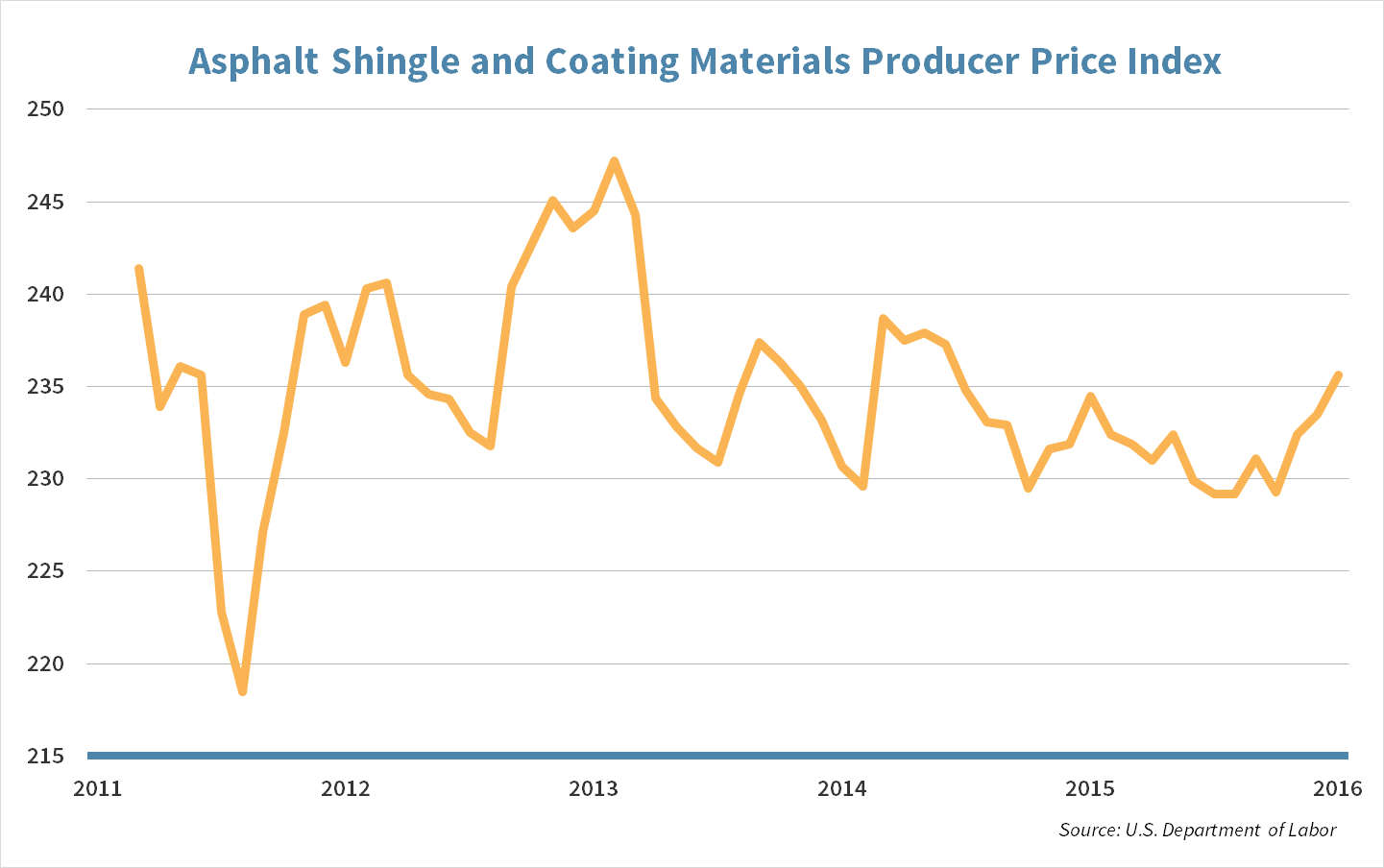

One obstacle to rebuilding after a natural disaster is access to construction workers, especially in a tightening labor force. Roof builders and cable line repairers are incentivized to move to and work in the hurricane damaged areas with extra hourly wages. Demand for roofing materials increase as coastal homes are rebuilt. As the chart below shows, roof shingle and coating material prices increased in the year after Hurricane Sandy. The price increase benefits shingle manufactures such as Owens Corning (OC) as their margins widen.

While Hurricane Mathew damaged billions of dollars’ worth of property, it is now time for property owners to cash in on their insurance and begin rebuilding. There may be calm before the storm but a potential construction boom could be on the horizon.

Week Ahead

The Final Round

U.S. presidential candidates Hillary Clinton and Donald Trump hold their final debate in Las Vegas on Wednesday.

- The topics for the third presidential debate will be: the economy, debt and entitlements, Supreme Court nominees, immigration and the candidate’s fitness to be President.

- Each topic will be allotted 15 minutes. Moderator Chris Wallace of Fox News will undoubtedly have his hands full trying to maintain order.

- This debate will not compete against football.

Banking on Earnings

Earnings season kicked off in earnest this past week. Next week all eyes will be on Financials, especially Banks.

- On the Financials front, Strategic holdings BlackRock (BLK), BB&T Bancorp (BBT), US Bancorp (USB), Travelers Companies (TRV), M&T Bank (MTB) and Bank of New York Mellon (BK) are due up. We will look to see if higher rates this past quarter translated to stronger earnings from regional banks.

- Johnson & Johnson (JNJ) and UnitedHealth (UNH) lead off in Health Care, while Intel (INTC) and Microsoft (MSFT) report from the Tech sector. These bellwether stocks should help fill in the earnings picture as it has been clouded by a soft start by industrials.

Data Marks

We will get more data about U.S. consumer prices and housing starts next week.

- Economists expect a 0.2% increase in consumer prices for the month of September, which is consistent with the Fed’s expectations.

- Analysts expect 1.14 million housing starts in the month of September.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Weekly Recap

REIT’s (Real Estate) finished strongly this week, ending up nearly 1.5%, despite continued chatter of a Fed rate hike. The sector had previously been sliding as bond rates rallied. The sell-off may have been overdone. The laggards for the week were both the Emerging and Developed overseas markets and the domestic Small Cap market.

Looking Abroad

International Developed markets are looking more attractive when comparing Price Earnings ratios (P/E) of its tracking index (EAFA) versus the S&P 500. However, digging through the dusty archives, we see that divergence between the P/E ratios of these two regions is not unusual. For example, in 2004 and late 2009, EAFA’s next 12 months P/E ratio was nearly 19x for both periods, vs S&P 500’s P/E ratio of 21x in 2004 and 18x in 2009.

International Developed equities have been lagging the U.S. since 2015. Since then, a wide gap has been opened between the indexes valuation (EAFA’s current forward P/E is 15.67x vs. S&P 500’s 18.22x). While there are signs of recovery in the developed markets it is not clear whether the recovery can persist. Pending Brexit and other reforms within the European Union may continue to drag on economic growth. Struggles from Germany’s biggest bank and Japan’s continued saga with deflation keep us on the sideline until the headwinds clear or valuation truly hits deep discount levels.

Call to Order

Our core bond portfolios will have elevated cash as several big Government Agency bond holdings were called away this week. We’ll look for opportunities to reallocate the proceeds as opportunities reveal themselves. We continue to prefer corporate debt in tax deferred accounts.

Strategic Growth

Beauty in the eye of the beholder

The Health Care sector was dragged down by a tough week from the Biotech space. While Consumer Discretionary was able to overcome an uneventful week with a very pretty guidance boost from…

- Ulta Salon (ULTA) treated investors to strong guidance ahead of its Analyst Day. The company raised its 3-year outlook for sales comparisons. It also outlined drivers that will allow the company to continue to achieve the high end of its guidance. The primary driver will be to take a bigger share of the fragmented $127 Billion domestic beauty market. Current market share is roughly 4%. Market share is expected to come from department stores as they shrink their physical presence, while Ulta is expecting to open 1,400 to 1,700 locations in the next few years.

Strategic Equity Income

Not that fast

Utilities got their grove back and were the leading sector on the week. Financials were the laggard, despite a better than expected quarter from JP Morgan & Co (JPM). In other earnings news…

- Fastenal Co. (FAST) the industrial supply company reported a slight miss on the bottom line and an inline sales number, but it was management comments that spooked investors. The company does not see an inflection from its underlying customers. It closed some stores and has chosen not to use its buyback authorization to purchase its own stock since first quarter. It doesn’t help that some industrial companies have already reported weak results.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters